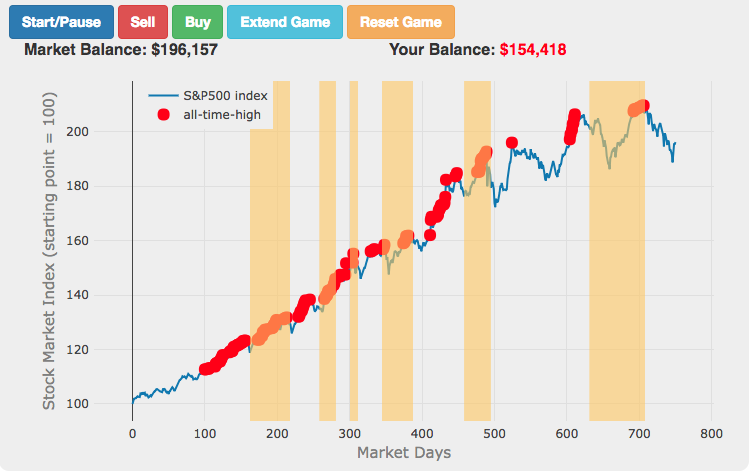

The Market Timing Game simulation is premised on the idea that buying-and-holding index investing and index funds are a no-brainer investment strategy and market timing (i.e. trying to predict market direction and trading accordingly) is a less than optimal strategy. The saying goes “Time in the market not timing the market”. In this simulation, you are given a 3-year market period from sometime in history (data starts January 1, 1950 and goes through the most recent market price, as prices are updated daily) or you can run in Monte Carlo mode (which picks randomly from daily returns in this period) and you start fully invested in the market and can trade out of (and into) the market if you feel like the market will fall (or rise). The goal is to see if you can beat the market index returns.

If you get the 80’s movie reference to “WarGames”, then you might guess the best way to avoid losing the Market Timing Game.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Another way to put this is just to buy and hold. Put your investments into low-cost index funds and don’t worry (too much) about the ups and downs of the market. They always happen, but over time, stocks tend to go up and trying to time when to get into or out of the market leads to sub-optimal result for most regular investors and even many professional investors.

Data and Tools: Daily, historical dividend adjusted prices for the S&P500 stock index (between 1950 and the last market day) were downloaded from Yahoo! Finance via a python script. The game was programmed in Javascript using the open source plot.ly javascript library to create the graph.

Update: Added a Monte Carlo mode which lets you play with data that is randomly generated from the daily returns of the S&P500. The probability of a daily return being picked is the same probability/frequency that it occurred in the last 68 years.

Related Posts

15 Comments »

15 Responses to Shall We Play A (Market Timing) Game?

would be amazing if you can also make a “turn base mode”. so the person have some time in every step to think while he have access to a more pro graph so he can analayze the graph, see it in different “zoom” etc. because people might say that they couldn’t time the market properly because they saw too little of the graph in every moment, and they didn’t have the time to analyze.

its a great game for some people, but some of them won’t accept it as a really good simulator from the reasons i mentioned above.

[…] an interactive “game” at Engaging-Data.com where you can test out your stock market timing skills based on actual historical returns. You’ll […]

[…] Further Reading:“The Futility of Market Timing” – Drew Dickson, Albert Bridge Capital“The Stock Market Timing Game” […]

[…] the blogger “Engaging Data” created a game where you cant try to time the market here. Try it for yourself. I made it only 1/10 times. Will you do it better than […]

[…] obvious the past was. But that’s not really how things play out. If you want to see what I mean, check out this simple market-timing game. If you’re like me, after a few rounds, you see how bad you really are! That’s exactly why we […]

[…] Elfenbein added this link to his weekly Friday piece. It is a market timing game . See how well you can do. Sometimes the biggest curse is that you get lucky and succeed the first […]

The market game is great – can you create a speed in between 3 and 4? 3 is actually quite slow over 750 days for people new to investing getting the general idea, while 4 is arcade game fast. Thanks!

Games not working for me, tried three different browsers (Firefox, Safari and Chrome).

thanks. I fixed the issue with the game not loading.

[…] included, on the left, a screen shot of the game, which you can access by clicking here. It’s a self-explanatory interface. One starts with $100,000 of capital, which starts off […]

Dear Mr. Rich,

If one really could successfully know whether the market will go up or down ahead of time, then would you not be a billion or trillionare at this point? Even successfully knowing whether this would happen for a few years would be sufficient to become one of the world’s wealthiest people. Is it possible you worked in the financial sector but did not really make a living successfully timing the market?

This is great! I wish there were moving averages added, as it would give one’s decisions some added gravitas. It would also be cool to stop the stimulation with a “real-time” news story–something that happened at that point in the simulation–and let one trade on that. I don’t believe the results would be any different.

I would like to play this game at a slower speed (or perhaps let the user stop the progress) so I can think. While I know many like to say market timing is impossible, I did it successfully for a living for 17 years. (In my first and only try above, I was 15% ahead of this market game.) My personal experiments would be: 1) could I beat the game on average over a large number of attempts, 2) would varying the amount of time I had to think change my success rate one way or the other, and 3) would my performance be worse if the game had random returns (matching frequency distribution, though)?

I have updated the game to allow for a Monte Carlo approach where returns are picked randomly and with the same probability from the pool of historical daily returns.

[…] You know why I don’t time the market? Check out the game at this link. […]