Posts for Tag: money

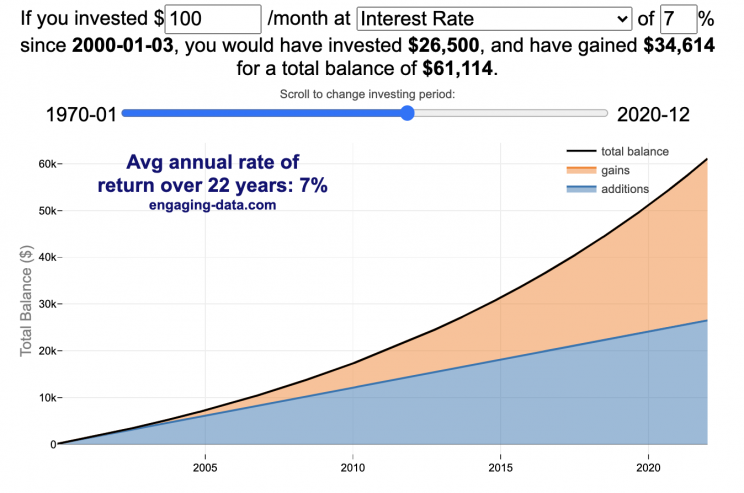

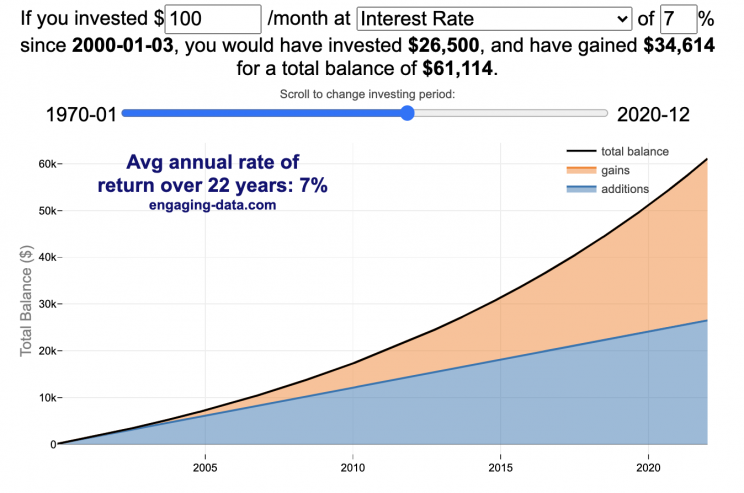

Compound Interest and Stock Returns Calculator

Calculate returns on regular, periodic investments

This calculator lets you visualize the value of investing regularly. It lets you calculate the compounding from a simple interest rate or looking at specific returns from the stock market indexes or a few different individual stocks.

Instructions

- Enter the amount of money to be invested monthly

- Choose to use an interest rate (and enter a specific rate) or

- Choose a stock market index or individual stock

- Use the slider to change the initial starting date of your periodic investments – You can go as far back as 1970 or the IPO date of the stock if it is later than that.

- Use the “Generate URL to Share” button to create a special URL with the specific parameters of your choice to share with others – the URL will appear in your browser’s address bar.

You can hover over the graph to see the split between the money you invested and the gains from the investment. In most cases (unless returns are very high), initially the investments are the large majority of the total balance, but over time the gains compound and eventually, it is those gains rather than the initial investments that become the majority of the total.

Some of the tech stocks included in the dropdown list have very high annualized returns and thus the gains quickly overtake the additions as the dominant component of the balance and you can make a great deal of money fairly quickly.

It becomes clearer as you move the slider around, that longer investing time periods are the key to increasing your balance, so building financial prosperity through investing is generally more of a marathon and not really a sprint. However, if you invest in individual stocks and pick a good one, you can speed up that process, though it’s not necessarily the most advisable way to proceed. Lots of people underperform the market (i.e. index funds) or even lose money by trying to pick big winners.

Understanding the Calculations

Calculating compound returns is relatively easy and is just a matter of consecutively multiplying the return. If the return is 7% for 5 years, that is equal to multiplying 1.07 five times, i.e. 1.075 = 1.402 (or a 40.2% gain).

In this case, we are adding additional investments each month but the idea is the same. Take the amount of money (or value of shares) and multiply by the return (>1 if positive or <1 for negative returns) after each period of the analysis.

Sources and Tools:

Stock and index monthly data is downloaded from Yahoo! finance is downloaded regularly using a python script.

The graph is created using the open-source Plotly javascript visualization library, as well as HTML, CSS and Javascript code to create interactivity and UI.

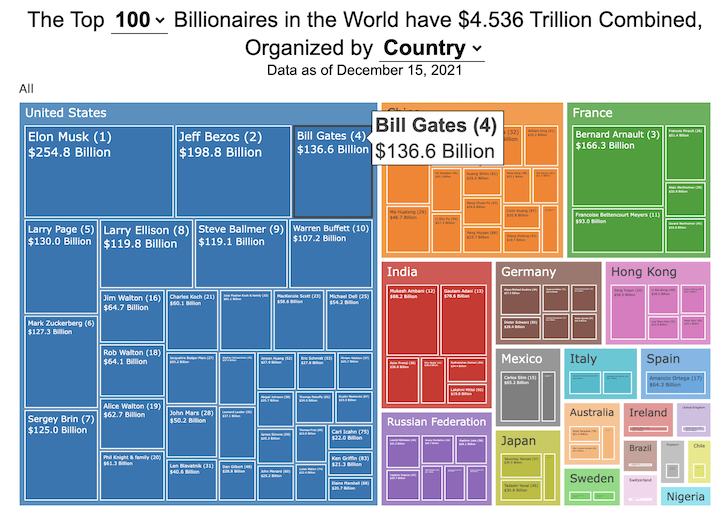

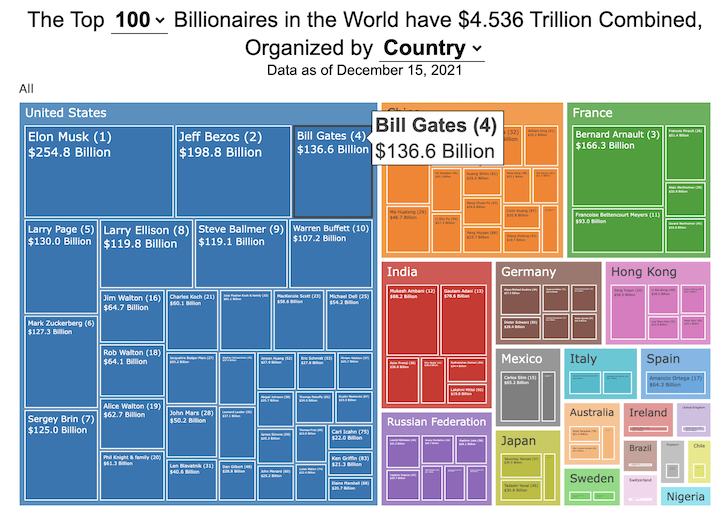

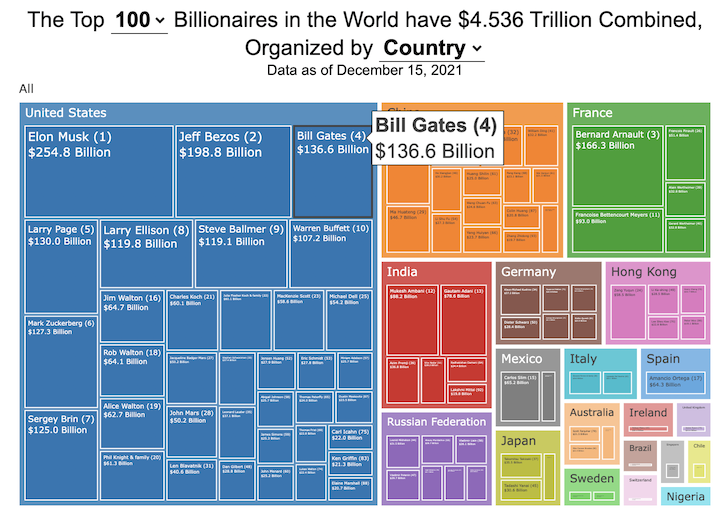

How much wealth do the world’s richest billionaires have?

This dataviz compares how rich the world’s top billionaires are, showing their wealth as a treemap. The treemap is used to show the relative size of their wealth as boxes and is organized in order from largest to smallest.

User controls let you change the number of billionaires shown on the graph as well as group each person by their country or industry. If you group by country or industry, you can also click on a specific grouping to isolate that group and zoom in to see the contents more clearly. Hovering over each of the boxes (especially the smaller ones) will give you a popup that lets you see their name, ranking and net worth more clearly.

The popup shows how much total wealth the top billionaires control and for context compare it to the wealth of a certain number of households in the US. The comparison isn’t ideal as many of the billionaires are not from the US, but I think it still provides a useful point of comparison.

This visualization uses the same data that I needed in order to create my “How Rich is Elon Musk?” visualization. Since I had all this data, I figured I could crank out another related graph.

Sources and Tools:

Data from Bloomberg’s Billionaire’s index is downloaded regularly using a python script. Data on US household net worth is from DQYDJ’s net worth percentile calculator.

The treemap is created using the open-source Plotly javascript visualization library, as well as HTML, CSS and Javascript code to create interactivity and UI.

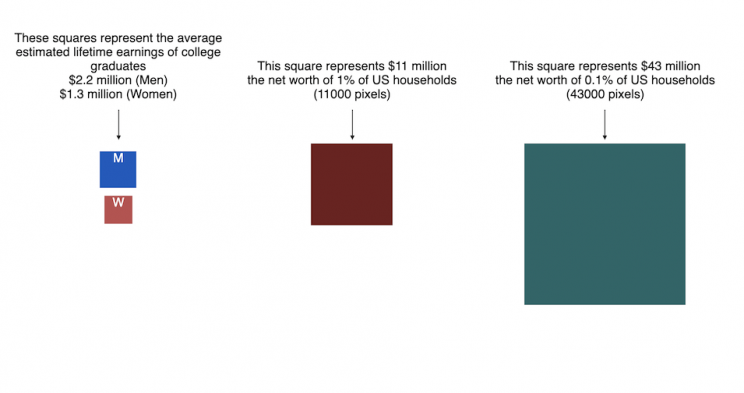

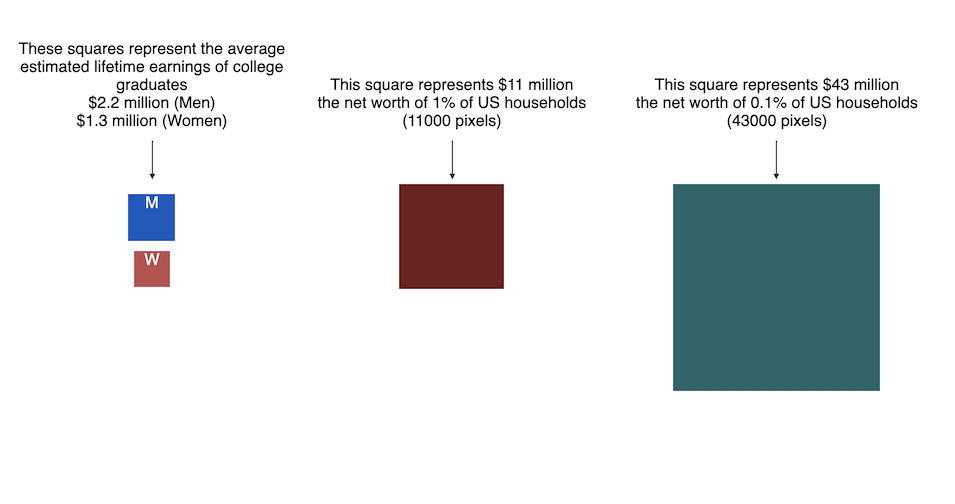

How Rich is Elon Musk? – Visualization of Extreme Wealth

See related visualization: How much wealth do the world’s richest billionaires have?

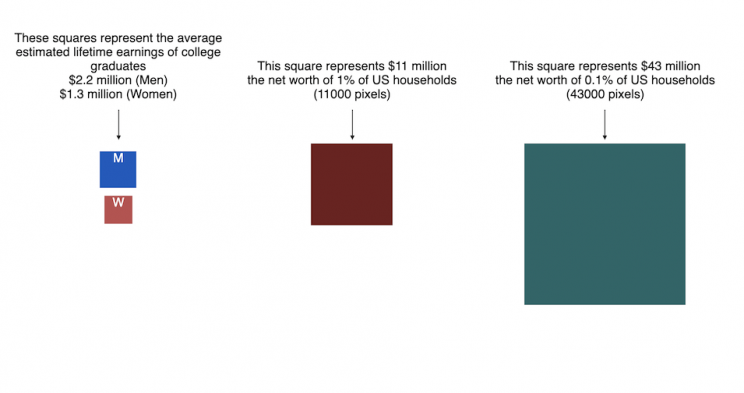

This visualization attempts to represent how much money Elon Musk, the richest person in the world, has. It gives context on this extreme amount of wealth by showing other very large sums of money that are somehow less than his net worth.

Each pixel on the screen represents a very modest amount of money (from $ 500 to $ 4000). As you scroll to the right, you will start to understand how incredibly large one billion dollars is, let alone hundreds of billions. You can change the amount of scrolling needed to get to the end of the visualization by selecting the amount represented by one pixel in the drop down menu.

This visualization was inspired heavily by a similar visualization made by Matt Korostoff for Jeff Bezos (when he was the richest person in the world) called “Wealth shown to scale”.

If you have any ideas about other items that could be added to the money chart, please leave them in the comments, and I will see if I can add it.

Mega-billionaires such as Musk or Jeff Bezos are not just extremely rich, the wealth they possess is unimaginably large. There are some extremely rich folks shown in the visualization who can buy pretty much whatever they could ever possibly need and yet their wealth is closer to that of the average person than they are to that of Elon Musk.

Sources and Tools:

The full list of data sources for the various money amounts are listed below. The visualization was made using HTML, CSS and Javascript code to create interactivity and UI. Data from Bloomberg’s Billionaire’s index , which is the source of Musk’s (and others) estimated wealth, is updated regularly.

Full List of Data Sources:

- Cost of a supertanker’s worth of oil (at $70/barrel): https://en.wikipedia.org/wiki/Oil_tanker

- Cost of a Boeing 777-200ER Airplane: https://en.wikipedia.org/wiki/Boeing_777

- Lebron James and Cristiano Ronaldo Net Worth: https://wealthygorilla.com/top-20-richest-athletes-world/

- Tiger Woods Net Worth: https://wealthygorilla.com/top-20-richest-athletes-world/

- It’s alot of money, but we’ve still got a long way to go:

- Cost of building the Burj Khalifa (world’s tallest building in Dubai): https://en.wikipedia.org/wiki/Burj_Khalifa

- Total Ad Revenue for CNN, Fox News and MSNBC: https://www.pewresearch.org/journalism/fact-sheet/cable-news/

- Ophrah Winfrey Net Worth: https://www.celebritynetworth.com/richest-celebrities/actors/oprah-net-worth/

- Tuition for all 280,000 University of California Students: https://www.ucop.edu/operating-budget/_files/rbudget/2021-22-budget-detail.pdf

- One 40-Foot Shipping Container Full of $100 Bills: self-calculation

- Net Worth of Bottom 33% of Americans: https://dqydj.com/average-median-top-net-worth-percentiles/

- George Lucas Net Worth: https://www.bloomberg.com/billionaires/

- Cost of 2020 Tokyo Olympics: https://www.usnews.com/news/business/articles/2021-08-06/tokyo-olympics-cost-154-billion-what-else-could-that-buy

- Annual Budget of the US Department of Energy: https://en.wikipedia.org/wiki/United_States_Department_of_Energy

- Worldwide Box Office Revenue for Marvel Cinematic Universe (2008-2021): https://www.the-numbers.com/movies/franchise/Marvel-Cinematic-Universe#tab=summary

- Total Amount Spent of Gasoline in the State of Texas in one year: https://www.eia.gov/state/seds/data.php?incfile=/state/seds/sep_fuel/html/fuel_mg.html&sid=US

- Size of Harvard University’s Endowment: https://www.thecrimson.com/article/2021/10/15/endowment-returns-soar-2021/

- Annual Budget of the US Department of Transportation: https://en.wikipedia.org/wiki/United_States_Department_of_Transportation

- Total Gross State Product of Hawaii in 2021: https://en.wikipedia.org/wiki/List_of_states_and_territories_of_the_United_States_by_GDP

- Warren Buffet Net Worth: https://www.bloomberg.com/billionaires/

- State of Texas Operating Budget: https://en.wikipedia.org/wiki/List_of_U.S._state_budgets

- Total Value of all National Football League (NFL) Teams: https://www.profootballnetwork.com/nfl-franchise-values/

- Total Annual Income of 2 Million Residents of Silicon Valley (San Jose-Sunnyvale-Santa Clara CA Metro Area): https://censusreporter.org/profiles/31000US41940-san-jose-sunnyvale-santa-clara-ca-metro-area/

- Total Dollar Value of All US Agricultural Production: https://www.ers.usda.gov/data-products/ag-and-food-statistics-charting-the-essentials/ag-and-food-sectors-and-the-economy/

- Bill Gates Net Worth: https://www.bloomberg.com/billionaires/

- Total Tesla Revenue Since Founding (2008-2021): https://www.statista.com/statistics/272120/revenue-of-tesla/

- Annual Advertising Revenue for Google: https://www.cnbc.com/2021/05/18/how-does-google-make-money-advertising-business-breakdown-.html

- Total Amount Spent on US Residential Electricity In A Year: https://www.eia.gov/state/seds/data.php?incfile=/state/seds/sep_fuel/html/fuel_pr_es.html&sid=US

- Jeff Bezos Net Worth: https://www.bloomberg.com/billionaires/

- Annual Federal Taxes paid in Florida: https://en.wikipedia.org/wiki/Federal_tax_revenue_by_state

- Global Electric Vehicle Market Size in 2020: https://www.globenewswire.com/en/news-release/2021/09/06/2291730/0/en/Electric-Vehicle-Market-Size-Is-Anticipated-to-Grow-USD-1-318-22-Billion-in-2028-at-a-CAGR-of-24-3.html

- Value (i.e. Market Capitalization) of Walt Disney Company: https://www.google.com/finance/quote/DIS:NYSE

- Annual Revenue of Toyota Motor Corporation: https://money.cnn.com/quote/financials/financials.html?symb=TM

- Annual Health Care Expenditures for the entire State of California: https://www.kff.org/other/state-indicator/health-care-expenditures-by-state-of-residence-in-millions/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

- Total Annual Income for 100,000 Average US Households: https://www.census.gov/library/publications/2021/demo/p60-273.html

- Cost of one Gerald Ford Class Aircraft Carrier: https://en.wikipedia.org/wiki/Gerald_R._Ford-class_aircraft_carrier

- Cost to Build California High Speed Rail System: https://en.wikipedia.org/wiki/California_High-Speed_Rail

- Inflation Adjusted Cost of NASA’s Apollo Program: https://www.forbes.com/sites/alexknapp/2019/07/20/apollo-11-facts-figures-business/

- Total Annual Housing and Utilities Expenditures For All 6.6 Million Households in Los Angeles Metro Area: https://www.bls.gov/cex/tables/geographic/mean/cu-msa-west-2-year-average-2020.pdf

- Annual Amount Spent on the Purchase of iPhones: https://www.businessofapps.com/data/apple-statistics/

- Elon Musk Net Worth: https://www.bloomberg.com/billionaires/

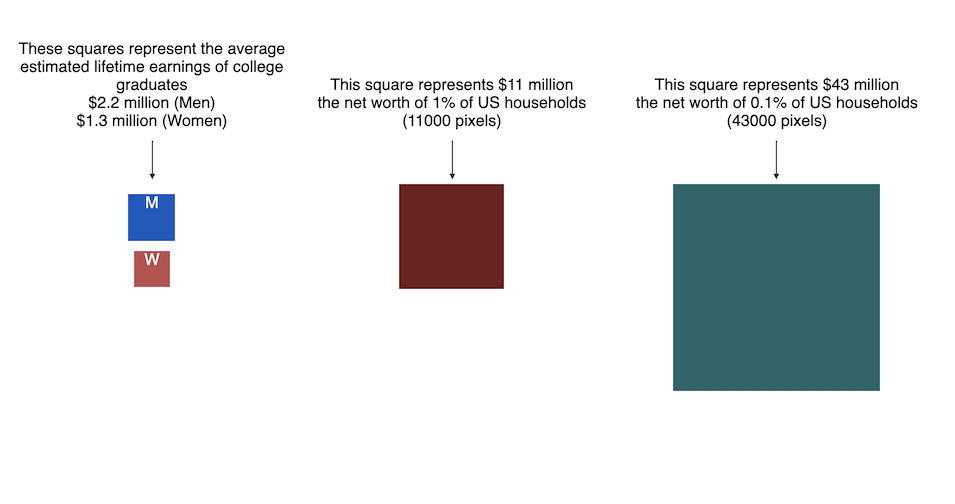

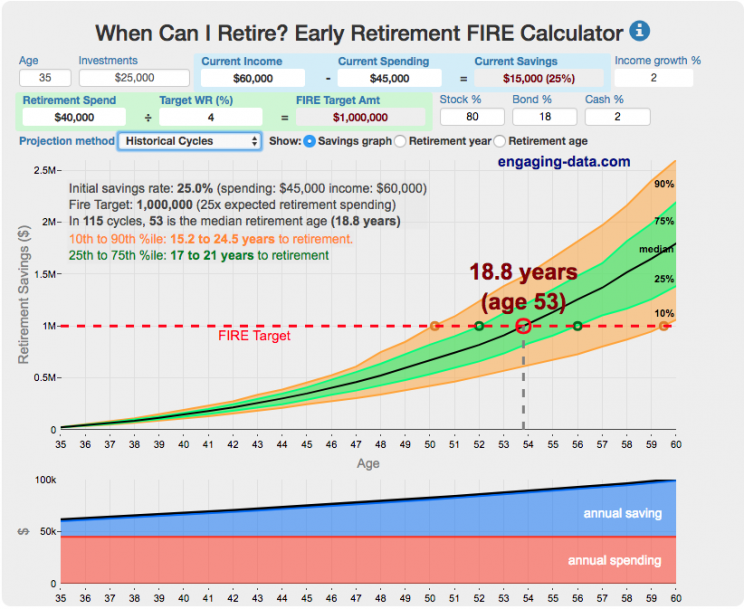

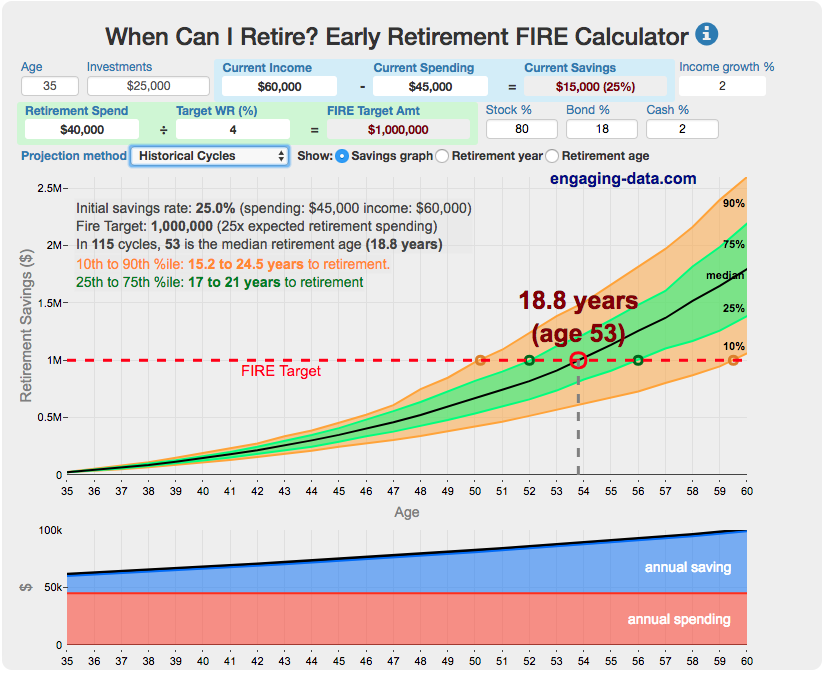

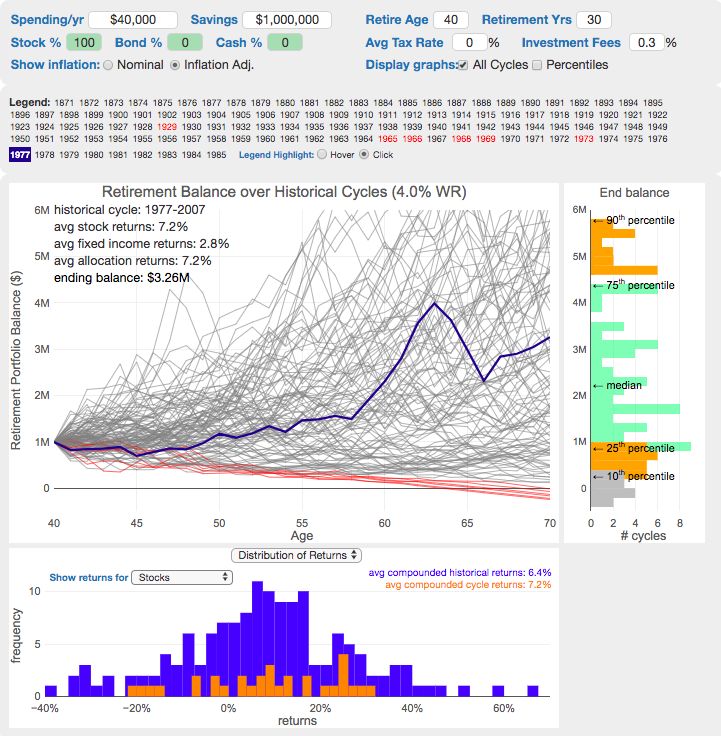

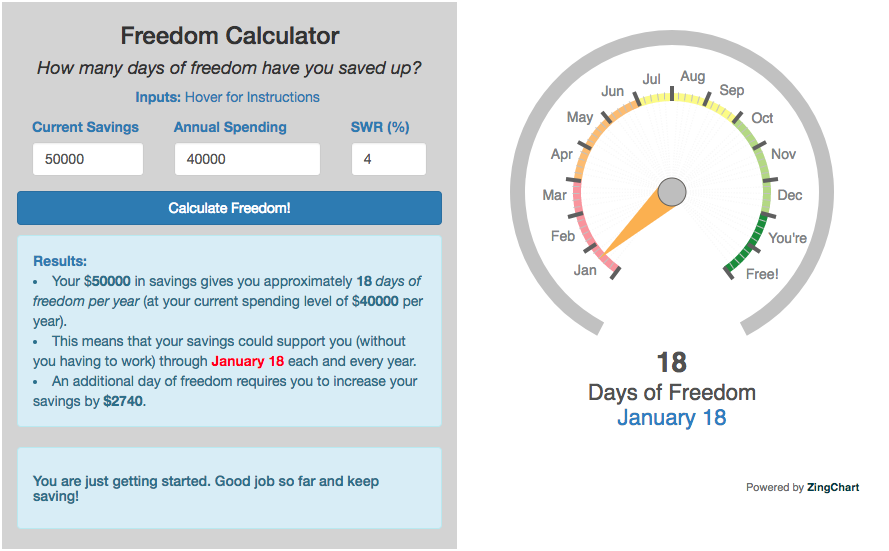

Early Retirement Calculators and Tools

Interested in Early Retirement or FIRE (Financial Independence to Retire Early)?

Here are some interactive and educational planning tools that I developed to help you understand the concepts of FIRE and calculate how long it will take to achieve retirement and how likely you are to survive retirement. Click on the tools below to try them out.

Financial Independence Calculators

Regardless of where you are on your path to FIRE, there are several types of tools that are useful:

Planning to get to retirement

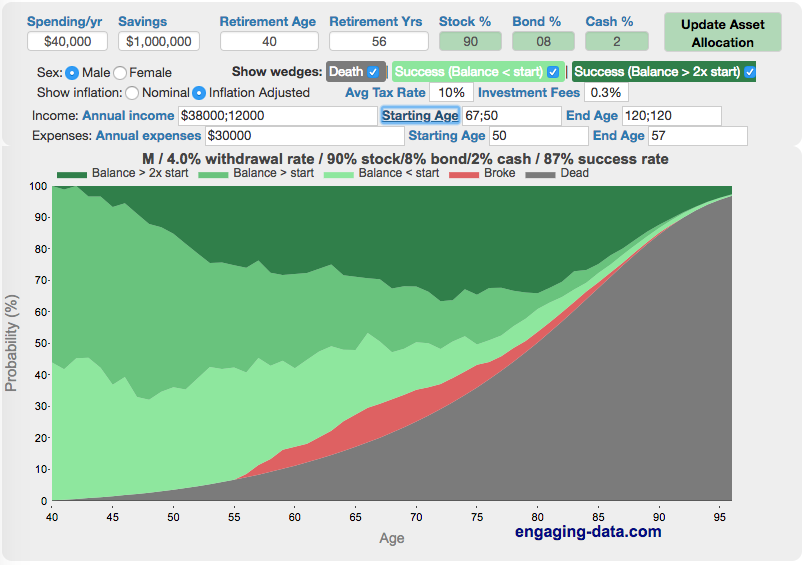

How long and how safe will your retirement be?

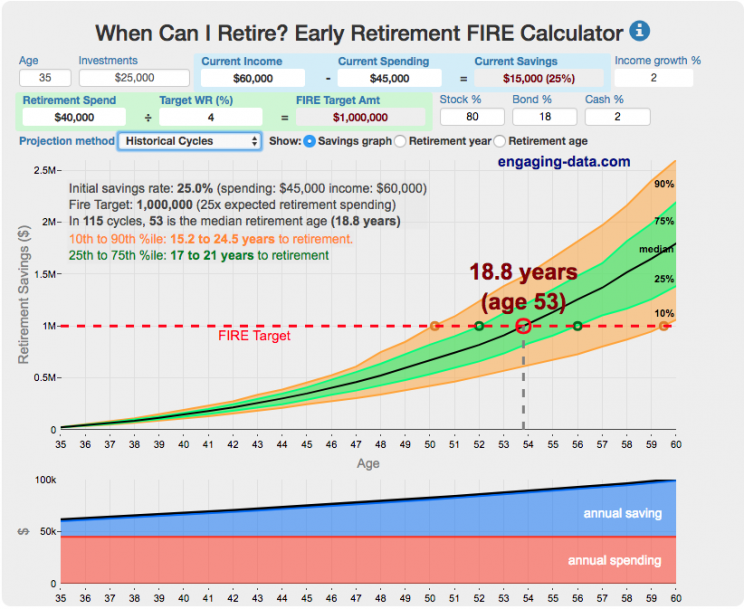

Rich, Broke or Dead? Will your Money Last Through Early Retirement?

Simulating retirement portfolio survival probability and human longevity

These tools all focus on the concept of FIRE. FIRE is the concept that revolves around saving and investing to achieve Financial Independence (FI) and to potentially Retire Early (RE). One of the core concepts is that once you can save up enough money, you can retire by withdrawing a fraction of this money annually to cover your living expenses. Other important topics related to this core concept have to do with reducing spending so you can save money and investing so your money can grow and sustain your retirement over many decades.

Other visualizations and tools related to Financial Independence

These tools relate to taxes and stock market returns.

Calculating Returns from Periodic Investments

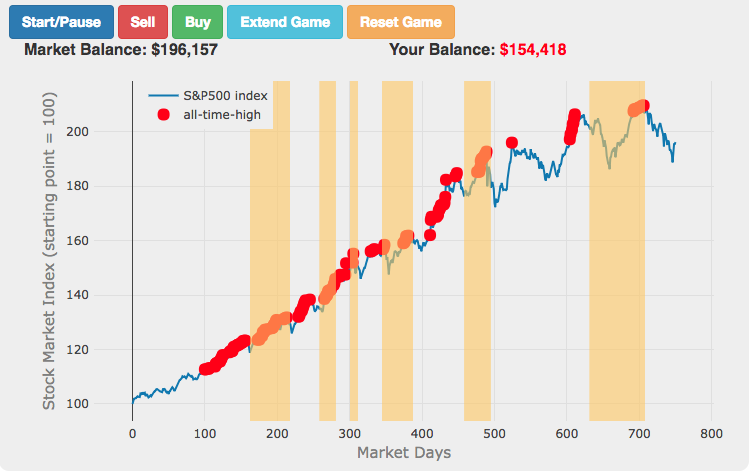

Visualizing Market Returns

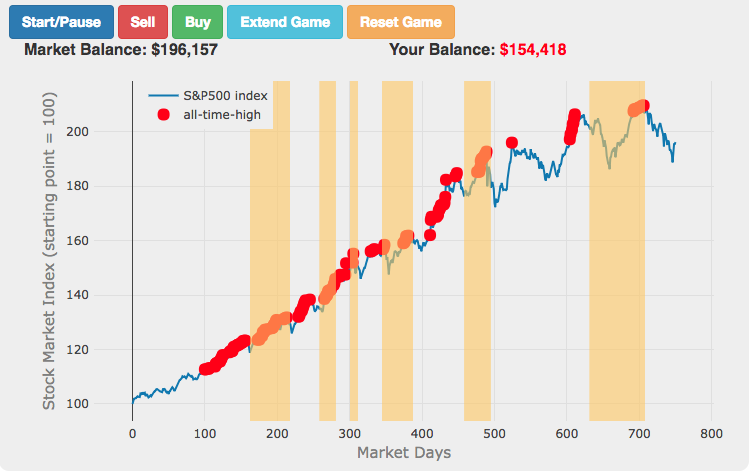

Understanding Market Timing

Market Timing Game

How difficult is it to time the stock market?

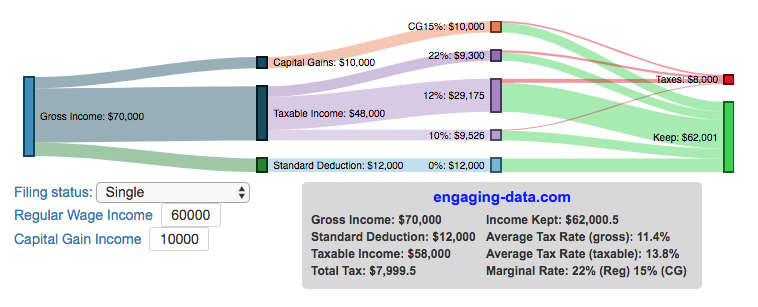

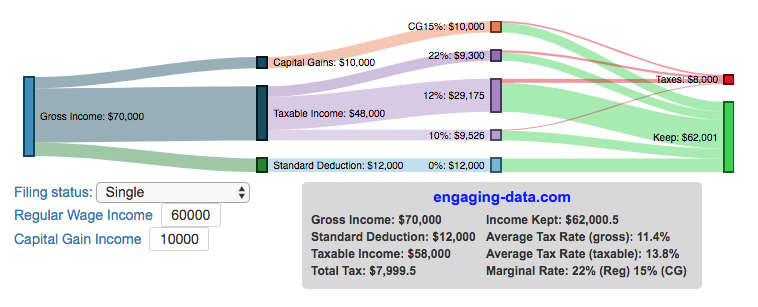

Income Taxes

Income Tax Bracket Calculator

Tax bracket calculator to visualize how income and capital gains taxed

Data Sources and Tools:

See the individual tool to learn more about how it was made.

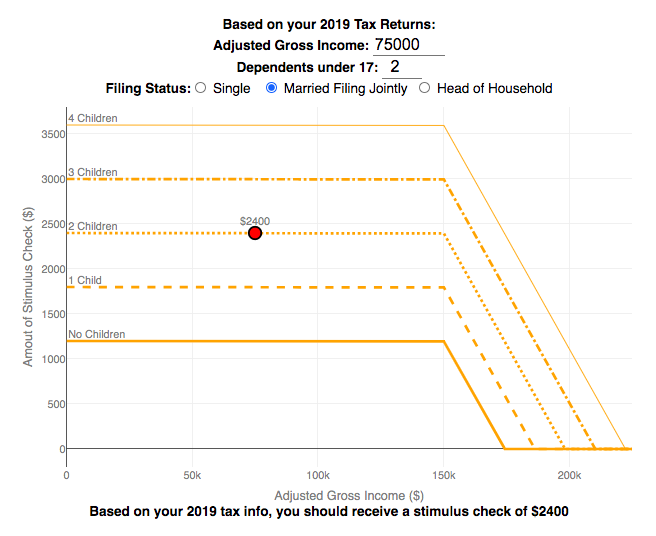

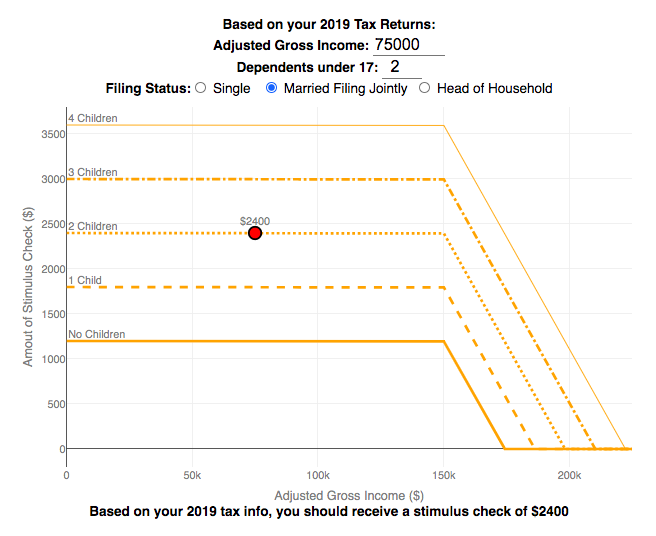

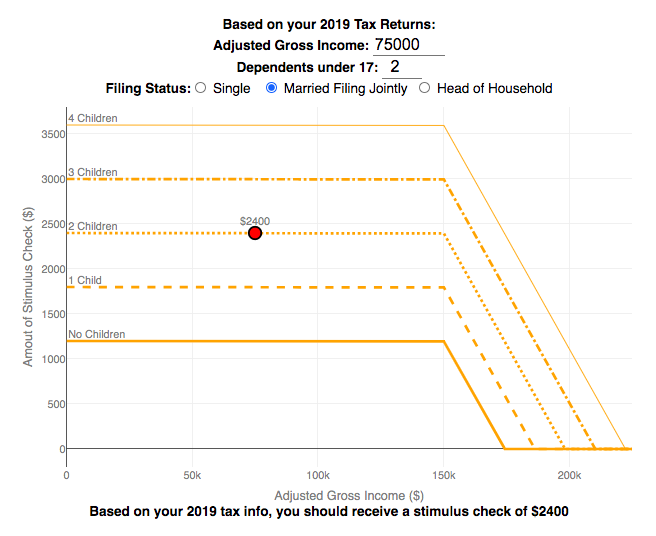

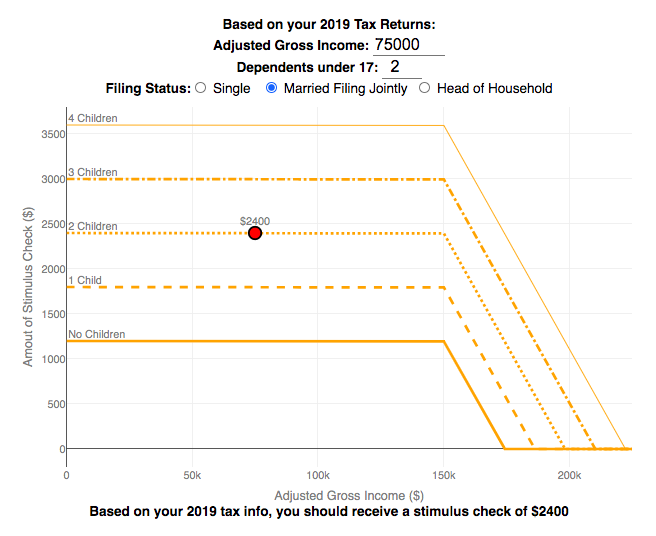

Stimulus Check Calculator (Late 2020 & Early 2021)

How much money can you expect in your stimulus check?

Updated to include the $1400 stimulus payment per adult and dependent in March 2021.

Use this stimulus check calculator to figure out how much you will receive in your thrid stimulus check.

On December 21, 2020, Congress passed a $900 billion dollar stimulus package in response to the COVID pandemic. The bill authorizes economic assistance to Americans in the amount of $600 per person subject to income limits. It also includes expanded unemployment benefits, rental assistance and an extension to the eviction ban. This calculator helps you calculate the amount of stimulus check that you can expect to receive based on your 2019 tax return filing status, adjusted gross income and number of dependents under 17.

Changing the inputs to the calculator, will show you how your expected stimulus check amount will change. The graph shows for a giving filing status (single, married filing jointly or head of household) how the stimulus check amount will change as a function of income and number of children. You can share a URL with specific parameters included

Sounds like some checks may even get to folks at the end of December and many more will get them in January 2021.

On March 5, congress passed the American Rescue Plan which includes $1400 payments for all Americans. The phase out of this stimulus check is different in that over a $10000 range the stimulus goes from 100% to 0% at the phase out threshold, no matter how many dependents you have. This changes things significantly as you’ll see in the calculator.

Sources and Tools:

The stimulus check calculator is made using javascript and the plotly open source graphing library. It is based on news reports of the expected stimulus amounts and income thresholds.

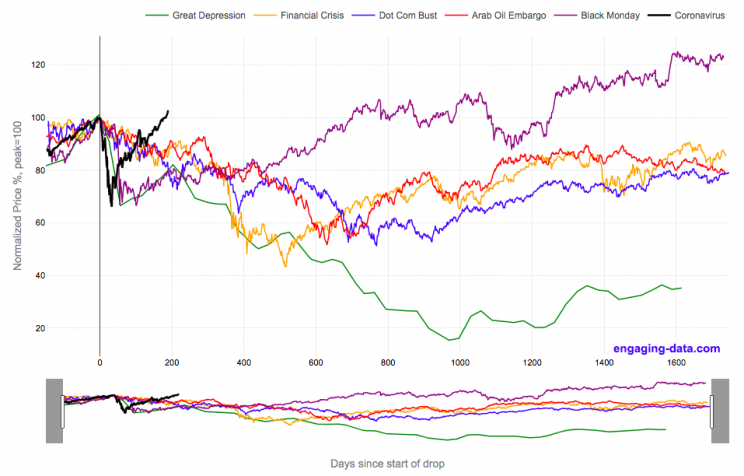

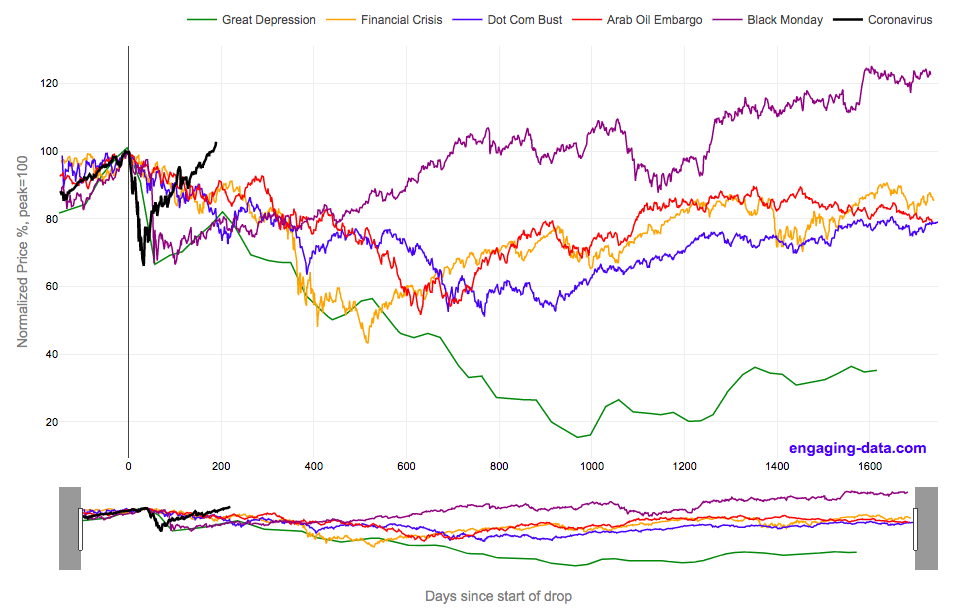

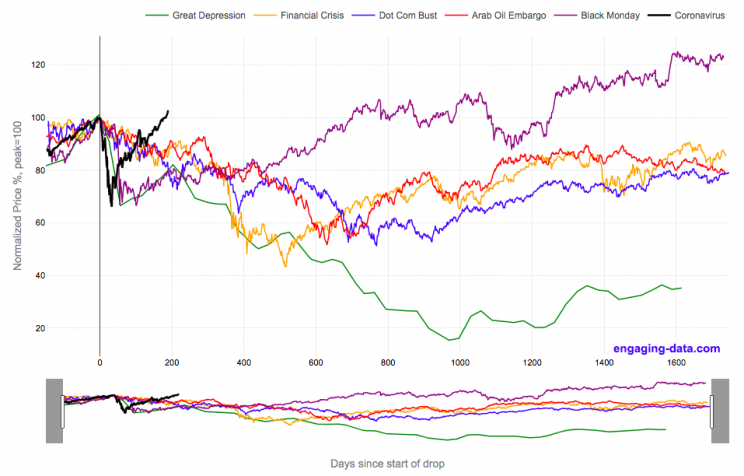

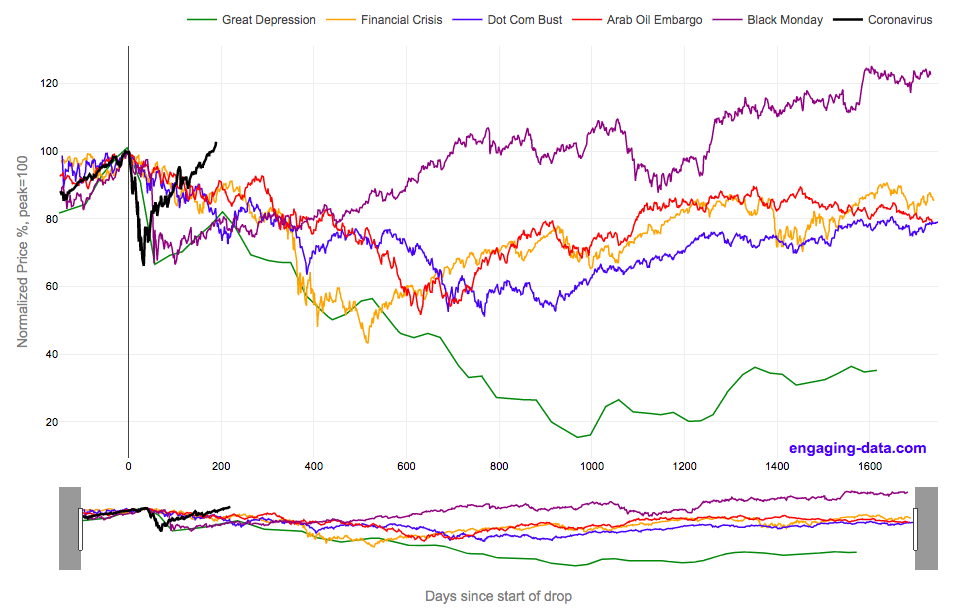

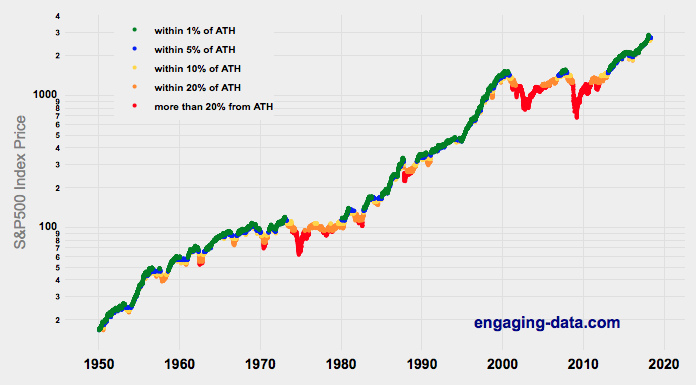

2020 Stock Market Drop Compared to other Bear Markets

2020’s stock market drop was unprecedented for the speed of the drop and also the speed of the recovery

This graph shows the stock market drops from the 2020 and other bear markets normalized so that the peak is at 100% at day 0. This lets you see the severity and duration of different bear markets from the Great Depression (1929), the Dot Com Bust (2000), and the Financial Crisis (2008) and other drops over 30%.

The coronavirus pandemic has significantly disrupted the global economy. Q2 GDP in the United States declined at an annualized rate of 32% and US unemployment reaching 15% due to coronavirus induced business shutdowns.

However, the stock market drop (represented by the S&P500 index) in late February and early March 2020 has somewhat surprisingly rebounded and reached a new all-time-high in August 2020, even as unemployment and GDP output has continued to falter. There certainly seems to be a disconnect between the fundamentals of the economy and the stock market.

Will the recovery in the stock markets continue or will it begin to align more closely with the fundamentals of the economy?

There are many proposed reasons why this disconnect is happening. The Federal Reserve actions to increase liquidity and prop up the stock market. The heavy weighting of tech in the S&P500 and the pandemic’s boost to many tech company’s business (i.e. Amazon, Zoom, Apple). Whatever the reason, the question of whether the market can continue at this pace or will have a correction is important and one to watch.

Data for the S&P500 price is daily from 1950 onward but before 1950, the data I had available was on a monthly basis. I interpolated this monthly data to create daily data, so not all the data is 100% accurate for any given day before 1950. Data for 2020 will continue to be updated daily.

Source and Tools:

Data on historical S&P500 prices is from Yahoo! Finance and downloaded and cleaned with a python script. Graph is made using the plotly open source javascript library.

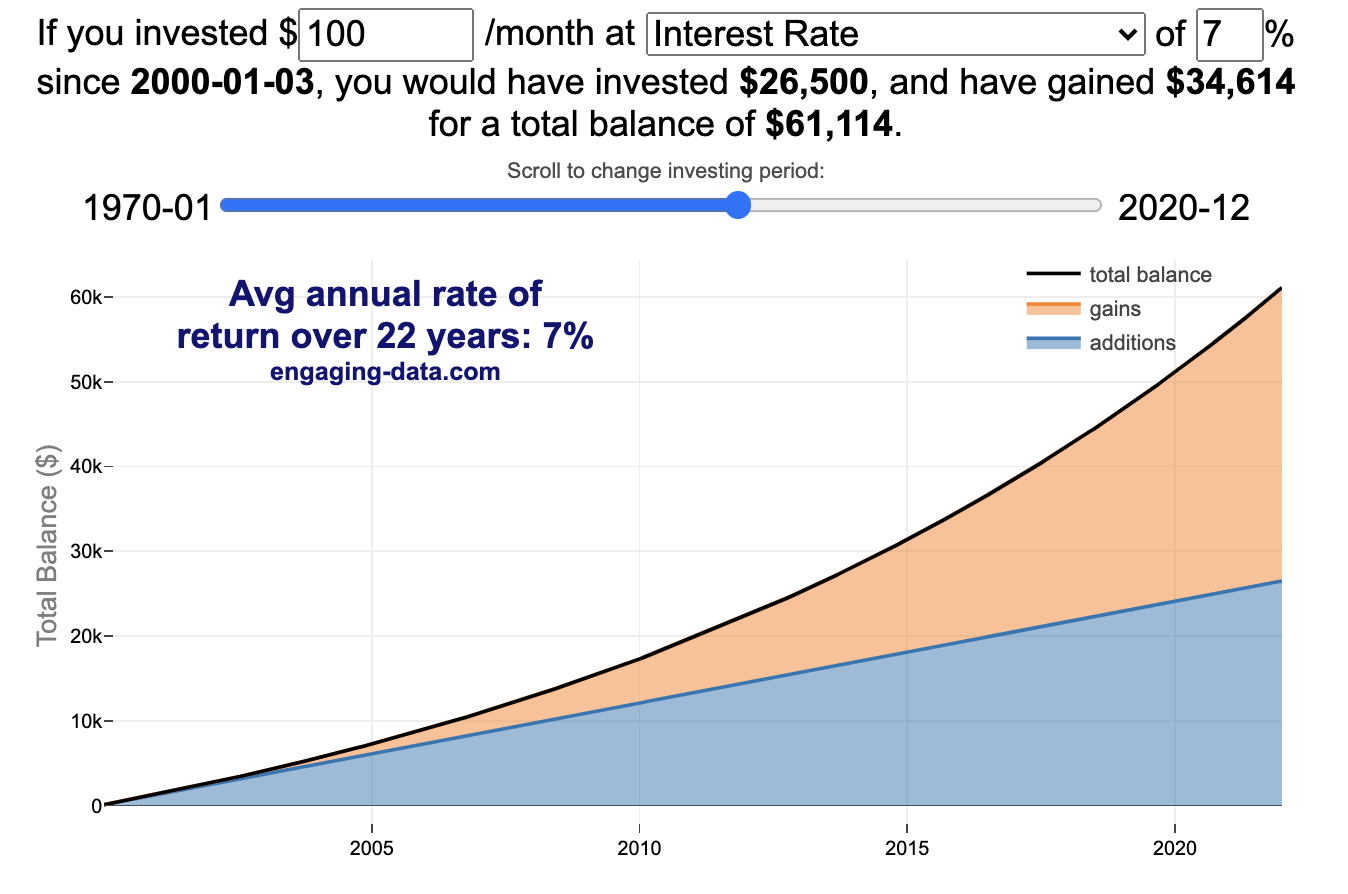

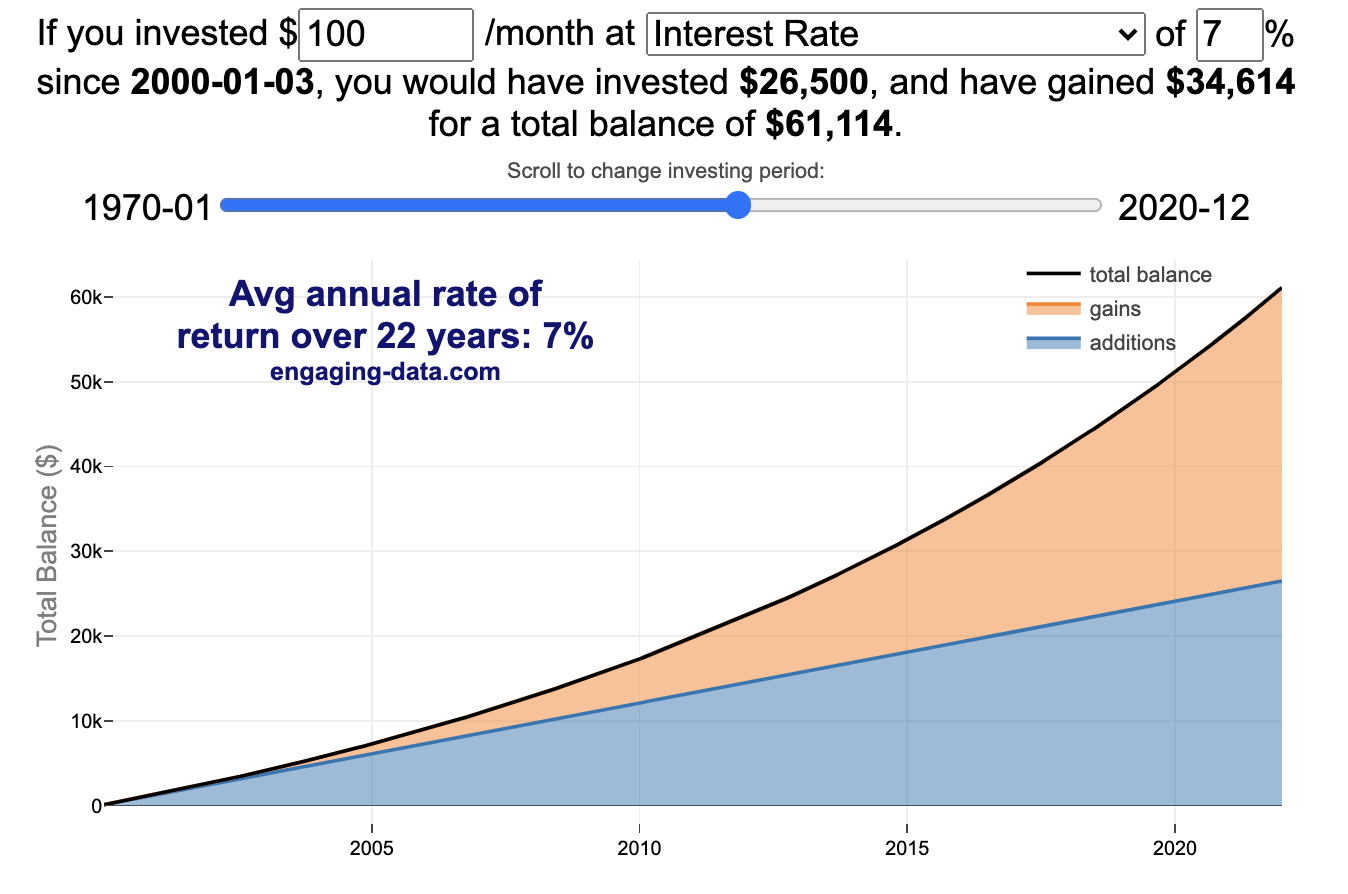

Compound Interest and Stock Returns Calculator

Calculate returns on regular, periodic investments

This calculator lets you visualize the value of investing regularly. It lets you calculate the compounding from a simple interest rate or looking at specific returns from the stock market indexes or a few different individual stocks.

Instructions

- Enter the amount of money to be invested monthly

- Choose to use an interest rate (and enter a specific rate) or

- Choose a stock market index or individual stock

- Use the slider to change the initial starting date of your periodic investments – You can go as far back as 1970 or the IPO date of the stock if it is later than that.

- Use the “Generate URL to Share” button to create a special URL with the specific parameters of your choice to share with others – the URL will appear in your browser’s address bar.

You can hover over the graph to see the split between the money you invested and the gains from the investment. In most cases (unless returns are very high), initially the investments are the large majority of the total balance, but over time the gains compound and eventually, it is those gains rather than the initial investments that become the majority of the total.

Some of the tech stocks included in the dropdown list have very high annualized returns and thus the gains quickly overtake the additions as the dominant component of the balance and you can make a great deal of money fairly quickly.

It becomes clearer as you move the slider around, that longer investing time periods are the key to increasing your balance, so building financial prosperity through investing is generally more of a marathon and not really a sprint. However, if you invest in individual stocks and pick a good one, you can speed up that process, though it’s not necessarily the most advisable way to proceed. Lots of people underperform the market (i.e. index funds) or even lose money by trying to pick big winners.

Understanding the Calculations

Calculating compound returns is relatively easy and is just a matter of consecutively multiplying the return. If the return is 7% for 5 years, that is equal to multiplying 1.07 five times, i.e. 1.075 = 1.402 (or a 40.2% gain).

In this case, we are adding additional investments each month but the idea is the same. Take the amount of money (or value of shares) and multiply by the return (>1 if positive or <1 for negative returns) after each period of the analysis.

Sources and Tools:

Stock and index monthly data is downloaded from Yahoo! finance is downloaded regularly using a python script.

The graph is created using the open-source Plotly javascript visualization library, as well as HTML, CSS and Javascript code to create interactivity and UI.

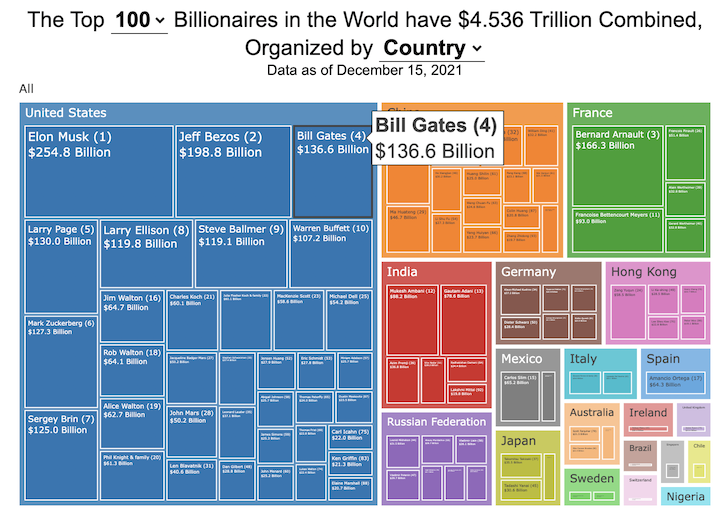

How much wealth do the world’s richest billionaires have?

This dataviz compares how rich the world’s top billionaires are, showing their wealth as a treemap. The treemap is used to show the relative size of their wealth as boxes and is organized in order from largest to smallest.

User controls let you change the number of billionaires shown on the graph as well as group each person by their country or industry. If you group by country or industry, you can also click on a specific grouping to isolate that group and zoom in to see the contents more clearly. Hovering over each of the boxes (especially the smaller ones) will give you a popup that lets you see their name, ranking and net worth more clearly.

The popup shows how much total wealth the top billionaires control and for context compare it to the wealth of a certain number of households in the US. The comparison isn’t ideal as many of the billionaires are not from the US, but I think it still provides a useful point of comparison.

This visualization uses the same data that I needed in order to create my “How Rich is Elon Musk?” visualization. Since I had all this data, I figured I could crank out another related graph.

Sources and Tools:

Data from Bloomberg’s Billionaire’s index is downloaded regularly using a python script. Data on US household net worth is from DQYDJ’s net worth percentile calculator.

The treemap is created using the open-source Plotly javascript visualization library, as well as HTML, CSS and Javascript code to create interactivity and UI.

How Rich is Elon Musk? – Visualization of Extreme Wealth

See related visualization: How much wealth do the world’s richest billionaires have?

This visualization attempts to represent how much money Elon Musk, the richest person in the world, has. It gives context on this extreme amount of wealth by showing other very large sums of money that are somehow less than his net worth.

Each pixel on the screen represents a very modest amount of money (from

This visualization was inspired heavily by a similar visualization made by Matt Korostoff for Jeff Bezos (when he was the richest person in the world) called “Wealth shown to scale”.

If you have any ideas about other items that could be added to the money chart, please leave them in the comments, and I will see if I can add it.

Mega-billionaires such as Musk or Jeff Bezos are not just extremely rich, the wealth they possess is unimaginably large. There are some extremely rich folks shown in the visualization who can buy pretty much whatever they could ever possibly need and yet their wealth is closer to that of the average person than they are to that of Elon Musk.

Sources and Tools:

The full list of data sources for the various money amounts are listed below. The visualization was made using HTML, CSS and Javascript code to create interactivity and UI. Data from Bloomberg’s Billionaire’s index , which is the source of Musk’s (and others) estimated wealth, is updated regularly.

Full List of Data Sources:

- Cost of a supertanker’s worth of oil (at $70/barrel): https://en.wikipedia.org/wiki/Oil_tanker

- Cost of a Boeing 777-200ER Airplane: https://en.wikipedia.org/wiki/Boeing_777

- Lebron James and Cristiano Ronaldo Net Worth: https://wealthygorilla.com/top-20-richest-athletes-world/

- Tiger Woods Net Worth: https://wealthygorilla.com/top-20-richest-athletes-world/

- It’s alot of money, but we’ve still got a long way to go:

- Cost of building the Burj Khalifa (world’s tallest building in Dubai): https://en.wikipedia.org/wiki/Burj_Khalifa

- Total Ad Revenue for CNN, Fox News and MSNBC: https://www.pewresearch.org/journalism/fact-sheet/cable-news/

- Ophrah Winfrey Net Worth: https://www.celebritynetworth.com/richest-celebrities/actors/oprah-net-worth/

- Tuition for all 280,000 University of California Students: https://www.ucop.edu/operating-budget/_files/rbudget/2021-22-budget-detail.pdf

- One 40-Foot Shipping Container Full of $100 Bills: self-calculation

- Net Worth of Bottom 33% of Americans: https://dqydj.com/average-median-top-net-worth-percentiles/

- George Lucas Net Worth: https://www.bloomberg.com/billionaires/

- Cost of 2020 Tokyo Olympics: https://www.usnews.com/news/business/articles/2021-08-06/tokyo-olympics-cost-154-billion-what-else-could-that-buy

- Annual Budget of the US Department of Energy: https://en.wikipedia.org/wiki/United_States_Department_of_Energy

- Worldwide Box Office Revenue for Marvel Cinematic Universe (2008-2021): https://www.the-numbers.com/movies/franchise/Marvel-Cinematic-Universe#tab=summary

- Total Amount Spent of Gasoline in the State of Texas in one year: https://www.eia.gov/state/seds/data.php?incfile=/state/seds/sep_fuel/html/fuel_mg.html&sid=US

- Size of Harvard University’s Endowment: https://www.thecrimson.com/article/2021/10/15/endowment-returns-soar-2021/

- Annual Budget of the US Department of Transportation: https://en.wikipedia.org/wiki/United_States_Department_of_Transportation

- Total Gross State Product of Hawaii in 2021: https://en.wikipedia.org/wiki/List_of_states_and_territories_of_the_United_States_by_GDP

- Warren Buffet Net Worth: https://www.bloomberg.com/billionaires/

- State of Texas Operating Budget: https://en.wikipedia.org/wiki/List_of_U.S._state_budgets

- Total Value of all National Football League (NFL) Teams: https://www.profootballnetwork.com/nfl-franchise-values/

- Total Annual Income of 2 Million Residents of Silicon Valley (San Jose-Sunnyvale-Santa Clara CA Metro Area): https://censusreporter.org/profiles/31000US41940-san-jose-sunnyvale-santa-clara-ca-metro-area/

- Total Dollar Value of All US Agricultural Production: https://www.ers.usda.gov/data-products/ag-and-food-statistics-charting-the-essentials/ag-and-food-sectors-and-the-economy/

- Bill Gates Net Worth: https://www.bloomberg.com/billionaires/

- Total Tesla Revenue Since Founding (2008-2021): https://www.statista.com/statistics/272120/revenue-of-tesla/

- Annual Advertising Revenue for Google: https://www.cnbc.com/2021/05/18/how-does-google-make-money-advertising-business-breakdown-.html

- Total Amount Spent on US Residential Electricity In A Year: https://www.eia.gov/state/seds/data.php?incfile=/state/seds/sep_fuel/html/fuel_pr_es.html&sid=US

- Jeff Bezos Net Worth: https://www.bloomberg.com/billionaires/

- Annual Federal Taxes paid in Florida: https://en.wikipedia.org/wiki/Federal_tax_revenue_by_state

- Global Electric Vehicle Market Size in 2020: https://www.globenewswire.com/en/news-release/2021/09/06/2291730/0/en/Electric-Vehicle-Market-Size-Is-Anticipated-to-Grow-USD-1-318-22-Billion-in-2028-at-a-CAGR-of-24-3.html

- Value (i.e. Market Capitalization) of Walt Disney Company: https://www.google.com/finance/quote/DIS:NYSE

- Annual Revenue of Toyota Motor Corporation: https://money.cnn.com/quote/financials/financials.html?symb=TM

- Annual Health Care Expenditures for the entire State of California: https://www.kff.org/other/state-indicator/health-care-expenditures-by-state-of-residence-in-millions/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

- Total Annual Income for 100,000 Average US Households: https://www.census.gov/library/publications/2021/demo/p60-273.html

- Cost of one Gerald Ford Class Aircraft Carrier: https://en.wikipedia.org/wiki/Gerald_R._Ford-class_aircraft_carrier

- Cost to Build California High Speed Rail System: https://en.wikipedia.org/wiki/California_High-Speed_Rail

- Inflation Adjusted Cost of NASA’s Apollo Program: https://www.forbes.com/sites/alexknapp/2019/07/20/apollo-11-facts-figures-business/

- Total Annual Housing and Utilities Expenditures For All 6.6 Million Households in Los Angeles Metro Area: https://www.bls.gov/cex/tables/geographic/mean/cu-msa-west-2-year-average-2020.pdf

- Annual Amount Spent on the Purchase of iPhones: https://www.businessofapps.com/data/apple-statistics/

- Elon Musk Net Worth: https://www.bloomberg.com/billionaires/

Early Retirement Calculators and Tools

Interested in Early Retirement or FIRE (Financial Independence to Retire Early)?

Here are some interactive and educational planning tools that I developed to help you understand the concepts of FIRE and calculate how long it will take to achieve retirement and how likely you are to survive retirement. Click on the tools below to try them out.

Financial Independence Calculators

Regardless of where you are on your path to FIRE, there are several types of tools that are useful:

Planning to get to retirement

How long and how safe will your retirement be?

Rich, Broke or Dead? Will your Money Last Through Early Retirement?

Simulating retirement portfolio survival probability and human longevity

These tools all focus on the concept of FIRE. FIRE is the concept that revolves around saving and investing to achieve Financial Independence (FI) and to potentially Retire Early (RE). One of the core concepts is that once you can save up enough money, you can retire by withdrawing a fraction of this money annually to cover your living expenses. Other important topics related to this core concept have to do with reducing spending so you can save money and investing so your money can grow and sustain your retirement over many decades.

Other visualizations and tools related to Financial Independence

These tools relate to taxes and stock market returns.

Calculating Returns from Periodic Investments

Visualizing Market Returns

Understanding Market Timing

How difficult is it to time the stock market?

Market Timing Game

Income Taxes

Tax bracket calculator to visualize how income and capital gains taxed

Income Tax Bracket Calculator

Data Sources and Tools:

See the individual tool to learn more about how it was made.

Stimulus Check Calculator (Late 2020 & Early 2021)

How much money can you expect in your stimulus check?

Updated to include the $1400 stimulus payment per adult and dependent in March 2021.

Use this stimulus check calculator to figure out how much you will receive in your thrid stimulus check.

On December 21, 2020, Congress passed a $900 billion dollar stimulus package in response to the COVID pandemic. The bill authorizes economic assistance to Americans in the amount of $600 per person subject to income limits. It also includes expanded unemployment benefits, rental assistance and an extension to the eviction ban. This calculator helps you calculate the amount of stimulus check that you can expect to receive based on your 2019 tax return filing status, adjusted gross income and number of dependents under 17.

Changing the inputs to the calculator, will show you how your expected stimulus check amount will change. The graph shows for a giving filing status (single, married filing jointly or head of household) how the stimulus check amount will change as a function of income and number of children. You can share a URL with specific parameters included

Sounds like some checks may even get to folks at the end of December and many more will get them in January 2021.

On March 5, congress passed the American Rescue Plan which includes $1400 payments for all Americans. The phase out of this stimulus check is different in that over a $10000 range the stimulus goes from 100% to 0% at the phase out threshold, no matter how many dependents you have. This changes things significantly as you’ll see in the calculator.

Sources and Tools:

The stimulus check calculator is made using javascript and the plotly open source graphing library. It is based on news reports of the expected stimulus amounts and income thresholds.

2020 Stock Market Drop Compared to other Bear Markets

2020’s stock market drop was unprecedented for the speed of the drop and also the speed of the recovery

This graph shows the stock market drops from the 2020 and other bear markets normalized so that the peak is at 100% at day 0. This lets you see the severity and duration of different bear markets from the Great Depression (1929), the Dot Com Bust (2000), and the Financial Crisis (2008) and other drops over 30%.

The coronavirus pandemic has significantly disrupted the global economy. Q2 GDP in the United States declined at an annualized rate of 32% and US unemployment reaching 15% due to coronavirus induced business shutdowns.

However, the stock market drop (represented by the S&P500 index) in late February and early March 2020 has somewhat surprisingly rebounded and reached a new all-time-high in August 2020, even as unemployment and GDP output has continued to falter. There certainly seems to be a disconnect between the fundamentals of the economy and the stock market.

Will the recovery in the stock markets continue or will it begin to align more closely with the fundamentals of the economy?

There are many proposed reasons why this disconnect is happening. The Federal Reserve actions to increase liquidity and prop up the stock market. The heavy weighting of tech in the S&P500 and the pandemic’s boost to many tech company’s business (i.e. Amazon, Zoom, Apple). Whatever the reason, the question of whether the market can continue at this pace or will have a correction is important and one to watch.

Data for the S&P500 price is daily from 1950 onward but before 1950, the data I had available was on a monthly basis. I interpolated this monthly data to create daily data, so not all the data is 100% accurate for any given day before 1950. Data for 2020 will continue to be updated daily.

Source and Tools:

Data on historical S&P500 prices is from Yahoo! Finance and downloaded and cleaned with a python script. Graph is made using the plotly open source javascript library.

Recent Comments