Posts for Tag: interactive

ScrabWordle

Also try WordGuessr and Tridle

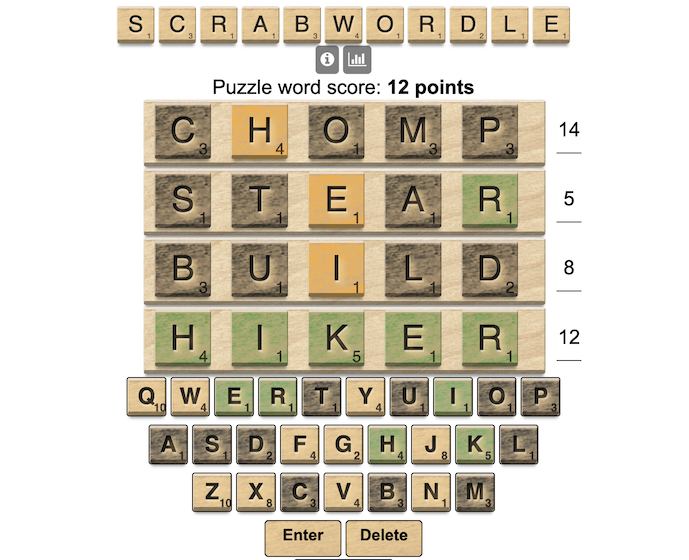

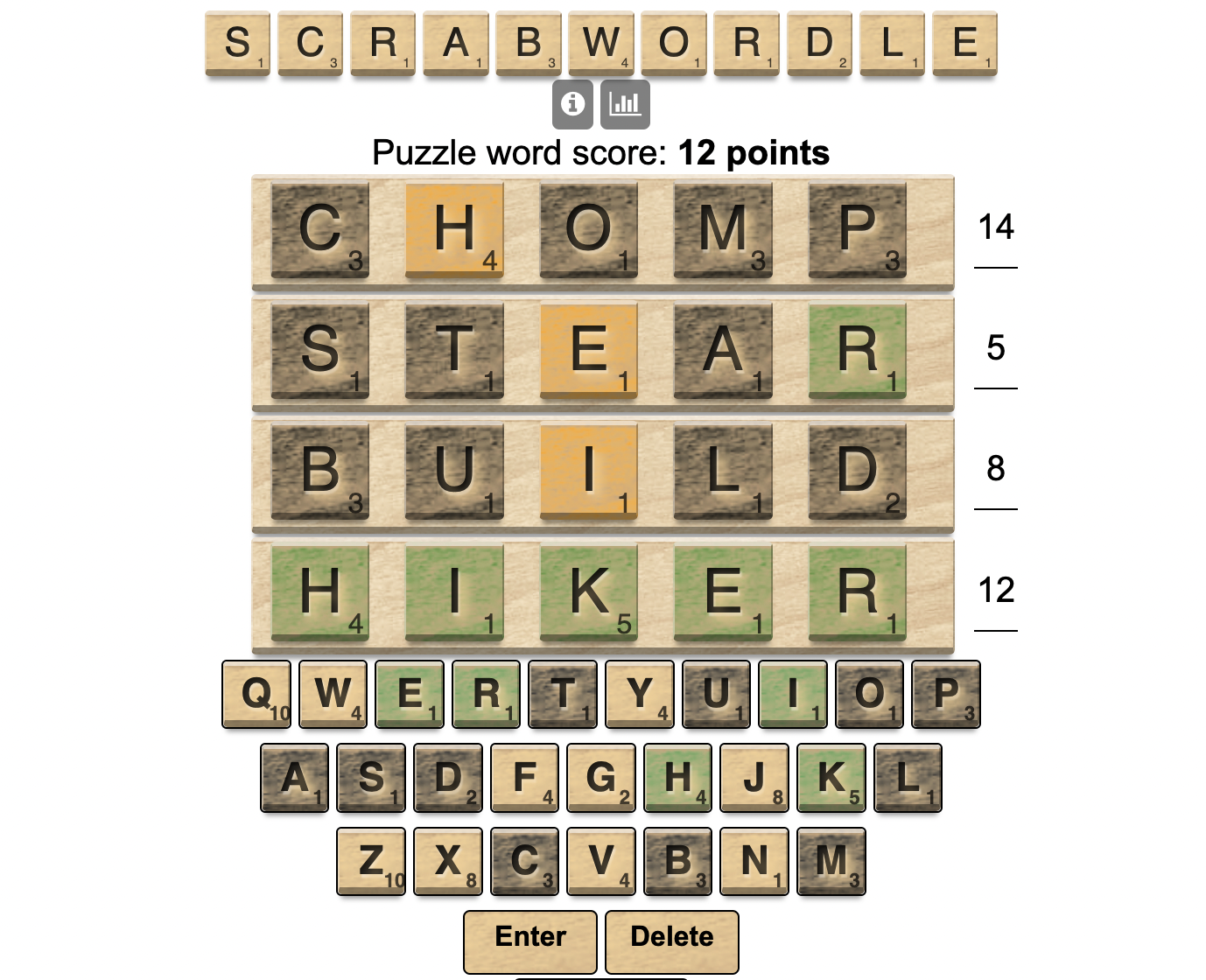

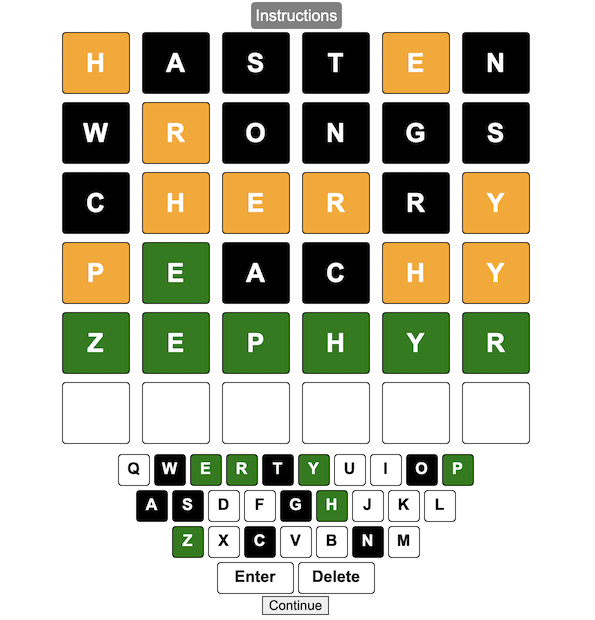

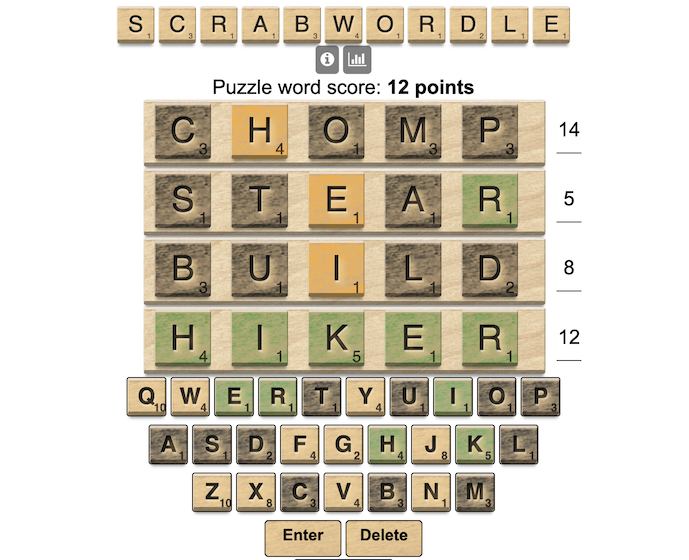

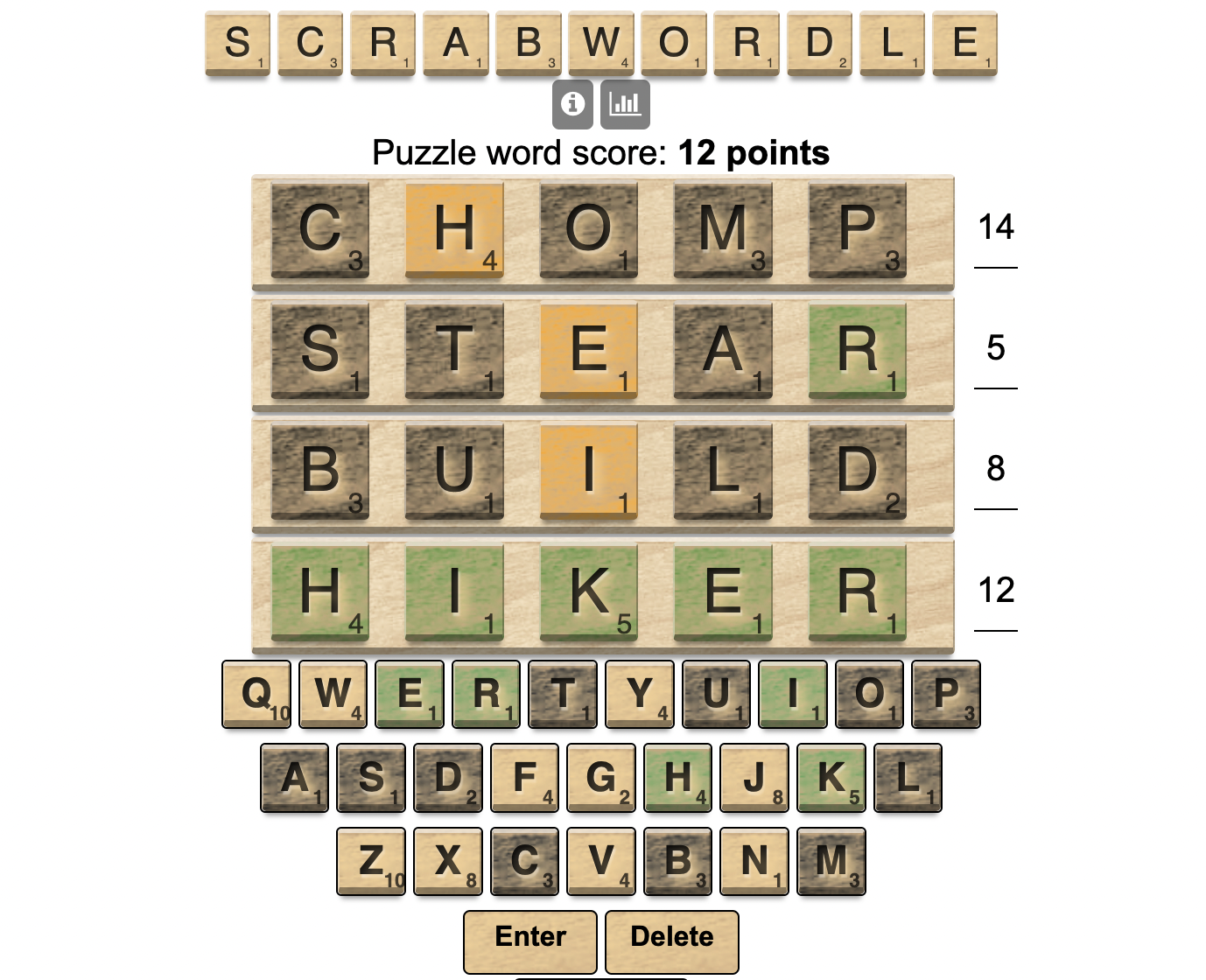

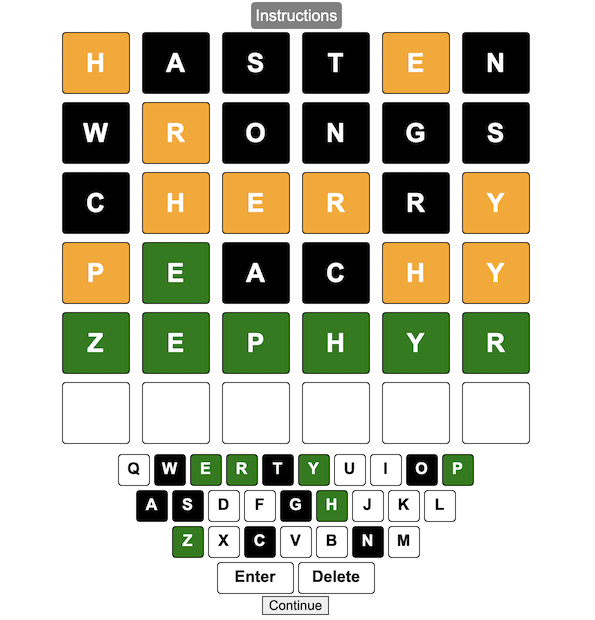

What is ScrabWordle? Wordle with a Scrabble twist

ScrabWordle is a game based on the hugely popular Wordle by Josh Wardle, where you try to solve a 5-letter puzzle. The Scrabble element of the game comes in where the point value of the target word is given based on the letter values in the game and is another helpful clue to help solve the puzzle.

I recently made WordGuessr and Tridle. So I’d already made the structure of the game and just needed to add the Scrabble elements. And it took me a little while to work out all the kinks and it also improved my CSS skills to get all the aspects of the look of the tiles correct.

How to Play ScrabWordle

If you know how to play Wordle, then the rules are the same:

1) the game reports the point value of the target word

2) just type in a guess and and press ‘Enter’, the score of your guess is updated in real time

3) the game will indicate how good your guess was. If any letter are in their correct position they will turn green, if they are correct but in the wrong place, they turn orange, and if they don’t show up in the word they turn black.

4) guess again, using the clues from the previous word

5) you can share your results with other folks or issue a challenge game

6) play all you want

The game is created using HTML, CSS and Javascript code to create interactivity and UI. Hope you enjoy it. I enjoy the extra element (word point values) to help me guess the word. Let me know in the comments how you like the new game play and if the difficulty levels are appropriate.

Tridle – a triple Wordle game

Over 5 Million games played! (December 2022).

Try my clone of the NYTimes game Digits

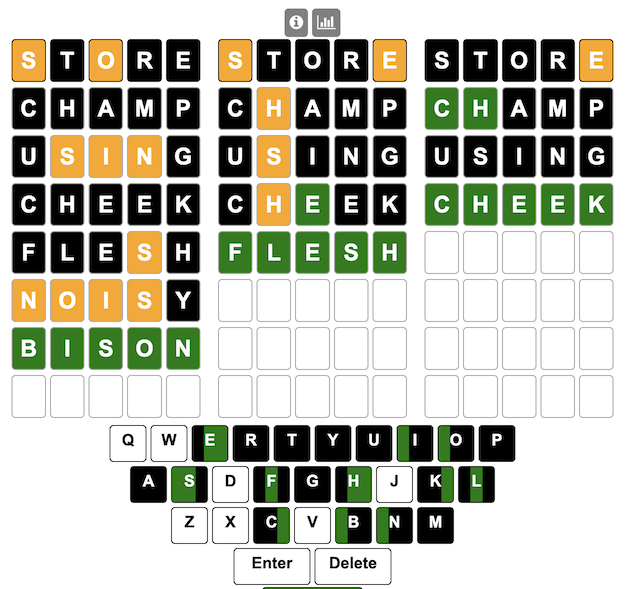

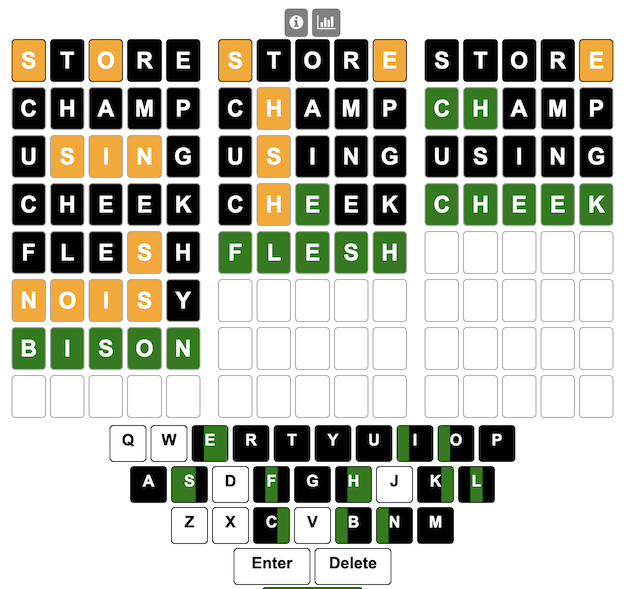

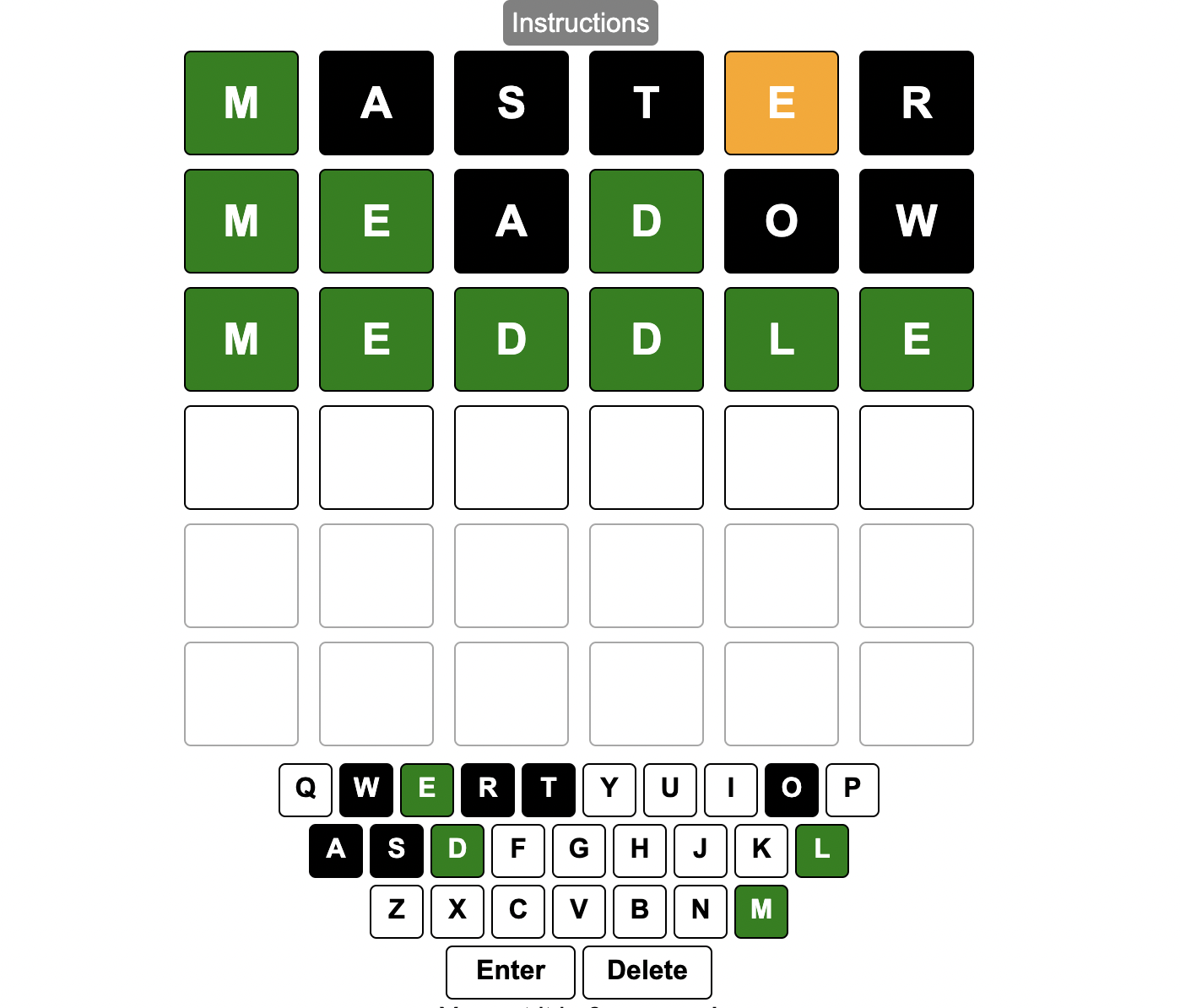

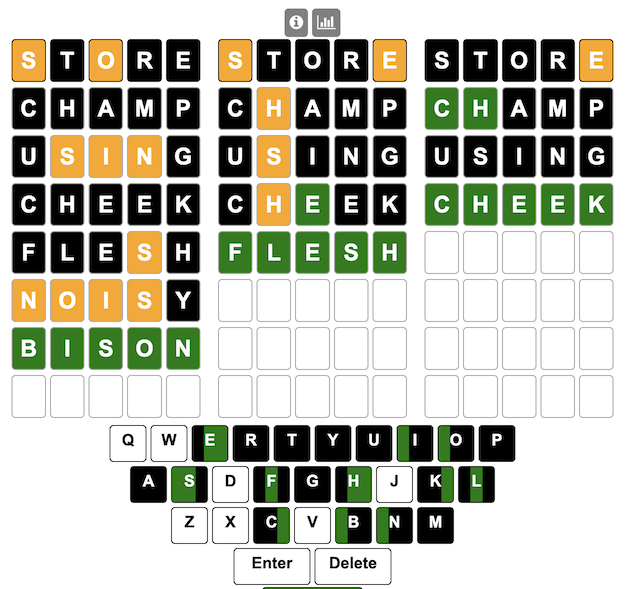

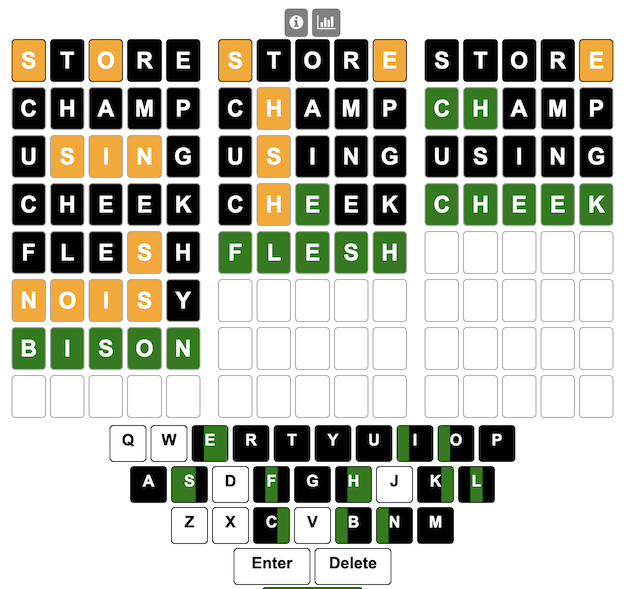

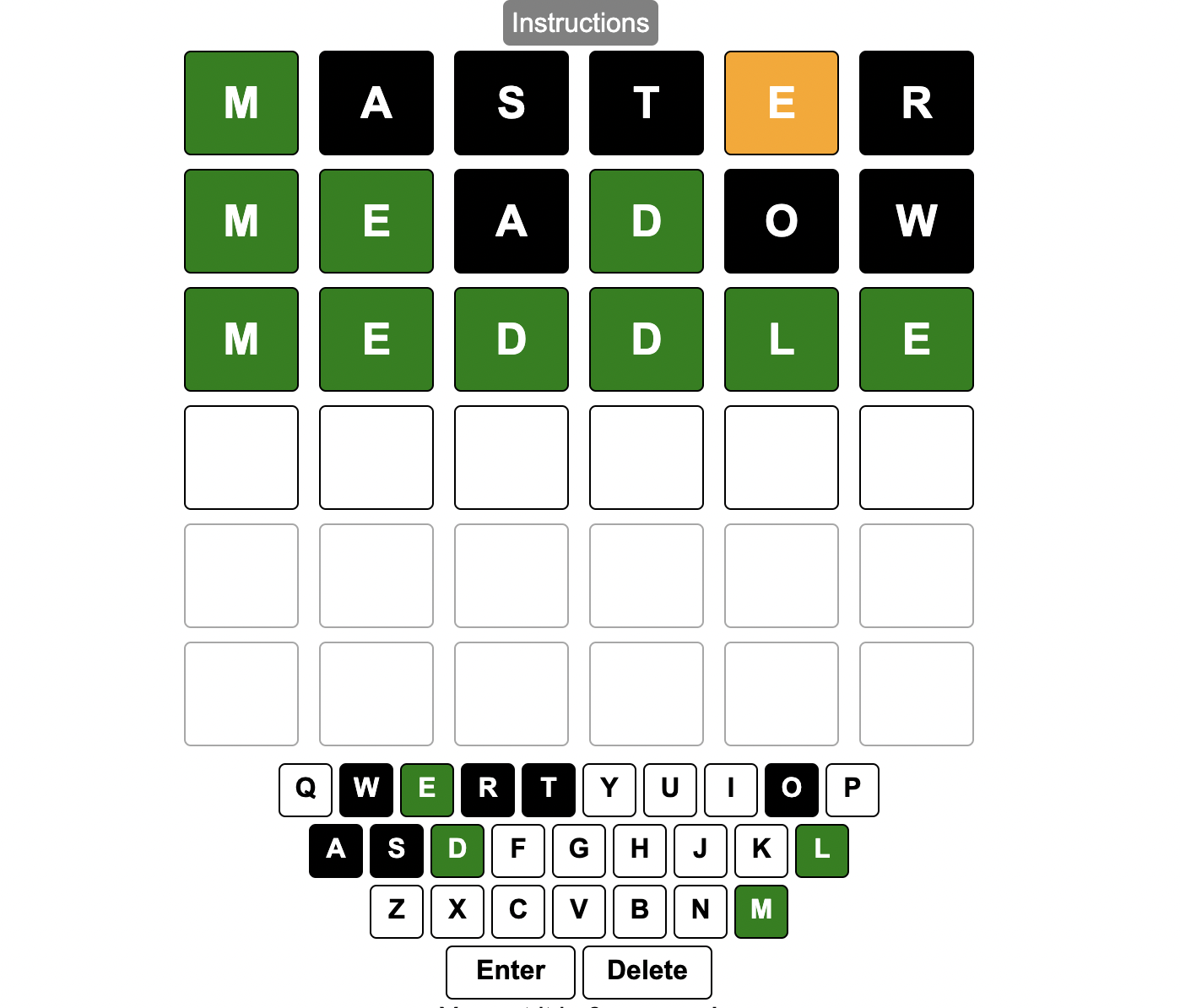

What is Tridle? Triple Wordle

Tridle is a game based on the hugely popular Wordle by Josh Wardle, where you try to solve three puzzles (Triple Wordle) at the same time. It is also modeled after Dordle and Quordle, but a little different (3 instead of 2 or 4!)

Shortly after I started playing Wordle in early January, I wanted to play more games so I decided to make a Wordle game so I could play as often as I wanted. I made WordGuessr in a day or so. It ended up being fairly popular and lots of people still play.

Recently, I started playing Dordle (where you solve two puzzles simultaneously), which adds an extra layer of challenge onto the Wordle game. I thought that a triple Wordle game would be a fun game to code up and since I’d already made the structure of the single game, how hard could making 3 be. Well, it took me another day or so to work out all the kinks and it was also stretched my CSS skills to get all the look correct with all the various permutations of the game and generating three boards simultaneously.

If you know how to play Wordle, then the rules are the same:

1) just type in a guess and and press ‘Enter’.

2) the game will indicate how good your guess was for each puzzle separately. If any letter are in their correct position they will turn green, if they are correct but in the wrong place, they turn orange, and if they don’t show up in the word they turn black.

3) guess again, using the clues from the previous word

4) repeat until you get each of the words correct or fail to figure them all out after 8 tries.

5) you can share your results with other folks

6) play all you want

The game is created using HTML, CSS and Javascript code to create interactivity and UI.

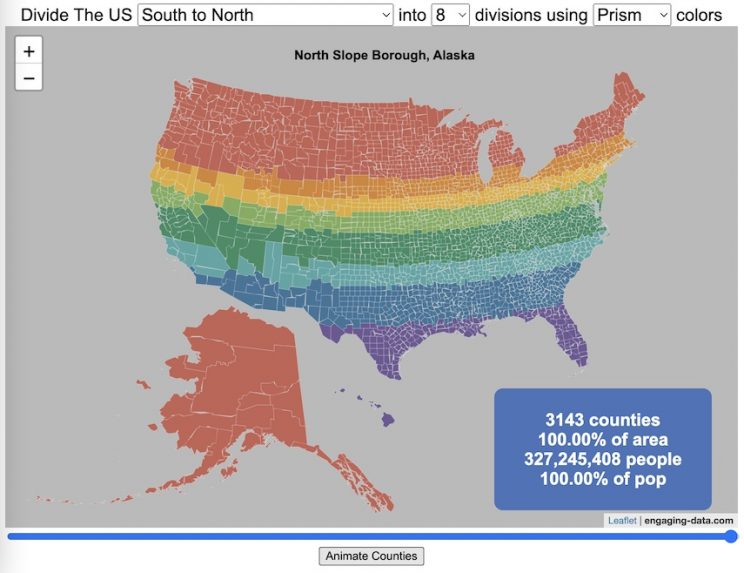

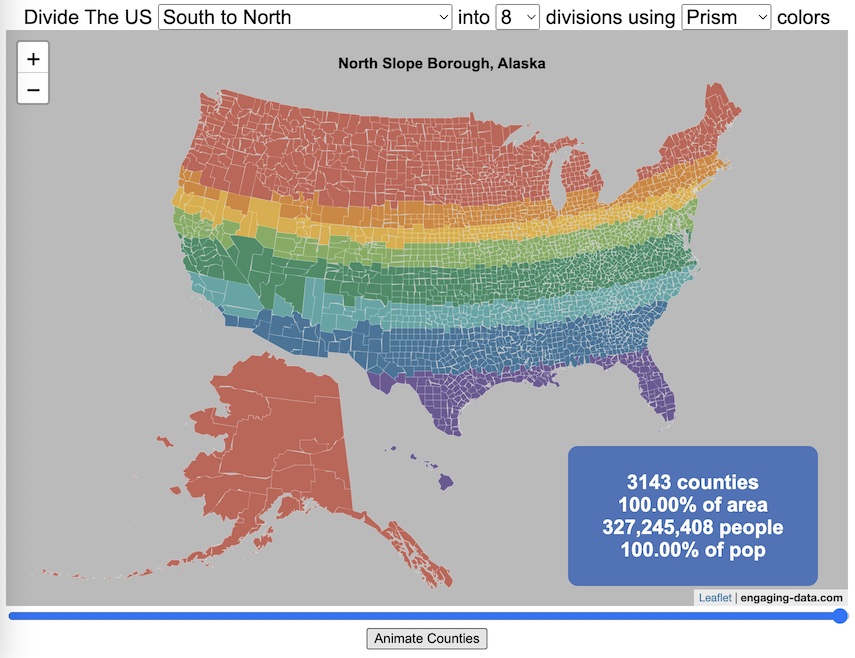

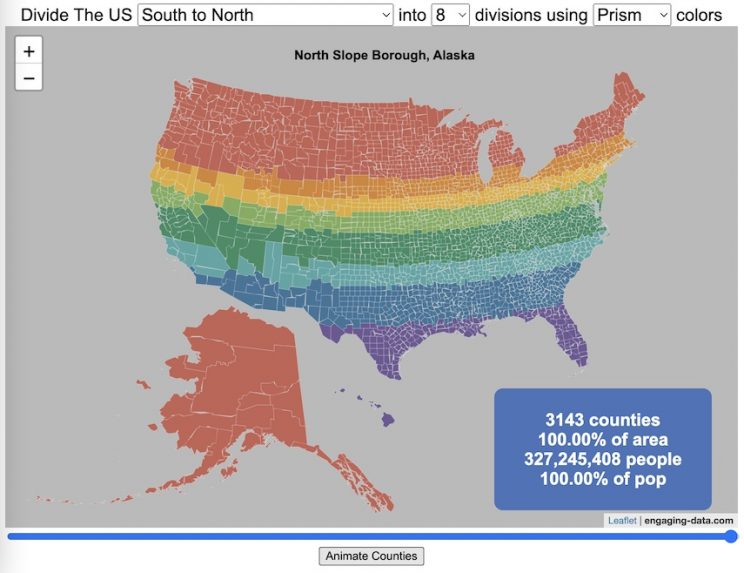

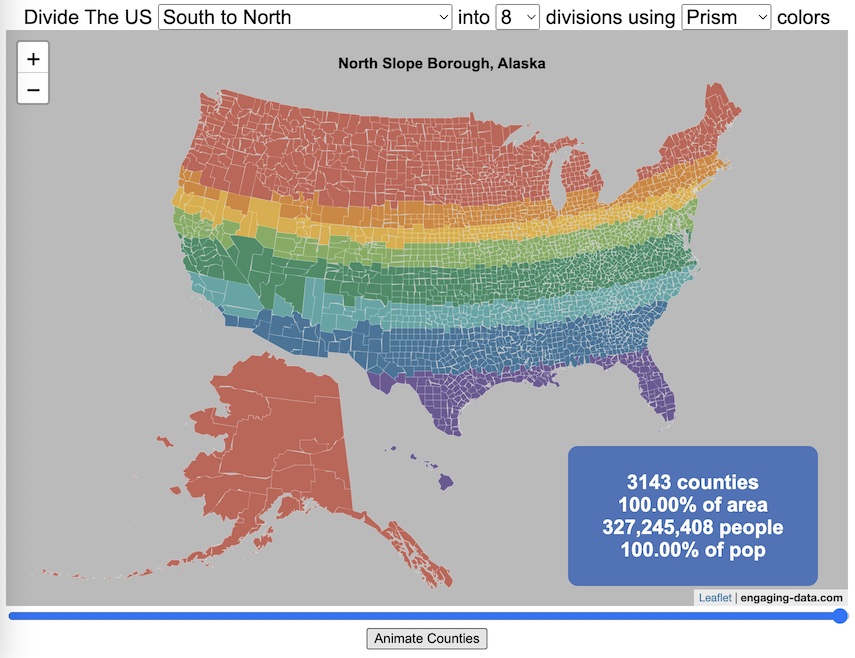

Splitting the US by Population

This visualization lets you divide the US into 1,2,3,4,5,8 and 10 different segments with equal population and across different dimensions. The divisions are made using counties as the building blocks (of which there are 3143 in the US). There are numerous different ways to make the divisions. This lets you make the divisions by different types of geographic directions and divisions by population density.

Instructions

- Select a dimension on which to divide up the country – there are geographic dimensions, like north to south or east to west, or by population density

- For some geographic divisions (concentric rings or pie slices), you can choose the geographic center of the divisions

- You can also choose the number and color scheme of the divisions

- To show the divisions, either click the Animate Counties button or use the slider to add counties

If you can think of other interesting ways to divide up the US, please let me know and I can try to add them to this visualization.

Sources and Tools:

2018 county population data is from US Census Bureau. The map visualization is created using the Leaflet javascript mapping library and the data wrangling and user interface and interactivity are created using HTML, CSS and Javascript code.

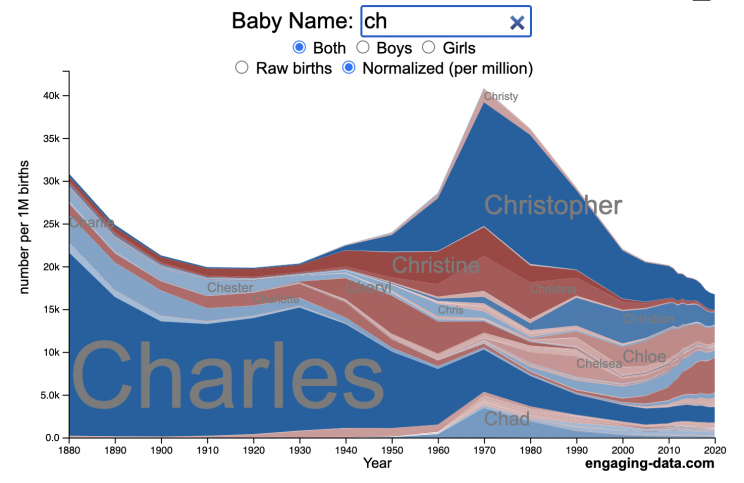

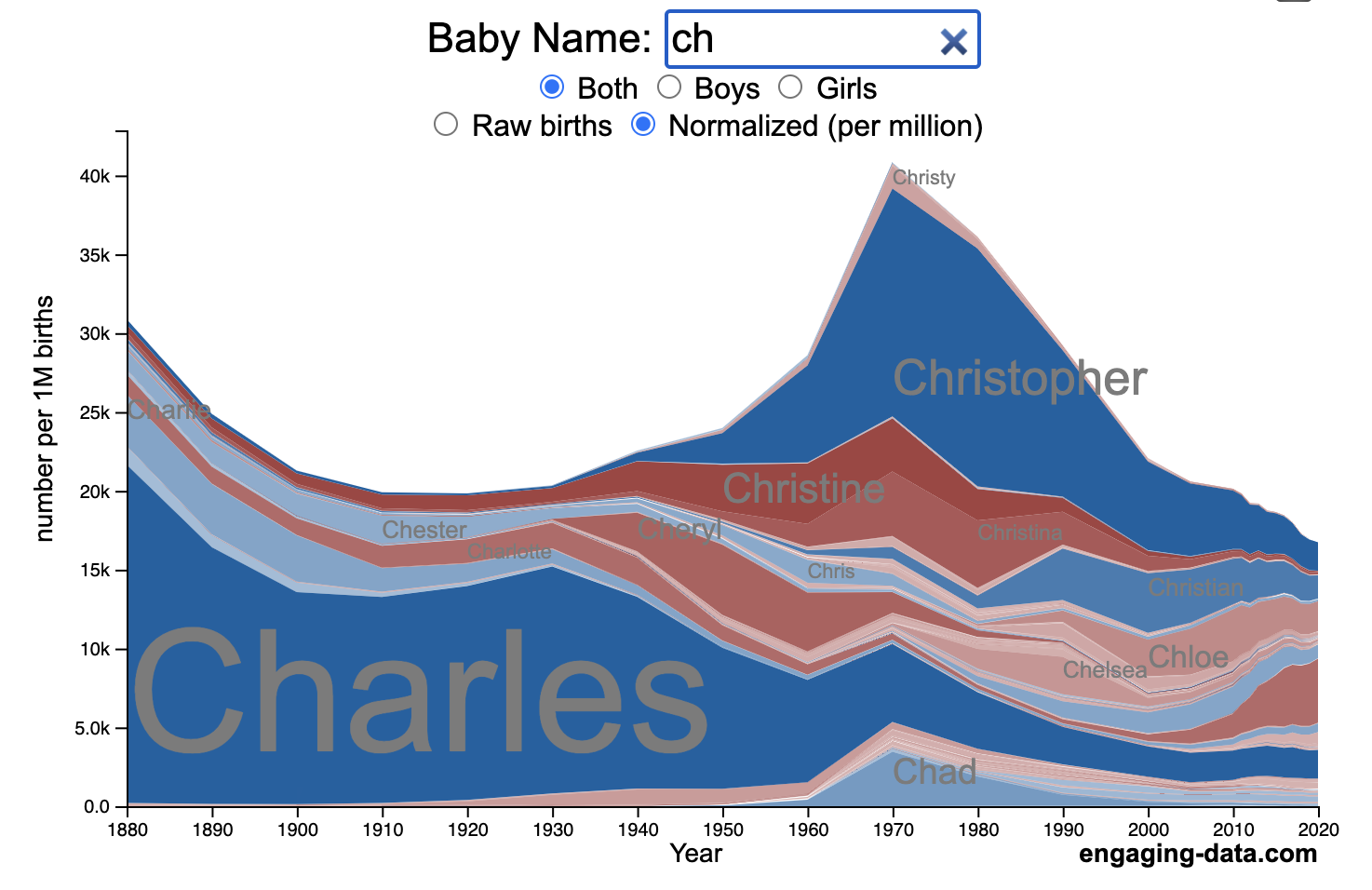

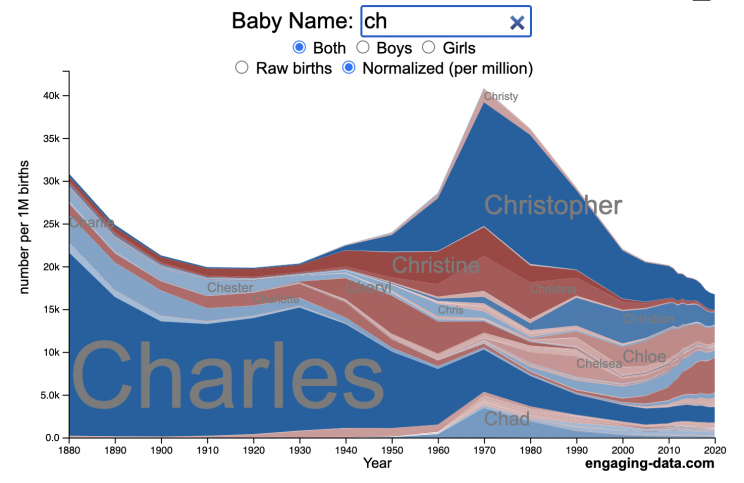

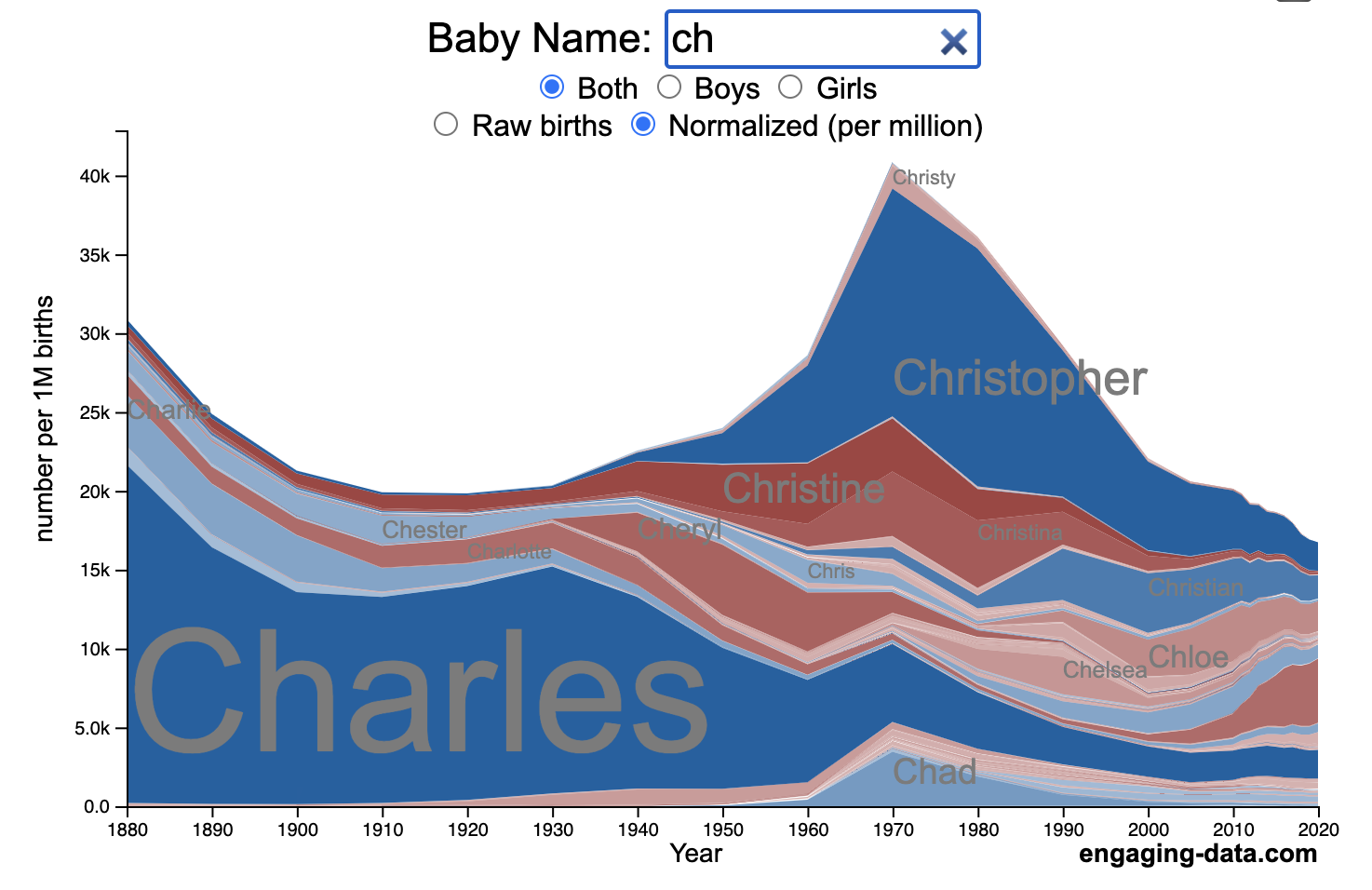

US Baby Name Popularity Visualizer

I added a share button (arrow button) that lets you send a graph with specific name. It copies a custom URL to your clipboard which you can paste into a message/tweet/email.

How popular is your name in US history?

Use this visualization to explore statistics about names, specifically the popularity of different names throughout US history (1880 until 2020). This is a useful tool for seeing the rise (and fall) of popularity of names. Look at names that we think of as old-fashioned, and names that are more modern.

Instructions

- Start typing a name into the input box above and the visualization will show all the names that begin with those letters. The graph will show the historical popularity of all these names as an area graph.

- You can hover (or click on mobile) to bring up a tooltip (popup) that shows you the exact number of births with that name for different years (or decades) and the names rank in that time period.

- It’s best used on computer (rather than a mobile or tablet device) so you can see the graph more clearly and also, if you click on a name wedge, it will zoom into names that begin with those letters.

- You can select different views, Boy names, Girl names or both, as well as looking at the raw number of births or a normalized popularity that accounts for the differential number of births throughout the period between 1880 and 2020.

- If you click the share (arrow) button, it will copy the parameters of the current graph you are looking at and create a custom URL to share with others. It copes the link into your clipboard and your browser’s address (URL) bar.

Isn’t there something out there like this already? Baby Name Wizard and Baby Name Voyager

This visualization is not my original idea, but rather a re-creation of the Baby Name Voyager (from the Baby Name Wizard website) created by Laura Wattenberg. The original visualization disappeared (for some unknown reason) from the web, and I thought it was a shame that we should be deprived of such a fun resource.

It started about a week ago, when I saw on twitter that the Baby Name Wizard website was gone. Here’s the blog post from Laura. I hadn’t used it in probably a decade, but it flashed me back to many years ago well before I got into web programming and dataviz and I remember seeing the Baby Name Voyager and thinking how amazing it was that someone could even make such a thing. Everyone I knew played with it quite a bit when it first came out. It got me thinking that it should still be around and that I could probably make it now with my programming skills and how cool that would be.

So I downloaded the frequency data for Baby Names from the US Social Security Administration and set to work trying to create a stacked area graph of baby names vs time. I started with my go to library for fast dataviz (Plotly.js) but eventually ended up creating the visualization in d3.js which is harder for me, but made it very responsive. I’m not an expert in d3, but know enough that using some similar examples and with lots of googling and stack overflow, I could create what I wanted.

I emailed Laura after creating a sample version, just to make sure it was okay to re-create it as a tribute to the Baby Name Wizard / Voyager and got the okay from her.

Where does the data come from?

Some info about Data (from SSA Baby Names Website):

All names are from Social Security card applications for births that occurred in the United States after 1879. Note that many people born before 1937 never applied for a Social Security card, so their names are not included in our data.

Name data are tabulated from the “First Name” field of the Social Security Card Application. Hyphens and spaces are removed, thus Julie-Anne, Julie Anne, and Julieanne will be counted as a single entry.

Name data are not edited. For example, the sex associated with a name may be incorrect.

Different spellings of similar names are not combined. For example, the names Caitlin, Caitlyn, Kaitlin, Kaitlyn, Kaitlynn, Katelyn, and Katelynn are considered separate names and each has its own rank.

All data are from a 100% sample of our records on Social Security card applications as of March 2021.

I did notice that there was a significant under-representation of male names in the early data (before 1910) relative to female names. In the normalized data, I set the data for each sex to 500,000 male and 500,000 female births per million total births, instead of the actual data which shows approximately double the number of female names than male names. Not sure why females would have higher rates of social security applications in the early 20th century. Update: A helpful Redditor pointed me to this blog post which explains some of the wonkiness of the early data. The gist of it is that Social Security cards and numbers weren’t really a thing until 1935. Thus the names of births in 1880 are actually 55 year olds who applied for Social Security numbers and since they weren’t mandatory, they don’t include everyone. My correction basically makes the assumption that this data is actually a survey and we got uneven samples from males and female respondents. It’s not perfect (like the later data) but it’s a decent representation of name distribution.

Sources and Tools:

The biggest source of inspiration was of course, Laura Wattenberg’s original Baby Name Explorer.

I downloaded the baby names from the Social Security website. Thanks to Michael W. Shackleford at the SSA for starting their name data reporting. I used a python script to parse and organize the historical data into the proper format my javascript. The visualization is created using HTML, CSS and Javascript code (and the d3.js visualization library) to create interactivity and UI. Curran Kelleher’s area label d3 javascript library was a huge help for adding the names to the graph.

WordGuessr – a social Wordle unlimited clone – Word Guesser

Over 16 Million games played! (Feb 2023).

Try playing my NYTimes Digits math game clone,

TRIDLE – Three Wordle Puzzles simultaneously and

Wordguessr – Unlimited endless Wordle practice

You can do your Wordle practice training here with unlimited attempts.

As my wife likes to say, “Practice makes ‘Pretty Good'”.

I made this Wordle clone in about a day after playing with Wordle for a few days. My wife and I were pretty hooked and I wanted to play more than once a day. It’s like a word version of Mastermind. I also thought it would be fun with words of different lengths, so I added the option for words between 3-7 letters long. Depending on the number of letters, the game feels very different. 3 letters is very short and it’s easier in some respects but you have to guess more. Longer words require much more thinking.

The rules of the game are pretty simple:

1) just type in a guess and and press ‘Enter’.

2) the game will indicate how good your guess was. If any letter are in their correct position they will turn green, if they are correct but in the wrong place, they turn orange, and if they don’t show up in the word they turn black.

3) guess again, using the clues from the previous word

4) repeat until you get the word correct or fail to figure it out after 6 tries.

I added the ability to create a challenge game that allows you to share a link (with a unique code) which will enable anyone with the link to play the same word.

Apparently, my site is unblocked on education websites (which makes sense since it has a lot of educational content), so I seem to be getting lots of traffic from Chromebooks searching for “Wordle Unblocked”.

You can also share your guessing results (not the answer) with a grid of boxes, like the original Wordle, as shown below:

WordGuessr Challenge

(5 letter) 4/6

🟩⬛⬛⬛🟧

🟩🟧🟧⬛⬛

🟩🟩🟩⬛🟧

🟩🟩🟩🟩🟩

Try the same exact puzzle here:

https://engaging-data.com/wordguessr-wordle/?challenge=uab5

I also added the game stats which should persist across games and lets you look at stats for games of different word lengths individually as well as all your games.

I wasn’t sure what how the original Wordle game handles duplicate letters so I made up my own set of rules for how it would happen. First, if there are multiple instances of a single letter (e.g. two ‘E’s in a word) and you make a guess of a word with two ‘E’. If one is in the correct spot and one is in the wrong spot, one will be green and the other orange. If both are in the wrong spot, they will both be orange. If there is only one ‘E’ in the answer but you guess two, one will be black and the other will be green or orange depending on its position.

Sources and Tools:

Obviously a big shout out to Josh Wardle and his Wordle game, as this is mostly a carbon copy of his game with a few additions.

I downloaded the most common words in English from the English Lexicon Project Web Site at Washington University in St. Louis. Then I processed these to remove foreign language words and other strange entries and split them into groups of words by number of letters using Python.

The game is created using HTML, CSS and Javascript code to create interactivity and UI. Thanks to my wife and daughter for beta-testing, lots of fun beta testing.

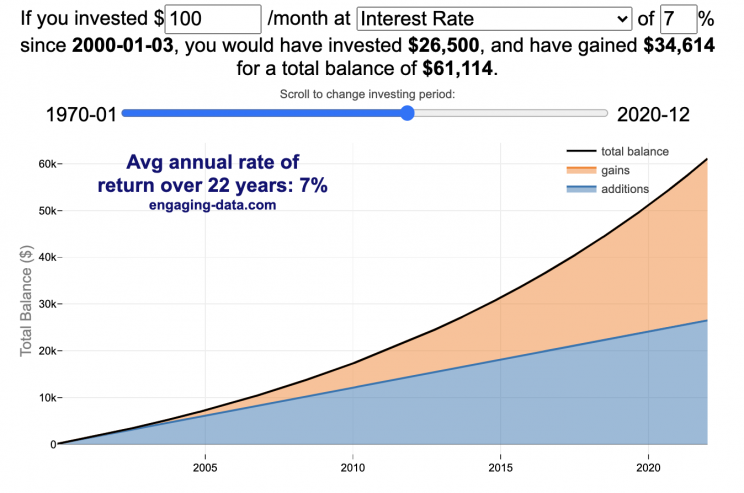

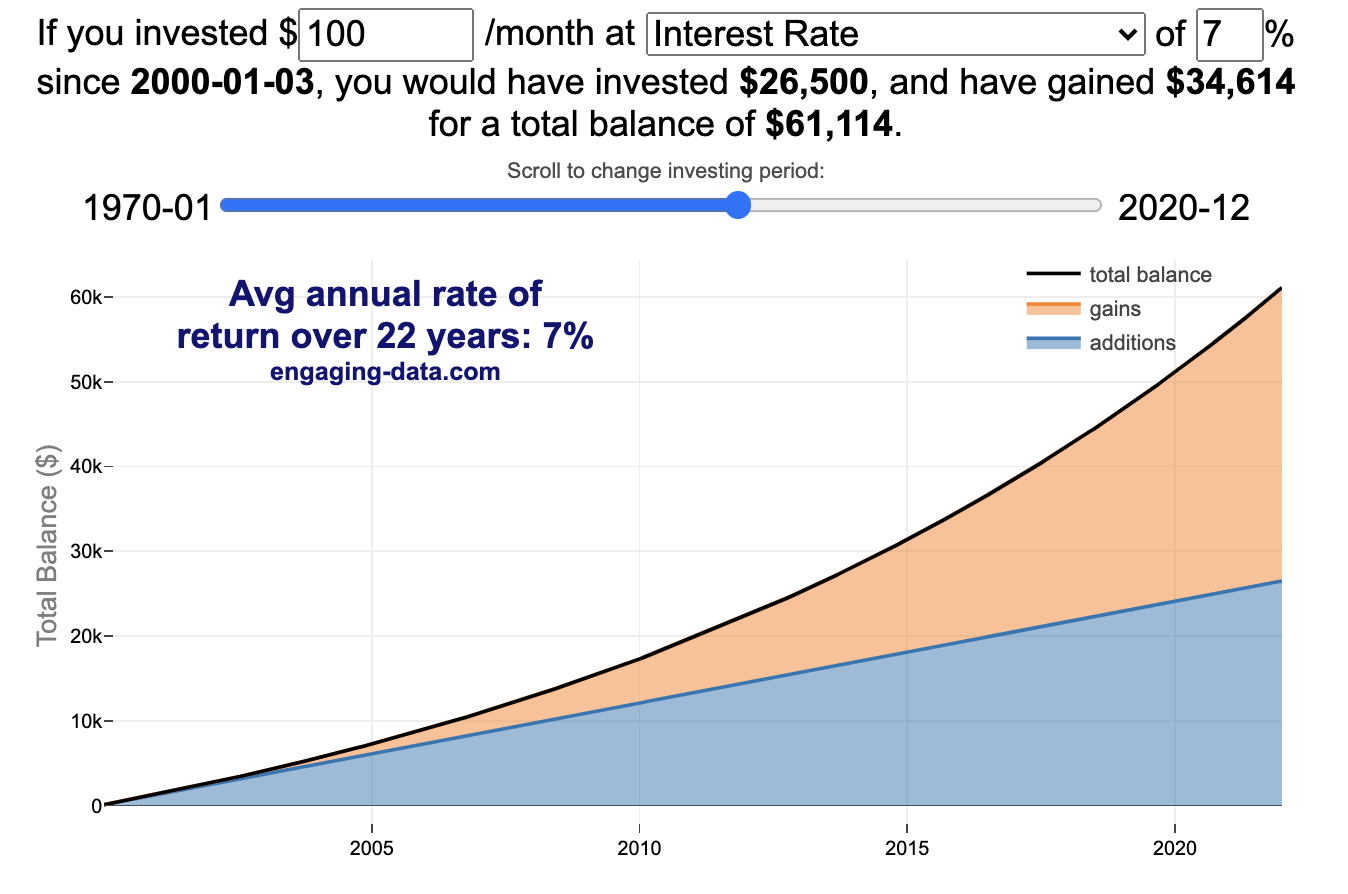

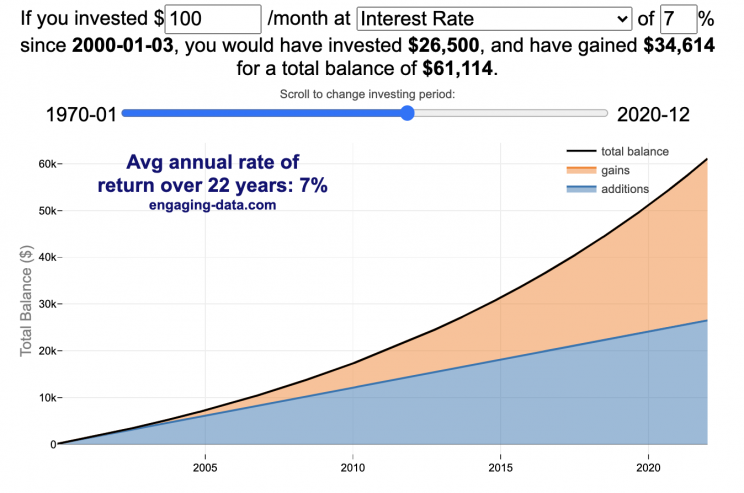

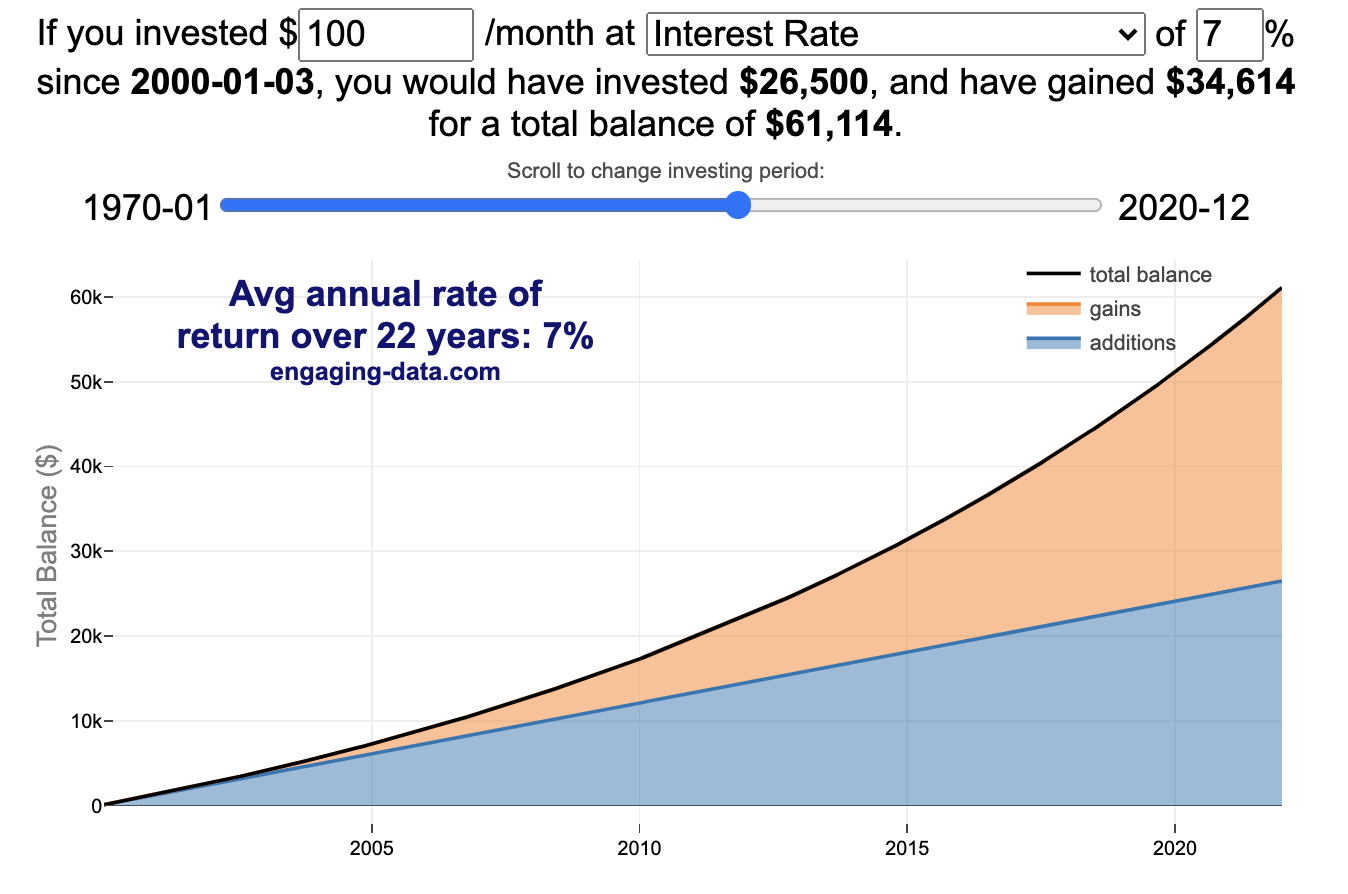

Compound Interest and Stock Returns Calculator

Calculate returns on regular, periodic investments

This calculator lets you visualize the value of investing regularly. It lets you calculate the compounding from a simple interest rate or looking at specific returns from the stock market indexes or a few different individual stocks.

Instructions

- Enter the amount of money to be invested monthly

- Choose to use an interest rate (and enter a specific rate) or

- Choose a stock market index or individual stock

- Use the slider to change the initial starting date of your periodic investments – You can go as far back as 1970 or the IPO date of the stock if it is later than that.

- Use the “Generate URL to Share” button to create a special URL with the specific parameters of your choice to share with others – the URL will appear in your browser’s address bar.

You can hover over the graph to see the split between the money you invested and the gains from the investment. In most cases (unless returns are very high), initially the investments are the large majority of the total balance, but over time the gains compound and eventually, it is those gains rather than the initial investments that become the majority of the total.

Some of the tech stocks included in the dropdown list have very high annualized returns and thus the gains quickly overtake the additions as the dominant component of the balance and you can make a great deal of money fairly quickly.

It becomes clearer as you move the slider around, that longer investing time periods are the key to increasing your balance, so building financial prosperity through investing is generally more of a marathon and not really a sprint. However, if you invest in individual stocks and pick a good one, you can speed up that process, though it’s not necessarily the most advisable way to proceed. Lots of people underperform the market (i.e. index funds) or even lose money by trying to pick big winners.

Understanding the Calculations

Calculating compound returns is relatively easy and is just a matter of consecutively multiplying the return. If the return is 7% for 5 years, that is equal to multiplying 1.07 five times, i.e. 1.075 = 1.402 (or a 40.2% gain).

In this case, we are adding additional investments each month but the idea is the same. Take the amount of money (or value of shares) and multiply by the return (>1 if positive or <1 for negative returns) after each period of the analysis.

Sources and Tools:

Stock and index monthly data is downloaded from Yahoo! finance is downloaded regularly using a python script.

The graph is created using the open-source Plotly javascript visualization library, as well as HTML, CSS and Javascript code to create interactivity and UI.

ScrabWordle

Also try WordGuessr and Tridle

What is ScrabWordle? Wordle with a Scrabble twist

ScrabWordle is a game based on the hugely popular Wordle by Josh Wardle, where you try to solve a 5-letter puzzle. The Scrabble element of the game comes in where the point value of the target word is given based on the letter values in the game and is another helpful clue to help solve the puzzle.

I recently made WordGuessr and Tridle. So I’d already made the structure of the game and just needed to add the Scrabble elements. And it took me a little while to work out all the kinks and it also improved my CSS skills to get all the aspects of the look of the tiles correct.

How to Play ScrabWordle

If you know how to play Wordle, then the rules are the same:

1) the game reports the point value of the target word

2) just type in a guess and and press ‘Enter’, the score of your guess is updated in real time

3) the game will indicate how good your guess was. If any letter are in their correct position they will turn green, if they are correct but in the wrong place, they turn orange, and if they don’t show up in the word they turn black.

4) guess again, using the clues from the previous word

5) you can share your results with other folks or issue a challenge game

6) play all you want

The game is created using HTML, CSS and Javascript code to create interactivity and UI. Hope you enjoy it. I enjoy the extra element (word point values) to help me guess the word. Let me know in the comments how you like the new game play and if the difficulty levels are appropriate.

Tridle – a triple Wordle game

Over 5 Million games played! (December 2022).

Try my clone of the NYTimes game Digits

What is Tridle? Triple Wordle

Tridle is a game based on the hugely popular Wordle by Josh Wardle, where you try to solve three puzzles (Triple Wordle) at the same time. It is also modeled after Dordle and Quordle, but a little different (3 instead of 2 or 4!)

Shortly after I started playing Wordle in early January, I wanted to play more games so I decided to make a Wordle game so I could play as often as I wanted. I made WordGuessr in a day or so. It ended up being fairly popular and lots of people still play.

Recently, I started playing Dordle (where you solve two puzzles simultaneously), which adds an extra layer of challenge onto the Wordle game. I thought that a triple Wordle game would be a fun game to code up and since I’d already made the structure of the single game, how hard could making 3 be. Well, it took me another day or so to work out all the kinks and it was also stretched my CSS skills to get all the look correct with all the various permutations of the game and generating three boards simultaneously.

If you know how to play Wordle, then the rules are the same:

1) just type in a guess and and press ‘Enter’.

2) the game will indicate how good your guess was for each puzzle separately. If any letter are in their correct position they will turn green, if they are correct but in the wrong place, they turn orange, and if they don’t show up in the word they turn black.

3) guess again, using the clues from the previous word

4) repeat until you get each of the words correct or fail to figure them all out after 8 tries.

5) you can share your results with other folks

6) play all you want

The game is created using HTML, CSS and Javascript code to create interactivity and UI.

Splitting the US by Population

This visualization lets you divide the US into 1,2,3,4,5,8 and 10 different segments with equal population and across different dimensions. The divisions are made using counties as the building blocks (of which there are 3143 in the US). There are numerous different ways to make the divisions. This lets you make the divisions by different types of geographic directions and divisions by population density.

Instructions

- Select a dimension on which to divide up the country – there are geographic dimensions, like north to south or east to west, or by population density

- For some geographic divisions (concentric rings or pie slices), you can choose the geographic center of the divisions

- You can also choose the number and color scheme of the divisions

- To show the divisions, either click the Animate Counties button or use the slider to add counties

If you can think of other interesting ways to divide up the US, please let me know and I can try to add them to this visualization.

Sources and Tools:

2018 county population data is from US Census Bureau. The map visualization is created using the Leaflet javascript mapping library and the data wrangling and user interface and interactivity are created using HTML, CSS and Javascript code.

US Baby Name Popularity Visualizer

I added a share button (arrow button) that lets you send a graph with specific name. It copies a custom URL to your clipboard which you can paste into a message/tweet/email.

How popular is your name in US history?

Use this visualization to explore statistics about names, specifically the popularity of different names throughout US history (1880 until 2020). This is a useful tool for seeing the rise (and fall) of popularity of names. Look at names that we think of as old-fashioned, and names that are more modern.

Instructions

- Start typing a name into the input box above and the visualization will show all the names that begin with those letters. The graph will show the historical popularity of all these names as an area graph.

- You can hover (or click on mobile) to bring up a tooltip (popup) that shows you the exact number of births with that name for different years (or decades) and the names rank in that time period.

- It’s best used on computer (rather than a mobile or tablet device) so you can see the graph more clearly and also, if you click on a name wedge, it will zoom into names that begin with those letters.

- You can select different views, Boy names, Girl names or both, as well as looking at the raw number of births or a normalized popularity that accounts for the differential number of births throughout the period between 1880 and 2020.

- If you click the share (arrow) button, it will copy the parameters of the current graph you are looking at and create a custom URL to share with others. It copes the link into your clipboard and your browser’s address (URL) bar.

Isn’t there something out there like this already? Baby Name Wizard and Baby Name Voyager

This visualization is not my original idea, but rather a re-creation of the Baby Name Voyager (from the Baby Name Wizard website) created by Laura Wattenberg. The original visualization disappeared (for some unknown reason) from the web, and I thought it was a shame that we should be deprived of such a fun resource.

It started about a week ago, when I saw on twitter that the Baby Name Wizard website was gone. Here’s the blog post from Laura. I hadn’t used it in probably a decade, but it flashed me back to many years ago well before I got into web programming and dataviz and I remember seeing the Baby Name Voyager and thinking how amazing it was that someone could even make such a thing. Everyone I knew played with it quite a bit when it first came out. It got me thinking that it should still be around and that I could probably make it now with my programming skills and how cool that would be.

So I downloaded the frequency data for Baby Names from the US Social Security Administration and set to work trying to create a stacked area graph of baby names vs time. I started with my go to library for fast dataviz (Plotly.js) but eventually ended up creating the visualization in d3.js which is harder for me, but made it very responsive. I’m not an expert in d3, but know enough that using some similar examples and with lots of googling and stack overflow, I could create what I wanted.

I emailed Laura after creating a sample version, just to make sure it was okay to re-create it as a tribute to the Baby Name Wizard / Voyager and got the okay from her.

Where does the data come from?

Some info about Data (from SSA Baby Names Website):

All names are from Social Security card applications for births that occurred in the United States after 1879. Note that many people born before 1937 never applied for a Social Security card, so their names are not included in our data.

Name data are tabulated from the “First Name” field of the Social Security Card Application. Hyphens and spaces are removed, thus Julie-Anne, Julie Anne, and Julieanne will be counted as a single entry.

Name data are not edited. For example, the sex associated with a name may be incorrect.Different spellings of similar names are not combined. For example, the names Caitlin, Caitlyn, Kaitlin, Kaitlyn, Kaitlynn, Katelyn, and Katelynn are considered separate names and each has its own rank.

All data are from a 100% sample of our records on Social Security card applications as of March 2021.

I did notice that there was a significant under-representation of male names in the early data (before 1910) relative to female names. In the normalized data, I set the data for each sex to 500,000 male and 500,000 female births per million total births, instead of the actual data which shows approximately double the number of female names than male names. Not sure why females would have higher rates of social security applications in the early 20th century. Update: A helpful Redditor pointed me to this blog post which explains some of the wonkiness of the early data. The gist of it is that Social Security cards and numbers weren’t really a thing until 1935. Thus the names of births in 1880 are actually 55 year olds who applied for Social Security numbers and since they weren’t mandatory, they don’t include everyone. My correction basically makes the assumption that this data is actually a survey and we got uneven samples from males and female respondents. It’s not perfect (like the later data) but it’s a decent representation of name distribution.

Sources and Tools:

The biggest source of inspiration was of course, Laura Wattenberg’s original Baby Name Explorer.

I downloaded the baby names from the Social Security website. Thanks to Michael W. Shackleford at the SSA for starting their name data reporting. I used a python script to parse and organize the historical data into the proper format my javascript. The visualization is created using HTML, CSS and Javascript code (and the d3.js visualization library) to create interactivity and UI. Curran Kelleher’s area label d3 javascript library was a huge help for adding the names to the graph.

WordGuessr – a social Wordle unlimited clone – Word Guesser

Over 16 Million games played! (Feb 2023).

Try playing my NYTimes Digits math game clone,

TRIDLE – Three Wordle Puzzles simultaneously and

Wordguessr – Unlimited endless Wordle practice

You can do your Wordle practice training here with unlimited attempts.

As my wife likes to say, “Practice makes ‘Pretty Good'”.

I made this Wordle clone in about a day after playing with Wordle for a few days. My wife and I were pretty hooked and I wanted to play more than once a day. It’s like a word version of Mastermind. I also thought it would be fun with words of different lengths, so I added the option for words between 3-7 letters long. Depending on the number of letters, the game feels very different. 3 letters is very short and it’s easier in some respects but you have to guess more. Longer words require much more thinking.

The rules of the game are pretty simple:

1) just type in a guess and and press ‘Enter’.

2) the game will indicate how good your guess was. If any letter are in their correct position they will turn green, if they are correct but in the wrong place, they turn orange, and if they don’t show up in the word they turn black.

3) guess again, using the clues from the previous word

4) repeat until you get the word correct or fail to figure it out after 6 tries.

I added the ability to create a challenge game that allows you to share a link (with a unique code) which will enable anyone with the link to play the same word.

Apparently, my site is unblocked on education websites (which makes sense since it has a lot of educational content), so I seem to be getting lots of traffic from Chromebooks searching for “Wordle Unblocked”.

You can also share your guessing results (not the answer) with a grid of boxes, like the original Wordle, as shown below:

WordGuessr Challenge

(5 letter) 4/6

🟩⬛⬛⬛🟧

🟩🟧🟧⬛⬛

🟩🟩🟩⬛🟧

🟩🟩🟩🟩🟩

Try the same exact puzzle here:

https://engaging-data.com/wordguessr-wordle/?challenge=uab5

I also added the game stats which should persist across games and lets you look at stats for games of different word lengths individually as well as all your games.

I wasn’t sure what how the original Wordle game handles duplicate letters so I made up my own set of rules for how it would happen. First, if there are multiple instances of a single letter (e.g. two ‘E’s in a word) and you make a guess of a word with two ‘E’. If one is in the correct spot and one is in the wrong spot, one will be green and the other orange. If both are in the wrong spot, they will both be orange. If there is only one ‘E’ in the answer but you guess two, one will be black and the other will be green or orange depending on its position.

Sources and Tools:

Obviously a big shout out to Josh Wardle and his Wordle game, as this is mostly a carbon copy of his game with a few additions.

I downloaded the most common words in English from the English Lexicon Project Web Site at Washington University in St. Louis. Then I processed these to remove foreign language words and other strange entries and split them into groups of words by number of letters using Python.

The game is created using HTML, CSS and Javascript code to create interactivity and UI. Thanks to my wife and daughter for beta-testing, lots of fun beta testing.

Compound Interest and Stock Returns Calculator

Calculate returns on regular, periodic investments

This calculator lets you visualize the value of investing regularly. It lets you calculate the compounding from a simple interest rate or looking at specific returns from the stock market indexes or a few different individual stocks.

Instructions

- Enter the amount of money to be invested monthly

- Choose to use an interest rate (and enter a specific rate) or

- Choose a stock market index or individual stock

- Use the slider to change the initial starting date of your periodic investments – You can go as far back as 1970 or the IPO date of the stock if it is later than that.

- Use the “Generate URL to Share” button to create a special URL with the specific parameters of your choice to share with others – the URL will appear in your browser’s address bar.

You can hover over the graph to see the split between the money you invested and the gains from the investment. In most cases (unless returns are very high), initially the investments are the large majority of the total balance, but over time the gains compound and eventually, it is those gains rather than the initial investments that become the majority of the total.

Some of the tech stocks included in the dropdown list have very high annualized returns and thus the gains quickly overtake the additions as the dominant component of the balance and you can make a great deal of money fairly quickly.

It becomes clearer as you move the slider around, that longer investing time periods are the key to increasing your balance, so building financial prosperity through investing is generally more of a marathon and not really a sprint. However, if you invest in individual stocks and pick a good one, you can speed up that process, though it’s not necessarily the most advisable way to proceed. Lots of people underperform the market (i.e. index funds) or even lose money by trying to pick big winners.

Understanding the Calculations

Calculating compound returns is relatively easy and is just a matter of consecutively multiplying the return. If the return is 7% for 5 years, that is equal to multiplying 1.07 five times, i.e. 1.075 = 1.402 (or a 40.2% gain).

In this case, we are adding additional investments each month but the idea is the same. Take the amount of money (or value of shares) and multiply by the return (>1 if positive or <1 for negative returns) after each period of the analysis.

Sources and Tools:

Stock and index monthly data is downloaded from Yahoo! finance is downloaded regularly using a python script.

The graph is created using the open-source Plotly javascript visualization library, as well as HTML, CSS and Javascript code to create interactivity and UI.

Recent Comments