Posts for Tag: taxes

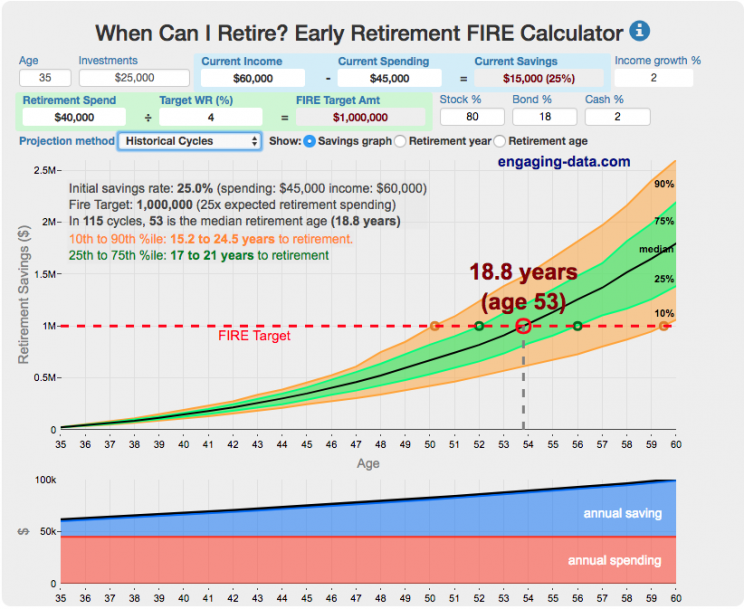

Early Retirement Calculators and Tools

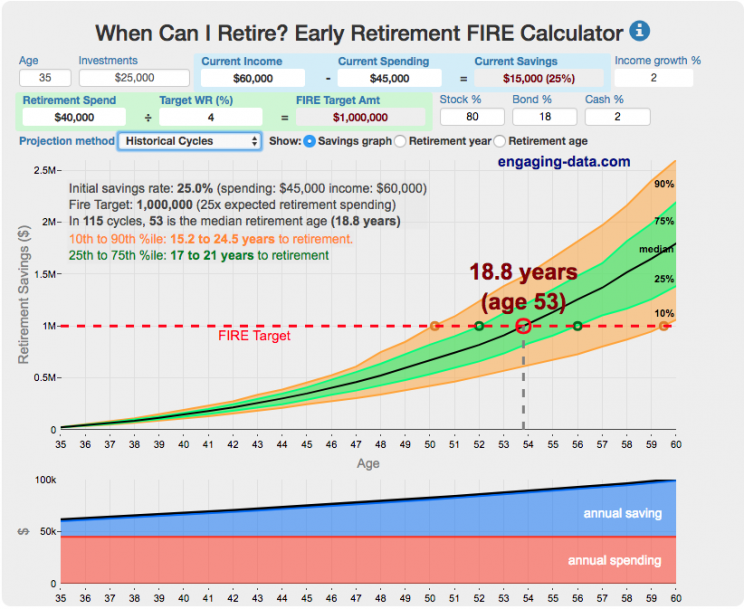

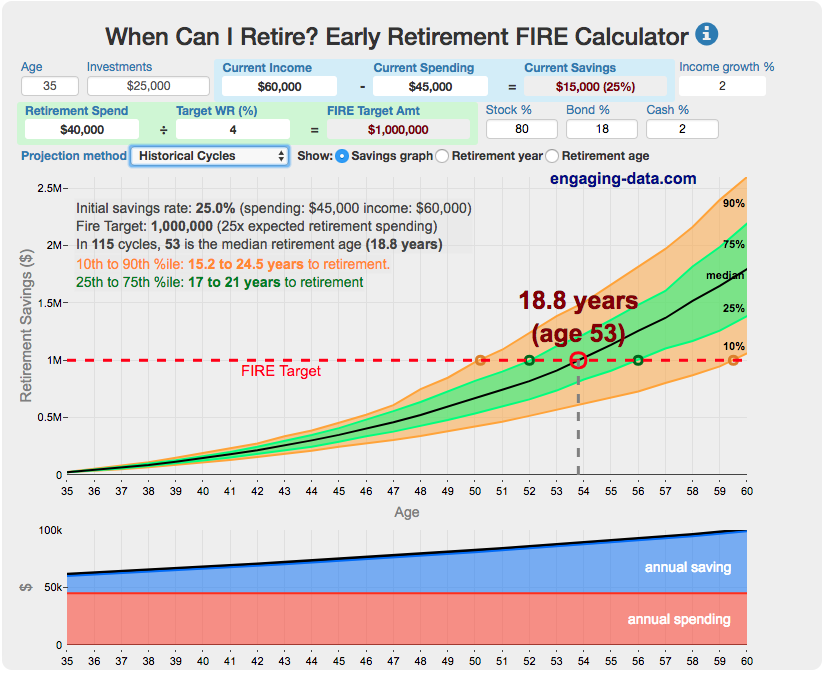

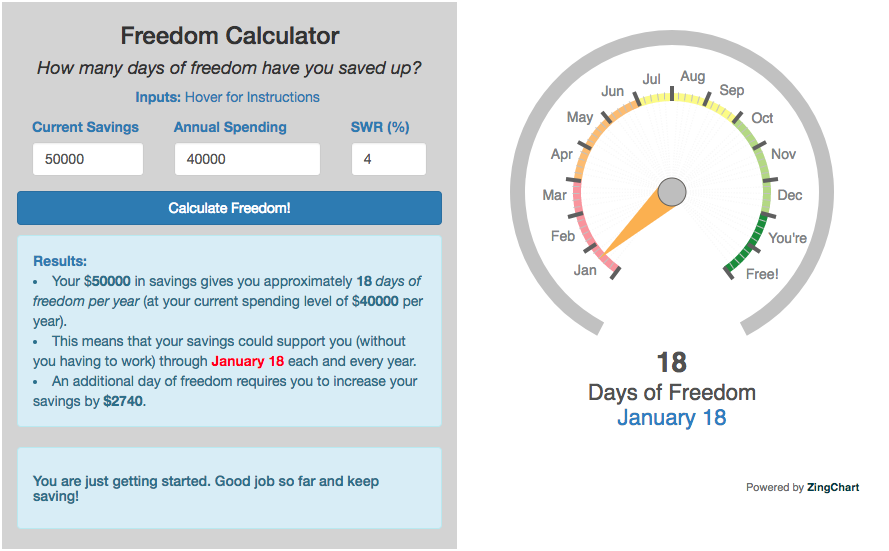

Interested in Early Retirement or FIRE (Financial Independence to Retire Early)?

Here are some interactive and educational planning tools that I developed to help you understand the concepts of FIRE and calculate how long it will take to achieve retirement and how likely you are to survive retirement. Click on the tools below to try them out.

Financial Independence Calculators

Regardless of where you are on your path to FIRE, there are several types of tools that are useful:

Planning to get to retirement

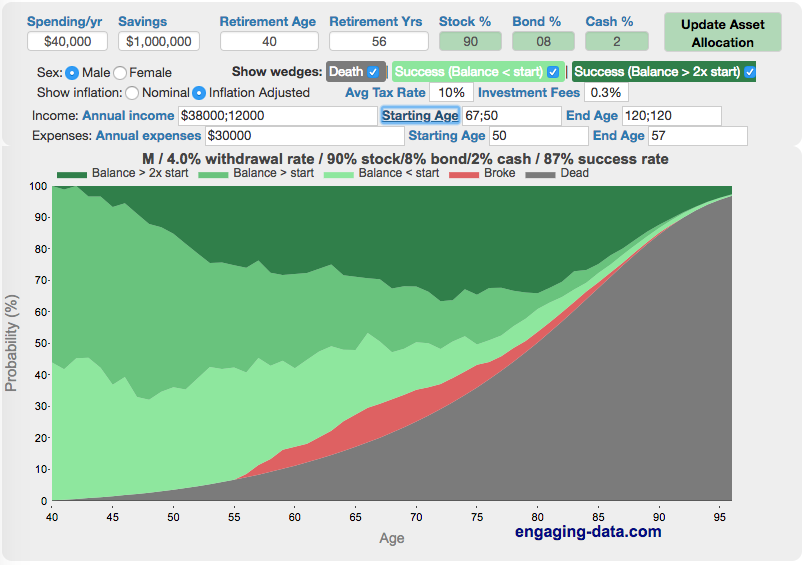

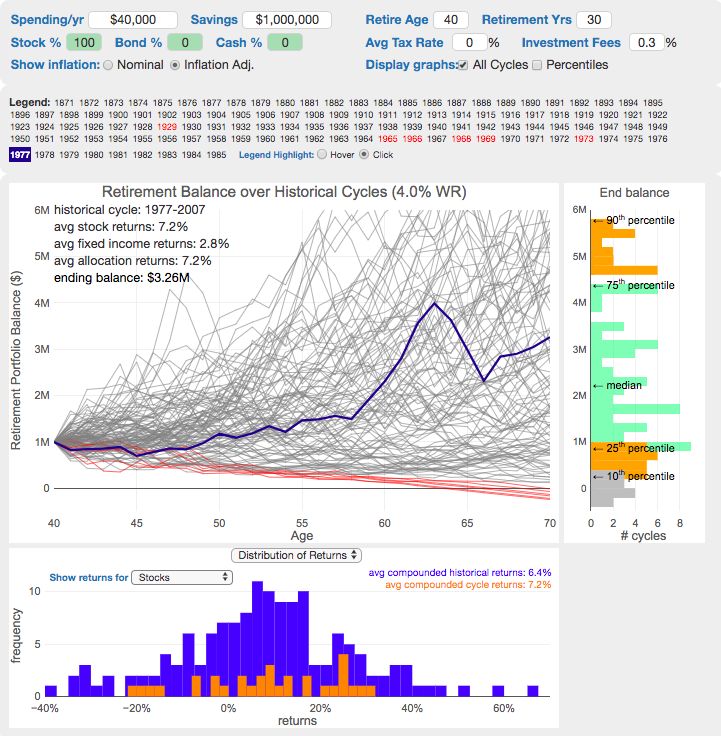

How long and how safe will your retirement be?

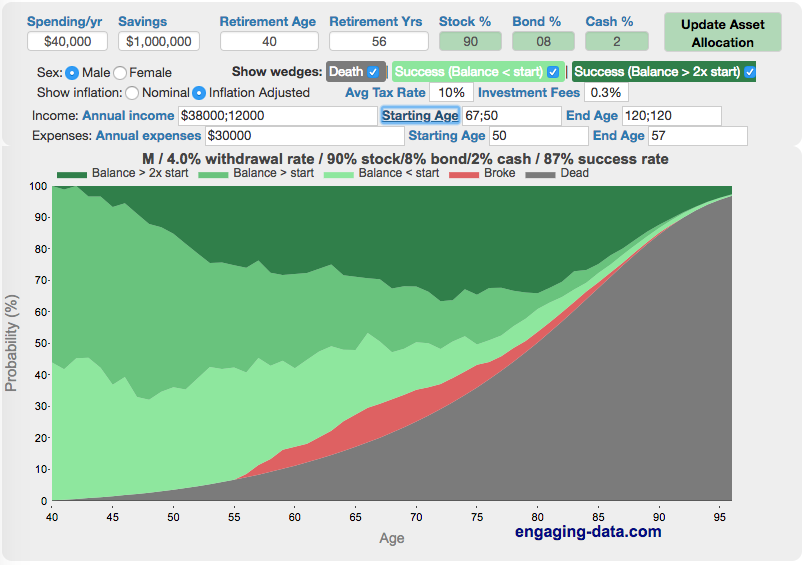

Rich, Broke or Dead? Will your Money Last Through Early Retirement?

Simulating retirement portfolio survival probability and human longevity

These tools all focus on the concept of FIRE. FIRE is the concept that revolves around saving and investing to achieve Financial Independence (FI) and to potentially Retire Early (RE). One of the core concepts is that once you can save up enough money, you can retire by withdrawing a fraction of this money annually to cover your living expenses. Other important topics related to this core concept have to do with reducing spending so you can save money and investing so your money can grow and sustain your retirement over many decades.

Other visualizations and tools related to Financial Independence

These tools relate to taxes and stock market returns.

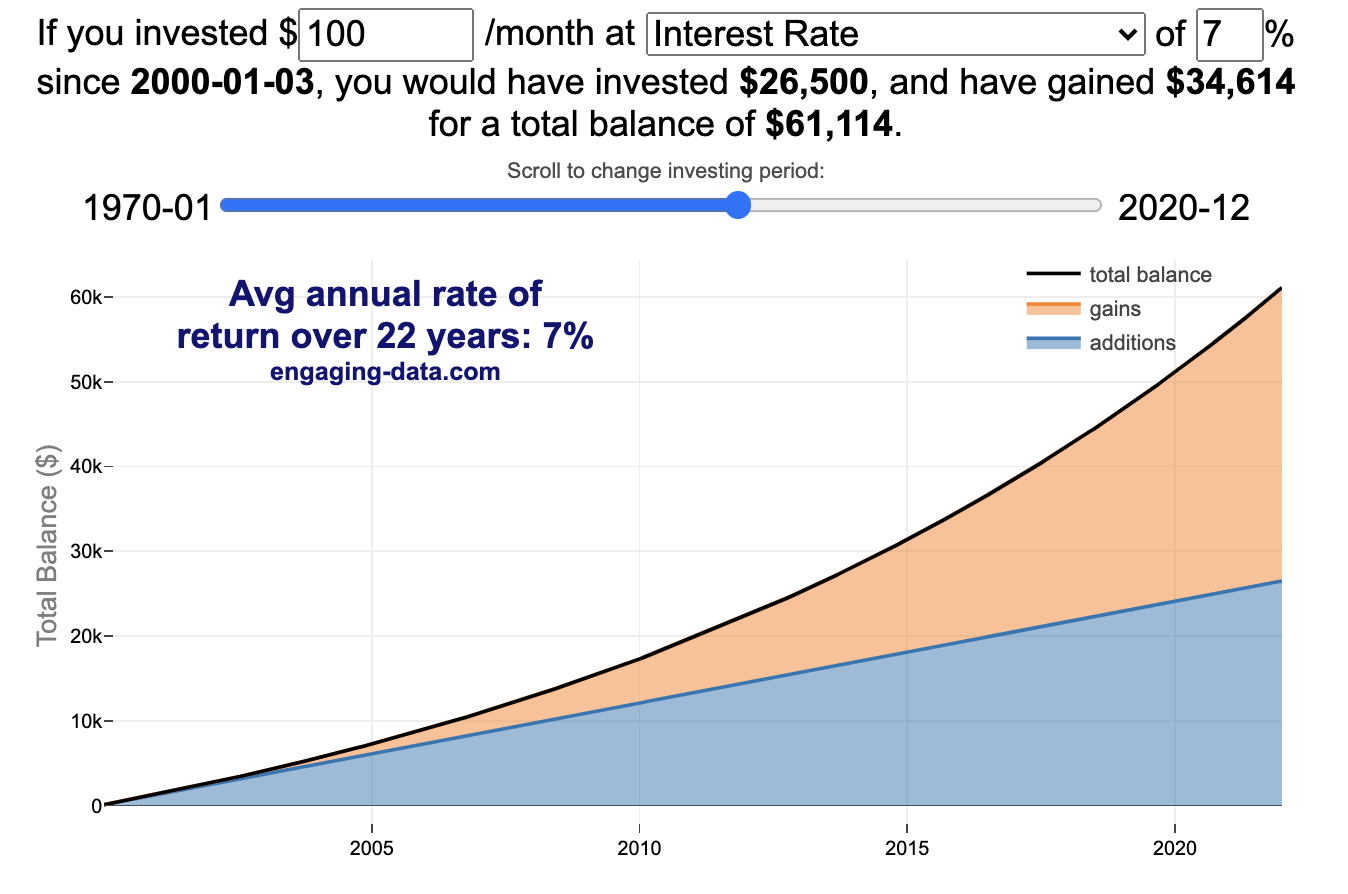

Calculating Returns from Periodic Investments

Visualizing Market Returns

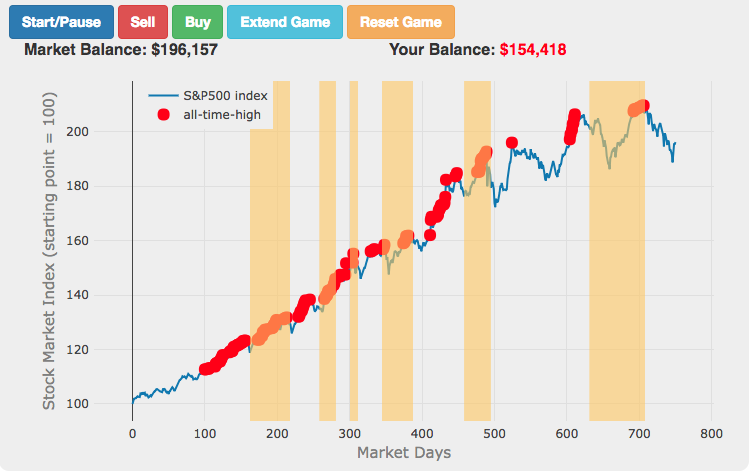

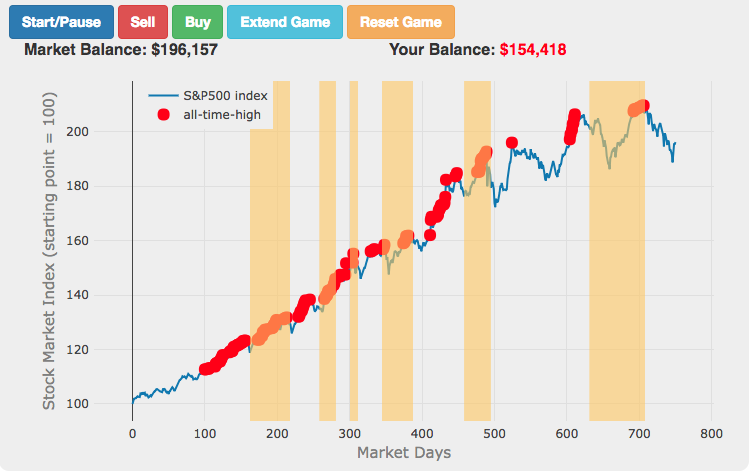

Understanding Market Timing

Market Timing Game

How difficult is it to time the stock market?

Income Taxes

Income Tax Bracket Calculator

Tax bracket calculator to visualize how income and capital gains taxed

Data Sources and Tools:

See the individual tool to learn more about how it was made.

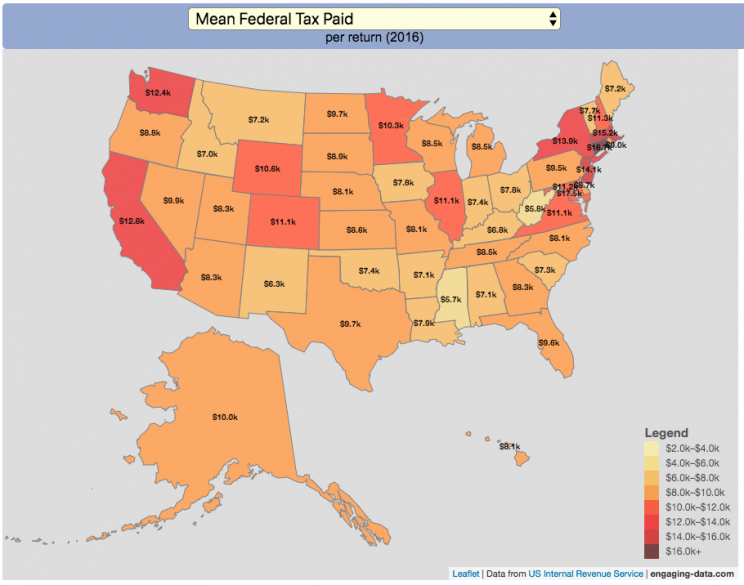

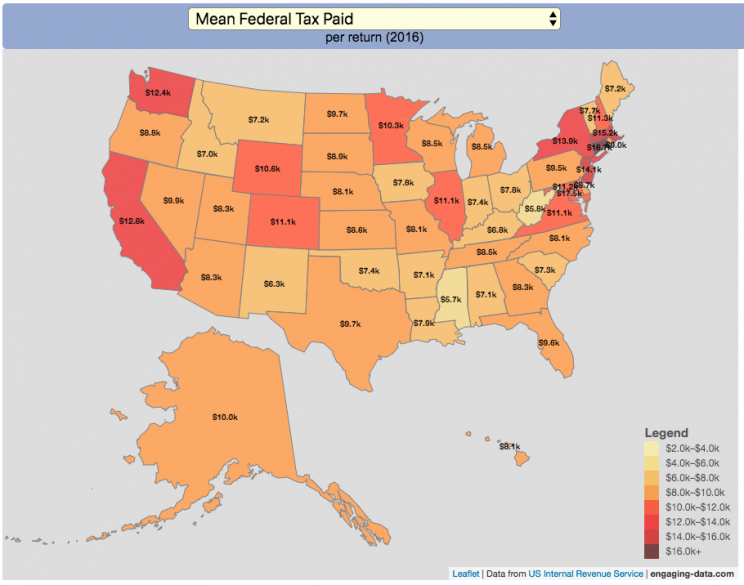

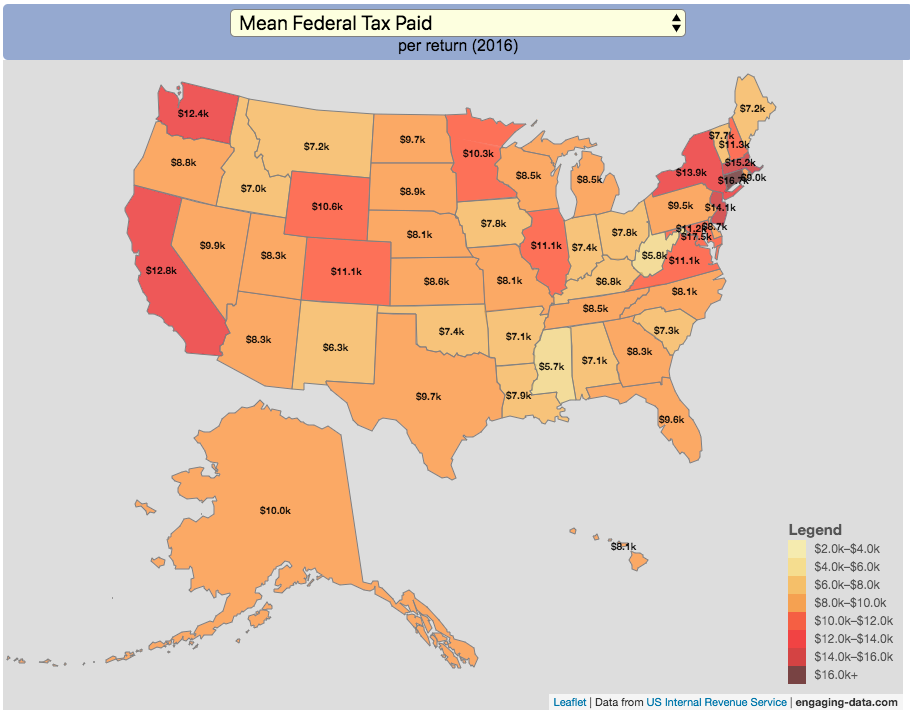

How Much Does Each State Pay In Taxes?

Given that tax day has just passed, I thought it would be good to check out some data on taxes. The IRS provides a great resource on tax data that I’ve only just gotten into. I think I’ll be able to do more with this in the future. This one looks at how taxes paid varies by state and presents it as a choropleth map (coloring states based on certain categories of tax data).

You can choose from a number of different categories:

- Mean Federal Tax Paid

- Mean Adjusted Gross Income

- Mean State/Local Tax

- Mean Combined (Fed/State/Local) Tax

- Percent Income from Dividends and Capital Gains

- Percent of Returns with Itemized Deductions

- Number of Tax Returns

- Mean Federal Tax Rate

- Mean State/Local Tax Rate

- Mean Combined (Fed/State/Local) Rate

- Total Federal Tax Liability

I may add more categories in the future, so if you have ideas of tax data you want to see visualized let me know and I’ll see what I can do.

For other tax-related tools and visualizations see my tax bracket calculator and visualization of marginal tax rates.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Data and Tools:

Data on tax returns by state is from the IRS website in an excel format. The map was made using the leaflet open source mapping library. Data was compiled in excel and calculations made using javascript.

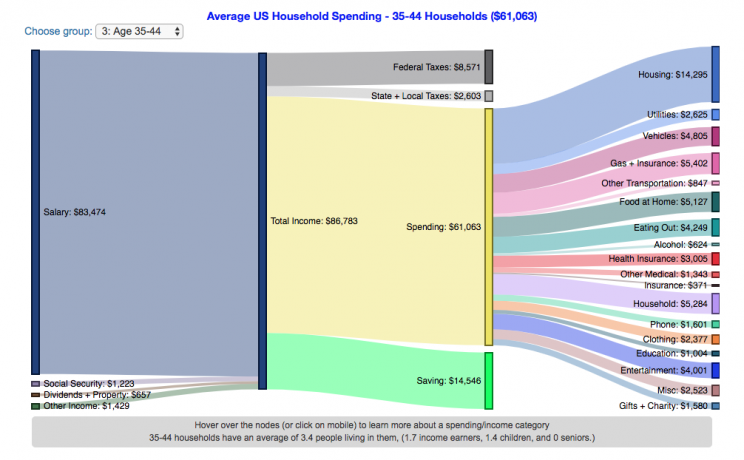

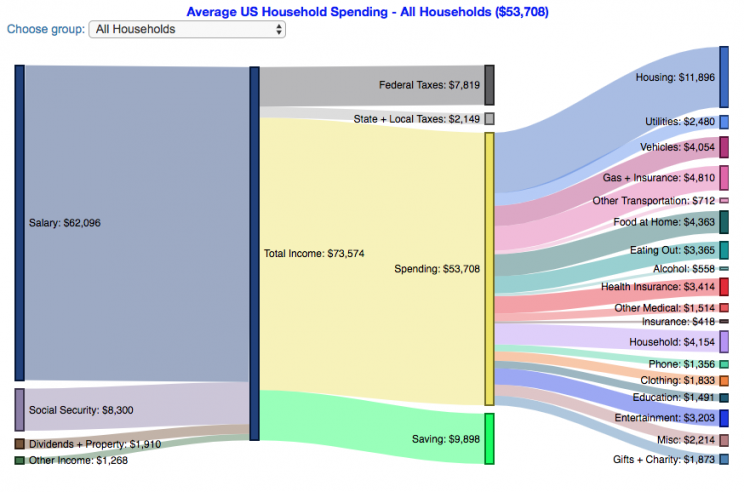

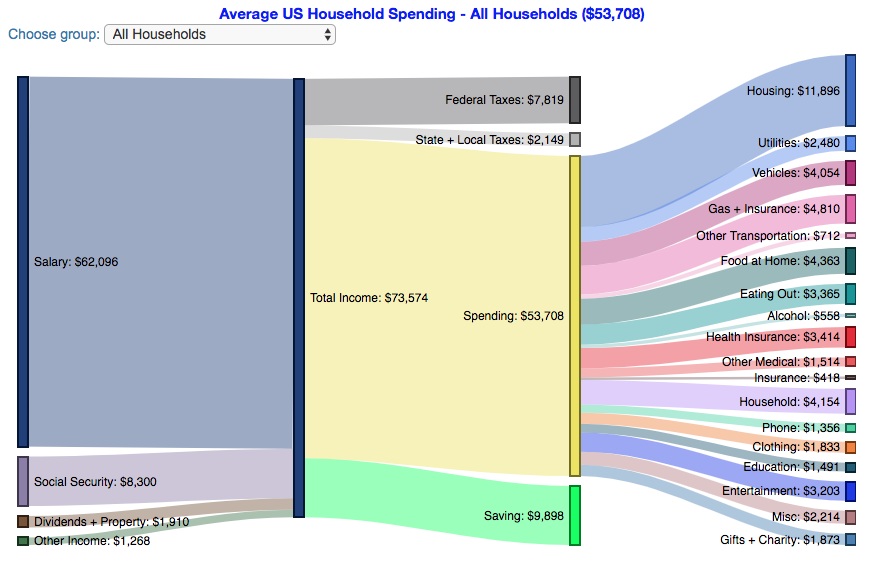

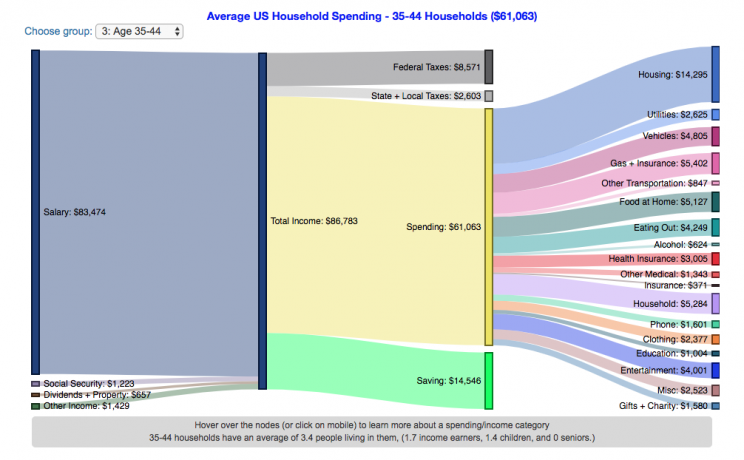

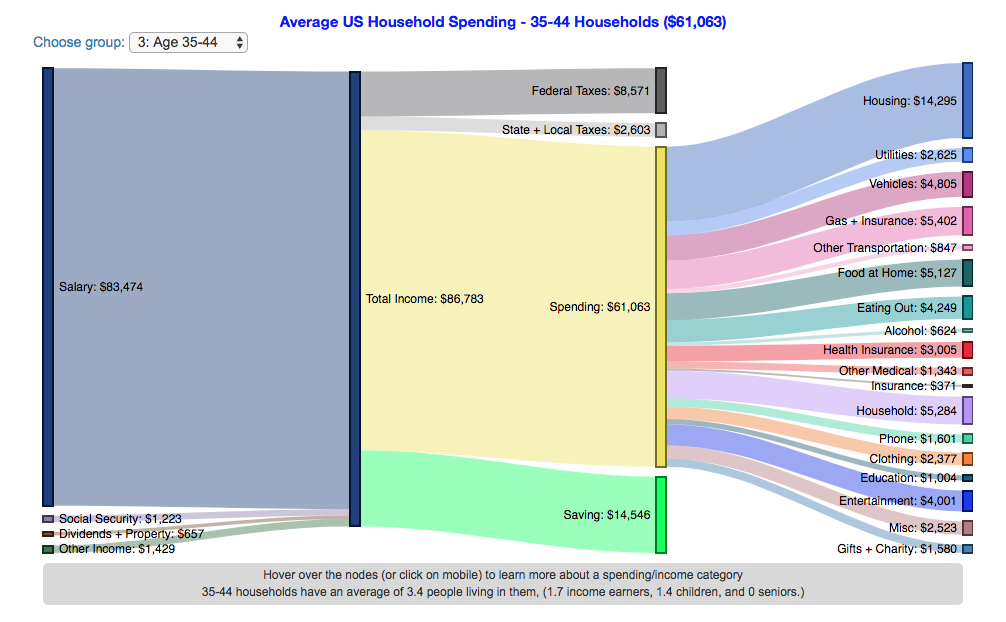

How do Americans Spend Money? US Household Spending Breakdown by Age

How much do US households spend and how does it change with age?

This visualization is one of a series of visualizations that present US household spending data from the US Bureau of Labor Statistics. This one looks at the age of the primary resident.

- US Household spending by income group

- US Household spending by age of primary resident

- US Household spending by education level of primary resident

- US Household spending by household composition

This visualization focuses on the age of the primary resident. This is defined in the BLS documentation as the person who is first mentioned when the survey respondent is asked who in the household rents or owns the home.

I obtained data from the US Bureau of Labor Statistics (BLS), based upon a survey of consumer households and their spending habits. This data breaks down spending and income into many categories that are aggregated and plotted in a Sankey graph.

One of the key factors in financial health of an individual or household is making sure that household spending is equal to or below household income. If your spending is higher than income, you will be drawing down your savings (if you have any) or borrowing money. If your spending is lower than your income, you will presumably be saving money which can provide flexibility in the future, fund your retirement (maybe even early) and generally give you peace of mind.

Instructions:

- Hover (or on mobile click) on a link to get more information on the definition of a particular spending or income category.

- Use the dropdown menu to look at averages for different groups of households based on the age of the primary resident. This data breaks households into groups (under 25, 25-34, 35-44, 45-54, 55-64, 65-75 and over 75). The composition of households and income change as the age of the primary resident changes, which in turn affects spending totals and individual categories.

As stated before, one of the keys to financial security is spending less than your income. We can see that on average, income tends to increase with the household primary age up to the 45-54 group, then declines from there.

The youngest group (under 25) tends to borrow or draw down on savings to live their lifestyle, while the same is true of the over 75 age group. This is probably because seniors tend to draw down savings that were built up specifically for this purpose, and college students borrow to go to school. Social security also makes up a big portion of income for the older age groups.

How does your overall spending compare with those in your income group? How about spending in individual categories like housing, vehicles, food, clothing, etc…?

Probably one of the best things you can do from a financial perspective is to go through your spending and understand where your money is going. These sankey diagrams are one way to do it and see it visually, but of course, you can just make a table or pie chart or whatever.

The main thing is to understand where your money is going. Once you’ve done this you can be more conscious of what you are spending your money on, and then decide if you are spending too much (or too little) in certain categories. Having context of what other people spend money on is helpful as well, and why it is useful to compare to these averages, even though the income level, regional cost of living, and household composition won’t look exactly the same as your household.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Here is more information about the Consumer Expenditure Surveys from the BLS website:

The Consumer Expenditure Surveys (CE) collect information from the US households and families on their spending habits (expenditures), income, and household characteristics. The strength of the surveys is that it allows data users to relate the expenditures and income of consumers to the characteristics of those consumers. The surveys consist of two components, a quarterly Interview Survey and a weekly Diary Survey, each with its own questionnaire and sample.

Data and Tools:

Data on consumer spending was obtained from the BLS Consumer Expenditure Surveys, and aggregation and calculations were done using javascript and code modified from the Sankeymatic plotting website. I aggregated many of the survey output categories so as to make the graph legible, otherwise there’d be 4x as many spending categories and all very small and difficult to read.

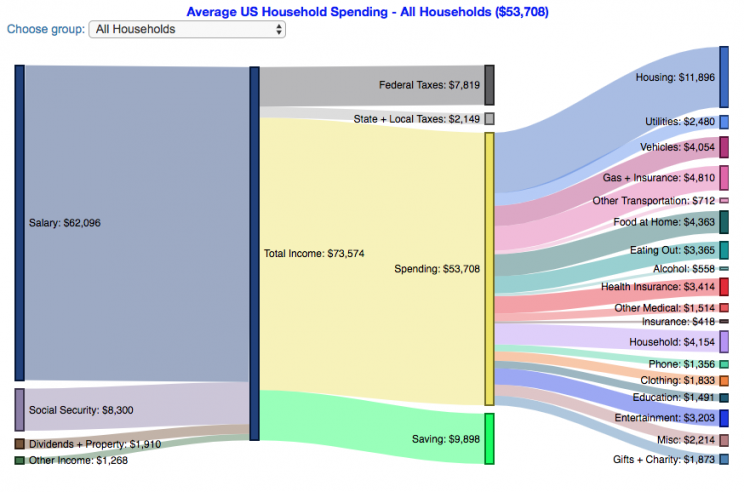

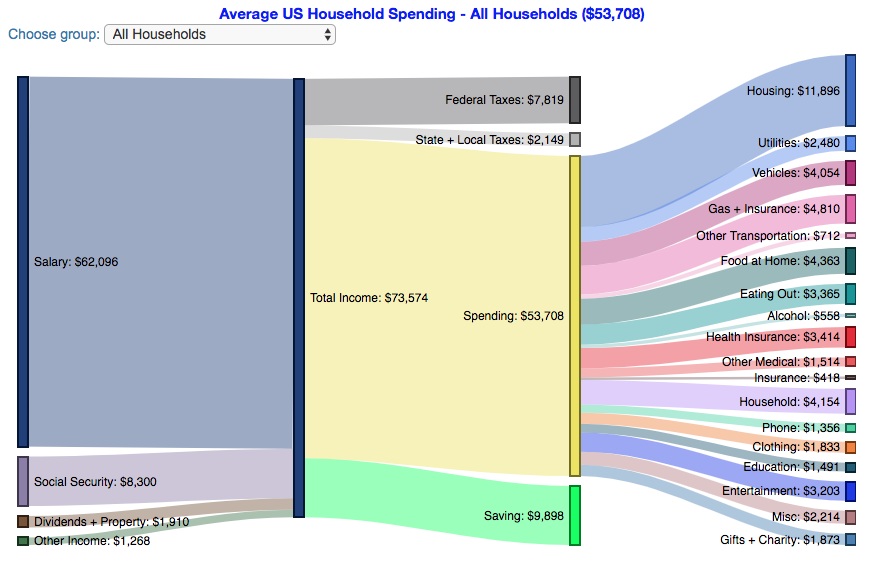

How do Americans Spend Money? US Household Spending Breakdown by Income Group

How much do US households spend?

This visualization is one of a series of visualizations that present US household spending data from the US Bureau of Labor Statistics. This one looks at the income of the household.

- US Household spending by income group

- US Household spending by age of primary resident

- US Household spending by education level of primary resident

- US Household spending by household composition

One of the key factors in financial health of an individual or household is making sure that household spending is equal to or below household income. If your spending is higher than income, you will be drawing down your savings (if you have any) or borrowing money. If your spending is lower than your income, you will presumably be saving money which can provide flexibility in the future, fund your retirement (maybe even early) and generally give you peace of mind.

I obtained data from the US Bureau of Labor Statistics (BLS), based upon a survey of consumer households and their spending habits. This data breaks down spending and income into many categories that are aggregated and plotted in a Sankey graph.

Instructions:

- Hover (or on mobile click) on a link to get more information on the definition of a particular spending or income category.

- Use the dropdown menu to look at averages for different groups of households based on income. This data breaks households into quintiles (groups of 20%) by income. The lowest quintile group is the group of 20% of households with the lowest income (and spend on average ~$25,500/yr).

As stated before, one of the keys to financial security is spending less than your income. We can see that on average, those in the lowest quintiles may be borrowing or drawing down on savings to live their lifestyle, while those in the highest quintiles are saving money and contributing to wealth. This fairly high level of borrowing/drawing on savings from the lowest quintile households may be deceptive because it includes seniors who are drawing down savings that were built up specifically for this purpose, and college students who are borrowing to go to school. These groups generally don’t have significant incomes.

How does your overall spending compare with those in your income group? How about spending in individual categories like housing, vehicles, food, clothing, etc…?

Probably one of the best things you can do from a financial perspective is to go through your spending and understand where your money is going. These sankey diagrams are one way to do it and see it visually, but of course, you can just make a table or pie chart or whatever.

The main thing is to understand where your money is going. Once you’ve done this you can be more conscious of what you are spending your money on, and then decide if you are spending too much (or too little) in certain categories. Having context of what other people spend money on is helpful as well, and why it is useful to compare to these averages, even though the income level, regional cost of living, and household composition won’t look exactly the same as your household.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Here is more information about the Consumer Expenditure Surveys from the BLS website:

The Consumer Expenditure Surveys (CE) collect information from the US households and families on their spending habits (expenditures), income, and household characteristics. The strength of the surveys is that it allows data users to relate the expenditures and income of consumers to the characteristics of those consumers. The surveys consist of two components, a quarterly Interview Survey and a weekly Diary Survey, each with its own questionnaire and sample.

Data and Tools:

Data on consumer spending was obtained from the BLS Consumer Expenditure Surveys, and aggregation and calculations were done using javascript and code modified from the Sankeymatic plotting website. I aggregated many of the survey output categories so as to make the graph legible, otherwise there’d be 4x as many spending categories and all very small and difficult to read.

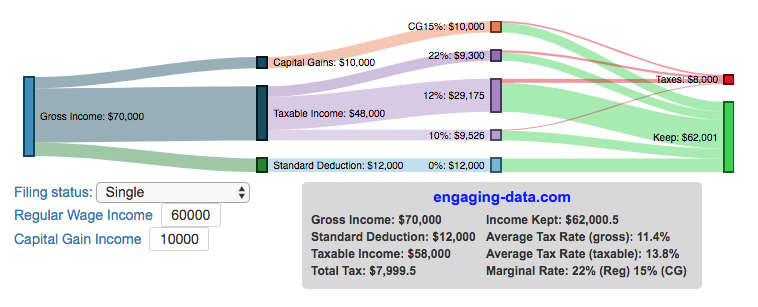

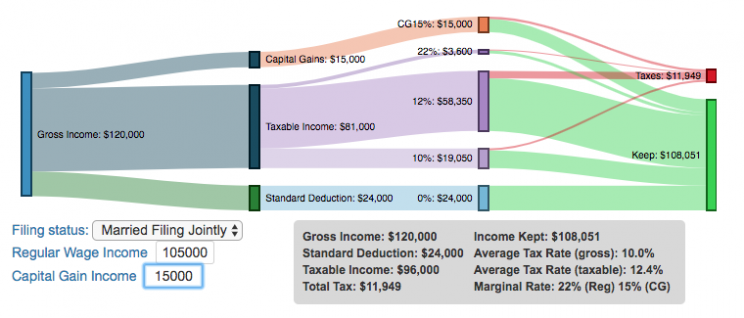

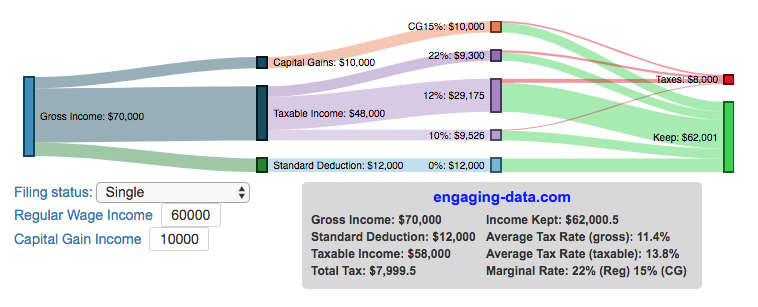

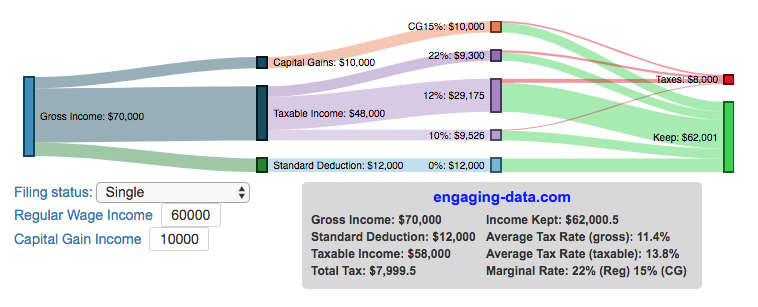

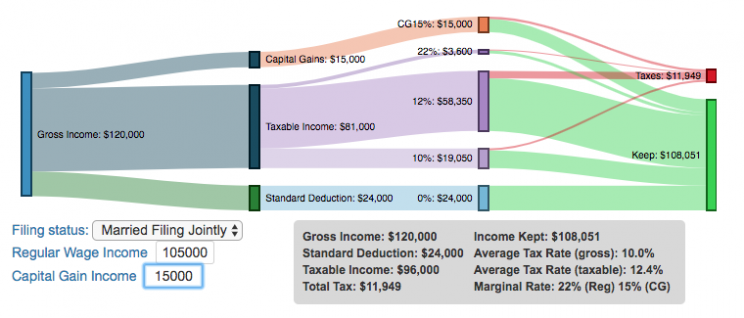

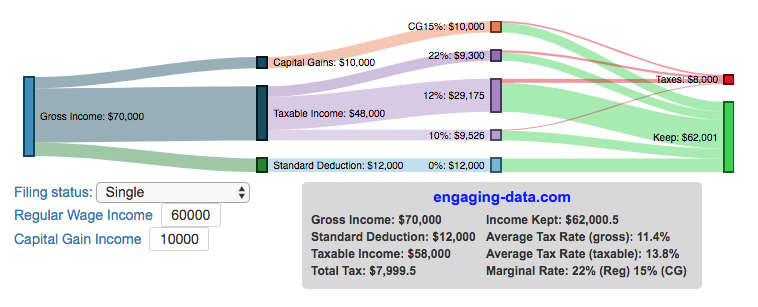

Understanding Tax Brackets: Interactive Income Tax Visualization and Calculator

How is your income distributed across tax brackets?

I previously made a graphical visualization of income and marginal tax rates to show how tax brackets work. That graph tried to show alot of info on the same graph, i.e. the breakdown of income tax brackets for incomes ranging from $10,000 to $3,000,000. It was nice looking, but I think several people were confused about how to read the graph. This Sankey graph is a more detailed look at the tax breakdown for one specific income. You can enter your (or any other) profile and see how taxes are distributed across the different brackets. It can help (as the other tried) to better understand marginal and average tax rates. This tool only looks at US Federal Income taxes and ignores state, local and Social Security/Medicare taxes.

– Use this button to generate a URL that you can share a specific set of inputs and graphs. Just copy the URL in the address bar at the top of your browser (after pressing the button).

Instructions for using the visual tax calculator:

- Select filing status: Single, Married Filing Jointly or Head of Household. For more info on these filing categories see the IRS website

- Enter your regular income and capital gains income. Regular income is wage or employment income and is taxed at a higher rate than capital gains income. Capital gains income is typically investment income from the sale of stocks or dividends and taxed at a lower rate than regular income.

- Move your cursor or click on the Sankey graph to select a specific link. This will give you more information about how income in a specific tax bracket is being taxed.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

As seen with the marginal rates graph, there is a big difference in how regular income and capital gains are taxed. Capital gains are taxed at a lower rate and generally have larger bracket sizes. Generally, wealthier households earn a greater fraction of their income from capital gains and as a result of the lower tax rates on capital gains, these household pay a lower effective tax rate than those making an order of magnitude less in overall income.

2018 Tax Brackets

Here are two tables that lists the marginal tax brackets in the United States in 2018 that form the basis of the calculations in the calculator. 2019’s numbers are listed below.

US Tax Brackets and Rates for 2018

Rate

Single

Taxable Income Over

Married Filing Joint

Taxable Income Over

Heads of Households

Taxable Income Over

10%

$0

$0

$0

12%

$9,525

$19,050

$13,600

22%

$38,700

$77,400

$51,800

24%

$82,500

$165,000

$82,500

32%

$157,500

$315,000

$157,500

35%

$200,000

$400,000

$200,000

37%

$500,000

$600,000

$500,000

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

Capital Gains Brackets for 2018

Single

Capital Gains Over

Married Filing Jointly

Capital Gains Over

Heads of Households

Capital Gains Over

0%

$0

$0

$0

15%

$38,700

$77,400

$51,850

20%

$426,700

$480,050

$453,350

2019 Tax Brackets

Here are the numbers for 2019:

US Tax Brackets and Rates for 2019

Rate

Single

Taxable Income Over

Married Filing Joint

Taxable Income Over

Heads of Households

Taxable Income Over

10%

$0

$0

$0

12%

$9,700

$19,400

$13,850

22%

$39,475

$78,950

$52,850

24%

$84,200

$168,400

$84,200

32%

$160,725

$321,450

$160,700

35%

$204,100

$408,200

$204,100

37%

$510,300

$612,350

$510,300

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

Capital Gains Brackets for 2019

Single

Capital Gains Over

Married Filing Jointly

Capital Gains Over

Heads of Households

Capital Gains Over

0%

$0

$0

$0

15%

$39,375

$78,750

$52,750

20%

$434,550

$488,850

$461,700

2020 Tax Brackets

Here are the numbers for 2020:

US Tax Brackets and Rates for 2020

Rate

Single

Taxable Income Over

Married Filing Joint

Taxable Income Over

Heads of Households

Taxable Income Over

10%

$0

$0

$0

12%

$9,875

$19,750

$14,100

22%

$40,125

$80,250

$53,700

24%

$85,525

$171,050

$85,500

32%

$163,300

$326,600

$163,300

35%

$207,350

$414,700

$207,350

37%

$518,400

$622,050

$518,400

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

Capital Gains Brackets for 2020

Single

Capital Gains Over

Married Filing Jointly

Capital Gains Over

Heads of Households

Capital Gains Over

0%

$0

$0

$0

15%

$40,000

$80,000

$53,600

20%

$441,450

$496,600

$469,050

2021 Tax Brackets

Here are the numbers for 2021:

US Tax Brackets and Rates for 2021

Rate

Single

Taxable Income Over

Married Filing Joint

Taxable Income Over

Heads of Households

Taxable Income Over

10%

$0

$0

$0

12%

$9,950

$19,900

$14,200

22%

$40,525

$81,050

$54,200

24%

$86,375

$172,750

$86,350

32%

$164,925

$329,850

$164,900

35%

$209,425

$418,850

$209,400

37%

$523,600

$628,300

$523,600

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

Capital Gains Brackets for 2021

Single

Capital Gains Over

Married Filing Jointly

Capital Gains Over

Heads of Households

Capital Gains Over

0%

$0

$0

$0

15%

$40,400

$80,800

$54,100

20%

$445,850

$501,600

$473,750

For those not visually inclined, here is a written description of how to apply marginal tax rates. The first thing to note is that the income shown here in the graphs is taxable income, which simply speaking is your gross income with deductions removed. The standard deduction for 2018 range from $12,000 for Single filers to $24,000 for Married filers.

- If you are single, all of your regular taxable income between 0 and $9,525 is taxed at a 10% rate. This means that your all of your gross income below $12,000 is not taxed and your gross income between $12,000 and $21,525 is taxed at 10%.

- If you have more income, you move up a marginal tax bracket. Any taxable income in excess of $9,525 but below $38,700 will be taxed at the 12% rate. It is important to note that not all of your income is taxed at the marginal rate, just the income between these amounts.

- Income between $38,700 and $82,500 is taxed at 24% and so on until you have income over $500,000 and are in the 37% marginal tax rate . . .

- Thus, different parts of your income are taxed at different rates and you can calculate an average or effective rate (which is shown in the summary table).

- Capital gains income complicates things slightly as it is taxed after regular income. Thus any amount of capital gains taxes you make are taxed at a rate that corresponds to starting after you regular income. If you made $100,000 in regular income, and only $100 in capital gains income, that $100 dollars would be taxed at the 15% rate and not at the 0% rate, because the $100,000 in regular income pushes you into the 2nd marginal tax bracket for capital gains (between $38,700 and $426,700).

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript and code modified from the Sankeymatic plotting website.

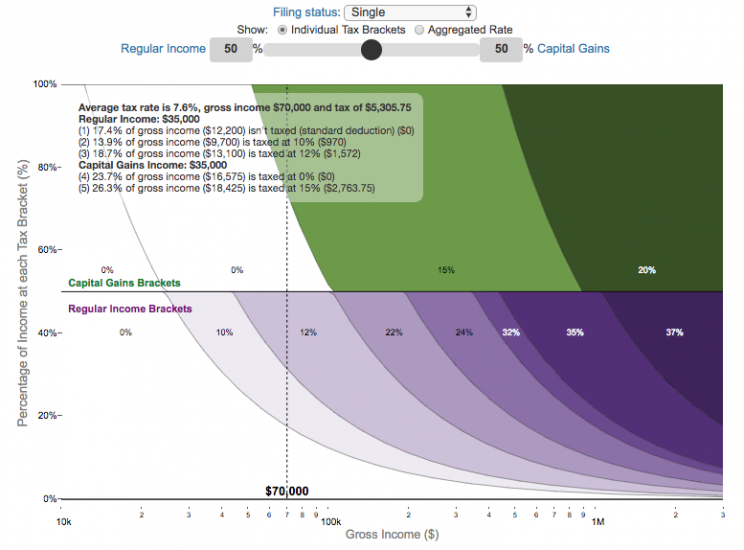

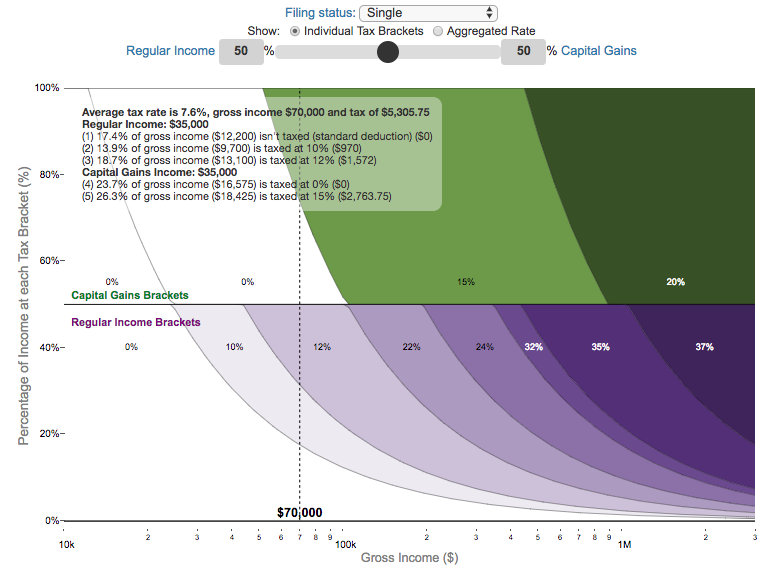

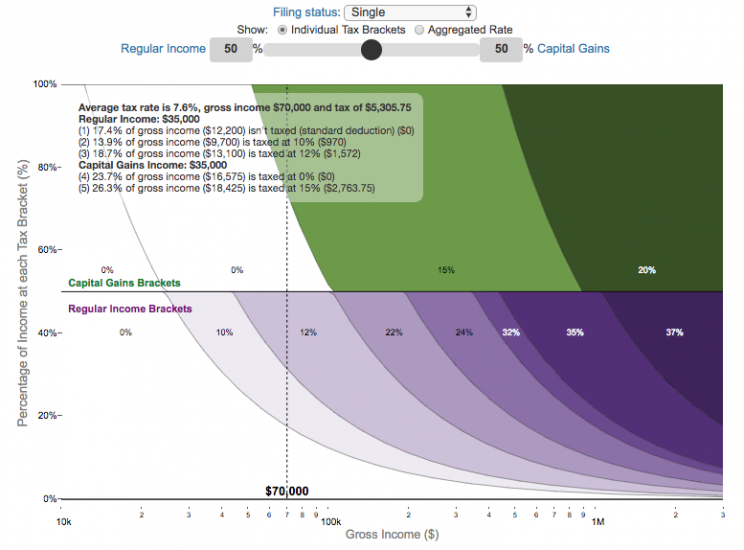

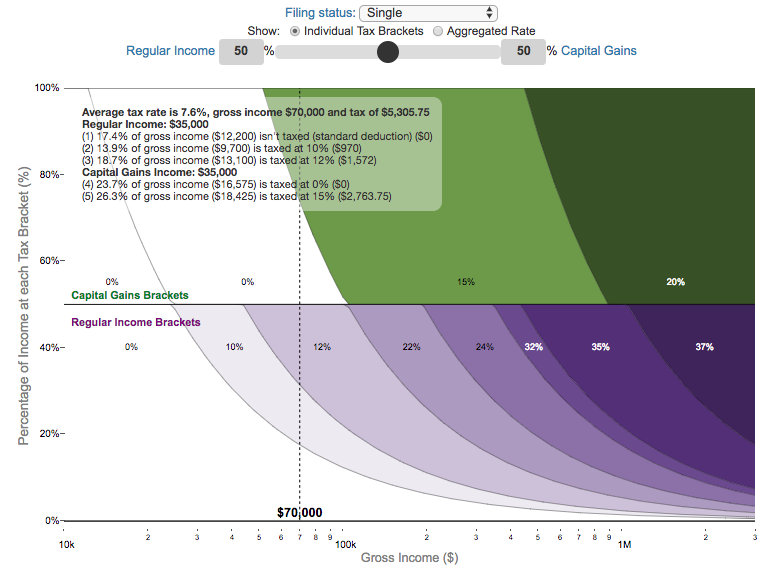

Visual Guide to Understanding Marginal Tax Rates

What is a marginal tax rate?

There is a fair amount of confusion about what a marginal tax rate is and how it affects how much tax you would owe the government on a certain amount of income. These graphs are here to help you better understand the difference between a marginal and average tax rate and to easily calculate these rates for specific examples in the US context. This tool only looks at US Federal Income taxes and ignores state, local and Social Security/Medicare taxes.

Marginal tax rates are the rate at which an additional dollar of income will be taxed at. There are different tax brackets (each with its own marginal rate) depending on which dollar of income you are looking at. This is very different from the Average (or effective) tax rate that is the result of applying these marginal tax rates across all of your income.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Instructions for using the visual tax calculator:

- Select filing status: Single, Married Filing Jointly or Head of Household. For more info on these filing categories see the IRS website

- Select percentage of regular income vs capital gains income. Regular income is wage or employment income and is taxed at a higher rate than capital gains income. Capital gains income is typically investment income from the sale of stocks or dividends and taxed at a lower rate than regular income.

- Move your cursor or click on the graph to select a specific income Make sure you note that the x-axis is a logarithmic-scale, meaning that income grows exponentially as you move to the right.

- Choose your graph preference One graph (Individual Tax Brackets) shows the individual tax brackets and how much of your income is taxed at the different marginal rates. The other graph (Aggregate Rates) shows the net result of applying the different rates to get your effective rate.

One of the most interesting things is to vary the proportion of regular income vs capital gains taxes. Generally, wealthier households earn a greater fraction of their income from capital gains and as a result of the lower tax rates on capital gains, these household pay a lower effective tax rate than those making an order of magnitude less in overall income.

Here are two tables that lists the marginal tax brackets in the United States in 2019 that form the basis of the calculations in the calculator. 2018’s numbers are pretty similar.

US Tax Brackets and Rates for 2019

Rate

Single

Taxable Income Over

Married Filing Joint

Taxable Income Over

Heads of Households

Taxable Income Over

10%

$0

$0

$0

12%

$9,700

$19,400

$13,850

22%

$39,475

$78,950

$52,850

24%

$84,200

$168,400

$84,200

32%

$160,725

$321,450

$160,700

35%

$204,100

$408,200

$204,100

37%

$510,300

$612,350

$510,300

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

Capital Gains Brackets for 2019

Single

Capital Gains Over

Married Filing Jointly

Capital Gains Over

Heads of Households

Capital Gains Over

0%

$0

$0

$0

15%

$39,375

$78,750

$52,750

20%

$434,550

$488,850

$461,700

For those not visually inclined, here is a written description of how to apply marginal tax rates. The first thing to note is that the income shown here in the graphs is taxable income, which simply speaking is your gross income with deductions removed. The standard deduction for 2019 range from $12,200 for Single filers to $24,400 for Married filers.

- If you are single, all of your regular taxable income between 0 and $9,700 is taxed at a 10% rate. This means that your all of your gross income below $12,200 is not taxed and your gross income between $12,200 and $21,900 is taxed at 10%.

- If you have more income, you move up a marginal tax bracket. Any taxable income in excess of $9,700 but below $39,475 will be taxed at the 12% rate. It is important to note that not all of your income is taxed at the marginal rate, just the income between these amounts.

- Income between $39,475 and $84,200 is taxed at 24% and so on until you have income over $510,300 and are in the 37% marginal tax rate . . .

- Thus, different parts of your income are taxed at different rates and you can calculate an average or effective rate (which is shown in the aggregate rates graph).

- Capital gains income complicates things slightly as it is taxed after regular income. Thus any amount of capital gains taxes you make are taxed at a rate that corresponds to starting after you regular income. If you made $100,000 in regular income, and only $100 in capital gains income, that $100 dollars would be taxed at the 15% rate and not at the 0% rate, because the $100,000 in regular income pushes you into the 2nd marginal tax bracket for capital gains (between $39,375 and $434,550).

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript and plotted using the plot.ly open source javascript plotting library.

Early Retirement Calculators and Tools

Interested in Early Retirement or FIRE (Financial Independence to Retire Early)?

Here are some interactive and educational planning tools that I developed to help you understand the concepts of FIRE and calculate how long it will take to achieve retirement and how likely you are to survive retirement. Click on the tools below to try them out.

Financial Independence Calculators

Regardless of where you are on your path to FIRE, there are several types of tools that are useful:

Planning to get to retirement

How long and how safe will your retirement be?

Rich, Broke or Dead? Will your Money Last Through Early Retirement?

Simulating retirement portfolio survival probability and human longevity

These tools all focus on the concept of FIRE. FIRE is the concept that revolves around saving and investing to achieve Financial Independence (FI) and to potentially Retire Early (RE). One of the core concepts is that once you can save up enough money, you can retire by withdrawing a fraction of this money annually to cover your living expenses. Other important topics related to this core concept have to do with reducing spending so you can save money and investing so your money can grow and sustain your retirement over many decades.

Other visualizations and tools related to Financial Independence

These tools relate to taxes and stock market returns.

Calculating Returns from Periodic Investments

Visualizing Market Returns

Understanding Market Timing

How difficult is it to time the stock market?

Market Timing Game

Income Taxes

Tax bracket calculator to visualize how income and capital gains taxed

Income Tax Bracket Calculator

Data Sources and Tools:

See the individual tool to learn more about how it was made.

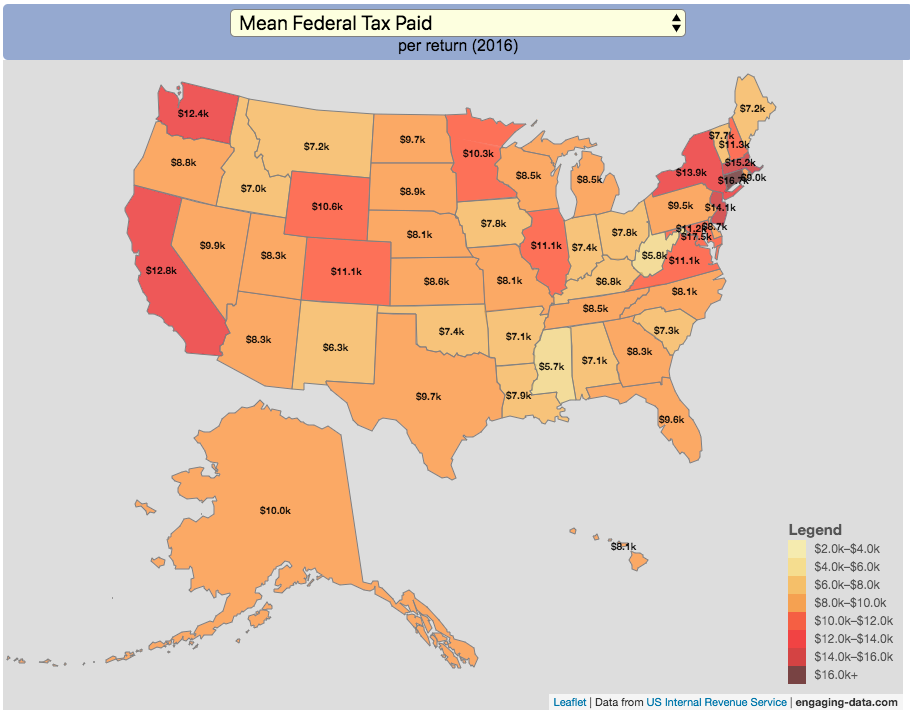

How Much Does Each State Pay In Taxes?

Given that tax day has just passed, I thought it would be good to check out some data on taxes. The IRS provides a great resource on tax data that I’ve only just gotten into. I think I’ll be able to do more with this in the future. This one looks at how taxes paid varies by state and presents it as a choropleth map (coloring states based on certain categories of tax data).

- Mean Federal Tax Paid

- Mean Adjusted Gross Income

- Mean State/Local Tax

- Mean Combined (Fed/State/Local) Tax

- Percent Income from Dividends and Capital Gains

- Percent of Returns with Itemized Deductions

- Number of Tax Returns

- Mean Federal Tax Rate

- Mean State/Local Tax Rate

- Mean Combined (Fed/State/Local) Rate

- Total Federal Tax Liability

I may add more categories in the future, so if you have ideas of tax data you want to see visualized let me know and I’ll see what I can do.

For other tax-related tools and visualizations see my tax bracket calculator and visualization of marginal tax rates.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Data and Tools:

Data on tax returns by state is from the IRS website in an excel format. The map was made using the leaflet open source mapping library. Data was compiled in excel and calculations made using javascript.

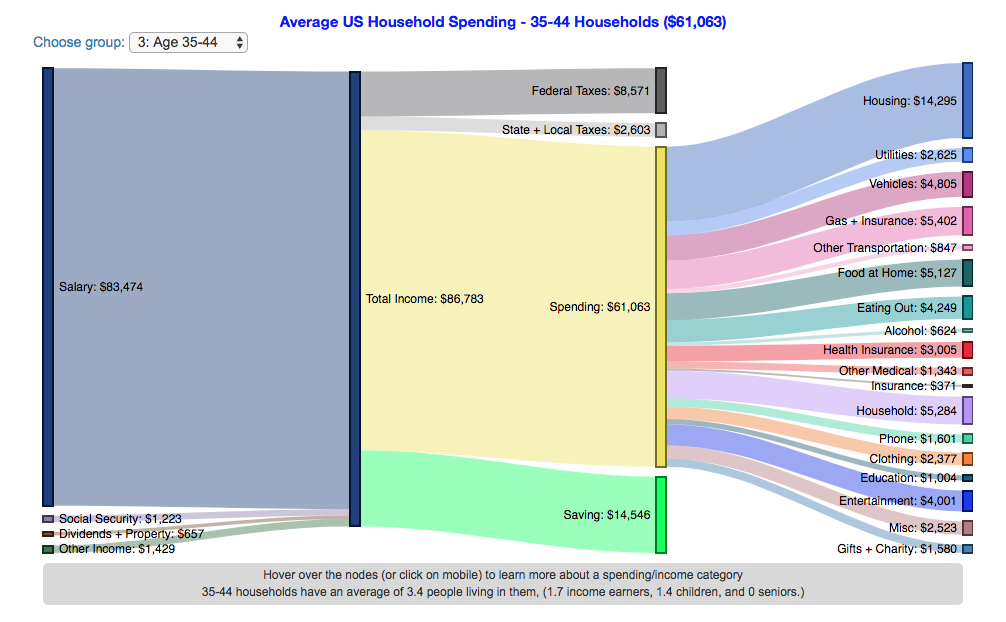

How do Americans Spend Money? US Household Spending Breakdown by Age

How much do US households spend and how does it change with age?

This visualization is one of a series of visualizations that present US household spending data from the US Bureau of Labor Statistics. This one looks at the age of the primary resident.

- US Household spending by income group

- US Household spending by age of primary resident

- US Household spending by education level of primary resident

- US Household spending by household composition

This visualization focuses on the age of the primary resident. This is defined in the BLS documentation as the person who is first mentioned when the survey respondent is asked who in the household rents or owns the home.

I obtained data from the US Bureau of Labor Statistics (BLS), based upon a survey of consumer households and their spending habits. This data breaks down spending and income into many categories that are aggregated and plotted in a Sankey graph.

One of the key factors in financial health of an individual or household is making sure that household spending is equal to or below household income. If your spending is higher than income, you will be drawing down your savings (if you have any) or borrowing money. If your spending is lower than your income, you will presumably be saving money which can provide flexibility in the future, fund your retirement (maybe even early) and generally give you peace of mind.

Instructions:

- Hover (or on mobile click) on a link to get more information on the definition of a particular spending or income category.

- Use the dropdown menu to look at averages for different groups of households based on the age of the primary resident. This data breaks households into groups (under 25, 25-34, 35-44, 45-54, 55-64, 65-75 and over 75). The composition of households and income change as the age of the primary resident changes, which in turn affects spending totals and individual categories.

As stated before, one of the keys to financial security is spending less than your income. We can see that on average, income tends to increase with the household primary age up to the 45-54 group, then declines from there.

The youngest group (under 25) tends to borrow or draw down on savings to live their lifestyle, while the same is true of the over 75 age group. This is probably because seniors tend to draw down savings that were built up specifically for this purpose, and college students borrow to go to school. Social security also makes up a big portion of income for the older age groups.

How does your overall spending compare with those in your income group? How about spending in individual categories like housing, vehicles, food, clothing, etc…?

Probably one of the best things you can do from a financial perspective is to go through your spending and understand where your money is going. These sankey diagrams are one way to do it and see it visually, but of course, you can just make a table or pie chart or whatever.

The main thing is to understand where your money is going. Once you’ve done this you can be more conscious of what you are spending your money on, and then decide if you are spending too much (or too little) in certain categories. Having context of what other people spend money on is helpful as well, and why it is useful to compare to these averages, even though the income level, regional cost of living, and household composition won’t look exactly the same as your household.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Here is more information about the Consumer Expenditure Surveys from the BLS website:

The Consumer Expenditure Surveys (CE) collect information from the US households and families on their spending habits (expenditures), income, and household characteristics. The strength of the surveys is that it allows data users to relate the expenditures and income of consumers to the characteristics of those consumers. The surveys consist of two components, a quarterly Interview Survey and a weekly Diary Survey, each with its own questionnaire and sample.

Data and Tools:

Data on consumer spending was obtained from the BLS Consumer Expenditure Surveys, and aggregation and calculations were done using javascript and code modified from the Sankeymatic plotting website. I aggregated many of the survey output categories so as to make the graph legible, otherwise there’d be 4x as many spending categories and all very small and difficult to read.

How do Americans Spend Money? US Household Spending Breakdown by Income Group

How much do US households spend?

This visualization is one of a series of visualizations that present US household spending data from the US Bureau of Labor Statistics. This one looks at the income of the household.

- US Household spending by income group

- US Household spending by age of primary resident

- US Household spending by education level of primary resident

- US Household spending by household composition

One of the key factors in financial health of an individual or household is making sure that household spending is equal to or below household income. If your spending is higher than income, you will be drawing down your savings (if you have any) or borrowing money. If your spending is lower than your income, you will presumably be saving money which can provide flexibility in the future, fund your retirement (maybe even early) and generally give you peace of mind.

I obtained data from the US Bureau of Labor Statistics (BLS), based upon a survey of consumer households and their spending habits. This data breaks down spending and income into many categories that are aggregated and plotted in a Sankey graph.

Instructions:

- Hover (or on mobile click) on a link to get more information on the definition of a particular spending or income category.

- Use the dropdown menu to look at averages for different groups of households based on income. This data breaks households into quintiles (groups of 20%) by income. The lowest quintile group is the group of 20% of households with the lowest income (and spend on average ~$25,500/yr).

As stated before, one of the keys to financial security is spending less than your income. We can see that on average, those in the lowest quintiles may be borrowing or drawing down on savings to live their lifestyle, while those in the highest quintiles are saving money and contributing to wealth. This fairly high level of borrowing/drawing on savings from the lowest quintile households may be deceptive because it includes seniors who are drawing down savings that were built up specifically for this purpose, and college students who are borrowing to go to school. These groups generally don’t have significant incomes.

How does your overall spending compare with those in your income group? How about spending in individual categories like housing, vehicles, food, clothing, etc…?

Probably one of the best things you can do from a financial perspective is to go through your spending and understand where your money is going. These sankey diagrams are one way to do it and see it visually, but of course, you can just make a table or pie chart or whatever.

The main thing is to understand where your money is going. Once you’ve done this you can be more conscious of what you are spending your money on, and then decide if you are spending too much (or too little) in certain categories. Having context of what other people spend money on is helpful as well, and why it is useful to compare to these averages, even though the income level, regional cost of living, and household composition won’t look exactly the same as your household.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Here is more information about the Consumer Expenditure Surveys from the BLS website:

The Consumer Expenditure Surveys (CE) collect information from the US households and families on their spending habits (expenditures), income, and household characteristics. The strength of the surveys is that it allows data users to relate the expenditures and income of consumers to the characteristics of those consumers. The surveys consist of two components, a quarterly Interview Survey and a weekly Diary Survey, each with its own questionnaire and sample.

Data and Tools:

Data on consumer spending was obtained from the BLS Consumer Expenditure Surveys, and aggregation and calculations were done using javascript and code modified from the Sankeymatic plotting website. I aggregated many of the survey output categories so as to make the graph legible, otherwise there’d be 4x as many spending categories and all very small and difficult to read.

Understanding Tax Brackets: Interactive Income Tax Visualization and Calculator

How is your income distributed across tax brackets?

I previously made a graphical visualization of income and marginal tax rates to show how tax brackets work. That graph tried to show alot of info on the same graph, i.e. the breakdown of income tax brackets for incomes ranging from $10,000 to $3,000,000. It was nice looking, but I think several people were confused about how to read the graph. This Sankey graph is a more detailed look at the tax breakdown for one specific income. You can enter your (or any other) profile and see how taxes are distributed across the different brackets. It can help (as the other tried) to better understand marginal and average tax rates. This tool only looks at US Federal Income taxes and ignores state, local and Social Security/Medicare taxes.

– Use this button to generate a URL that you can share a specific set of inputs and graphs. Just copy the URL in the address bar at the top of your browser (after pressing the button).

- Select filing status: Single, Married Filing Jointly or Head of Household. For more info on these filing categories see the IRS website

- Enter your regular income and capital gains income. Regular income is wage or employment income and is taxed at a higher rate than capital gains income. Capital gains income is typically investment income from the sale of stocks or dividends and taxed at a lower rate than regular income.

- Move your cursor or click on the Sankey graph to select a specific link. This will give you more information about how income in a specific tax bracket is being taxed.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

As seen with the marginal rates graph, there is a big difference in how regular income and capital gains are taxed. Capital gains are taxed at a lower rate and generally have larger bracket sizes. Generally, wealthier households earn a greater fraction of their income from capital gains and as a result of the lower tax rates on capital gains, these household pay a lower effective tax rate than those making an order of magnitude less in overall income.

2018 Tax Brackets

Here are two tables that lists the marginal tax brackets in the United States in 2018 that form the basis of the calculations in the calculator. 2019’s numbers are listed below.

| Rate | Single Taxable Income Over |

Married Filing Joint Taxable Income Over |

Heads of Households Taxable Income Over |

|---|---|---|---|

| 10% | $0 | $0 | $0 |

| 12% | $9,525 | $19,050 | $13,600 |

| 22% | $38,700 | $77,400 | $51,800 |

| 24% | $82,500 | $165,000 | $82,500 |

| 32% | $157,500 | $315,000 | $157,500 |

| 35% | $200,000 | $400,000 | $200,000 |

| 37% | $500,000 | $600,000 | $500,000 |

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

| Single Capital Gains Over |

Married Filing Jointly Capital Gains Over |

Heads of Households Capital Gains Over |

|

|---|---|---|---|

| 0% | $0 | $0 | $0 |

| 15% | $38,700 | $77,400 | $51,850 |

| 20% | $426,700 | $480,050 | $453,350 |

2019 Tax Brackets

Here are the numbers for 2019:

| Rate | Single Taxable Income Over |

Married Filing Joint Taxable Income Over |

Heads of Households Taxable Income Over |

|---|---|---|---|

| 10% | $0 | $0 | $0 |

| 12% | $9,700 | $19,400 | $13,850 |

| 22% | $39,475 | $78,950 | $52,850 |

| 24% | $84,200 | $168,400 | $84,200 |

| 32% | $160,725 | $321,450 | $160,700 |

| 35% | $204,100 | $408,200 | $204,100 |

| 37% | $510,300 | $612,350 | $510,300 |

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

| Single Capital Gains Over |

Married Filing Jointly Capital Gains Over |

Heads of Households Capital Gains Over |

|

|---|---|---|---|

| 0% | $0 | $0 | $0 |

| 15% | $39,375 | $78,750 | $52,750 |

| 20% | $434,550 | $488,850 | $461,700 |

2020 Tax Brackets

Here are the numbers for 2020:

| Rate | Single Taxable Income Over |

Married Filing Joint Taxable Income Over |

Heads of Households Taxable Income Over |

|---|---|---|---|

| 10% | $0 | $0 | $0 |

| 12% | $9,875 | $19,750 | $14,100 |

| 22% | $40,125 | $80,250 | $53,700 |

| 24% | $85,525 | $171,050 | $85,500 |

| 32% | $163,300 | $326,600 | $163,300 |

| 35% | $207,350 | $414,700 | $207,350 |

| 37% | $518,400 | $622,050 | $518,400 |

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

| Single Capital Gains Over |

Married Filing Jointly Capital Gains Over |

Heads of Households Capital Gains Over |

|

|---|---|---|---|

| 0% | $0 | $0 | $0 |

| 15% | $40,000 | $80,000 | $53,600 |

| 20% | $441,450 | $496,600 | $469,050 |

2021 Tax Brackets

Here are the numbers for 2021:

| Rate | Single Taxable Income Over |

Married Filing Joint Taxable Income Over |

Heads of Households Taxable Income Over |

|---|---|---|---|

| 10% | $0 | $0 | $0 |

| 12% | $9,950 | $19,900 | $14,200 |

| 22% | $40,525 | $81,050 | $54,200 |

| 24% | $86,375 | $172,750 | $86,350 |

| 32% | $164,925 | $329,850 | $164,900 |

| 35% | $209,425 | $418,850 | $209,400 |

| 37% | $523,600 | $628,300 | $523,600 |

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

| Single Capital Gains Over |

Married Filing Jointly Capital Gains Over |

Heads of Households Capital Gains Over |

|

|---|---|---|---|

| 0% | $0 | $0 | $0 |

| 15% | $40,400 | $80,800 | $54,100 |

| 20% | $445,850 | $501,600 | $473,750 |

- If you are single, all of your regular taxable income between 0 and $9,525 is taxed at a 10% rate. This means that your all of your gross income below $12,000 is not taxed and your gross income between $12,000 and $21,525 is taxed at 10%.

- If you have more income, you move up a marginal tax bracket. Any taxable income in excess of $9,525 but below $38,700 will be taxed at the 12% rate. It is important to note that not all of your income is taxed at the marginal rate, just the income between these amounts.

- Income between $38,700 and $82,500 is taxed at 24% and so on until you have income over $500,000 and are in the 37% marginal tax rate . . .

- Thus, different parts of your income are taxed at different rates and you can calculate an average or effective rate (which is shown in the summary table).

- Capital gains income complicates things slightly as it is taxed after regular income. Thus any amount of capital gains taxes you make are taxed at a rate that corresponds to starting after you regular income. If you made $100,000 in regular income, and only $100 in capital gains income, that $100 dollars would be taxed at the 15% rate and not at the 0% rate, because the $100,000 in regular income pushes you into the 2nd marginal tax bracket for capital gains (between $38,700 and $426,700).

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript and code modified from the Sankeymatic plotting website.

Visual Guide to Understanding Marginal Tax Rates

What is a marginal tax rate?

There is a fair amount of confusion about what a marginal tax rate is and how it affects how much tax you would owe the government on a certain amount of income. These graphs are here to help you better understand the difference between a marginal and average tax rate and to easily calculate these rates for specific examples in the US context. This tool only looks at US Federal Income taxes and ignores state, local and Social Security/Medicare taxes.

Marginal tax rates are the rate at which an additional dollar of income will be taxed at. There are different tax brackets (each with its own marginal rate) depending on which dollar of income you are looking at. This is very different from the Average (or effective) tax rate that is the result of applying these marginal tax rates across all of your income.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Instructions for using the visual tax calculator:

- Select filing status: Single, Married Filing Jointly or Head of Household. For more info on these filing categories see the IRS website

- Select percentage of regular income vs capital gains income. Regular income is wage or employment income and is taxed at a higher rate than capital gains income. Capital gains income is typically investment income from the sale of stocks or dividends and taxed at a lower rate than regular income.

- Move your cursor or click on the graph to select a specific income Make sure you note that the x-axis is a logarithmic-scale, meaning that income grows exponentially as you move to the right.

- Choose your graph preference One graph (Individual Tax Brackets) shows the individual tax brackets and how much of your income is taxed at the different marginal rates. The other graph (Aggregate Rates) shows the net result of applying the different rates to get your effective rate.

Here are two tables that lists the marginal tax brackets in the United States in 2019 that form the basis of the calculations in the calculator. 2018’s numbers are pretty similar.

| Rate | Single Taxable Income Over |

Married Filing Joint Taxable Income Over |

Heads of Households Taxable Income Over |

|---|---|---|---|

| 10% | $0 | $0 | $0 |

| 12% | $9,700 | $19,400 | $13,850 |

| 22% | $39,475 | $78,950 | $52,850 |

| 24% | $84,200 | $168,400 | $84,200 |

| 32% | $160,725 | $321,450 | $160,700 |

| 35% | $204,100 | $408,200 | $204,100 |

| 37% | $510,300 | $612,350 | $510,300 |

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

| Single Capital Gains Over |

Married Filing Jointly Capital Gains Over |

Heads of Households Capital Gains Over |

|

|---|---|---|---|

| 0% | $0 | $0 | $0 |

| 15% | $39,375 | $78,750 | $52,750 |

| 20% | $434,550 | $488,850 | $461,700 |

For those not visually inclined, here is a written description of how to apply marginal tax rates. The first thing to note is that the income shown here in the graphs is taxable income, which simply speaking is your gross income with deductions removed. The standard deduction for 2019 range from $12,200 for Single filers to $24,400 for Married filers.

- If you are single, all of your regular taxable income between 0 and $9,700 is taxed at a 10% rate. This means that your all of your gross income below $12,200 is not taxed and your gross income between $12,200 and $21,900 is taxed at 10%.

- If you have more income, you move up a marginal tax bracket. Any taxable income in excess of $9,700 but below $39,475 will be taxed at the 12% rate. It is important to note that not all of your income is taxed at the marginal rate, just the income between these amounts.

- Income between $39,475 and $84,200 is taxed at 24% and so on until you have income over $510,300 and are in the 37% marginal tax rate . . .

- Thus, different parts of your income are taxed at different rates and you can calculate an average or effective rate (which is shown in the aggregate rates graph).

- Capital gains income complicates things slightly as it is taxed after regular income. Thus any amount of capital gains taxes you make are taxed at a rate that corresponds to starting after you regular income. If you made $100,000 in regular income, and only $100 in capital gains income, that $100 dollars would be taxed at the 15% rate and not at the 0% rate, because the $100,000 in regular income pushes you into the 2nd marginal tax bracket for capital gains (between $39,375 and $434,550).

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript and plotted using the plot.ly open source javascript plotting library.

Recent Comments