Posts for Tag: graph

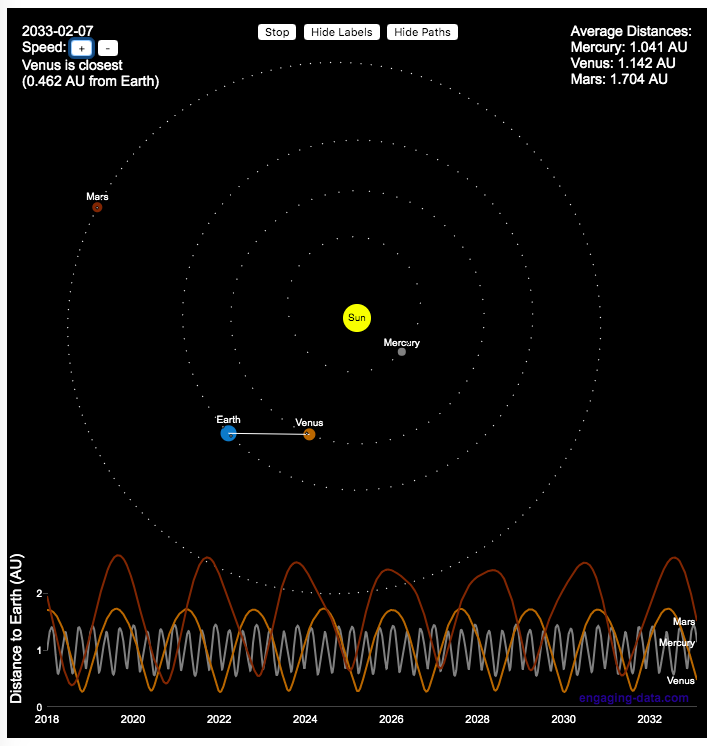

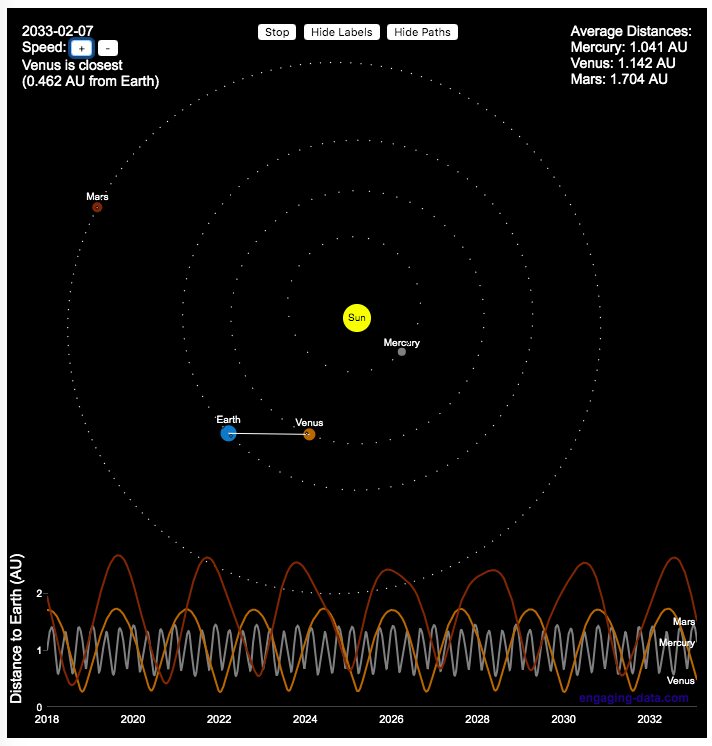

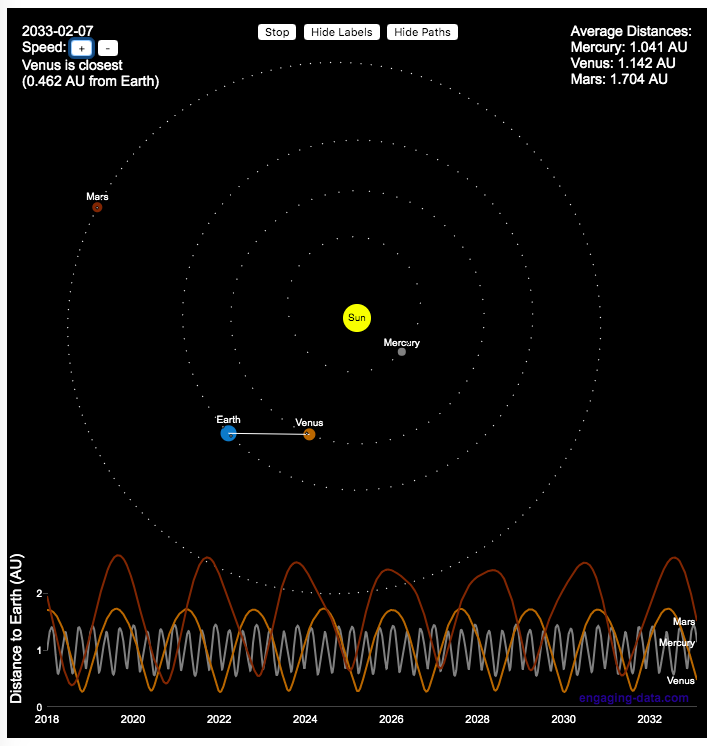

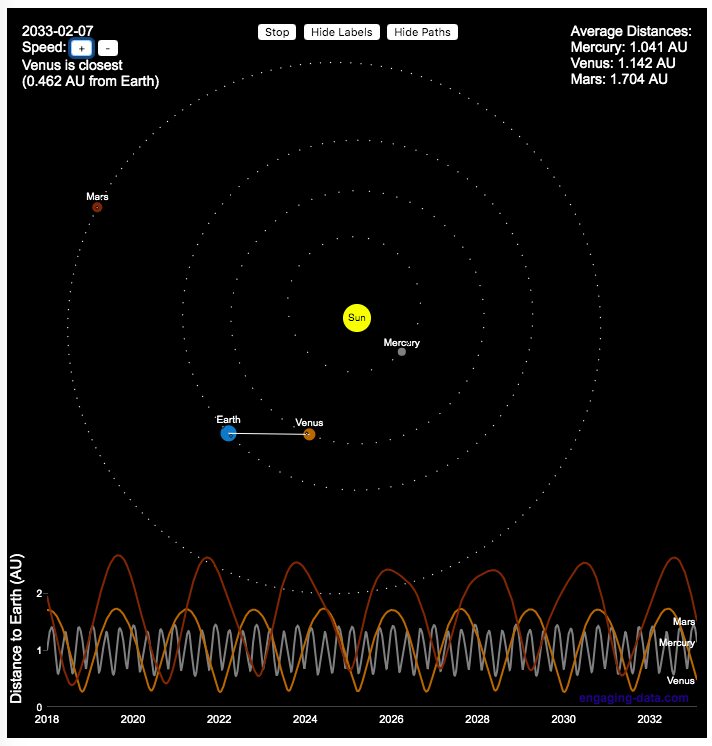

Mercury is the closest planet to Earth (on average)

We all learned the order of planets in school. In my case using the mnemonic, My Very Excellent Mother Just Served Us Nine Pizzas (MVEMJSUNP) for Mercury, Venus, Earth, Mars Jupiter Saturn, Uranus, Neptune, and Pluto. Since Pluto has been demoted to a dwarf planet, you could change the Nine Pizzas to Noodles or something else.

And in terms of distances, Venus’s orbit (0.72 AU, or Astronomical Units (i.e. 1 AU is the distance from the Earth to the Sun) is closer to Earth’s orbit (1 AU by definition) than Mercury’s (varies between 0.31 and 0.47 AU because of it’s more elliptical orbit) or Mars’ (1.5 AU).

However, I saw an article, stating that Mercury might in fact be the closest planet to Earth (on average) so I thought I’d whip up a visualization that shows which planet is closest as a function of the planetary orbits around the sun.

Because of where the planets are on these orbital paths, and specifically the time it takes Mercury to orbit the sun, Mercury is the planet that is closest to Earth more often and has an average distance to Earth that is lower than the other 2 inner planets. Mars is occasionally the closest as well, but on average much further than Mercury or Venus. Also interesting is that Mercury is, on average, about 1 AU away from Earth, which is the same as the distance to the Sun.

This simulation shows how the planet positions vary each day over a 30 year period and the regularity with which the distance between Earth and the other varies over time. Mercury has the shortest period while Mars has the longest. You can change the speed of the simulation to speed up or slow down the orbits of the planets.

Data and Tools:

I thought about simulating the planets but there are plenty of tools out there that generate this orbital data so instead just downloaded ephemeris data (data related to positions of astronomical bodies) from NASA website.. I processed the data using javascript and drew the picture using HTML canvas tools and made the distance vs time plot with the Plotly open source plotting javascript library.

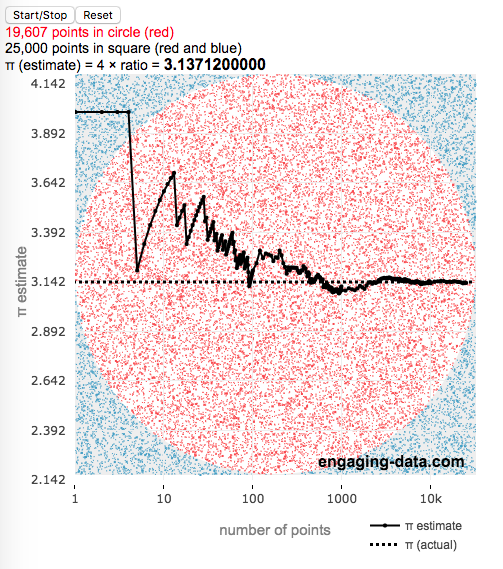

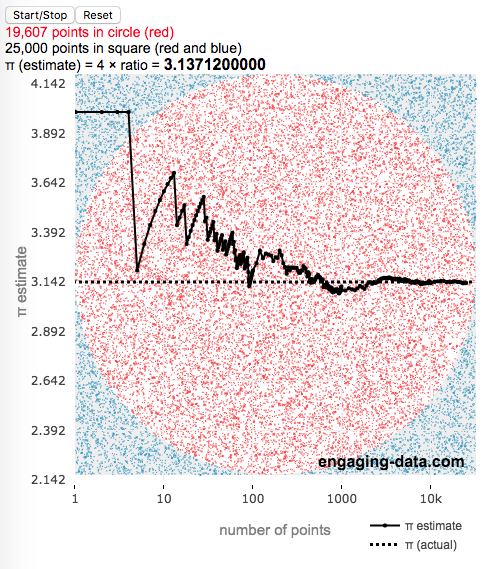

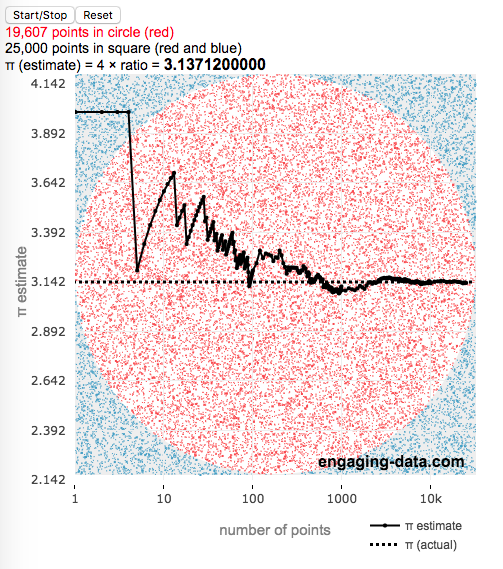

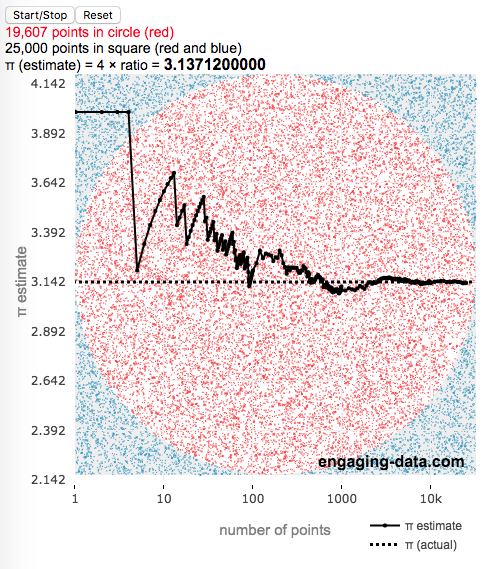

Estimating pi (π) using Monte Carlo Simulation

This interactive simulation estimates the value of the fundamental constant, pi (π), by drawing lots of random points to estimate the relative areas of a square and an inscribed circle.

Pi, (π), is used in a number of math equations related to circles, including calculating the area, circumference, etc. and is widely used in geometry, trigonometry and physics.

This app estimates the value of pi by comparing the area of a square and an inscribed circle. The areas are calculated by randomly placing dots into the square and then counting how many of them are also inside the circle. If you do this enough times, you will get a rough ratio of the relative areas of the two shapes. These points are plotted on the graph (red if the fall inside the circle and blue if the fall outside).

Also shown on the graph is the value of our estimate of pi as the simulation progresses, from a few points to many thousands, to millions of points. We can see that when we have only a few points, the value may not be very accurate but as the number of points increases the value of our estimate gets closer to the true value. Running the simulation will add and plot 1 million points. After the first 100 points are added, the rate at which points are added increases. You’ll notice this as the speed at which dots fills up the square increases and because the plot is shown with a logarithmic x-axis.

Here is the math:

Length of side of square: $2 \times r$

radius of circle: $r$

Area of square: $A_{square} = 4r^2$

Area of circle: $A_{circle} = \pi r^2$

The ratio of areas is $A_{circle}/A_{square} = \pi r^2 / 4r^2 = \pi / 4$

Solving for pi: $\pi = 4 \times A_{circle}/A_{square} \approx 4 \times N_{dots_{circle}}/N_{dots_{square}}$

So pi is estimated as 4 times the ratio of dots in the circle vs square

Tools:

This was programmed in javascript, canvas and plotted using the open source plotly javascript plotting library.

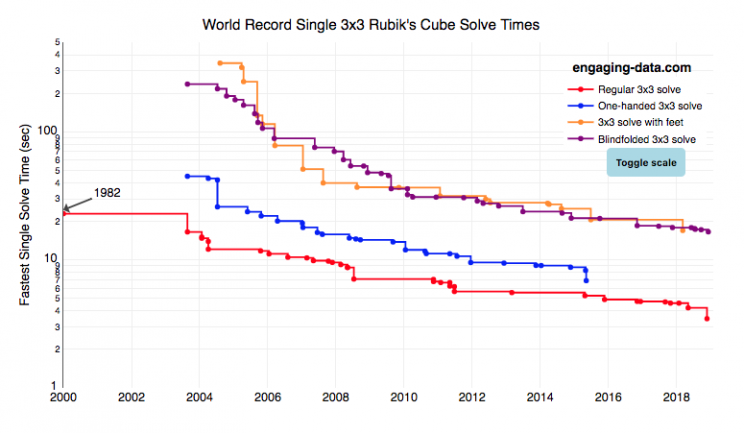

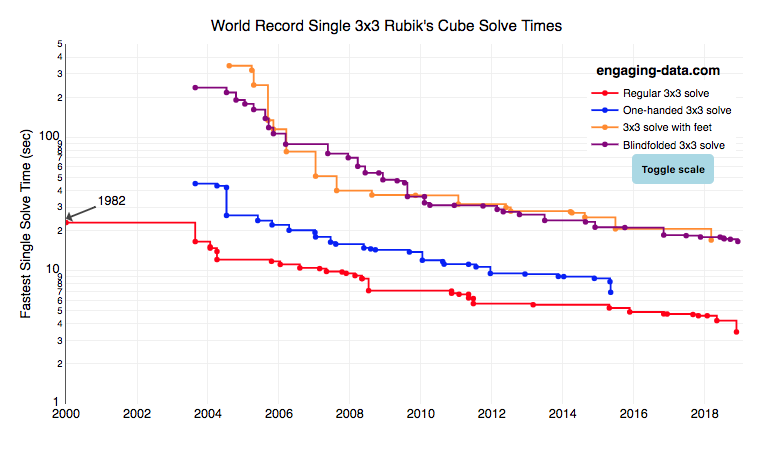

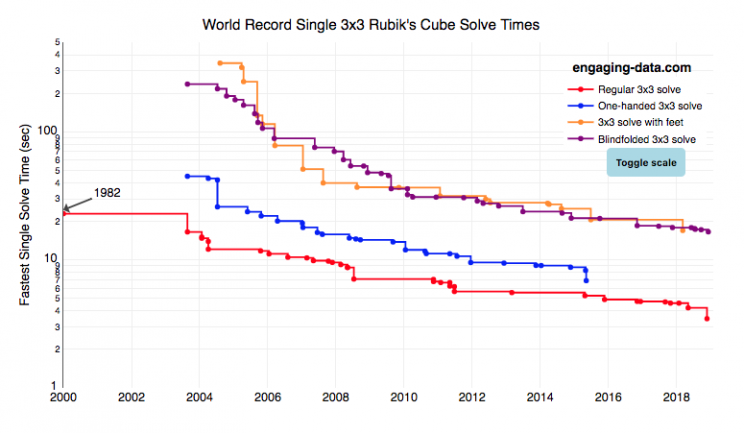

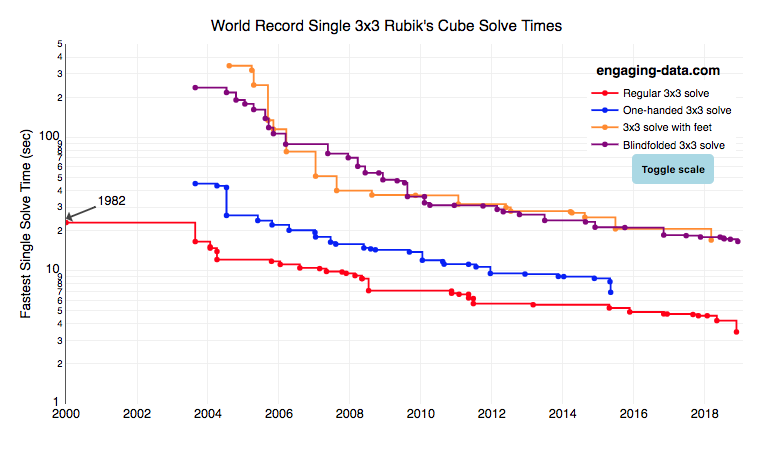

Rubik’s Cube World Records for 3×3 Puzzles (Regular, feet, blindfolded, one-handed)

I recently taught my daughter how to solve the rubik’s cube using “the beginner method”. She’s getting decently fast, but when we watched some youtube videos about really fast speed cubers, we were blown away by how fast people can solve the cube. The world record time is under 4 seconds! I thought it’d be fun to document the progression of world records since the cube was introduced in 1980.

What was interesting in looking through the records are the strange events that people compete in and post amazing times in. Blindfolded! With Feet! One-handed! Feet or one-handed is at least in the realm of possibility, though it would slow down my already slow solves, but blindfolded is next-level stuff.

Hover over the different data series for the events to see the record-holder’s name, country, solve time and competition for each world record. You can also toggle the y-axis scale from linear to log scale in order to distinguish between the latest world records as they tend to converge and have very small changes.

Not sure if it’s motivating or discouraging to see these ridiculously fast solve times. Knowing that we’ll never be able to beat people who solve the cube blindfolded is a bit humbling.

Data and Tools:

Data was downloaded from cubecomps.com, a speed cubing website and the data was plotted using the open-sourced Plot.ly javascript engine.

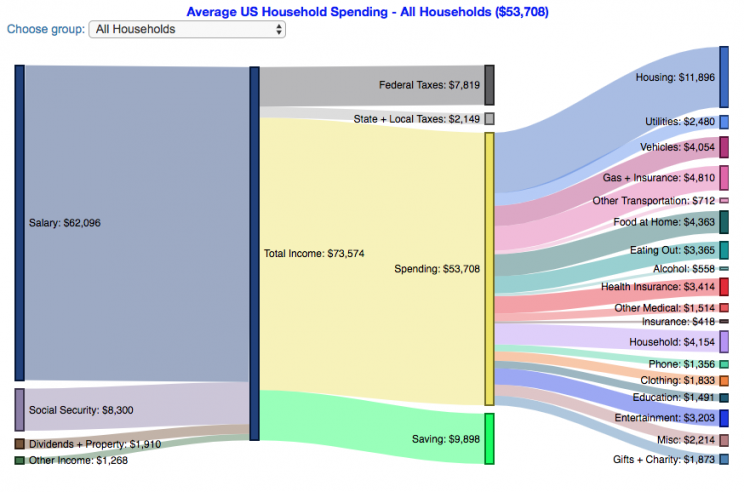

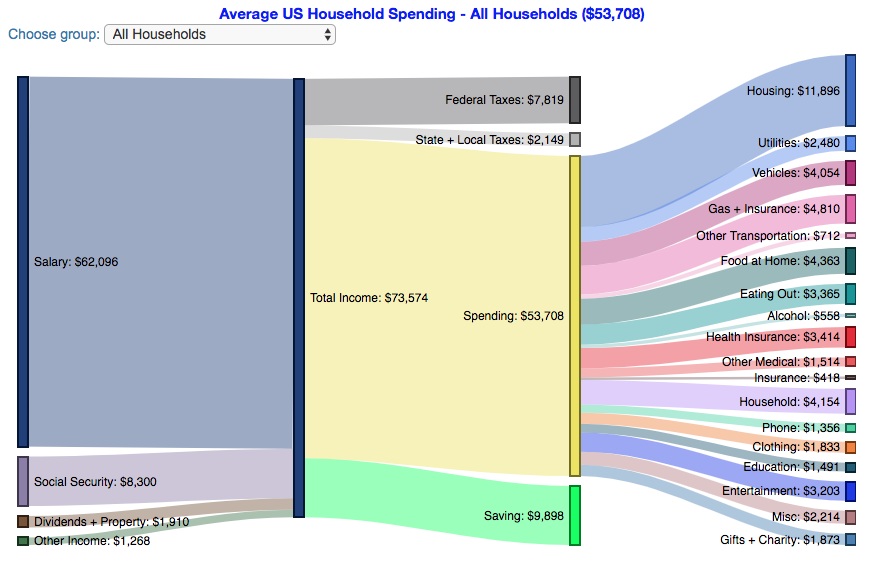

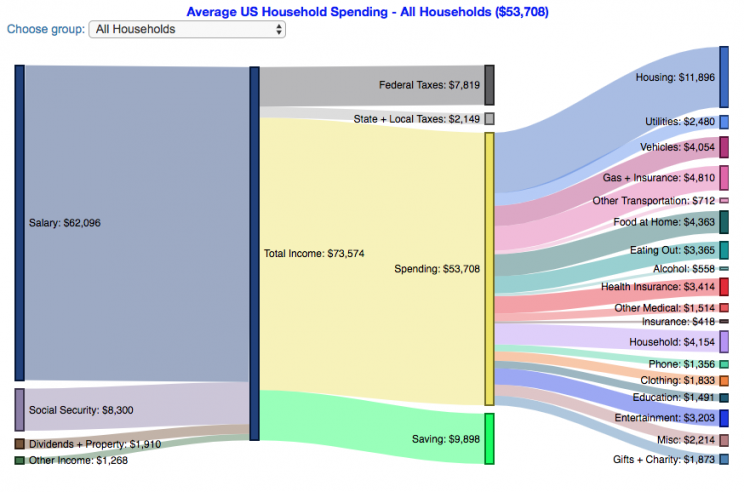

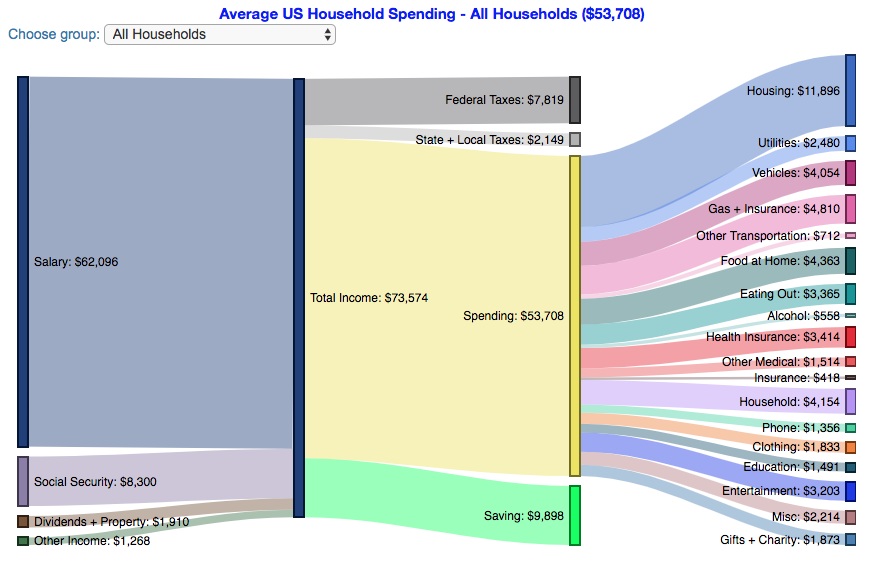

How do Americans Spend Money? US Household Spending Breakdown by Income Group

How much do US households spend?

This visualization is one of a series of visualizations that present US household spending data from the US Bureau of Labor Statistics. This one looks at the income of the household.

- US Household spending by income group

- US Household spending by age of primary resident

- US Household spending by education level of primary resident

- US Household spending by household composition

One of the key factors in financial health of an individual or household is making sure that household spending is equal to or below household income. If your spending is higher than income, you will be drawing down your savings (if you have any) or borrowing money. If your spending is lower than your income, you will presumably be saving money which can provide flexibility in the future, fund your retirement (maybe even early) and generally give you peace of mind.

I obtained data from the US Bureau of Labor Statistics (BLS), based upon a survey of consumer households and their spending habits. This data breaks down spending and income into many categories that are aggregated and plotted in a Sankey graph.

Instructions:

- Hover (or on mobile click) on a link to get more information on the definition of a particular spending or income category.

- Use the dropdown menu to look at averages for different groups of households based on income. This data breaks households into quintiles (groups of 20%) by income. The lowest quintile group is the group of 20% of households with the lowest income (and spend on average ~$25,500/yr).

As stated before, one of the keys to financial security is spending less than your income. We can see that on average, those in the lowest quintiles may be borrowing or drawing down on savings to live their lifestyle, while those in the highest quintiles are saving money and contributing to wealth. This fairly high level of borrowing/drawing on savings from the lowest quintile households may be deceptive because it includes seniors who are drawing down savings that were built up specifically for this purpose, and college students who are borrowing to go to school. These groups generally don’t have significant incomes.

How does your overall spending compare with those in your income group? How about spending in individual categories like housing, vehicles, food, clothing, etc…?

Probably one of the best things you can do from a financial perspective is to go through your spending and understand where your money is going. These sankey diagrams are one way to do it and see it visually, but of course, you can just make a table or pie chart or whatever.

The main thing is to understand where your money is going. Once you’ve done this you can be more conscious of what you are spending your money on, and then decide if you are spending too much (or too little) in certain categories. Having context of what other people spend money on is helpful as well, and why it is useful to compare to these averages, even though the income level, regional cost of living, and household composition won’t look exactly the same as your household.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Here is more information about the Consumer Expenditure Surveys from the BLS website:

The Consumer Expenditure Surveys (CE) collect information from the US households and families on their spending habits (expenditures), income, and household characteristics. The strength of the surveys is that it allows data users to relate the expenditures and income of consumers to the characteristics of those consumers. The surveys consist of two components, a quarterly Interview Survey and a weekly Diary Survey, each with its own questionnaire and sample.

Data and Tools:

Data on consumer spending was obtained from the BLS Consumer Expenditure Surveys, and aggregation and calculations were done using javascript and code modified from the Sankeymatic plotting website. I aggregated many of the survey output categories so as to make the graph legible, otherwise there’d be 4x as many spending categories and all very small and difficult to read.

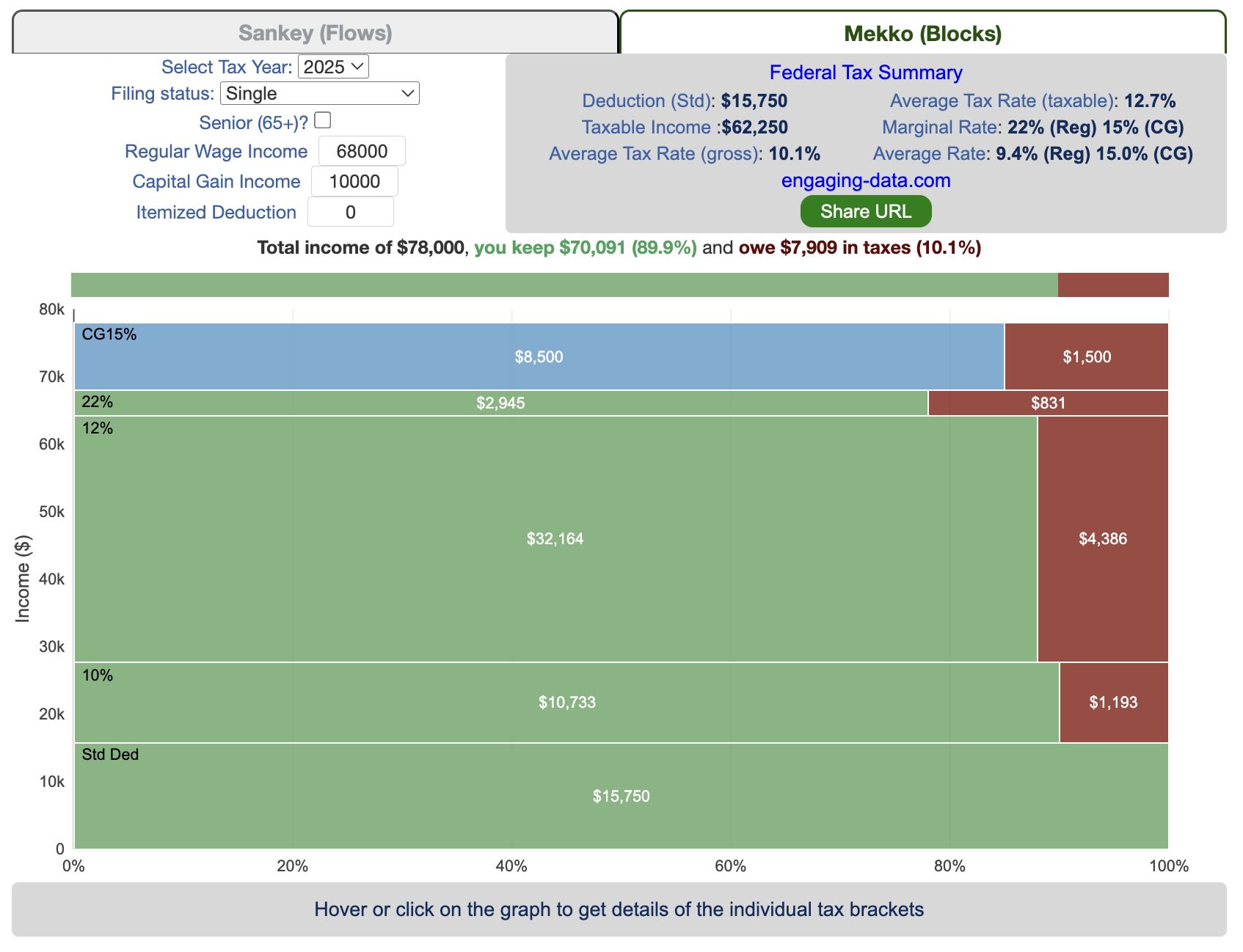

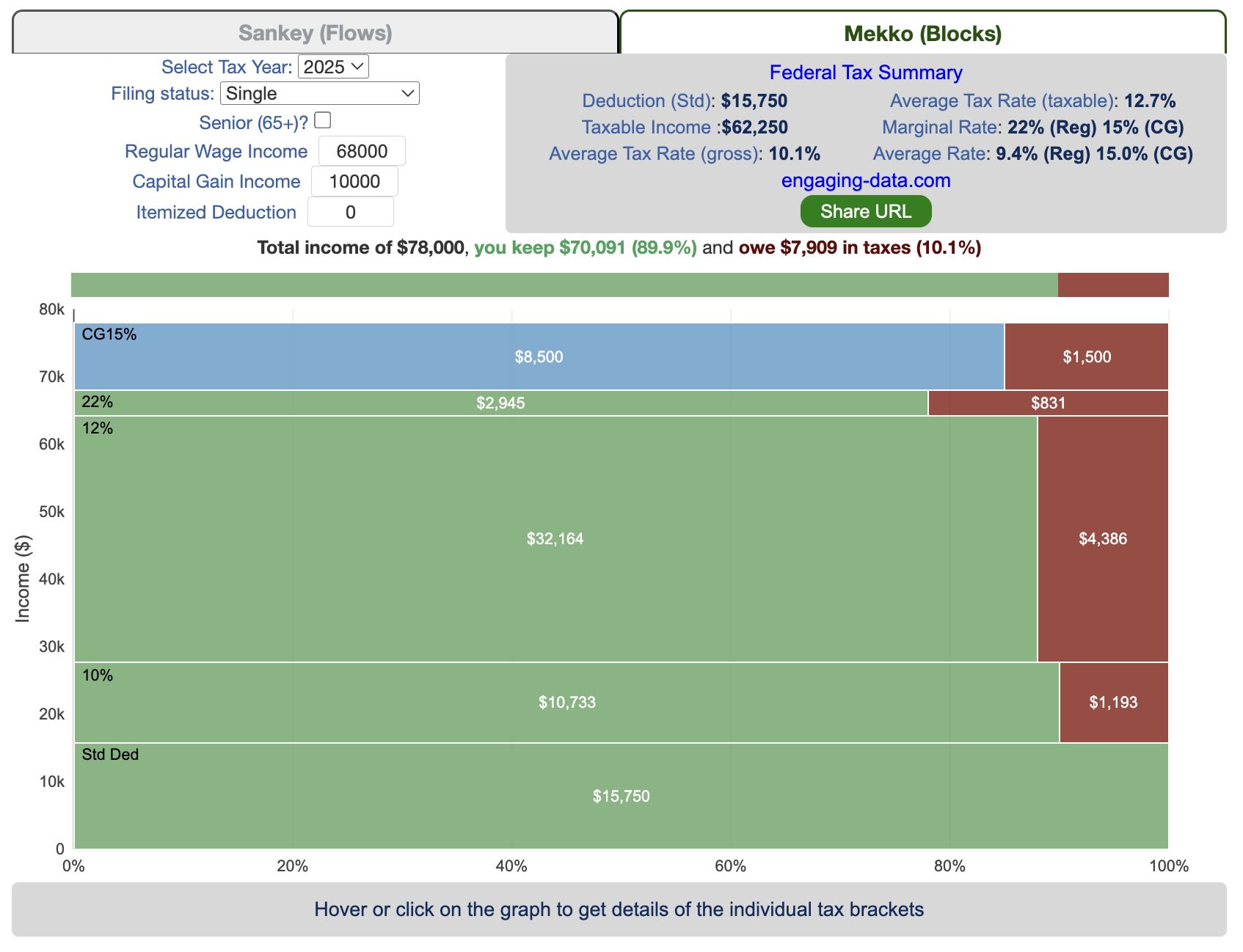

Tax Brackets v2.0: Interactive Income Tax Visualization and Calculator

How is your income distributed across tax brackets?

This updated visualization is a detailed look at the breakdown how taxes are applied to your income across each of the tax brackets. The previous version of this visualization was a Sankey graph and this new version combines the sankey view with a mekko (or marimekko) graph view. It should help you to better understand marginal and average tax rates. This tool only looks at US Federal Income taxes and ignores state, local and Social Security/Medicare taxes.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Instructions for using the visual tax calculator:

- Tax Year: Select year from list of years as bracket sizes and deduction changes by year

- Select filing status: Single, Married Filing Jointly or Head of Household. For more info on these filing categories see the IRS website

- Senior checkbox Seniors are eligible for additional standard deduction and from 2025-2028 eligible for additional deduction even if you itemize

- Enter your regular income and capital gains income. Regular income is wage or employment income and is taxed at a higher rate than capital gains income. Capital gains income is typically investment income from the sale of stocks or dividends and taxed at a lower rate than regular income.

- Move your cursor or click on the Sankey graph to select a specific link. This will give you more information about how income in a specific tax bracket is being taxed.

- Itemized deduction Enter the amount of itemized deductions you have including: state and local (property) taxes, mortgage interest, charitable contributions and medical expenses above 7.5% of your AGI

- Share URL Click on the share button to generate a custom URL that will share a graph with your specific numbers in it. The link is copied to your clipboard and placed into the URL bar.

Interpreting the tax visualization graphs

Both the sankey and mekko graphs help you easily the size each of these tax brackets and the fraction of income in that bracket that you can keep and the fraction going to taxes. Also shown is the split of the regular income vs capital gains and how capital gains is “stacked” on top of the regular income.

The mekko graph is a stacked horizontal bar graph where the height of each bar is proportional to the size of the tax bracket and the bar is split into two parts: a keep and a tax portion. This makes it clear the progressive nature of the tax code, initial tax brackets are taxed at the lowest amounts and as you fill up more tax brackets, the tax rate, and the amount of money you must give to the government, increases.

As seen with the marginal rates graph, there is a big difference in how regular income and capital gains are taxed. Capital gains are taxed at a lower rate and generally have larger bracket sizes. Generally, wealthier households earn a greater fraction of their income from capital gains and as a result of the lower tax rates on capital gains, these household pay a lower effective tax rate than those making an order of magnitude less in overall income.

Also shown is a summary bar graph that shows the split in your total income into a part that you keep and the other that owed to taxes, i.e. your average tax rate.

How Do Tax Brackets Work

This is a written description of how to apply marginal tax rates. The income you have is split across various tax brackets, which by analogy can be thought of as buckets where once you fill one up, the additional money goes into another bucket, until that is filled up and so on until all your income is distributed across these brackets. The last brackets are open-ended so they are of infinite size.

You start with your deductions which changes based on your filing status, age and if you have itemized deductions. You fill this up first and you can think of this as the 0% tax bracket. Then any additional income goes into the 10% bracket where 10% of this income goes to taxes. This proceeds then onto the 12%, 22% and so on brackets.

The default example is described here for tax year 2025

- If you are single, your standard deduction is $15,750 and you pay no taxes on this money. After that, all of your regular taxable income up to $11,925 is taxed at a 10% rate. This means that your all of your gross income below $15,750 is not taxed and your gross income between $15,750 and $27,675 is taxed at 10%.

- If you have more income, you move up a marginal tax bracket. The next $36,550 in additional taxable income will be taxed at the 12% rate. It is important to note that not all of your income is taxed at the marginal rate, just the income in this bracket these amounts.

- The next $48,900 is taxed at 22% and so on until you have income over $500,000 and are in the 37% marginal tax rate . . . In the default case, you only have $3,775 instead of $48,900 so this portion is taxed at 22%.

- Thus, different parts of your income are taxed at different rates. If you have additional income that puts you into a higher tax bracket, that only affects the added income. This is the approach you would use to calculate an average or effective rate (which is shown in the summary table).

- Capital gains income complicates things slightly as it is taxed after regular income. Thus any amount of capital gains taxes you make are taxed at a rate that corresponds to starting after you regular income. If you made $100,000 in regular income, and only $100 in capital gains income, that $100 dollars would be taxed at the 15% rate and not at the 0% rate, because the $100,000 in regular income pushes you into the 2nd marginal tax bracket for capital gains (between $48,350 and $533,400).

- if the 0% capital gains rate threshold is at $48,350, then any regular income you have will take away from this 0% bracket size. If you have $48,000 in regular taxable income after your deduction, then you will be left with only $350 in 0% capital gains bracket space and the remainder of your capital gains will be taxed in the next bracket, 15%.

Tax Brackets By Year

This table lets you choose to view the thresholds for each income and capital gains tax bracket for the last few years. You can see that tax rates are much lower for capital gains in the table below than for regular income.

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript, CSS and HTML. The sankey graph was made using code modified from the Sankeymatic plotting website and the mekko graph was made using the Plotly javascript open source library.

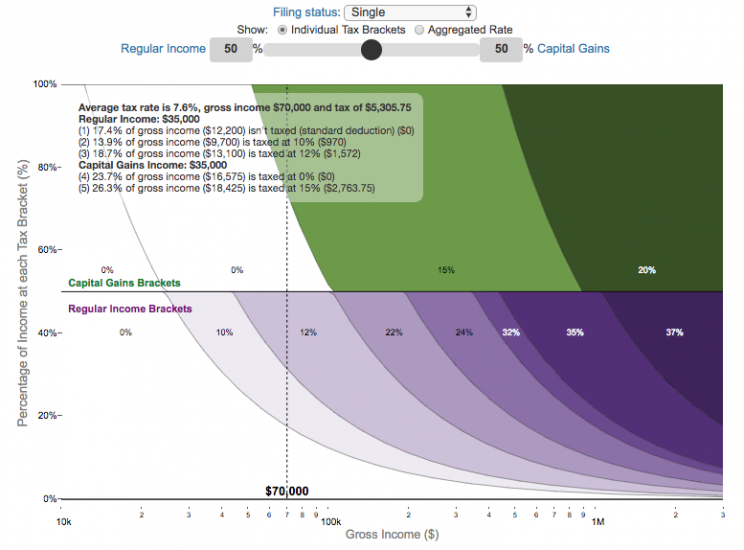

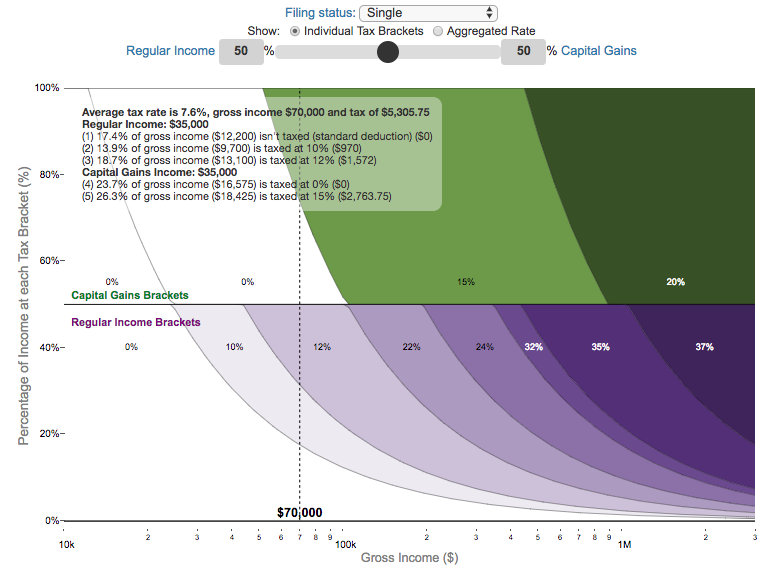

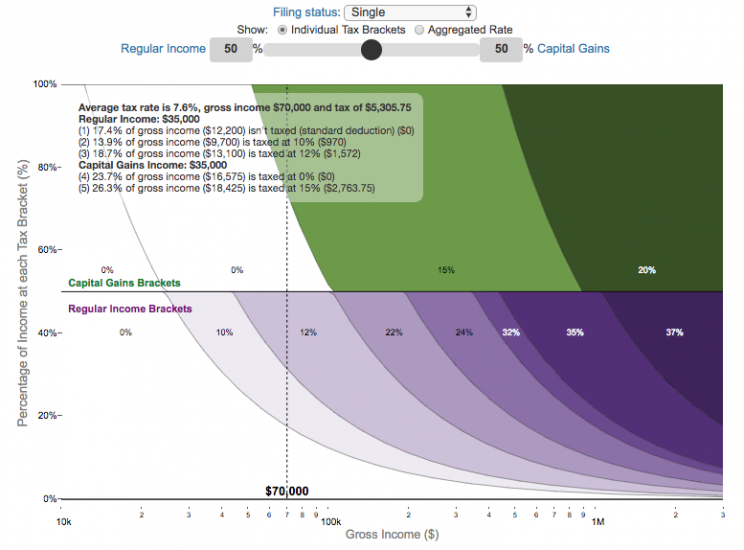

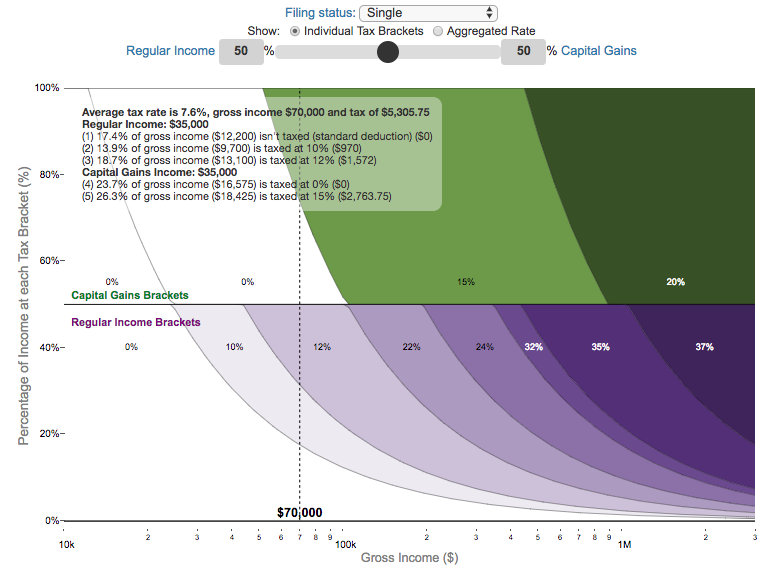

Visual Guide to Understanding Marginal Tax Rates

What is a marginal tax rate?

There is a fair amount of confusion about what a marginal tax rate is and how it affects how much tax you would owe the government on a certain amount of income. These graphs are here to help you better understand the difference between a marginal and average tax rate and to easily calculate these rates for specific examples in the US context. This tool only looks at US Federal Income taxes and ignores state, local and Social Security/Medicare taxes.

Marginal tax rates are the rate at which an additional dollar of income will be taxed at. There are different tax brackets (each with its own marginal rate) depending on which dollar of income you are looking at. This is very different from the Average (or effective) tax rate that is the result of applying these marginal tax rates across all of your income.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Instructions for using the visual tax calculator:

- Select filing status: Single, Married Filing Jointly or Head of Household. For more info on these filing categories see the IRS website

- Select percentage of regular income vs capital gains income. Regular income is wage or employment income and is taxed at a higher rate than capital gains income. Capital gains income is typically investment income from the sale of stocks or dividends and taxed at a lower rate than regular income.

- Move your cursor or click on the graph to select a specific income Make sure you note that the x-axis is a logarithmic-scale, meaning that income grows exponentially as you move to the right.

- Choose your graph preference One graph (Individual Tax Brackets) shows the individual tax brackets and how much of your income is taxed at the different marginal rates. The other graph (Aggregate Rates) shows the net result of applying the different rates to get your effective rate.

One of the most interesting things is to vary the proportion of regular income vs capital gains taxes. Generally, wealthier households earn a greater fraction of their income from capital gains and as a result of the lower tax rates on capital gains, these household pay a lower effective tax rate than those making an order of magnitude less in overall income.

Here are two tables that lists the marginal tax brackets in the United States in 2019 that form the basis of the calculations in the calculator. 2018’s numbers are pretty similar.

US Tax Brackets and Rates for 2019

Rate

Single

Taxable Income Over

Married Filing Joint

Taxable Income Over

Heads of Households

Taxable Income Over

10%

$0

$0

$0

12%

$9,700

$19,400

$13,850

22%

$39,475

$78,950

$52,850

24%

$84,200

$168,400

$84,200

32%

$160,725

$321,450

$160,700

35%

$204,100

$408,200

$204,100

37%

$510,300

$612,350

$510,300

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

Capital Gains Brackets for 2019

Single

Capital Gains Over

Married Filing Jointly

Capital Gains Over

Heads of Households

Capital Gains Over

0%

$0

$0

$0

15%

$39,375

$78,750

$52,750

20%

$434,550

$488,850

$461,700

For those not visually inclined, here is a written description of how to apply marginal tax rates. The first thing to note is that the income shown here in the graphs is taxable income, which simply speaking is your gross income with deductions removed. The standard deduction for 2019 range from $12,200 for Single filers to $24,400 for Married filers.

- If you are single, all of your regular taxable income between 0 and $9,700 is taxed at a 10% rate. This means that your all of your gross income below $12,200 is not taxed and your gross income between $12,200 and $21,900 is taxed at 10%.

- If you have more income, you move up a marginal tax bracket. Any taxable income in excess of $9,700 but below $39,475 will be taxed at the 12% rate. It is important to note that not all of your income is taxed at the marginal rate, just the income between these amounts.

- Income between $39,475 and $84,200 is taxed at 24% and so on until you have income over $510,300 and are in the 37% marginal tax rate . . .

- Thus, different parts of your income are taxed at different rates and you can calculate an average or effective rate (which is shown in the aggregate rates graph).

- Capital gains income complicates things slightly as it is taxed after regular income. Thus any amount of capital gains taxes you make are taxed at a rate that corresponds to starting after you regular income. If you made $100,000 in regular income, and only $100 in capital gains income, that $100 dollars would be taxed at the 15% rate and not at the 0% rate, because the $100,000 in regular income pushes you into the 2nd marginal tax bracket for capital gains (between $39,375 and $434,550).

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript and plotted using the plot.ly open source javascript plotting library.

Mercury is the closest planet to Earth (on average)

We all learned the order of planets in school. In my case using the mnemonic, My Very Excellent Mother Just Served Us Nine Pizzas (MVEMJSUNP) for Mercury, Venus, Earth, Mars Jupiter Saturn, Uranus, Neptune, and Pluto. Since Pluto has been demoted to a dwarf planet, you could change the Nine Pizzas to Noodles or something else.

And in terms of distances, Venus’s orbit (0.72 AU, or Astronomical Units (i.e. 1 AU is the distance from the Earth to the Sun) is closer to Earth’s orbit (1 AU by definition) than Mercury’s (varies between 0.31 and 0.47 AU because of it’s more elliptical orbit) or Mars’ (1.5 AU).

However, I saw an article, stating that Mercury might in fact be the closest planet to Earth (on average) so I thought I’d whip up a visualization that shows which planet is closest as a function of the planetary orbits around the sun.

Because of where the planets are on these orbital paths, and specifically the time it takes Mercury to orbit the sun, Mercury is the planet that is closest to Earth more often and has an average distance to Earth that is lower than the other 2 inner planets. Mars is occasionally the closest as well, but on average much further than Mercury or Venus. Also interesting is that Mercury is, on average, about 1 AU away from Earth, which is the same as the distance to the Sun.

This simulation shows how the planet positions vary each day over a 30 year period and the regularity with which the distance between Earth and the other varies over time. Mercury has the shortest period while Mars has the longest. You can change the speed of the simulation to speed up or slow down the orbits of the planets.

Data and Tools:

I thought about simulating the planets but there are plenty of tools out there that generate this orbital data so instead just downloaded ephemeris data (data related to positions of astronomical bodies) from NASA website.. I processed the data using javascript and drew the picture using HTML canvas tools and made the distance vs time plot with the Plotly open source plotting javascript library.

Estimating pi (π) using Monte Carlo Simulation

This interactive simulation estimates the value of the fundamental constant, pi (π), by drawing lots of random points to estimate the relative areas of a square and an inscribed circle.

Pi, (π), is used in a number of math equations related to circles, including calculating the area, circumference, etc. and is widely used in geometry, trigonometry and physics.

This app estimates the value of pi by comparing the area of a square and an inscribed circle. The areas are calculated by randomly placing dots into the square and then counting how many of them are also inside the circle. If you do this enough times, you will get a rough ratio of the relative areas of the two shapes. These points are plotted on the graph (red if the fall inside the circle and blue if the fall outside).

Also shown on the graph is the value of our estimate of pi as the simulation progresses, from a few points to many thousands, to millions of points. We can see that when we have only a few points, the value may not be very accurate but as the number of points increases the value of our estimate gets closer to the true value. Running the simulation will add and plot 1 million points. After the first 100 points are added, the rate at which points are added increases. You’ll notice this as the speed at which dots fills up the square increases and because the plot is shown with a logarithmic x-axis.

Here is the math:

Length of side of square: $2 \times r$

radius of circle: $r$

Area of square: $A_{square} = 4r^2$

Area of circle: $A_{circle} = \pi r^2$

The ratio of areas is $A_{circle}/A_{square} = \pi r^2 / 4r^2 = \pi / 4$

Solving for pi: $\pi = 4 \times A_{circle}/A_{square} \approx 4 \times N_{dots_{circle}}/N_{dots_{square}}$

So pi is estimated as 4 times the ratio of dots in the circle vs square

Tools:

This was programmed in javascript, canvas and plotted using the open source plotly javascript plotting library.

Rubik’s Cube World Records for 3×3 Puzzles (Regular, feet, blindfolded, one-handed)

I recently taught my daughter how to solve the rubik’s cube using “the beginner method”. She’s getting decently fast, but when we watched some youtube videos about really fast speed cubers, we were blown away by how fast people can solve the cube. The world record time is under 4 seconds! I thought it’d be fun to document the progression of world records since the cube was introduced in 1980.

What was interesting in looking through the records are the strange events that people compete in and post amazing times in. Blindfolded! With Feet! One-handed! Feet or one-handed is at least in the realm of possibility, though it would slow down my already slow solves, but blindfolded is next-level stuff.

Hover over the different data series for the events to see the record-holder’s name, country, solve time and competition for each world record. You can also toggle the y-axis scale from linear to log scale in order to distinguish between the latest world records as they tend to converge and have very small changes.

Not sure if it’s motivating or discouraging to see these ridiculously fast solve times. Knowing that we’ll never be able to beat people who solve the cube blindfolded is a bit humbling.

Data and Tools:

Data was downloaded from cubecomps.com, a speed cubing website and the data was plotted using the open-sourced Plot.ly javascript engine.

How do Americans Spend Money? US Household Spending Breakdown by Income Group

How much do US households spend?

This visualization is one of a series of visualizations that present US household spending data from the US Bureau of Labor Statistics. This one looks at the income of the household.

- US Household spending by income group

- US Household spending by age of primary resident

- US Household spending by education level of primary resident

- US Household spending by household composition

One of the key factors in financial health of an individual or household is making sure that household spending is equal to or below household income. If your spending is higher than income, you will be drawing down your savings (if you have any) or borrowing money. If your spending is lower than your income, you will presumably be saving money which can provide flexibility in the future, fund your retirement (maybe even early) and generally give you peace of mind.

I obtained data from the US Bureau of Labor Statistics (BLS), based upon a survey of consumer households and their spending habits. This data breaks down spending and income into many categories that are aggregated and plotted in a Sankey graph.

Instructions:

- Hover (or on mobile click) on a link to get more information on the definition of a particular spending or income category.

- Use the dropdown menu to look at averages for different groups of households based on income. This data breaks households into quintiles (groups of 20%) by income. The lowest quintile group is the group of 20% of households with the lowest income (and spend on average ~$25,500/yr).

As stated before, one of the keys to financial security is spending less than your income. We can see that on average, those in the lowest quintiles may be borrowing or drawing down on savings to live their lifestyle, while those in the highest quintiles are saving money and contributing to wealth. This fairly high level of borrowing/drawing on savings from the lowest quintile households may be deceptive because it includes seniors who are drawing down savings that were built up specifically for this purpose, and college students who are borrowing to go to school. These groups generally don’t have significant incomes.

How does your overall spending compare with those in your income group? How about spending in individual categories like housing, vehicles, food, clothing, etc…?

Probably one of the best things you can do from a financial perspective is to go through your spending and understand where your money is going. These sankey diagrams are one way to do it and see it visually, but of course, you can just make a table or pie chart or whatever.

The main thing is to understand where your money is going. Once you’ve done this you can be more conscious of what you are spending your money on, and then decide if you are spending too much (or too little) in certain categories. Having context of what other people spend money on is helpful as well, and why it is useful to compare to these averages, even though the income level, regional cost of living, and household composition won’t look exactly the same as your household.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Here is more information about the Consumer Expenditure Surveys from the BLS website:

The Consumer Expenditure Surveys (CE) collect information from the US households and families on their spending habits (expenditures), income, and household characteristics. The strength of the surveys is that it allows data users to relate the expenditures and income of consumers to the characteristics of those consumers. The surveys consist of two components, a quarterly Interview Survey and a weekly Diary Survey, each with its own questionnaire and sample.

Data and Tools:

Data on consumer spending was obtained from the BLS Consumer Expenditure Surveys, and aggregation and calculations were done using javascript and code modified from the Sankeymatic plotting website. I aggregated many of the survey output categories so as to make the graph legible, otherwise there’d be 4x as many spending categories and all very small and difficult to read.

Tax Brackets v2.0: Interactive Income Tax Visualization and Calculator

How is your income distributed across tax brackets?

This updated visualization is a detailed look at the breakdown how taxes are applied to your income across each of the tax brackets. The previous version of this visualization was a Sankey graph and this new version combines the sankey view with a mekko (or marimekko) graph view. It should help you to better understand marginal and average tax rates. This tool only looks at US Federal Income taxes and ignores state, local and Social Security/Medicare taxes.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Instructions for using the visual tax calculator:

- Tax Year: Select year from list of years as bracket sizes and deduction changes by year

- Select filing status: Single, Married Filing Jointly or Head of Household. For more info on these filing categories see the IRS website

- Senior checkbox Seniors are eligible for additional standard deduction and from 2025-2028 eligible for additional deduction even if you itemize

- Enter your regular income and capital gains income. Regular income is wage or employment income and is taxed at a higher rate than capital gains income. Capital gains income is typically investment income from the sale of stocks or dividends and taxed at a lower rate than regular income.

- Move your cursor or click on the Sankey graph to select a specific link. This will give you more information about how income in a specific tax bracket is being taxed.

- Itemized deduction Enter the amount of itemized deductions you have including: state and local (property) taxes, mortgage interest, charitable contributions and medical expenses above 7.5% of your AGI

- Share URL Click on the share button to generate a custom URL that will share a graph with your specific numbers in it. The link is copied to your clipboard and placed into the URL bar.

Interpreting the tax visualization graphs

Both the sankey and mekko graphs help you easily the size each of these tax brackets and the fraction of income in that bracket that you can keep and the fraction going to taxes. Also shown is the split of the regular income vs capital gains and how capital gains is “stacked” on top of the regular income.

The mekko graph is a stacked horizontal bar graph where the height of each bar is proportional to the size of the tax bracket and the bar is split into two parts: a keep and a tax portion. This makes it clear the progressive nature of the tax code, initial tax brackets are taxed at the lowest amounts and as you fill up more tax brackets, the tax rate, and the amount of money you must give to the government, increases.

As seen with the marginal rates graph, there is a big difference in how regular income and capital gains are taxed. Capital gains are taxed at a lower rate and generally have larger bracket sizes. Generally, wealthier households earn a greater fraction of their income from capital gains and as a result of the lower tax rates on capital gains, these household pay a lower effective tax rate than those making an order of magnitude less in overall income.

Also shown is a summary bar graph that shows the split in your total income into a part that you keep and the other that owed to taxes, i.e. your average tax rate.

How Do Tax Brackets Work

This is a written description of how to apply marginal tax rates. The income you have is split across various tax brackets, which by analogy can be thought of as buckets where once you fill one up, the additional money goes into another bucket, until that is filled up and so on until all your income is distributed across these brackets. The last brackets are open-ended so they are of infinite size.

You start with your deductions which changes based on your filing status, age and if you have itemized deductions. You fill this up first and you can think of this as the 0% tax bracket. Then any additional income goes into the 10% bracket where 10% of this income goes to taxes. This proceeds then onto the 12%, 22% and so on brackets.

The default example is described here for tax year 2025

- If you are single, your standard deduction is $15,750 and you pay no taxes on this money. After that, all of your regular taxable income up to $11,925 is taxed at a 10% rate. This means that your all of your gross income below $15,750 is not taxed and your gross income between $15,750 and $27,675 is taxed at 10%.

- If you have more income, you move up a marginal tax bracket. The next $36,550 in additional taxable income will be taxed at the 12% rate. It is important to note that not all of your income is taxed at the marginal rate, just the income in this bracket these amounts.

- The next $48,900 is taxed at 22% and so on until you have income over $500,000 and are in the 37% marginal tax rate . . . In the default case, you only have $3,775 instead of $48,900 so this portion is taxed at 22%.

- Thus, different parts of your income are taxed at different rates. If you have additional income that puts you into a higher tax bracket, that only affects the added income. This is the approach you would use to calculate an average or effective rate (which is shown in the summary table).

- Capital gains income complicates things slightly as it is taxed after regular income. Thus any amount of capital gains taxes you make are taxed at a rate that corresponds to starting after you regular income. If you made $100,000 in regular income, and only $100 in capital gains income, that $100 dollars would be taxed at the 15% rate and not at the 0% rate, because the $100,000 in regular income pushes you into the 2nd marginal tax bracket for capital gains (between $48,350 and $533,400).

- if the 0% capital gains rate threshold is at $48,350, then any regular income you have will take away from this 0% bracket size. If you have $48,000 in regular taxable income after your deduction, then you will be left with only $350 in 0% capital gains bracket space and the remainder of your capital gains will be taxed in the next bracket, 15%.

Tax Brackets By Year

This table lets you choose to view the thresholds for each income and capital gains tax bracket for the last few years. You can see that tax rates are much lower for capital gains in the table below than for regular income.

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript, CSS and HTML. The sankey graph was made using code modified from the Sankeymatic plotting website and the mekko graph was made using the Plotly javascript open source library.

Visual Guide to Understanding Marginal Tax Rates

What is a marginal tax rate?

There is a fair amount of confusion about what a marginal tax rate is and how it affects how much tax you would owe the government on a certain amount of income. These graphs are here to help you better understand the difference between a marginal and average tax rate and to easily calculate these rates for specific examples in the US context. This tool only looks at US Federal Income taxes and ignores state, local and Social Security/Medicare taxes.

Marginal tax rates are the rate at which an additional dollar of income will be taxed at. There are different tax brackets (each with its own marginal rate) depending on which dollar of income you are looking at. This is very different from the Average (or effective) tax rate that is the result of applying these marginal tax rates across all of your income.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Instructions for using the visual tax calculator:

- Select filing status: Single, Married Filing Jointly or Head of Household. For more info on these filing categories see the IRS website

- Select percentage of regular income vs capital gains income. Regular income is wage or employment income and is taxed at a higher rate than capital gains income. Capital gains income is typically investment income from the sale of stocks or dividends and taxed at a lower rate than regular income.

- Move your cursor or click on the graph to select a specific income Make sure you note that the x-axis is a logarithmic-scale, meaning that income grows exponentially as you move to the right.

- Choose your graph preference One graph (Individual Tax Brackets) shows the individual tax brackets and how much of your income is taxed at the different marginal rates. The other graph (Aggregate Rates) shows the net result of applying the different rates to get your effective rate.

Here are two tables that lists the marginal tax brackets in the United States in 2019 that form the basis of the calculations in the calculator. 2018’s numbers are pretty similar.

| Rate | Single Taxable Income Over |

Married Filing Joint Taxable Income Over |

Heads of Households Taxable Income Over |

|---|---|---|---|

| 10% | $0 | $0 | $0 |

| 12% | $9,700 | $19,400 | $13,850 |

| 22% | $39,475 | $78,950 | $52,850 |

| 24% | $84,200 | $168,400 | $84,200 |

| 32% | $160,725 | $321,450 | $160,700 |

| 35% | $204,100 | $408,200 | $204,100 |

| 37% | $510,300 | $612,350 | $510,300 |

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

| Single Capital Gains Over |

Married Filing Jointly Capital Gains Over |

Heads of Households Capital Gains Over |

|

|---|---|---|---|

| 0% | $0 | $0 | $0 |

| 15% | $39,375 | $78,750 | $52,750 |

| 20% | $434,550 | $488,850 | $461,700 |

For those not visually inclined, here is a written description of how to apply marginal tax rates. The first thing to note is that the income shown here in the graphs is taxable income, which simply speaking is your gross income with deductions removed. The standard deduction for 2019 range from $12,200 for Single filers to $24,400 for Married filers.

- If you are single, all of your regular taxable income between 0 and $9,700 is taxed at a 10% rate. This means that your all of your gross income below $12,200 is not taxed and your gross income between $12,200 and $21,900 is taxed at 10%.

- If you have more income, you move up a marginal tax bracket. Any taxable income in excess of $9,700 but below $39,475 will be taxed at the 12% rate. It is important to note that not all of your income is taxed at the marginal rate, just the income between these amounts.

- Income between $39,475 and $84,200 is taxed at 24% and so on until you have income over $510,300 and are in the 37% marginal tax rate . . .

- Thus, different parts of your income are taxed at different rates and you can calculate an average or effective rate (which is shown in the aggregate rates graph).

- Capital gains income complicates things slightly as it is taxed after regular income. Thus any amount of capital gains taxes you make are taxed at a rate that corresponds to starting after you regular income. If you made $100,000 in regular income, and only $100 in capital gains income, that $100 dollars would be taxed at the 15% rate and not at the 0% rate, because the $100,000 in regular income pushes you into the 2nd marginal tax bracket for capital gains (between $39,375 and $434,550).

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript and plotted using the plot.ly open source javascript plotting library.

Recent Comments