Posts for Tag: graph

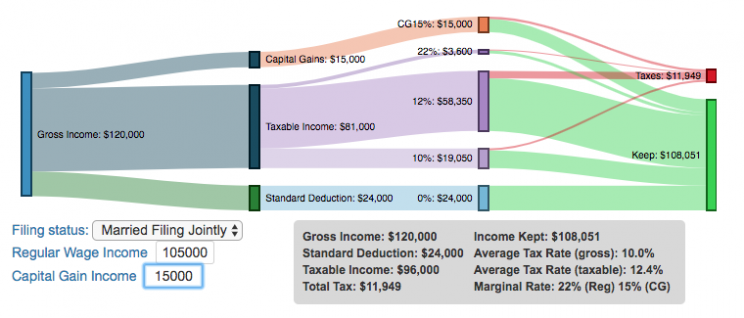

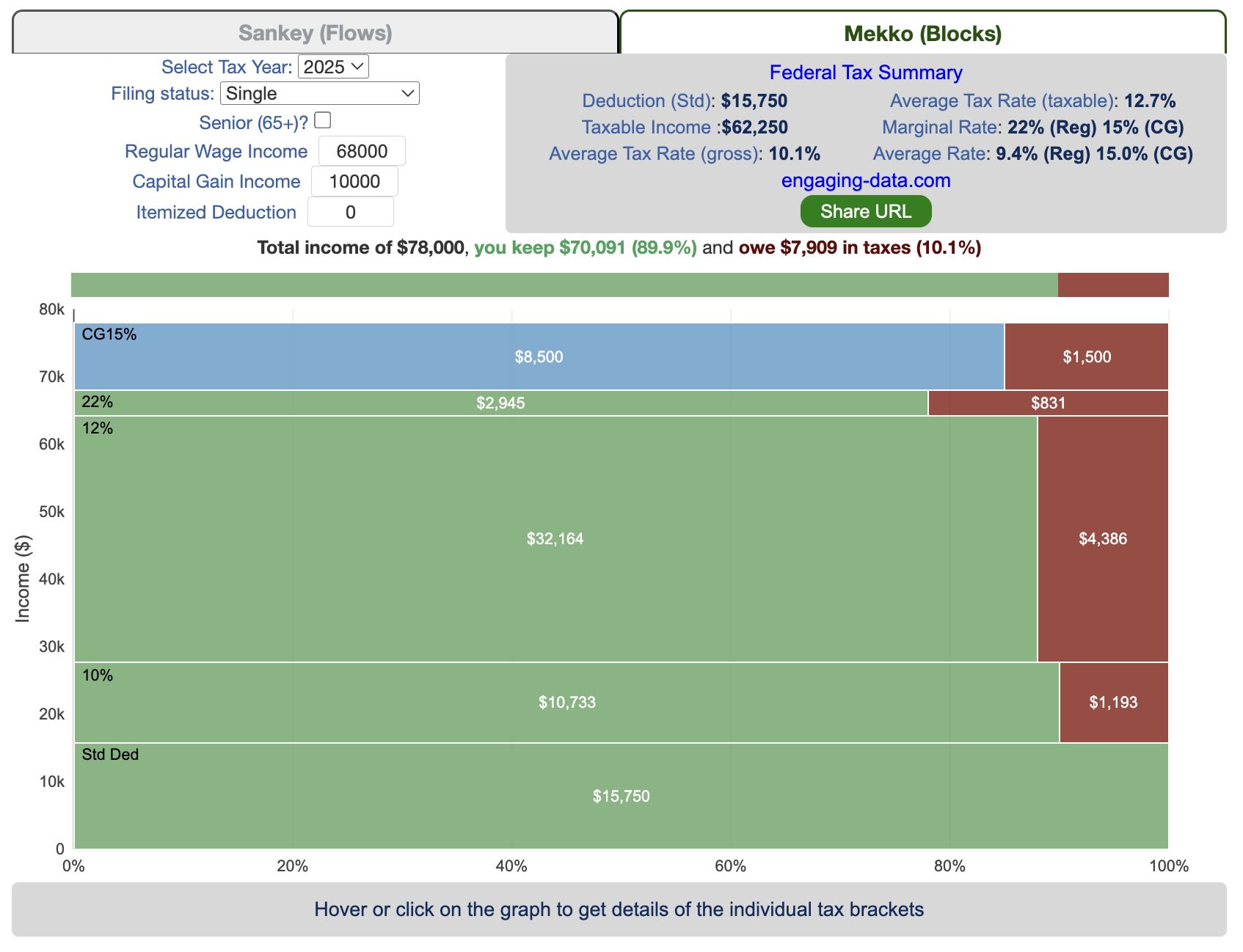

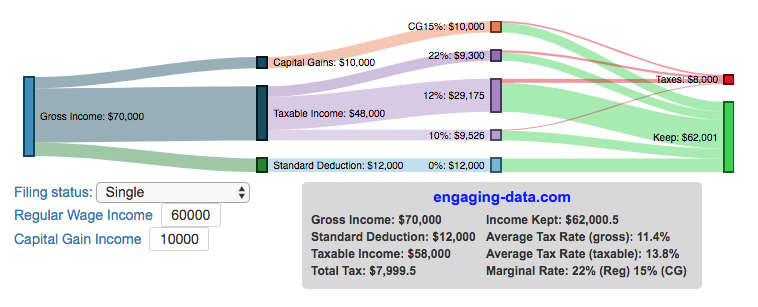

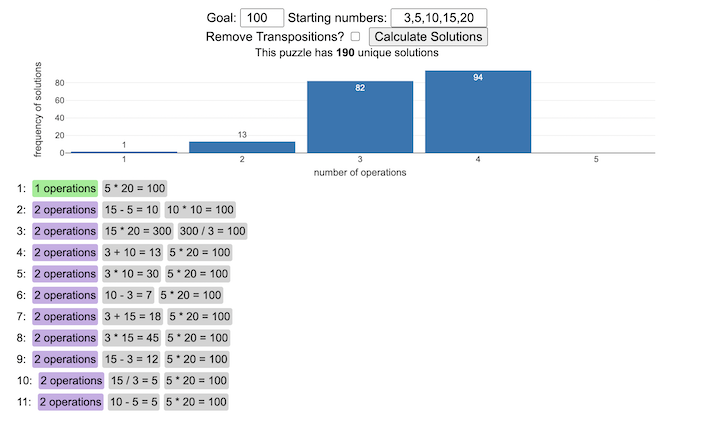

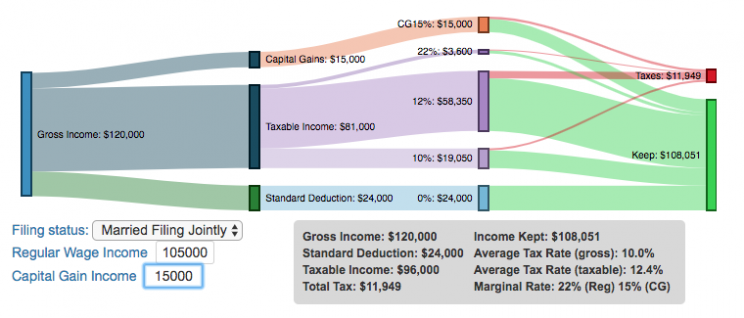

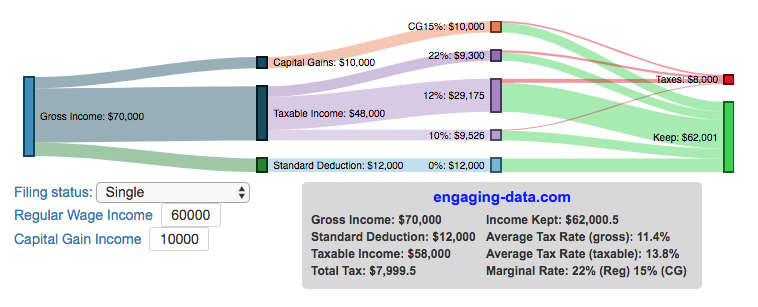

Understanding Tax Brackets: Interactive Income Tax Visualization and Calculator

Please check out the newer version of this visualization

How is your income distributed across tax brackets?

I previously made a graphical visualization of income and marginal tax rates to show how tax brackets work. That graph tried to show alot of info on the same graph, i.e. the breakdown of income tax brackets for incomes ranging from $10,000 to $3,000,000. It was nice looking, but I think several people were confused about how to read the graph. This Sankey graph is a more detailed look at the tax breakdown for one specific income. You can enter your (or any other) profile and see how taxes are distributed across the different brackets. It can help (as the other tried) to better understand marginal and average tax rates. This tool only looks at US Federal Income taxes and ignores state, local and Social Security/Medicare taxes.

– Use this button to generate a URL that you can share a specific set of inputs and graphs. Just copy the URL in the address bar at the top of your browser (after pressing the button).

Instructions for using the visual tax calculator:

- Select filing status: Single, Married Filing Jointly or Head of Household. For more info on these filing categories see the IRS website

- Enter your regular income and capital gains income. Regular income is wage or employment income and is taxed at a higher rate than capital gains income. Capital gains income is typically investment income from the sale of stocks or dividends and taxed at a lower rate than regular income.

- Move your cursor or click on the Sankey graph to select a specific link. This will give you more information about how income in a specific tax bracket is being taxed.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

As seen with the marginal rates graph, there is a big difference in how regular income and capital gains are taxed. Capital gains are taxed at a lower rate and generally have larger bracket sizes. Generally, wealthier households earn a greater fraction of their income from capital gains and as a result of the lower tax rates on capital gains, these household pay a lower effective tax rate than those making an order of magnitude less in overall income.

Tax Brackets By Year

This table lets you choose to view the thresholds for each income and capital gains tax bracket for the last few years. You can see that tax rates are much lower for capital gains in the table below than for regular income.

For those not visually inclined, here is a written description of how to apply marginal tax rates. The first thing to note is that the income shown here in the graphs is taxable income, which simply speaking is your gross income with deductions removed. The standard deduction for 2018 range from $12,000 for Single filers to $24,000 for Married filers.

- If you are single, all of your regular taxable income between 0 and $9,525 is taxed at a 10% rate. This means that your all of your gross income below $12,000 is not taxed and your gross income between $12,000 and $21,525 is taxed at 10%.

- If you have more income, you move up a marginal tax bracket. Any taxable income in excess of $9,525 but below $38,700 will be taxed at the 12% rate. It is important to note that not all of your income is taxed at the marginal rate, just the income between these amounts.

- Income between $38,700 and $82,500 is taxed at 24% and so on until you have income over $500,000 and are in the 37% marginal tax rate . . .

- Thus, different parts of your income are taxed at different rates and you can calculate an average or effective rate (which is shown in the summary table).

- Capital gains income complicates things slightly as it is taxed after regular income. Thus any amount of capital gains taxes you make are taxed at a rate that corresponds to starting after you regular income. If you made $100,000 in regular income, and only $100 in capital gains income, that $100 dollars would be taxed at the 15% rate and not at the 0% rate, because the $100,000 in regular income pushes you into the 2nd marginal tax bracket for capital gains (between $38,700 and $426,700).

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript and code modified from the Sankeymatic plotting website.

California is World’s 4th Largest Economy

This is one of an ongoing series of visualizations about the state of California. This one is about the state’s economy, which recently moved into 4th place (2024), if California were its own country. It is, however, still part of the United States.

The visualization shows the relative sizes of the top 10 world economies (including the US, with California removed for context). California has the smallest population of any of the top 10, with #9 Canada just barely larger than California in population, though with a significantly smaller sized economy (about 1/2 the size).

Hover over the countries to see their GDP and population. California is behind the United States, China and Germany in total economic output (in nominal terms), but ahead of much larger countries Japan and India and the United Kingdom.

The state’s economy produces $4.1 Trillion dollars of economic output, driven by a range of industries including technology, real estate, manufacturing, agriculture and health care. It is a hub for innovation and entrepreneurship. California is also the leading agricultural state in the United States. Immigration is a huge part of the state’s workforce.

Sources and Tools:

2024 economic data was downloaded from the International Monetary Fund (IMF). This visualization is made using d3.js, an open-source javascript visualization library.

University of California Admission Rates by Major

Which majors are most competitive across the University of California system?

The University of California consists of nine campuses with undergraduate programs and they are all ranked among the best universities in the US (according to US News). All nine rank within the top 45 public schools including #1 and #2 and top 85 national universities in the US.

This data visualization focuses on the acceptance rates for students based on their indicated preferred majors in their application to the various University of California campuses in the Fall of 2023 admissions cycle. When you apply to a given university campus, you need to specify a major and this choice can affect the student’s chances of getting accepted, especially if the major is very sought after. Subjects like computer science are very popular and as a result, the data shows that most campuses have a lower acceptance rate for computer science as compared to the university as a whole.

Data visualization

The graph shown in the data visualization is a marimekko graph which shows a percentage based bar graph showing the acceptance rate (in blue) for a given major at a given university. The height of each horizontal bar is proportional to the number of applicants to that major, so taller bars have more applicants vs bars that are shorter. If you hover over (or click on mobile) a bar, it provides more information about the acceptance rate, enrollment rate (i.e. yield rate) and the GPA of accepted students. You can choose to sort the graph by subject name, admit rate or number of applicants.

The data visualization can help you explore different campuses and major categories. If you are viewing “School View“, you can see how the various disciplines compare for a single university at one time. Whereas if you view “Subject View” you can see the comparison of a single discipline across the University campuses that offer those majors.

The University of California has over 240,000 undergraduate students and extends about 140,000 acceptances to fill out 42,000 slots for first year students. There is a significant amount of overlap as most students applying for admission apply to several campuses, and many students get accepted to multiple campuses.

The broad disciplines used in the visualization are composed of a number of individual majors and these are detailed in the table below.

GPA calculation

The University of California only considers grades from 10th grade and 11th grade for admissions decisions, and uses a weighted system where honors and AP classes are given an extra point in GPA calculations above the normal A=4, B=3, C=2, etc. . GPA calculation. So for an honors math class, for example, an A would be worth 5 points.

Sources and Tools:

Data comes directly from the University of California website for the fall of 2023, which has quite a bit of interesting data about students and admissions. I downloaded the data and processed it with python to organize it. The webtool is made using javascript, HTML and CSS and graphed using the open-source plotly graphing library.

Table of Disciplines to majors

This table lists the specific areas and majors that make up the broad disciplines shown in the data visualization.

Broad discipline

CIP Family Title

CIP Subfamily Title

Architecture

ARCHITECTURE AND RELATED SERVICES

Architecture.

Architecture

ARCHITECTURE AND RELATED SERVICES

City/Urban, Community, and Regional Planning.

Architecture

ARCHITECTURE AND RELATED SERVICES

Environmental Design.

Architecture

ARCHITECTURE AND RELATED SERVICES

Landscape Architecture.

Architecture

ARCHITECTURE AND RELATED SERVICES

Real Estate Development.

Arts & Humanities

FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS

Linguistic, Comparative, and Related Language Studies and Services.

Arts & Humanities

FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS

African Languages, Literatures, and Linguistics.

Arts & Humanities

FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS

East Asian Languages, Literatures, and Linguistics.

Arts & Humanities

FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS

Slavic, Baltic and Albanian Languages, Literatures, and Linguistics.

Arts & Humanities

FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS

Germanic Languages, Literatures, and Linguistics.

Arts & Humanities

FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS

Romance Languages, Literatures, and Linguistics.

Arts & Humanities

FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS

Middle/Near Eastern and Semitic Languages, Literatures, and Linguistics.

Arts & Humanities

FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS

Classics and Classical Languages, Literatures, and Linguistics.

Arts & Humanities

FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS

Celtic Languages, Literatures, and Linguistics.

Arts & Humanities

FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS

Foreign Languages, Literatures, and Linguistics, Other.

Arts & Humanities

ENGLISH LANGUAGE AND LITERATURE/LETTERS

English Language and Literature, General.

Arts & Humanities

ENGLISH LANGUAGE AND LITERATURE/LETTERS

Rhetoric and Composition/Writing Studies.

Arts & Humanities

ENGLISH LANGUAGE AND LITERATURE/LETTERS

Literature.

Arts & Humanities

ENGLISH LANGUAGE AND LITERATURE/LETTERS

English Language and Literature/Letters, Other.

Arts & Humanities

LIBERAL ARTS AND SCIENCES, GENERAL STUDIES AND HUMANITIES

Liberal Arts and Sciences, General Studies and Humanities.

Arts & Humanities

PHILOSOPHY AND RELIGIOUS STUDIES

Philosophy.

Arts & Humanities

PHILOSOPHY AND RELIGIOUS STUDIES

Religion/Religious Studies.

Arts & Humanities

VISUAL AND PERFORMING ARTS

Visual and Performing Arts, General.

Arts & Humanities

VISUAL AND PERFORMING ARTS

Dance.

Arts & Humanities

VISUAL AND PERFORMING ARTS

Design and Applied Arts.

Arts & Humanities

VISUAL AND PERFORMING ARTS

Drama/Theatre Arts and Stagecraft.

Arts & Humanities

VISUAL AND PERFORMING ARTS

Film/Video and Photographic Arts.

Arts & Humanities

VISUAL AND PERFORMING ARTS

Fine and Studio Arts.

Arts & Humanities

VISUAL AND PERFORMING ARTS

Music.

Arts & Humanities

VISUAL AND PERFORMING ARTS

Arts, Entertainment, and Media Management.

Arts & Humanities

VISUAL AND PERFORMING ARTS

Visual and Performing Arts, Other.

Arts & Humanities

HISTORY

History.

Broad discipline

CIP Family Title

CIP Subfamily Title

Business

BUSINESS, MANAGEMENT, MARKETING, AND RELATED SUPPORT SERVICES

Business Administration, Management and Operations.

Business

BUSINESS, MANAGEMENT, MARKETING, AND RELATED SUPPORT SERVICES

Business/Managerial Economics.

Business

BUSINESS, MANAGEMENT, MARKETING, AND RELATED SUPPORT SERVICES

Human Resources Management and Services.

Business

BUSINESS, MANAGEMENT, MARKETING, AND RELATED SUPPORT SERVICES

Management Information Systems and Services.

Business

BUSINESS, MANAGEMENT, MARKETING, AND RELATED SUPPORT SERVICES

Management Sciences and Quantitative Methods.

Computer Science

COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES

Computer and Information Sciences, General.

Computer Science

COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES

Computer Programming.

Computer Science

COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES

Information Science/Studies.

Computer Science

COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES

Computer Science.

Computer Science

COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES

Computer Software and Media Applications.

Computer Science

COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES

Computer/Information Technology Administration and Management.

Education

EDUCATION

Education, General.

Education

EDUCATION

Social and Philosophical Foundations of Education.

Education

EDUCATION

Special Education and Teaching.

Education

EDUCATION

Teacher Education and Professional Development, Specific Subject Areas.

Engineering

ENGINEERING

Engineering, General.

Engineering

ENGINEERING

Aerospace, Aeronautical, and Astronautical/Space Engineering.

Engineering

ENGINEERING

Agricultural Engineering.

Engineering

ENGINEERING

Biomedical/Medical Engineering.

Engineering

ENGINEERING

Chemical Engineering.

Engineering

ENGINEERING

Civil Engineering.

Engineering

ENGINEERING

Computer Engineering.

Engineering

ENGINEERING

Electrical, Electronics, and Communications Engineering.

Engineering

ENGINEERING

Engineering Physics.

Engineering

ENGINEERING

Engineering Science.

Engineering

ENGINEERING

Environmental/Environmental Health Engineering.

Engineering

ENGINEERING

Materials Engineering.

Engineering

ENGINEERING

Mechanical Engineering.

Engineering

ENGINEERING

Nuclear Engineering.

Engineering

ENGINEERING

Operations Research.

Engineering

ENGINEERING

Geological/Geophysical Engineering.

Engineering

ENGINEERING

Mechatronics, Robotics, and Automation Engineering.

Engineering

ENGINEERING

Biochemical Engineering.

Engineering

ENGINEERING

Biological/Biosystems Engineering.

Engineering

ENGINEERING

Engineering, Other.

Life Sciences

AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS

Animal Sciences.

Life Sciences

AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS

Food Science and Technology.

Life Sciences

AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS

Plant Sciences.

Life Sciences

NATURAL RESOURCES AND CONSERVATION

Natural Resources Conservation and Research.

Life Sciences

NATURAL RESOURCES AND CONSERVATION

Forestry.

Life Sciences

NATURAL RESOURCES AND CONSERVATION

Wildlife and Wildlands Science and Management.

Life Sciences

NATURAL RESOURCES AND CONSERVATION

Natural Resources and Conservation, Other.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Biology, General.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Biochemistry, Biophysics and Molecular Biology.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Botany/Plant Biology.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Cell/Cellular Biology and Anatomical Sciences.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Microbiological Sciences and Immunology.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Zoology/Animal Biology.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Genetics.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Physiology, Pathology and Related Sciences.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Pharmacology and Toxicology.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Biomathematics, Bioinformatics, and Computational Biology.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Biotechnology.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Ecology, Evolution, Systematics, and Population Biology.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Neurobiology and Neurosciences.

Life Sciences

BIOLOGICAL AND BIOMEDICAL SCIENCES

Biological and Biomedical Sciences, Other.

Broad discipline

CIP Family Title

CIP Subfamily Title

Nursing

HEALTH PROFESSIONS AND RELATED PROGRAMS

Registered Nursing, Nursing Administration, Nursing Research and Clinical

Other Health Science

HEALTH PROFESSIONS AND RELATED PROGRAMS

Pharmacy, Pharmaceutical Sciences, and Administration.

Other Health Science

HEALTH PROFESSIONS AND RELATED PROGRAMS

Public Health.

Other/ Interdisciplinary

AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS

Agricultural Business and Management.

Other/ Interdisciplinary

AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS

Agricultural Production Operations.

Other/ Interdisciplinary

AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS

International Agriculture.

Other/ Interdisciplinary

COMMUNICATION, JOURNALISM, AND RELATED PROGRAMS

Communication and Media Studies.

Other/ Interdisciplinary

COMMUNICATION, JOURNALISM, AND RELATED PROGRAMS

Journalism.

Other/ Interdisciplinary

LEGAL PROFESSIONS AND STUDIES

Non-Professional Legal Studies.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Peace Studies and Conflict Resolution.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Mathematics and Computer Science.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Medieval and Renaissance Studies.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Science, Technology and Society.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Nutrition Sciences.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

International/Globalization Studies.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Classical and Ancient Studies.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Cognitive Science.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Human Biology.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Marine Sciences.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Sustainability Studies.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Geography and Environmental Studies.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Data Science.

Other/ Interdisciplinary

MULTI/INTERDISCIPLINARY STUDIES

Multi/Interdisciplinary Studies, Other.

Pharmacy

HEALTH PROFESSIONS AND RELATED PROGRAMS

Pharmacy, Pharmaceutical Sciences, and Administration.

Physical Sciences/Math

MATHEMATICS AND STATISTICS

Mathematics.

Physical Sciences/Math

MATHEMATICS AND STATISTICS

Applied Mathematics.

Physical Sciences/Math

MATHEMATICS AND STATISTICS

Statistics.

Physical Sciences/Math

PHYSICAL SCIENCES

Astronomy and Astrophysics.

Physical Sciences/Math

PHYSICAL SCIENCES

Atmospheric Sciences and Meteorology.

Physical Sciences/Math

PHYSICAL SCIENCES

Chemistry.

Physical Sciences/Math

PHYSICAL SCIENCES

Geological and Earth Sciences/Geosciences.

Physical Sciences/Math

PHYSICAL SCIENCES

Physics.

Physical Sciences/Math

PHYSICAL SCIENCES

Materials Sciences.

Physical Sciences/Math

PHYSICAL SCIENCES

Physical Sciences, Other.

Broad discipline

CIP Family Title

CIP Subfamily Title

Public Admin

PUBLIC ADMINISTRATION AND SOCIAL SERVICE PROFESSIONS

Community Organization and Advocacy.

Public Admin

PUBLIC ADMINISTRATION AND SOCIAL SERVICE PROFESSIONS

Public Administration.

Public Admin

PUBLIC ADMINISTRATION AND SOCIAL SERVICE PROFESSIONS

Public Policy Analysis.

Public Admin

PUBLIC ADMINISTRATION AND SOCIAL SERVICE PROFESSIONS

Social Work.

Public Admin

PUBLIC ADMINISTRATION AND SOCIAL SERVICE PROFESSIONS

Public Administration and Social Service Professions, Other.

Public Health

HEALTH PROFESSIONS AND RELATED PROGRAMS

Public Health.

Social Sciences

AGRICULTURAL/ANIMAL/ PLANT/VETERINARY SCIENCE AND RELATED FIELDS

Agricultural Business and Management.

Social Sciences

AREA, ETHNIC, CULTURAL, GENDER, AND GROUP STUDIES

Area Studies.

Social Sciences

AREA, ETHNIC, CULTURAL, GENDER, AND GROUP STUDIES

Ethnic, Cultural Minority, Gender, and Group Studies.

Social Sciences

AREA, ETHNIC, CULTURAL, GENDER, AND GROUP STUDIES

Area, Ethnic, Cultural, Gender, and Group Studies, Other.

Social Sciences

FAMILY AND CONSUMER SCIENCES/HUMAN SCIENCES

Human Development, Family Studies, and Related Services.

Social Sciences

FAMILY AND CONSUMER SCIENCES/HUMAN SCIENCES

Apparel and Textiles.

Social Sciences

PSYCHOLOGY

Psychology, General.

Social Sciences

PSYCHOLOGY

Research and Experimental Psychology.

Social Sciences

PSYCHOLOGY

Clinical, Counseling and Applied Psychology.

Social Sciences

PSYCHOLOGY

Psychology, Other.

Social Sciences

SOCIAL SCIENCES

Social Sciences, General.

Social Sciences

SOCIAL SCIENCES

Anthropology.

Social Sciences

SOCIAL SCIENCES

Archeology.

Social Sciences

SOCIAL SCIENCES

Criminology.

Social Sciences

SOCIAL SCIENCES

Economics.

Social Sciences

SOCIAL SCIENCES

Geography and Cartography.

Social Sciences

SOCIAL SCIENCES

International Relations and National Security Studies.

Social Sciences

SOCIAL SCIENCES

Political Science and Government.

Social Sciences

SOCIAL SCIENCES

Sociology.

Social Sciences

SOCIAL SCIENCES

Urban Studies/Affairs.

Social Sciences

SOCIAL SCIENCES

Social Sciences, Other.

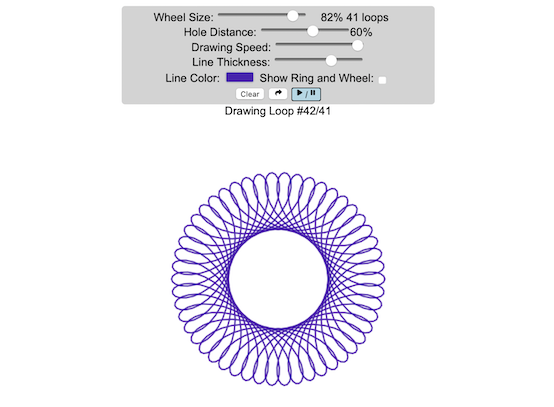

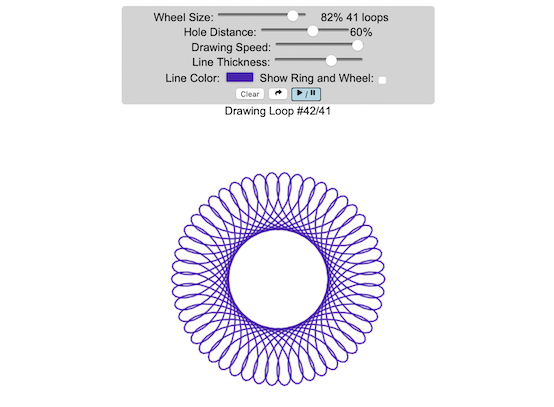

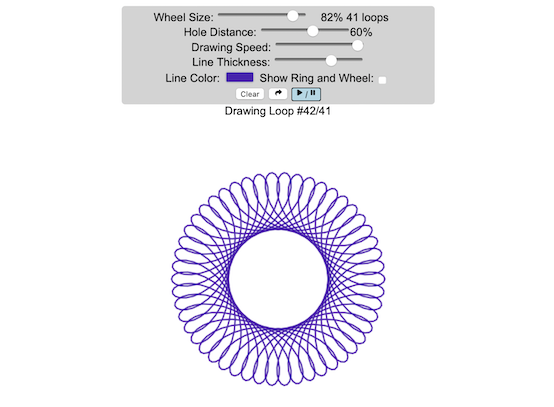

Interactive Spirograph

Play with an interactive spirograph and share your creations with your friends. Just play around with the controls at the top and see what interesting designs you can come up with.

Instructions

– Wheel Size controls the size of the wheel inside the ring

– Hole Distance controls the distance from the center of the wheel and the edge

– Drawing Speed controls the speed at which the spirograph is spins

– Line Thickness controls the thickness of the line on the drawing

– Line Color is a color picker letting you change the color of the lines

– Show Ring and Wheel lets you toggle whether the Ring and Wheel are showing

– Clear erases the design

– generates a custom URL and copies it to the clipboard so you can share this exact design with your friends.

– / allows you to start and stop the spirograph animation

Equations

The spirographs shown here are hypotrochoids, which is described as a curve generated by tracing a point attached to a circle that rolls around the interior of a larger circle. The equations for the curve are:

\begin{aligned}&x(\theta )=(R-r)\cos \theta +d\cos \left({R-r \over r}\theta \right)\\&y(\theta )=(R-r)\sin \theta -d\sin \left({R-r \over r}\theta \right)\end{aligned}

Sources and Tools

The equations for the spirograph hypotrochoids are from Wikipedia. The drawings and UI are made using canvas and HTML/Javascript and CSS.

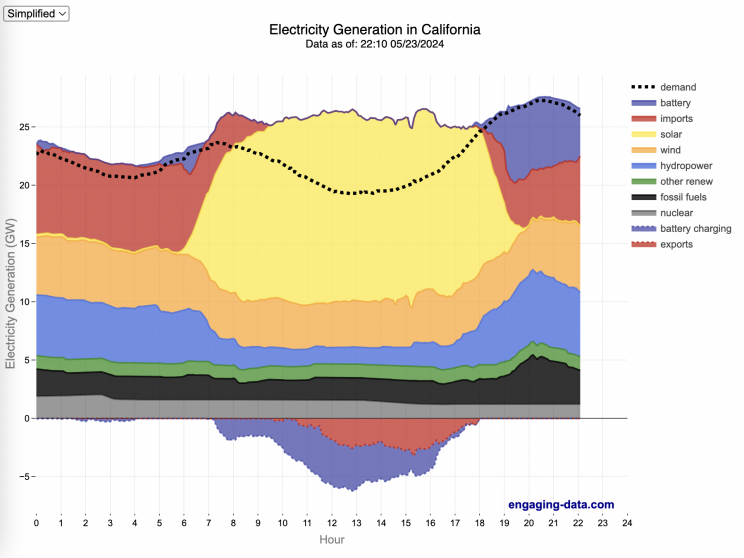

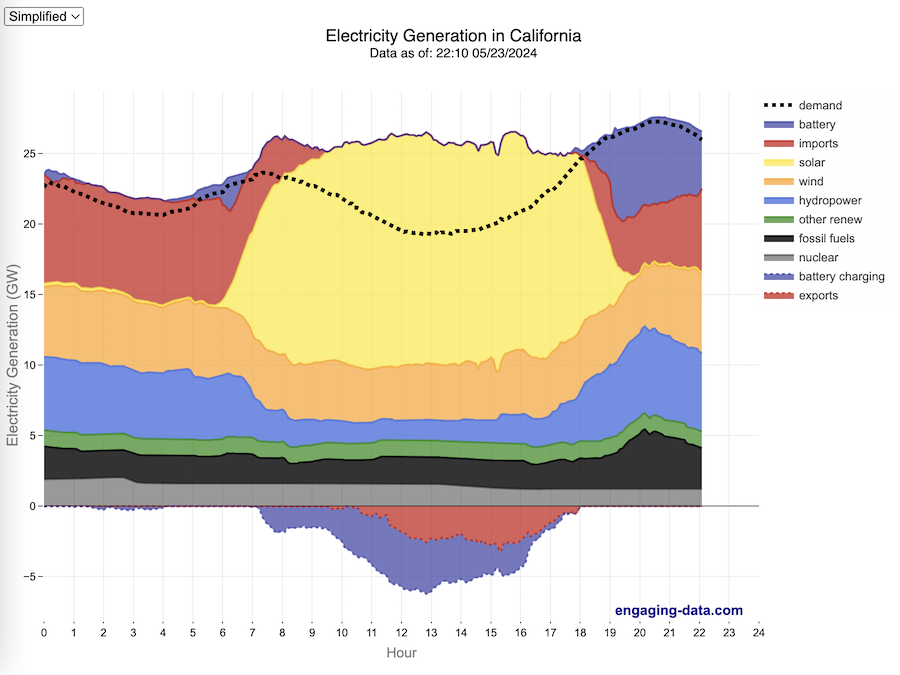

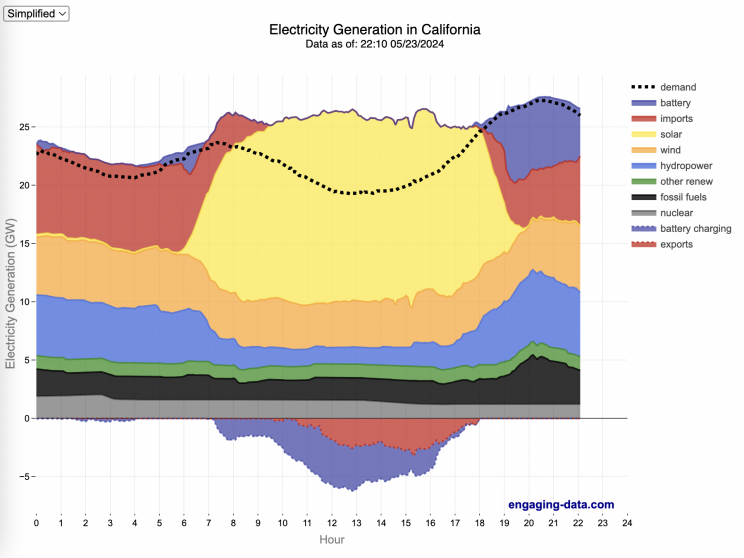

California Electricity Generation

What are the main sources of California’s electricity?

I added the option to view the graph for any day or monthly average from April 2018 to the present using the calendar picker and a daily generation summary

In the United States, electric power plant emissions account for about 25% of greenhouse gas emissions. However, California has been a leader in the transition to clean and renewable energy, driven by ambitious climate policies and a commitment to reducing greenhouse gas emissions. The state has set an electricity target for the state of 60% renewables by 2030 and 100% zero-carbon, clean electricity by 2045. To meet these targets, the state has been investing heavily into solar and wind energy sources. Solar is the largest proportion of California’s electricity grid and California now generates more solar energy than any other state.

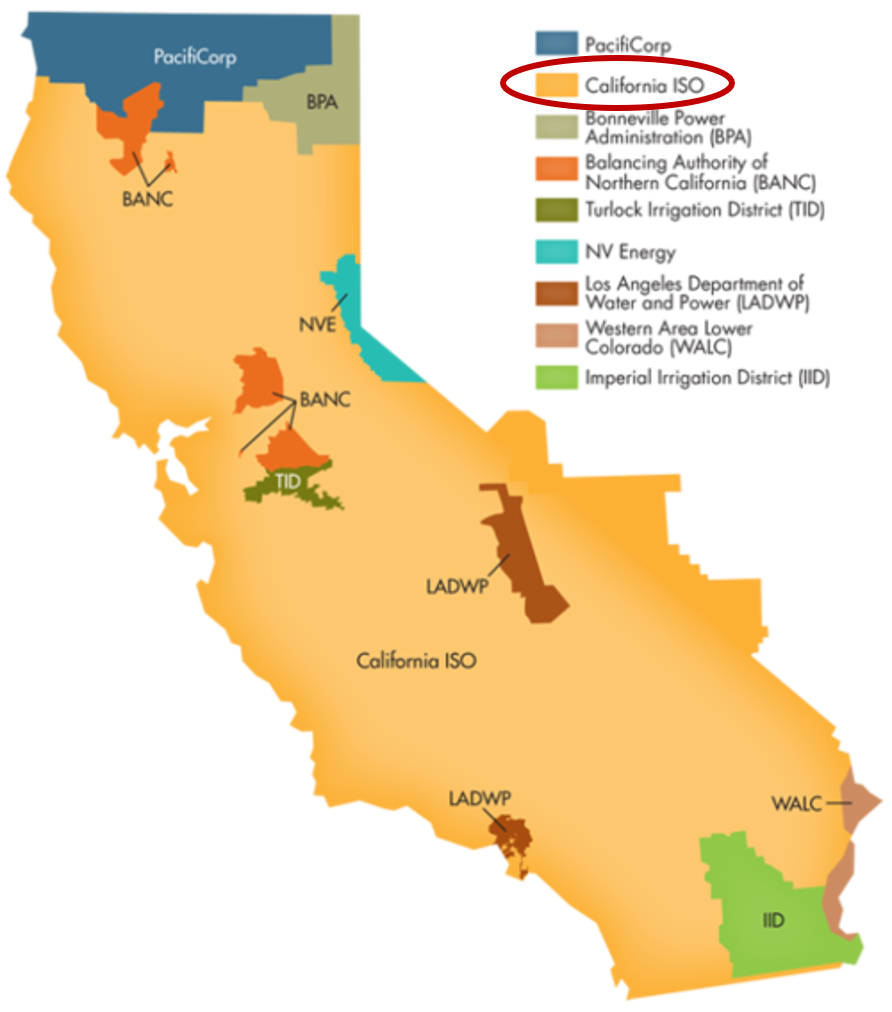

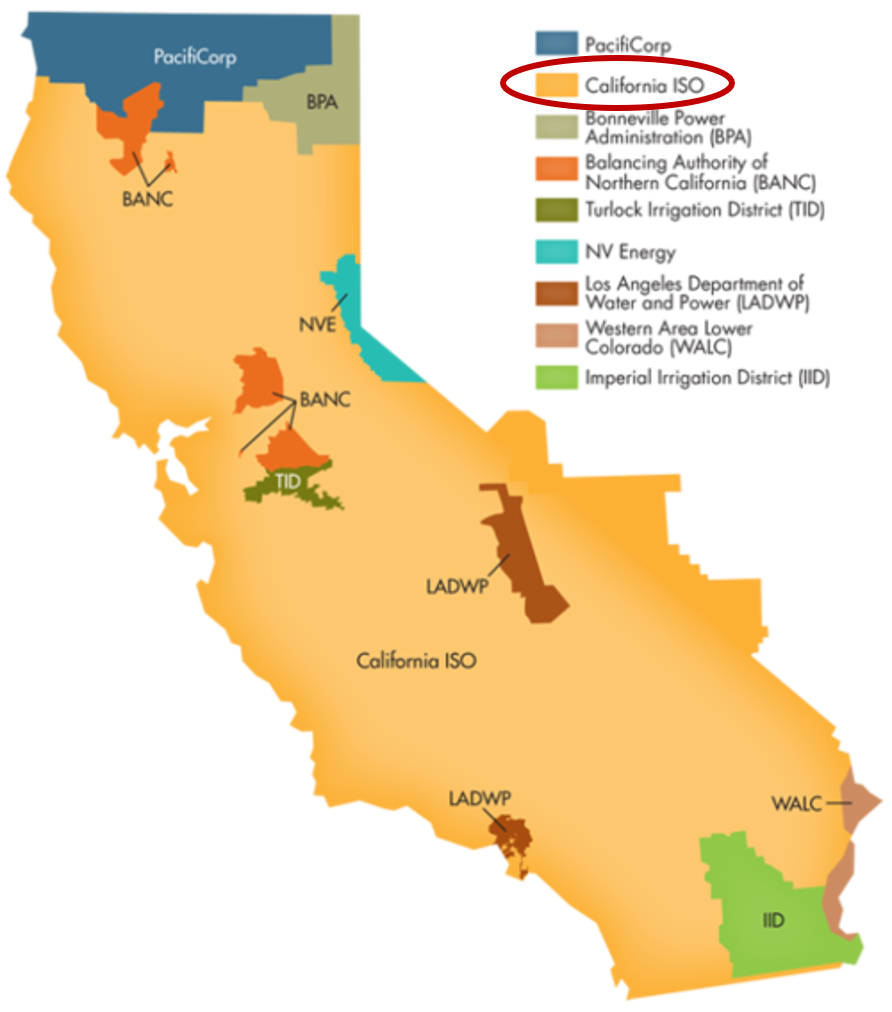

The California Independent System Operator manages the grid for around 32 million Californians or about 80% of the total demand in the state. Here is a map showing the service area and the other electricity districts in the state, the main exceptions include the city of LA and the Sacramento area.

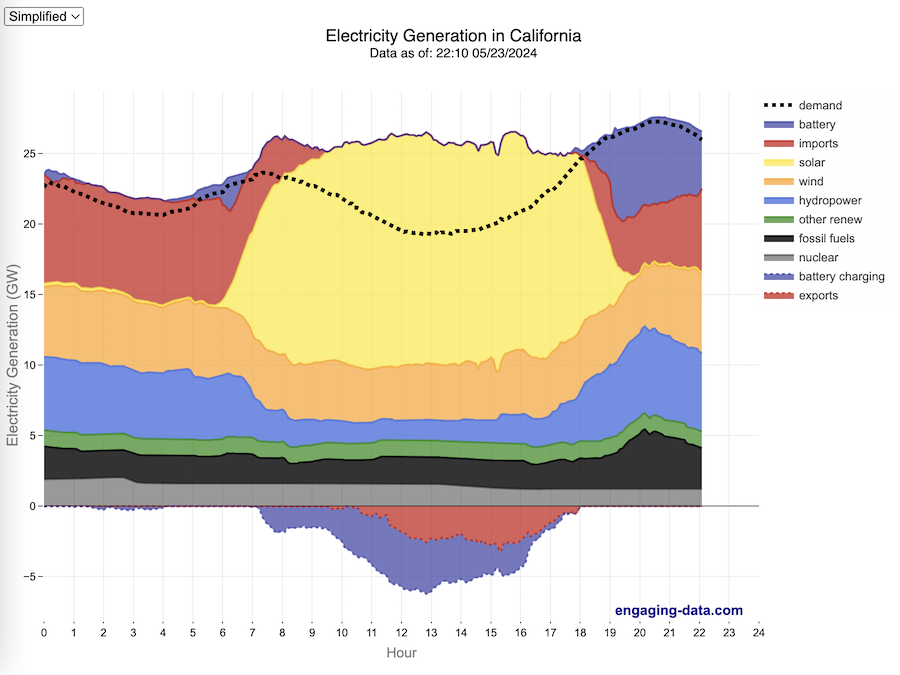

How to read the graph of California’s electricity

The graphs shown here allow us to visualize how electricity generation in the California Independent System Operator (CAISO) region varies over the course of the day. We can see how solar ramps up to be a huge contributor in the middle of the day. And overall, the vast majority of the generation in the state is one form of renewable electricity or another (e.g. solar, wind, hydro, geothermal, biomass and biogas). Add in a small contribution from zero-carbon nuclear energy and we can see that a large majority of power generation comes from zero-carbon sources. It also shows the total electricity demand, which should always be less than the total electricity supply in the state.

Because of the intermittent nature of some renewables, like wind and solar, there are times where the demand for electricity is not able to be met by these sources, and other options are needed to maintain supply demand balance on the state’s grid. To address this issue, the state relies on importing power from outside of the state as well as energy storage (primarily batteries) to meet electricity demand when renewable energy supply is low. If demand is much less than supply, then likely there will be power exported or some charging of batteries. And if demand is less than total generation in the state, power will be imported and/or batteries will be discharged to make up for the power shortfall.

On the graph, positive values from batteries and imports is when those sources are supplying power to the California grid. Negative values for batteries and exports are when there is excess power in the state and batteries are being charged up or power is being exported to neighboring states.

You can view the graph in two forms:

- Detailed – shows all of the power plant fuel types that is provided in the CAISO data: Solar, Wind, Nuclear, Coal, Other, Natural Gas, Large Hydropower, Small Hydropower, Geothermal, Biomass and Biogas. In addition, it shows aggregated net imports into the state from other regions as well as battery discharging or charging.

- Simplified – I aggregated the categories from CAISO into Solar, Wind, Nuclear, Fossil Fuel (including Coal, Other and Natural Gas), Hydro (Large and Small Hydropower), and Other Renewable (Geothermal, Biomass and Biogas). In addition, it shows aggregated net imports into the state from other regions as well as battery discharging or charging.

Also, I added the ability to see yesterday’s data as well. In the future, I will add the ability to see other dates as well.

Data Sources and Tools

Data for electricity sources for California grid comes from the California Independent System Operator (CAISO). This data from this site is downloaded and processed using a python script and updated every 5 minutes. The graph is made using the open source Plotly javascript graphing library.

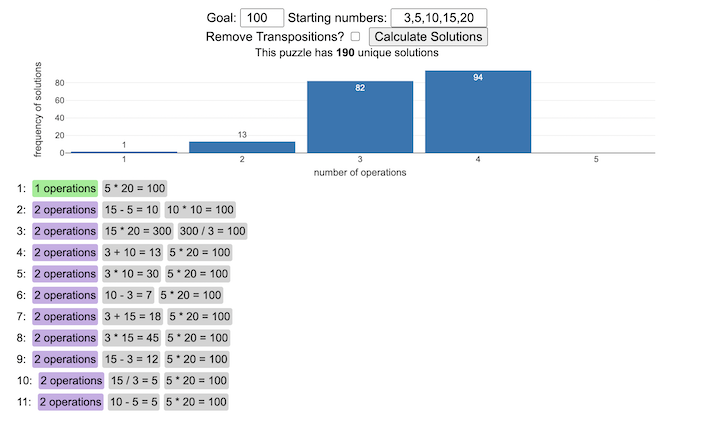

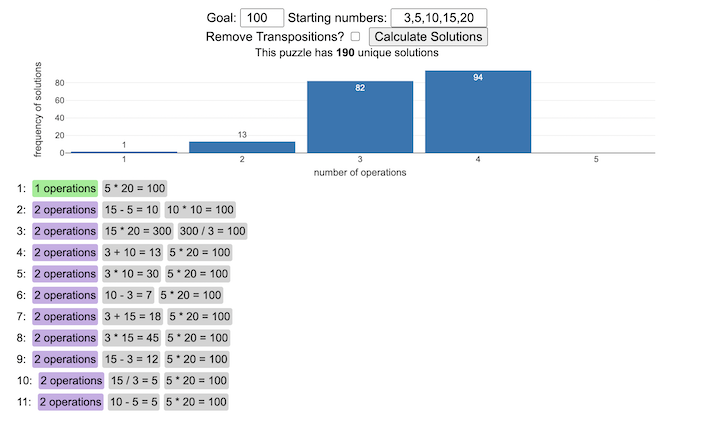

NYT Digits Solver

You can play new daily Digits puzzles

Calculate the solution to any digits puzzle

This tool lets you view all of the potential solutions to a Digits puzzle. Enter the goal number and the five starting numbers separated by a comma like “1,2,3,4,5” and hit the “Calculate Solutions” button to see all of the possible solutions to the puzzle. The list is likely quite long so you’ll probably need to scroll through all of the solutions in the list.

There is also a checkbox that lets you remove transpositions, which are operations that occur in different orders but the same set of operations are used to achieve the final number. For example, where the first two operations appear in reverse order and then are added together in the 3rd operation to hit the target.

e.g. these two solutions are an example of a transposition.

5 + 10 = 15 15 / 3 = 5 5 * 20 = 100

vs

15 / 3 = 5 5 + 10 = 15 5 * 20 = 100

Tools

A version of the solution code is written in Python code and is used to generate the puzzles. This code is re-written in javascript so it is solved inside the browser and the visuals are made with javascript, CSS and HTML and the graphs are made using the open source Plotly javascript graphing library.

Understanding Tax Brackets: Interactive Income Tax Visualization and Calculator

Please check out the newer version of this visualization

How is your income distributed across tax brackets?

I previously made a graphical visualization of income and marginal tax rates to show how tax brackets work. That graph tried to show alot of info on the same graph, i.e. the breakdown of income tax brackets for incomes ranging from $10,000 to $3,000,000. It was nice looking, but I think several people were confused about how to read the graph. This Sankey graph is a more detailed look at the tax breakdown for one specific income. You can enter your (or any other) profile and see how taxes are distributed across the different brackets. It can help (as the other tried) to better understand marginal and average tax rates. This tool only looks at US Federal Income taxes and ignores state, local and Social Security/Medicare taxes.

– Use this button to generate a URL that you can share a specific set of inputs and graphs. Just copy the URL in the address bar at the top of your browser (after pressing the button).

- Select filing status: Single, Married Filing Jointly or Head of Household. For more info on these filing categories see the IRS website

- Enter your regular income and capital gains income. Regular income is wage or employment income and is taxed at a higher rate than capital gains income. Capital gains income is typically investment income from the sale of stocks or dividends and taxed at a lower rate than regular income.

- Move your cursor or click on the Sankey graph to select a specific link. This will give you more information about how income in a specific tax bracket is being taxed.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

As seen with the marginal rates graph, there is a big difference in how regular income and capital gains are taxed. Capital gains are taxed at a lower rate and generally have larger bracket sizes. Generally, wealthier households earn a greater fraction of their income from capital gains and as a result of the lower tax rates on capital gains, these household pay a lower effective tax rate than those making an order of magnitude less in overall income.

Tax Brackets By Year

This table lets you choose to view the thresholds for each income and capital gains tax bracket for the last few years. You can see that tax rates are much lower for capital gains in the table below than for regular income.

- If you are single, all of your regular taxable income between 0 and $9,525 is taxed at a 10% rate. This means that your all of your gross income below $12,000 is not taxed and your gross income between $12,000 and $21,525 is taxed at 10%.

- If you have more income, you move up a marginal tax bracket. Any taxable income in excess of $9,525 but below $38,700 will be taxed at the 12% rate. It is important to note that not all of your income is taxed at the marginal rate, just the income between these amounts.

- Income between $38,700 and $82,500 is taxed at 24% and so on until you have income over $500,000 and are in the 37% marginal tax rate . . .

- Thus, different parts of your income are taxed at different rates and you can calculate an average or effective rate (which is shown in the summary table).

- Capital gains income complicates things slightly as it is taxed after regular income. Thus any amount of capital gains taxes you make are taxed at a rate that corresponds to starting after you regular income. If you made $100,000 in regular income, and only $100 in capital gains income, that $100 dollars would be taxed at the 15% rate and not at the 0% rate, because the $100,000 in regular income pushes you into the 2nd marginal tax bracket for capital gains (between $38,700 and $426,700).

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript and code modified from the Sankeymatic plotting website.

California is World’s 4th Largest Economy

This is one of an ongoing series of visualizations about the state of California. This one is about the state’s economy, which recently moved into 4th place (2024), if California were its own country. It is, however, still part of the United States.

The visualization shows the relative sizes of the top 10 world economies (including the US, with California removed for context). California has the smallest population of any of the top 10, with #9 Canada just barely larger than California in population, though with a significantly smaller sized economy (about 1/2 the size).

Hover over the countries to see their GDP and population. California is behind the United States, China and Germany in total economic output (in nominal terms), but ahead of much larger countries Japan and India and the United Kingdom.

The state’s economy produces $4.1 Trillion dollars of economic output, driven by a range of industries including technology, real estate, manufacturing, agriculture and health care. It is a hub for innovation and entrepreneurship. California is also the leading agricultural state in the United States. Immigration is a huge part of the state’s workforce.

Sources and Tools:

2024 economic data was downloaded from the International Monetary Fund (IMF). This visualization is made using d3.js, an open-source javascript visualization library.

University of California Admission Rates by Major

Which majors are most competitive across the University of California system?

The University of California consists of nine campuses with undergraduate programs and they are all ranked among the best universities in the US (according to US News). All nine rank within the top 45 public schools including #1 and #2 and top 85 national universities in the US.

This data visualization focuses on the acceptance rates for students based on their indicated preferred majors in their application to the various University of California campuses in the Fall of 2023 admissions cycle. When you apply to a given university campus, you need to specify a major and this choice can affect the student’s chances of getting accepted, especially if the major is very sought after. Subjects like computer science are very popular and as a result, the data shows that most campuses have a lower acceptance rate for computer science as compared to the university as a whole.

Data visualization

The graph shown in the data visualization is a marimekko graph which shows a percentage based bar graph showing the acceptance rate (in blue) for a given major at a given university. The height of each horizontal bar is proportional to the number of applicants to that major, so taller bars have more applicants vs bars that are shorter. If you hover over (or click on mobile) a bar, it provides more information about the acceptance rate, enrollment rate (i.e. yield rate) and the GPA of accepted students. You can choose to sort the graph by subject name, admit rate or number of applicants.

The data visualization can help you explore different campuses and major categories. If you are viewing “School View“, you can see how the various disciplines compare for a single university at one time. Whereas if you view “Subject View” you can see the comparison of a single discipline across the University campuses that offer those majors.

The University of California has over 240,000 undergraduate students and extends about 140,000 acceptances to fill out 42,000 slots for first year students. There is a significant amount of overlap as most students applying for admission apply to several campuses, and many students get accepted to multiple campuses.

The broad disciplines used in the visualization are composed of a number of individual majors and these are detailed in the table below.

GPA calculation

The University of California only considers grades from 10th grade and 11th grade for admissions decisions, and uses a weighted system where honors and AP classes are given an extra point in GPA calculations above the normal A=4, B=3, C=2, etc. . GPA calculation. So for an honors math class, for example, an A would be worth 5 points.

Sources and Tools:

Data comes directly from the University of California website for the fall of 2023, which has quite a bit of interesting data about students and admissions. I downloaded the data and processed it with python to organize it. The webtool is made using javascript, HTML and CSS and graphed using the open-source plotly graphing library.

Table of Disciplines to majors

This table lists the specific areas and majors that make up the broad disciplines shown in the data visualization.

| Broad discipline | CIP Family Title | CIP Subfamily Title |

|---|---|---|

| Architecture | ARCHITECTURE AND RELATED SERVICES | Architecture. |

| Architecture | ARCHITECTURE AND RELATED SERVICES | City/Urban, Community, and Regional Planning. |

| Architecture | ARCHITECTURE AND RELATED SERVICES | Environmental Design. |

| Architecture | ARCHITECTURE AND RELATED SERVICES | Landscape Architecture. |

| Architecture | ARCHITECTURE AND RELATED SERVICES | Real Estate Development. |

| Arts & Humanities | FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS | Linguistic, Comparative, and Related Language Studies and Services. |

| Arts & Humanities | FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS | African Languages, Literatures, and Linguistics. |

| Arts & Humanities | FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS | East Asian Languages, Literatures, and Linguistics. |

| Arts & Humanities | FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS | Slavic, Baltic and Albanian Languages, Literatures, and Linguistics. |

| Arts & Humanities | FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS | Germanic Languages, Literatures, and Linguistics. |

| Arts & Humanities | FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS | Romance Languages, Literatures, and Linguistics. |

| Arts & Humanities | FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS | Middle/Near Eastern and Semitic Languages, Literatures, and Linguistics. |

| Arts & Humanities | FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS | Classics and Classical Languages, Literatures, and Linguistics. |

| Arts & Humanities | FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS | Celtic Languages, Literatures, and Linguistics. |

| Arts & Humanities | FOREIGN LANGUAGES, LITERATURES, AND LINGUISTICS | Foreign Languages, Literatures, and Linguistics, Other. |

| Arts & Humanities | ENGLISH LANGUAGE AND LITERATURE/LETTERS | English Language and Literature, General. |

| Arts & Humanities | ENGLISH LANGUAGE AND LITERATURE/LETTERS | Rhetoric and Composition/Writing Studies. |

| Arts & Humanities | ENGLISH LANGUAGE AND LITERATURE/LETTERS | Literature. |

| Arts & Humanities | ENGLISH LANGUAGE AND LITERATURE/LETTERS | English Language and Literature/Letters, Other. |

| Arts & Humanities | LIBERAL ARTS AND SCIENCES, GENERAL STUDIES AND HUMANITIES | Liberal Arts and Sciences, General Studies and Humanities. |

| Arts & Humanities | PHILOSOPHY AND RELIGIOUS STUDIES | Philosophy. |

| Arts & Humanities | PHILOSOPHY AND RELIGIOUS STUDIES | Religion/Religious Studies. |

| Arts & Humanities | VISUAL AND PERFORMING ARTS | Visual and Performing Arts, General. |

| Arts & Humanities | VISUAL AND PERFORMING ARTS | Dance. |

| Arts & Humanities | VISUAL AND PERFORMING ARTS | Design and Applied Arts. |

| Arts & Humanities | VISUAL AND PERFORMING ARTS | Drama/Theatre Arts and Stagecraft. |

| Arts & Humanities | VISUAL AND PERFORMING ARTS | Film/Video and Photographic Arts. |

| Arts & Humanities | VISUAL AND PERFORMING ARTS | Fine and Studio Arts. |

| Arts & Humanities | VISUAL AND PERFORMING ARTS | Music. |

| Arts & Humanities | VISUAL AND PERFORMING ARTS | Arts, Entertainment, and Media Management. |

| Arts & Humanities | VISUAL AND PERFORMING ARTS | Visual and Performing Arts, Other. |

| Arts & Humanities | HISTORY | History. |

| Broad discipline | CIP Family Title | CIP Subfamily Title |

|---|---|---|

| Business | BUSINESS, MANAGEMENT, MARKETING, AND RELATED SUPPORT SERVICES | Business Administration, Management and Operations. |

| Business | BUSINESS, MANAGEMENT, MARKETING, AND RELATED SUPPORT SERVICES | Business/Managerial Economics. |

| Business | BUSINESS, MANAGEMENT, MARKETING, AND RELATED SUPPORT SERVICES | Human Resources Management and Services. |

| Business | BUSINESS, MANAGEMENT, MARKETING, AND RELATED SUPPORT SERVICES | Management Information Systems and Services. |

| Business | BUSINESS, MANAGEMENT, MARKETING, AND RELATED SUPPORT SERVICES | Management Sciences and Quantitative Methods. |

| Computer Science | COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES | Computer and Information Sciences, General. |

| Computer Science | COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES | Computer Programming. |

| Computer Science | COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES | Information Science/Studies. |

| Computer Science | COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES | Computer Science. |

| Computer Science | COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES | Computer Software and Media Applications. |

| Computer Science | COMPUTER AND INFORMATION SCIENCES AND SUPPORT SERVICES | Computer/Information Technology Administration and Management. |

| Education | EDUCATION | Education, General. |

| Education | EDUCATION | Social and Philosophical Foundations of Education. |

| Education | EDUCATION | Special Education and Teaching. |

| Education | EDUCATION | Teacher Education and Professional Development, Specific Subject Areas. |

| Engineering | ENGINEERING | Engineering, General. |

| Engineering | ENGINEERING | Aerospace, Aeronautical, and Astronautical/Space Engineering. |

| Engineering | ENGINEERING | Agricultural Engineering. |

| Engineering | ENGINEERING | Biomedical/Medical Engineering. |

| Engineering | ENGINEERING | Chemical Engineering. |

| Engineering | ENGINEERING | Civil Engineering. |

| Engineering | ENGINEERING | Computer Engineering. |

| Engineering | ENGINEERING | Electrical, Electronics, and Communications Engineering. |

| Engineering | ENGINEERING | Engineering Physics. |

| Engineering | ENGINEERING | Engineering Science. |

| Engineering | ENGINEERING | Environmental/Environmental Health Engineering. |

| Engineering | ENGINEERING | Materials Engineering. |

| Engineering | ENGINEERING | Mechanical Engineering. |

| Engineering | ENGINEERING | Nuclear Engineering. |

| Engineering | ENGINEERING | Operations Research. |

| Engineering | ENGINEERING | Geological/Geophysical Engineering. |

| Engineering | ENGINEERING | Mechatronics, Robotics, and Automation Engineering. |

| Engineering | ENGINEERING | Biochemical Engineering. |

| Engineering | ENGINEERING | Biological/Biosystems Engineering. |

| Engineering | ENGINEERING | Engineering, Other. |

| Life Sciences | AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS | Animal Sciences. |

| Life Sciences | AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS | Food Science and Technology. |

| Life Sciences | AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS | Plant Sciences. |

| Life Sciences | NATURAL RESOURCES AND CONSERVATION | Natural Resources Conservation and Research. |

| Life Sciences | NATURAL RESOURCES AND CONSERVATION | Forestry. |

| Life Sciences | NATURAL RESOURCES AND CONSERVATION | Wildlife and Wildlands Science and Management. |

| Life Sciences | NATURAL RESOURCES AND CONSERVATION | Natural Resources and Conservation, Other. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Biology, General. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Biochemistry, Biophysics and Molecular Biology. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Botany/Plant Biology. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Cell/Cellular Biology and Anatomical Sciences. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Microbiological Sciences and Immunology. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Zoology/Animal Biology. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Genetics. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Physiology, Pathology and Related Sciences. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Pharmacology and Toxicology. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Biomathematics, Bioinformatics, and Computational Biology. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Biotechnology. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Ecology, Evolution, Systematics, and Population Biology. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Neurobiology and Neurosciences. |

| Life Sciences | BIOLOGICAL AND BIOMEDICAL SCIENCES | Biological and Biomedical Sciences, Other. |

| Broad discipline | CIP Family Title | CIP Subfamily Title |

|---|---|---|

| Nursing | HEALTH PROFESSIONS AND RELATED PROGRAMS | Registered Nursing, Nursing Administration, Nursing Research and Clinical |

| Other Health Science | HEALTH PROFESSIONS AND RELATED PROGRAMS | Pharmacy, Pharmaceutical Sciences, and Administration. |

| Other Health Science | HEALTH PROFESSIONS AND RELATED PROGRAMS | Public Health. |

| Other/ Interdisciplinary | AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS | Agricultural Business and Management. |

| Other/ Interdisciplinary | AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS | Agricultural Production Operations. |

| Other/ Interdisciplinary | AGRICULTURAL/ ANIMAL/ PLANT/ VETERINARY SCIENCE AND RELATED FIELDS | International Agriculture. |

| Other/ Interdisciplinary | COMMUNICATION, JOURNALISM, AND RELATED PROGRAMS | Communication and Media Studies. |

| Other/ Interdisciplinary | COMMUNICATION, JOURNALISM, AND RELATED PROGRAMS | Journalism. |

| Other/ Interdisciplinary | LEGAL PROFESSIONS AND STUDIES | Non-Professional Legal Studies. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Peace Studies and Conflict Resolution. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Mathematics and Computer Science. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Medieval and Renaissance Studies. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Science, Technology and Society. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Nutrition Sciences. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | International/Globalization Studies. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Classical and Ancient Studies. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Cognitive Science. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Human Biology. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Marine Sciences. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Sustainability Studies. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Geography and Environmental Studies. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Data Science. |

| Other/ Interdisciplinary | MULTI/INTERDISCIPLINARY STUDIES | Multi/Interdisciplinary Studies, Other. |

| Pharmacy | HEALTH PROFESSIONS AND RELATED PROGRAMS | Pharmacy, Pharmaceutical Sciences, and Administration. |

| Physical Sciences/Math | MATHEMATICS AND STATISTICS | Mathematics. |

| Physical Sciences/Math | MATHEMATICS AND STATISTICS | Applied Mathematics. |

| Physical Sciences/Math | MATHEMATICS AND STATISTICS | Statistics. |

| Physical Sciences/Math | PHYSICAL SCIENCES | Astronomy and Astrophysics. |

| Physical Sciences/Math | PHYSICAL SCIENCES | Atmospheric Sciences and Meteorology. |

| Physical Sciences/Math | PHYSICAL SCIENCES | Chemistry. |

| Physical Sciences/Math | PHYSICAL SCIENCES | Geological and Earth Sciences/Geosciences. |

| Physical Sciences/Math | PHYSICAL SCIENCES | Physics. |

| Physical Sciences/Math | PHYSICAL SCIENCES | Materials Sciences. |

| Physical Sciences/Math | PHYSICAL SCIENCES | Physical Sciences, Other. |

| Broad discipline | CIP Family Title | CIP Subfamily Title |

|---|---|---|

| Public Admin | PUBLIC ADMINISTRATION AND SOCIAL SERVICE PROFESSIONS | Community Organization and Advocacy. |

| Public Admin | PUBLIC ADMINISTRATION AND SOCIAL SERVICE PROFESSIONS | Public Administration. |

| Public Admin | PUBLIC ADMINISTRATION AND SOCIAL SERVICE PROFESSIONS | Public Policy Analysis. |

| Public Admin | PUBLIC ADMINISTRATION AND SOCIAL SERVICE PROFESSIONS | Social Work. |

| Public Admin | PUBLIC ADMINISTRATION AND SOCIAL SERVICE PROFESSIONS | Public Administration and Social Service Professions, Other. |

| Public Health | HEALTH PROFESSIONS AND RELATED PROGRAMS | Public Health. |

| Social Sciences | AGRICULTURAL/ANIMAL/ PLANT/VETERINARY SCIENCE AND RELATED FIELDS | Agricultural Business and Management. |

| Social Sciences | AREA, ETHNIC, CULTURAL, GENDER, AND GROUP STUDIES | Area Studies. |

| Social Sciences | AREA, ETHNIC, CULTURAL, GENDER, AND GROUP STUDIES | Ethnic, Cultural Minority, Gender, and Group Studies. |

| Social Sciences | AREA, ETHNIC, CULTURAL, GENDER, AND GROUP STUDIES | Area, Ethnic, Cultural, Gender, and Group Studies, Other. |

| Social Sciences | FAMILY AND CONSUMER SCIENCES/HUMAN SCIENCES | Human Development, Family Studies, and Related Services. |

| Social Sciences | FAMILY AND CONSUMER SCIENCES/HUMAN SCIENCES | Apparel and Textiles. |

| Social Sciences | PSYCHOLOGY | Psychology, General. |

| Social Sciences | PSYCHOLOGY | Research and Experimental Psychology. |

| Social Sciences | PSYCHOLOGY | Clinical, Counseling and Applied Psychology. |

| Social Sciences | PSYCHOLOGY | Psychology, Other. |

| Social Sciences | SOCIAL SCIENCES | Social Sciences, General. |

| Social Sciences | SOCIAL SCIENCES | Anthropology. |

| Social Sciences | SOCIAL SCIENCES | Archeology. |

| Social Sciences | SOCIAL SCIENCES | Criminology. |

| Social Sciences | SOCIAL SCIENCES | Economics. |

| Social Sciences | SOCIAL SCIENCES | Geography and Cartography. |

| Social Sciences | SOCIAL SCIENCES | International Relations and National Security Studies. |

| Social Sciences | SOCIAL SCIENCES | Political Science and Government. |

| Social Sciences | SOCIAL SCIENCES | Sociology. |

| Social Sciences | SOCIAL SCIENCES | Urban Studies/Affairs. |

| Social Sciences | SOCIAL SCIENCES | Social Sciences, Other. |

Interactive Spirograph

Play with an interactive spirograph and share your creations with your friends. Just play around with the controls at the top and see what interesting designs you can come up with.

Instructions

– Wheel Size controls the size of the wheel inside the ring

– Hole Distance controls the distance from the center of the wheel and the edge

– Drawing Speed controls the speed at which the spirograph is spins

– Line Thickness controls the thickness of the line on the drawing

– Line Color is a color picker letting you change the color of the lines

– Show Ring and Wheel lets you toggle whether the Ring and Wheel are showing

– Clear erases the design

– generates a custom URL and copies it to the clipboard so you can share this exact design with your friends.

– / allows you to start and stop the spirograph animation

Equations

The spirographs shown here are hypotrochoids, which is described as a curve generated by tracing a point attached to a circle that rolls around the interior of a larger circle. The equations for the curve are:

\begin{aligned}&x(\theta )=(R-r)\cos \theta +d\cos \left({R-r \over r}\theta \right)\\&y(\theta )=(R-r)\sin \theta -d\sin \left({R-r \over r}\theta \right)\end{aligned}

Sources and Tools

The equations for the spirograph hypotrochoids are from Wikipedia. The drawings and UI are made using canvas and HTML/Javascript and CSS.

California Electricity Generation

What are the main sources of California’s electricity?

I added the option to view the graph for any day or monthly average from April 2018 to the present using the calendar picker and a daily generation summary

In the United States, electric power plant emissions account for about 25% of greenhouse gas emissions. However, California has been a leader in the transition to clean and renewable energy, driven by ambitious climate policies and a commitment to reducing greenhouse gas emissions. The state has set an electricity target for the state of 60% renewables by 2030 and 100% zero-carbon, clean electricity by 2045. To meet these targets, the state has been investing heavily into solar and wind energy sources. Solar is the largest proportion of California’s electricity grid and California now generates more solar energy than any other state.

The California Independent System Operator manages the grid for around 32 million Californians or about 80% of the total demand in the state. Here is a map showing the service area and the other electricity districts in the state, the main exceptions include the city of LA and the Sacramento area.

How to read the graph of California’s electricity

The graphs shown here allow us to visualize how electricity generation in the California Independent System Operator (CAISO) region varies over the course of the day. We can see how solar ramps up to be a huge contributor in the middle of the day. And overall, the vast majority of the generation in the state is one form of renewable electricity or another (e.g. solar, wind, hydro, geothermal, biomass and biogas). Add in a small contribution from zero-carbon nuclear energy and we can see that a large majority of power generation comes from zero-carbon sources. It also shows the total electricity demand, which should always be less than the total electricity supply in the state.

Because of the intermittent nature of some renewables, like wind and solar, there are times where the demand for electricity is not able to be met by these sources, and other options are needed to maintain supply demand balance on the state’s grid. To address this issue, the state relies on importing power from outside of the state as well as energy storage (primarily batteries) to meet electricity demand when renewable energy supply is low. If demand is much less than supply, then likely there will be power exported or some charging of batteries. And if demand is less than total generation in the state, power will be imported and/or batteries will be discharged to make up for the power shortfall.

On the graph, positive values from batteries and imports is when those sources are supplying power to the California grid. Negative values for batteries and exports are when there is excess power in the state and batteries are being charged up or power is being exported to neighboring states.

You can view the graph in two forms:

- Detailed – shows all of the power plant fuel types that is provided in the CAISO data: Solar, Wind, Nuclear, Coal, Other, Natural Gas, Large Hydropower, Small Hydropower, Geothermal, Biomass and Biogas. In addition, it shows aggregated net imports into the state from other regions as well as battery discharging or charging.

- Simplified – I aggregated the categories from CAISO into Solar, Wind, Nuclear, Fossil Fuel (including Coal, Other and Natural Gas), Hydro (Large and Small Hydropower), and Other Renewable (Geothermal, Biomass and Biogas). In addition, it shows aggregated net imports into the state from other regions as well as battery discharging or charging.

Also, I added the ability to see yesterday’s data as well. In the future, I will add the ability to see other dates as well.

Data Sources and Tools

Data for electricity sources for California grid comes from the California Independent System Operator (CAISO). This data from this site is downloaded and processed using a python script and updated every 5 minutes. The graph is made using the open source Plotly javascript graphing library.

NYT Digits Solver

You can play new daily Digits puzzles

Calculate the solution to any digits puzzle

This tool lets you view all of the potential solutions to a Digits puzzle. Enter the goal number and the five starting numbers separated by a comma like “1,2,3,4,5” and hit the “Calculate Solutions” button to see all of the possible solutions to the puzzle. The list is likely quite long so you’ll probably need to scroll through all of the solutions in the list.

There is also a checkbox that lets you remove transpositions, which are operations that occur in different orders but the same set of operations are used to achieve the final number. For example, where the first two operations appear in reverse order and then are added together in the 3rd operation to hit the target.

e.g. these two solutions are an example of a transposition.

5 + 10 = 15 15 / 3 = 5 5 * 20 = 100

vs

15 / 3 = 5 5 + 10 = 15 5 * 20 = 100

Tools

A version of the solution code is written in Python code and is used to generate the puzzles. This code is re-written in javascript so it is solved inside the browser and the visuals are made with javascript, CSS and HTML and the graphs are made using the open source Plotly javascript graphing library.

Recent Comments