Welcome to Engaging Data

This is a virtual workshop / gallery where I post data visualizations, calculators, maps and other web programming projects. It covers a wide range of visualization styles and topics: whatever interests me at the time and I feel compelled to explore. Check out the tabs below to see visualizations in different categories. On mobile, scroll to the right to see more category tabs.

If you are an educator using any of these tools/visualizations in an educational setting, I’d love to hear how you are incorporating it into your curriculum, either in the comments or on twitter or via email.

Popular / FeaturedMapsEnvironmentEnergyFinancialPolitics/SocietyHealthFunMath/ScienceOther Dataviz

These are popular and featured projects

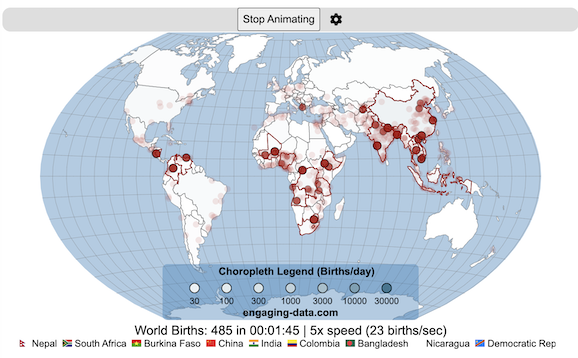

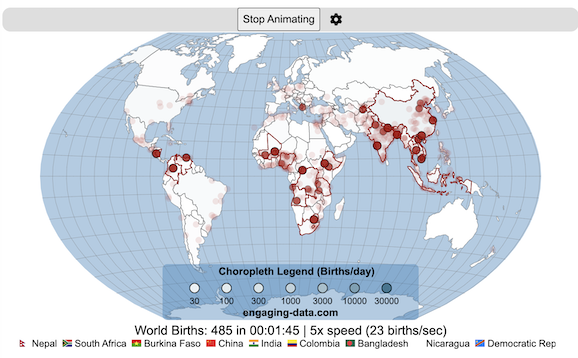

Global Birth Map

Global Birth Map

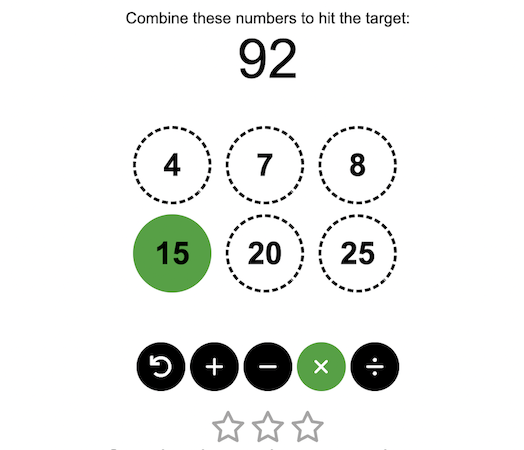

Digits Math Game

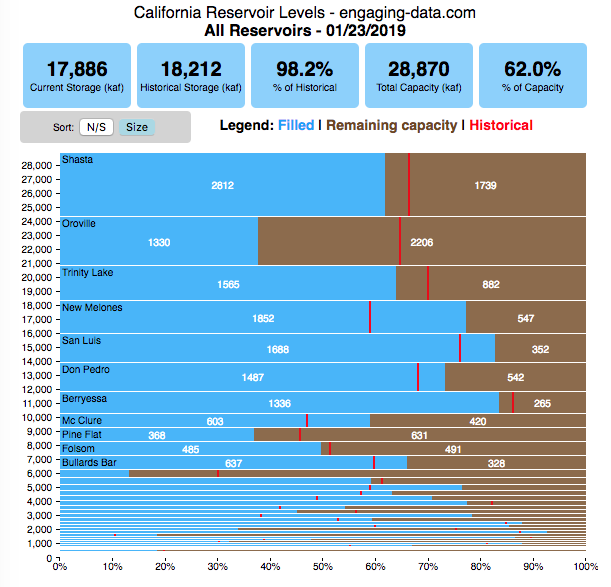

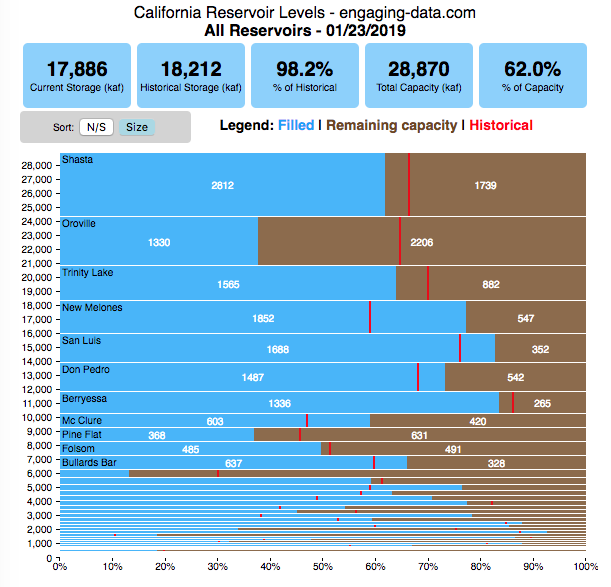

California Reservoir Dashboard

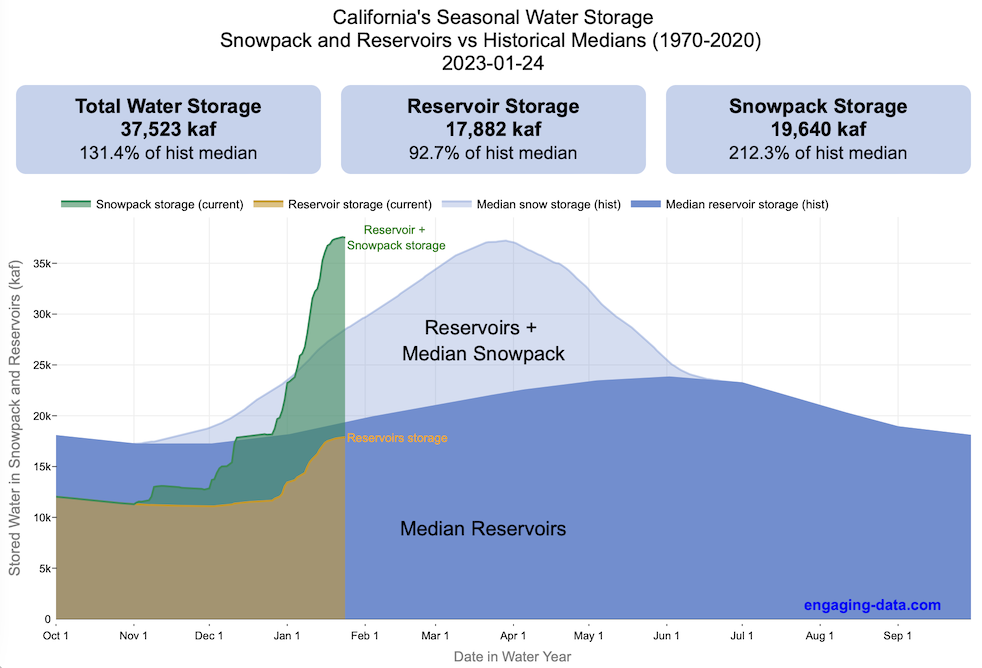

California Reservoirs and Snowpack

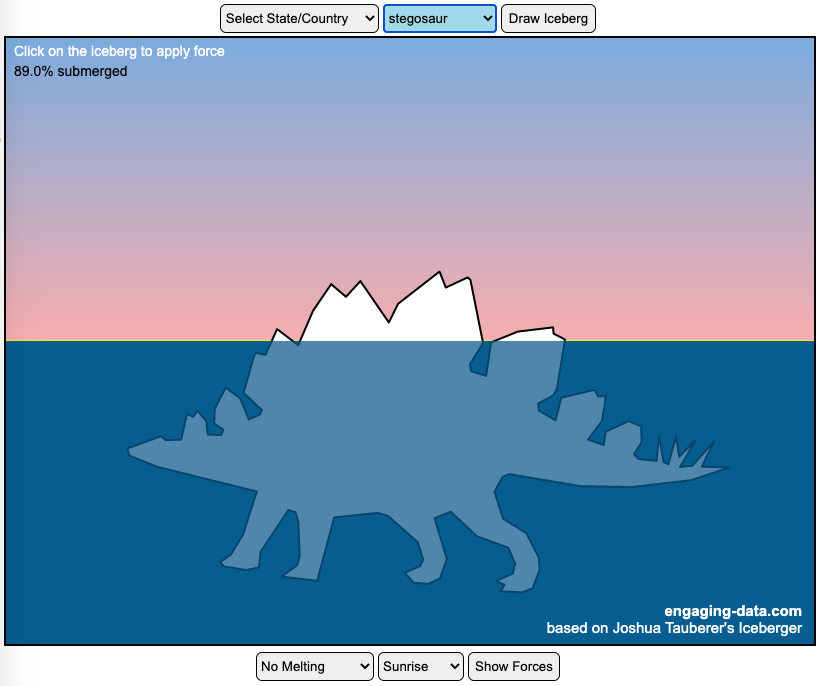

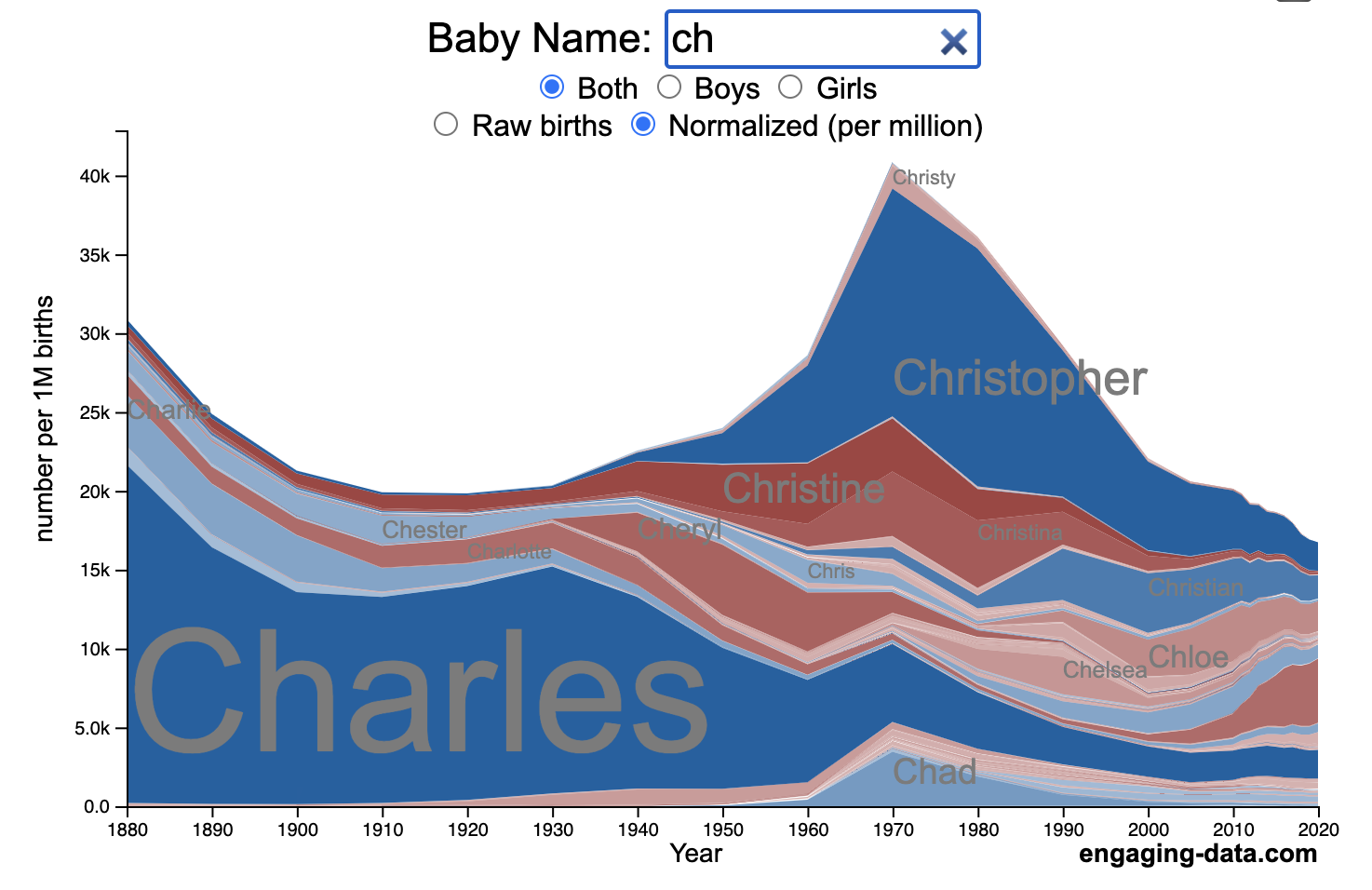

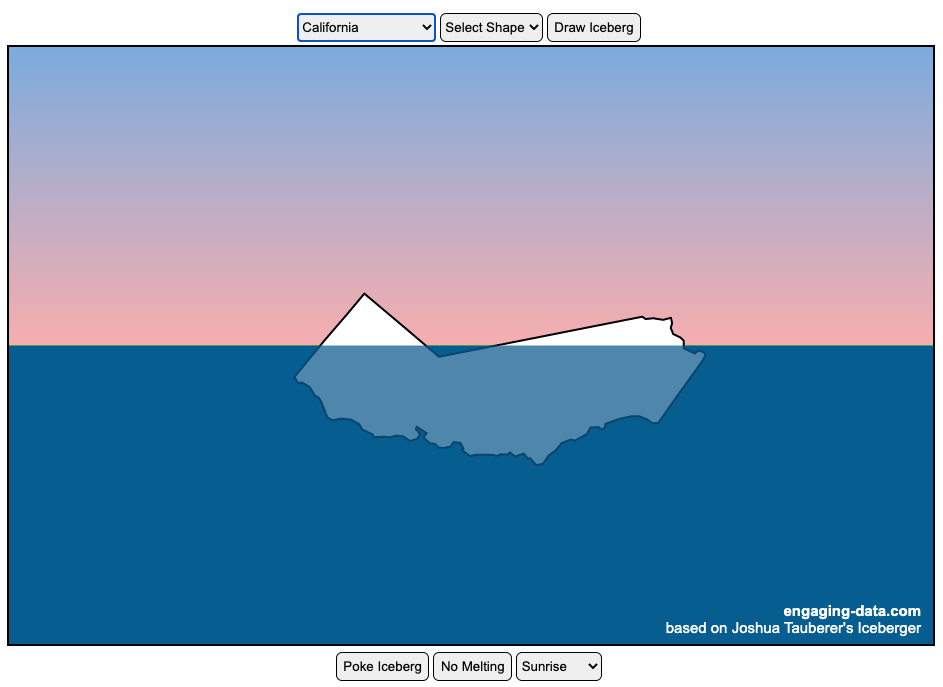

Iceberg Simulator Baby name popularity visualizer

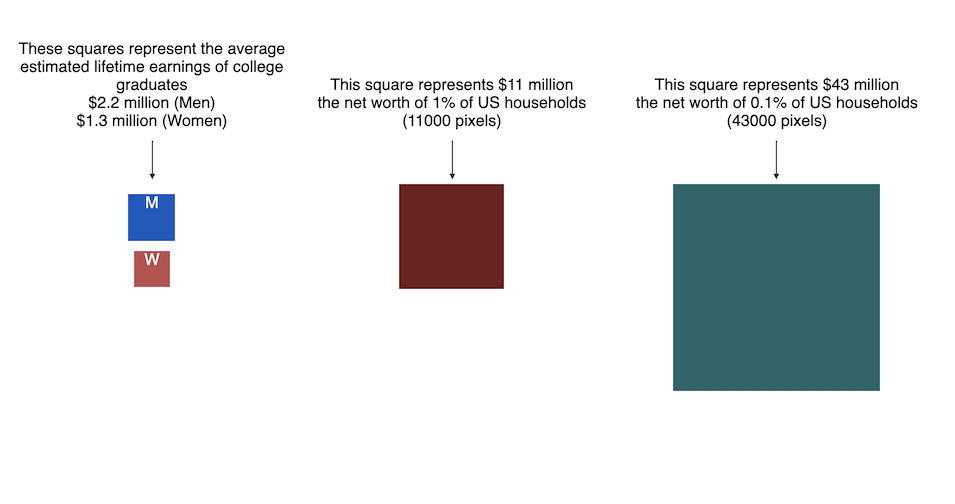

Baby name popularity visualizer How Rich is Elon Musk? shown in pixels

How Rich is Elon Musk? shown in pixels

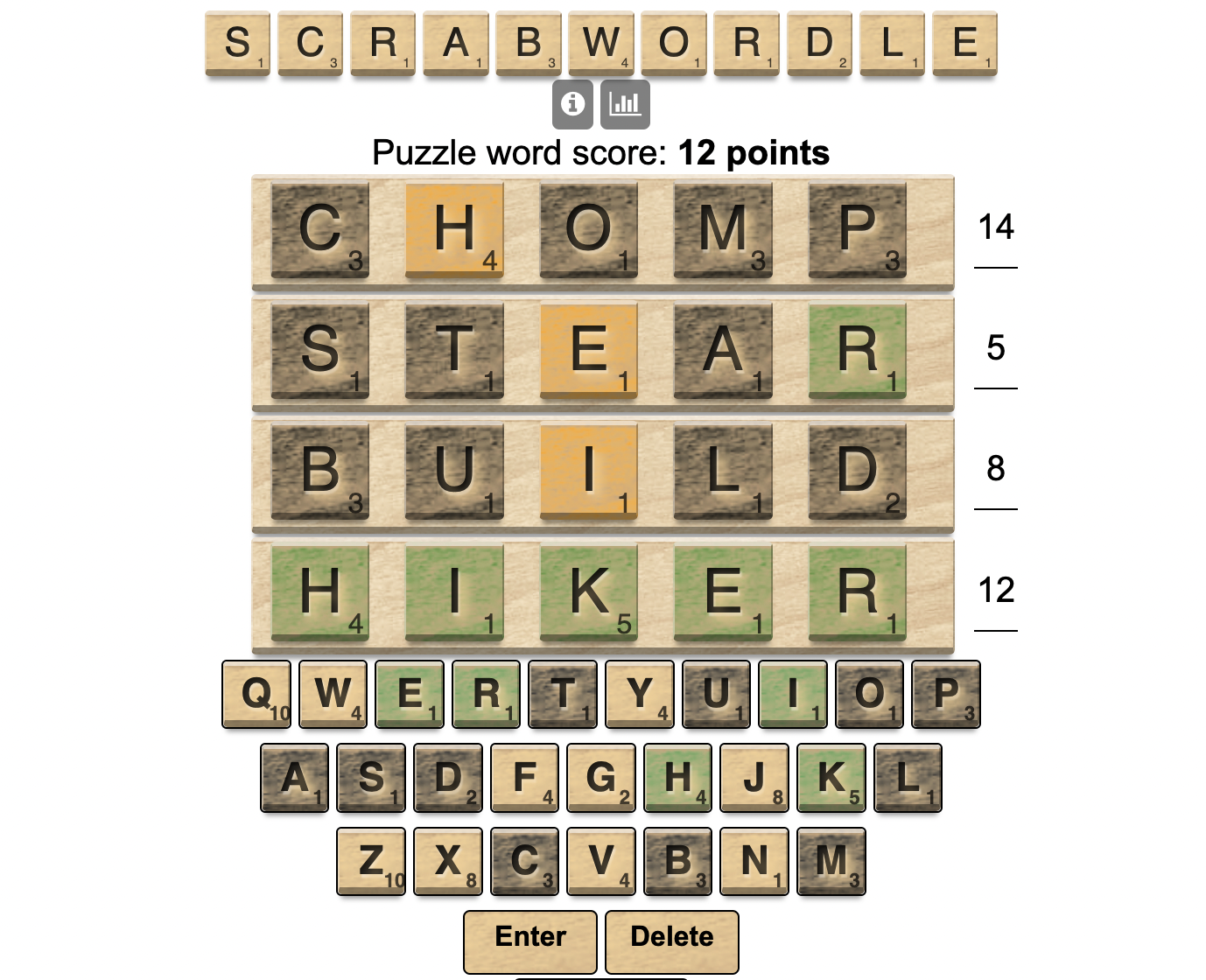

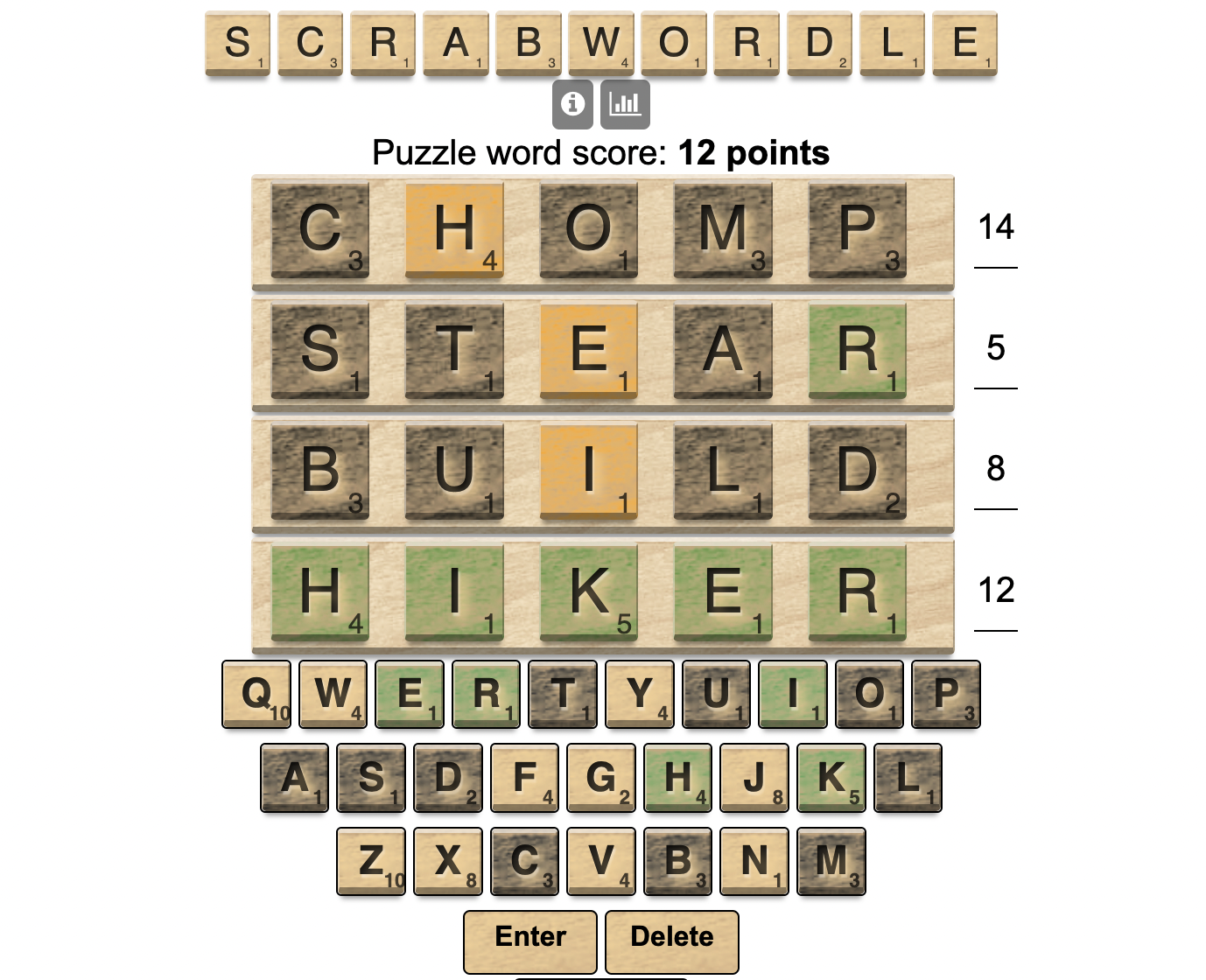

ScrabWordle

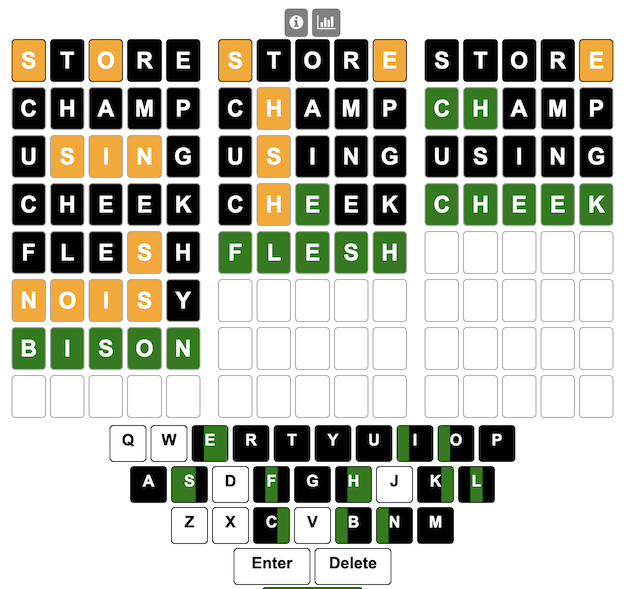

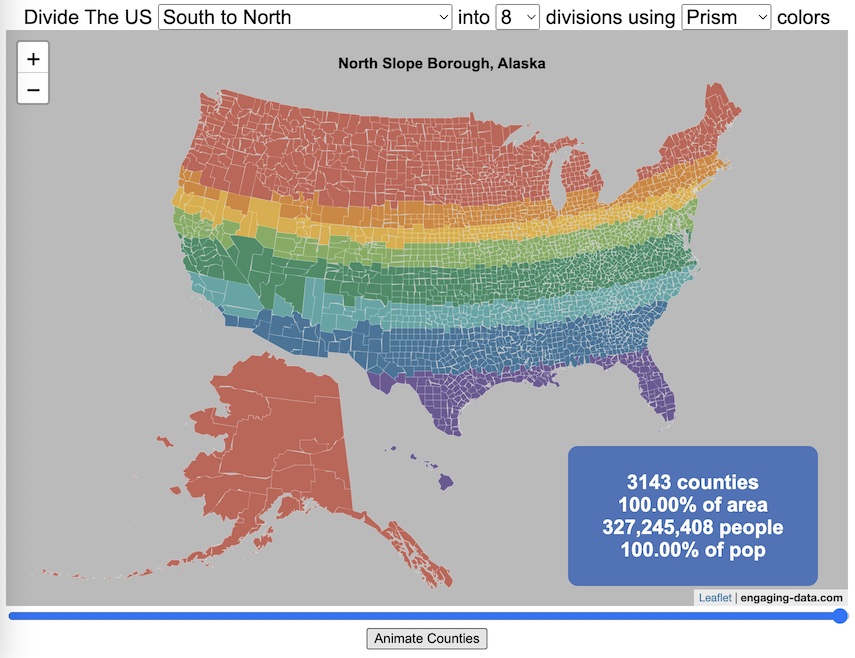

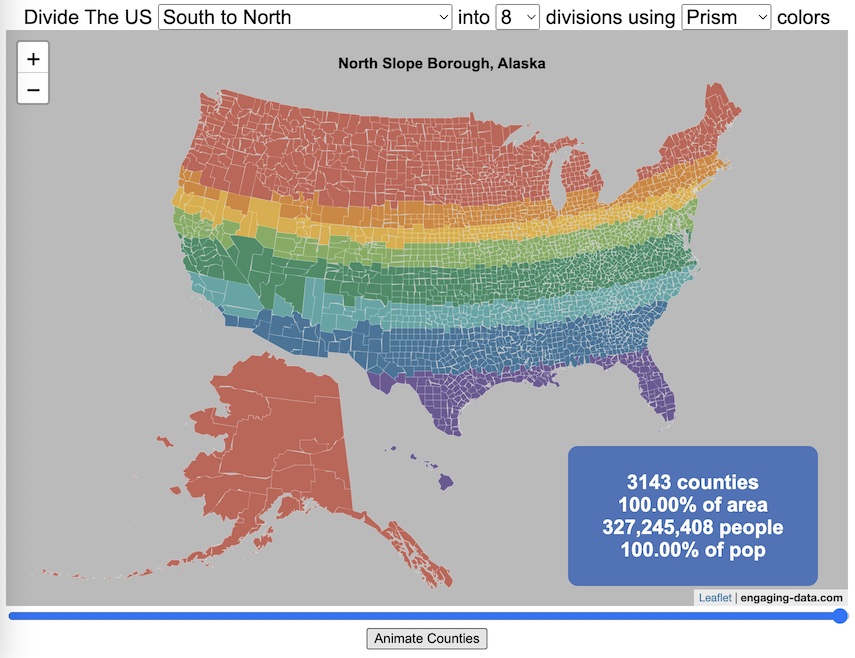

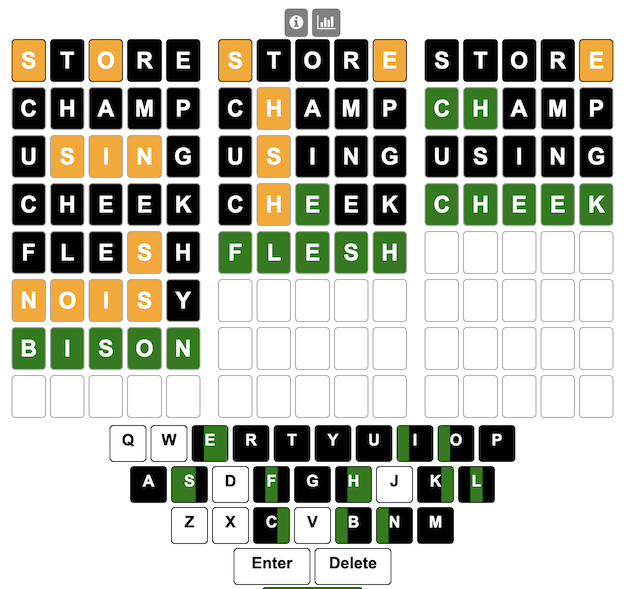

Tridle – Triple Wordle Splitting the US by Population

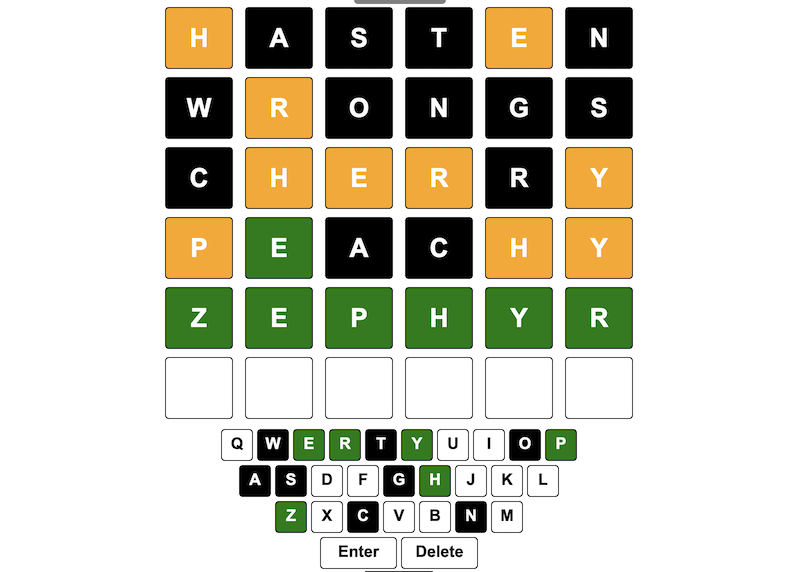

Splitting the US by Population WordGuessr Wordle clone

WordGuessr Wordle clone

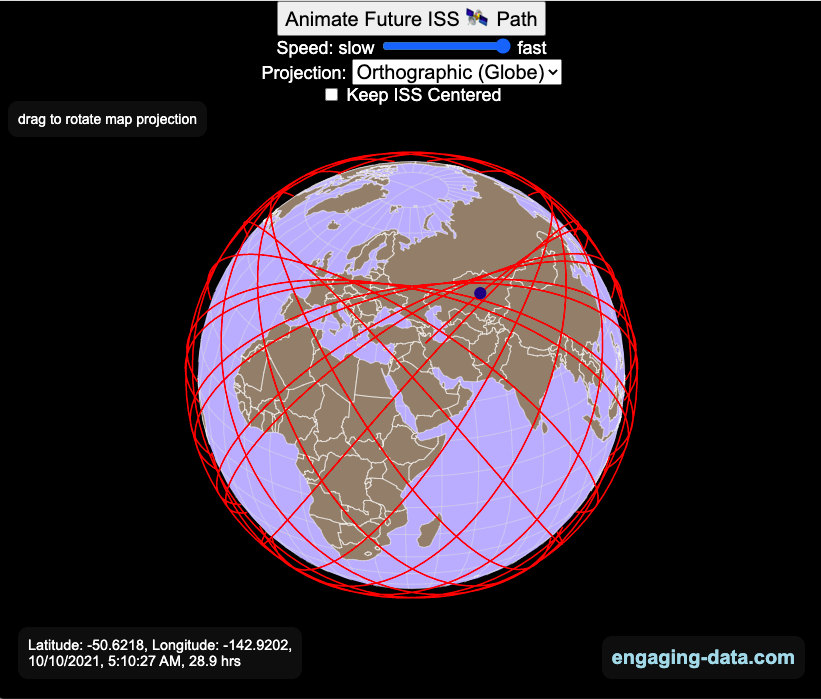

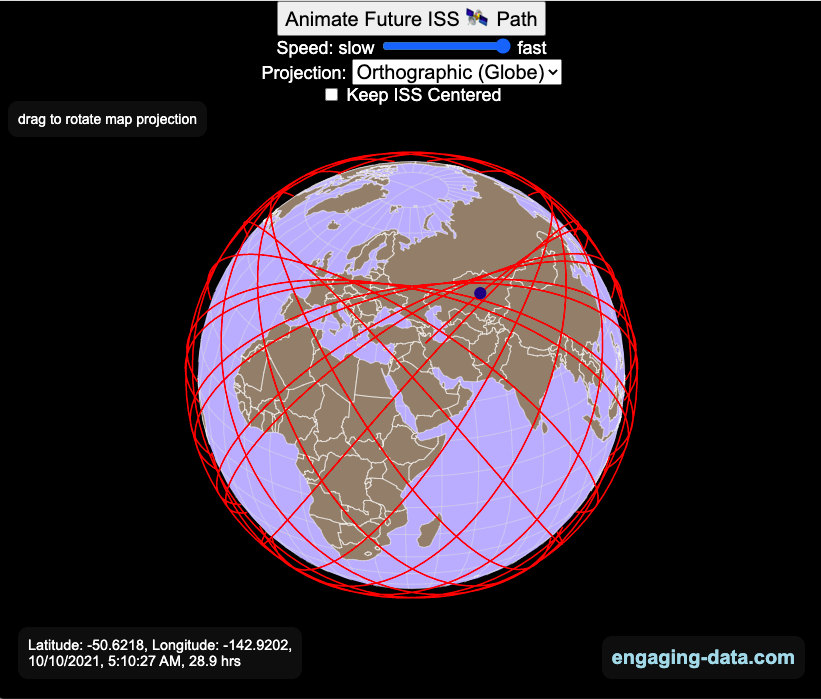

Orbital Pattern of the International Space Station

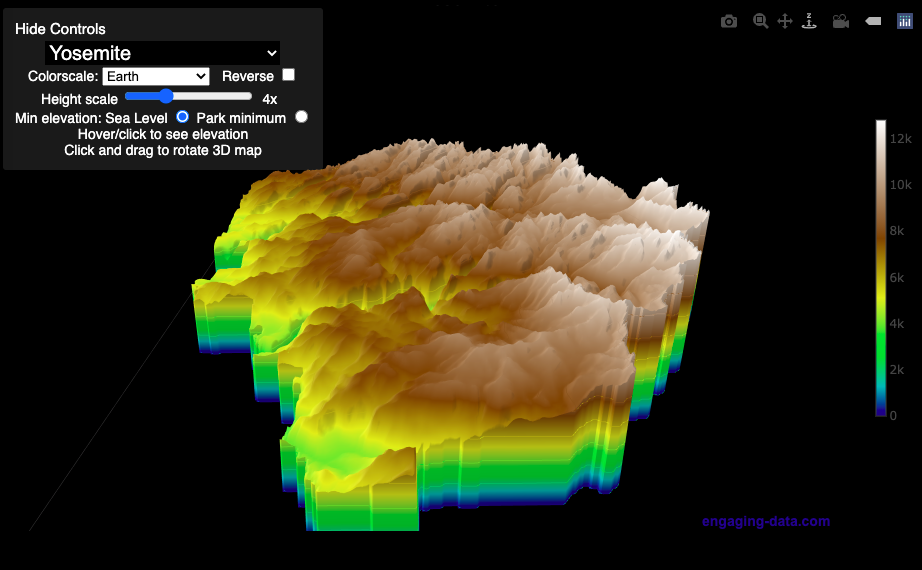

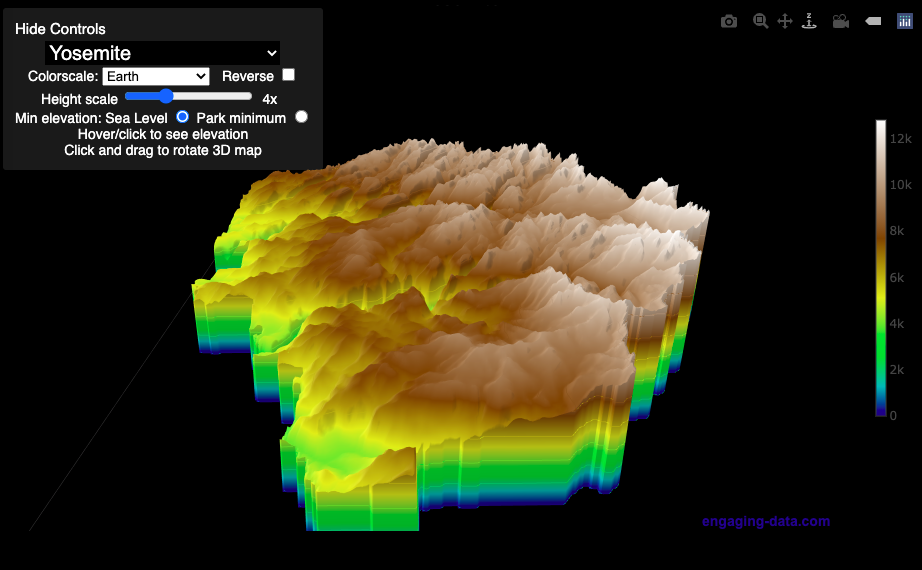

3D Elevation of National Parks

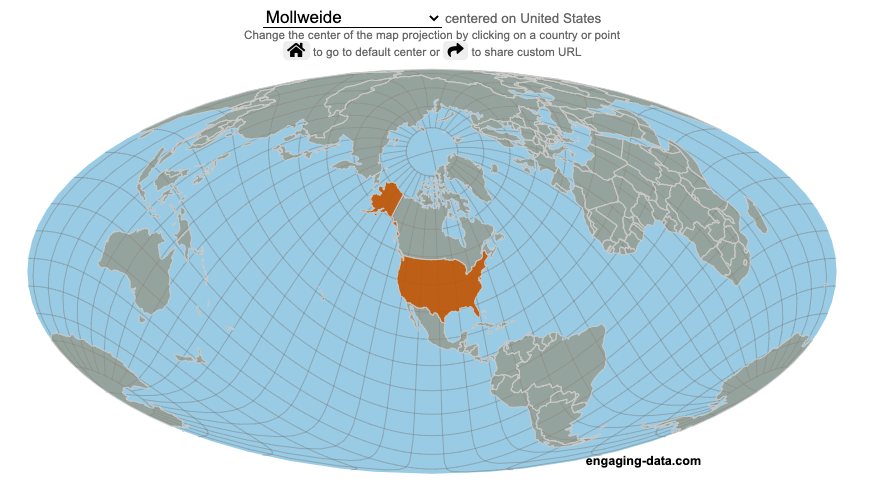

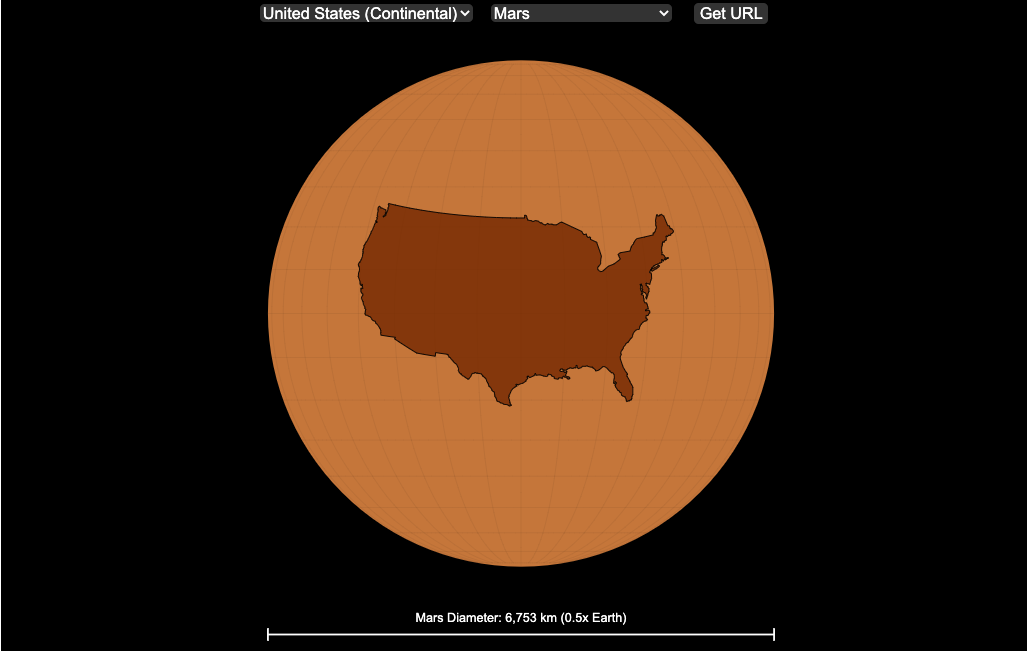

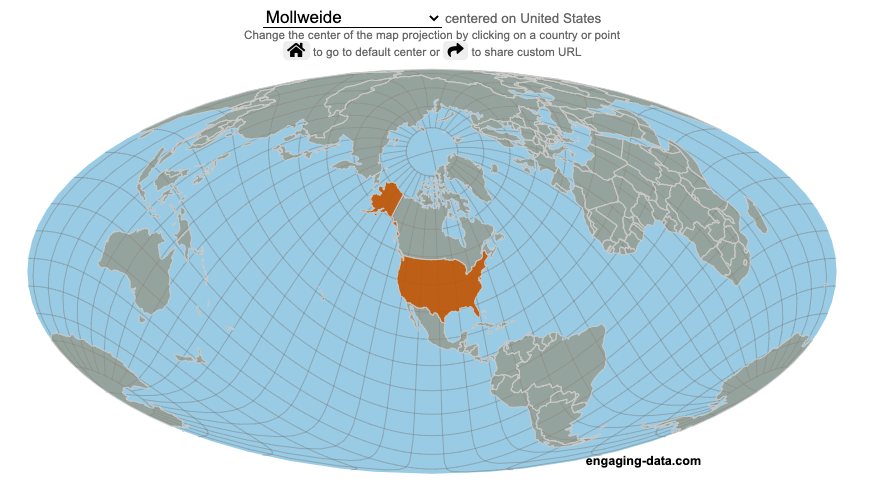

Country-Centered Maps

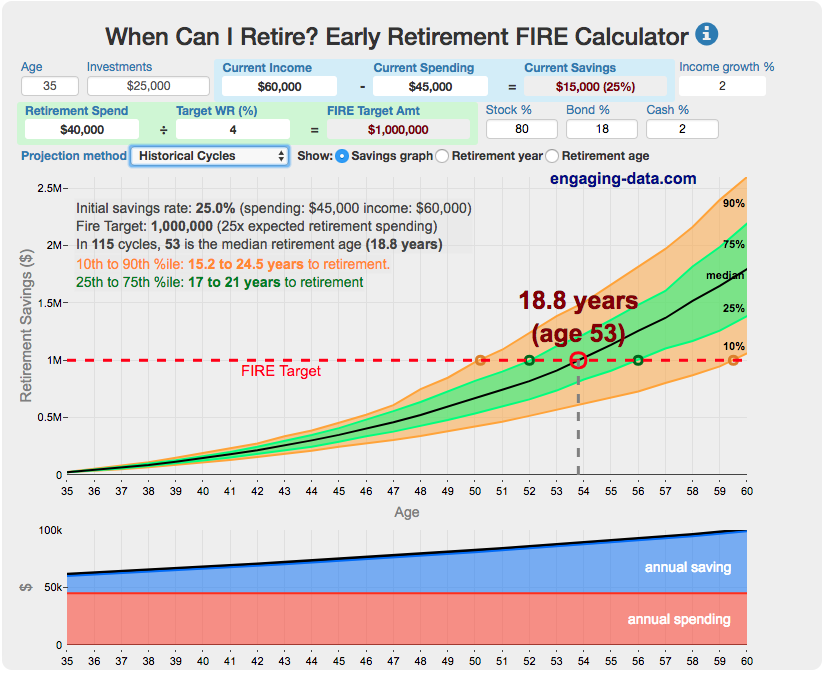

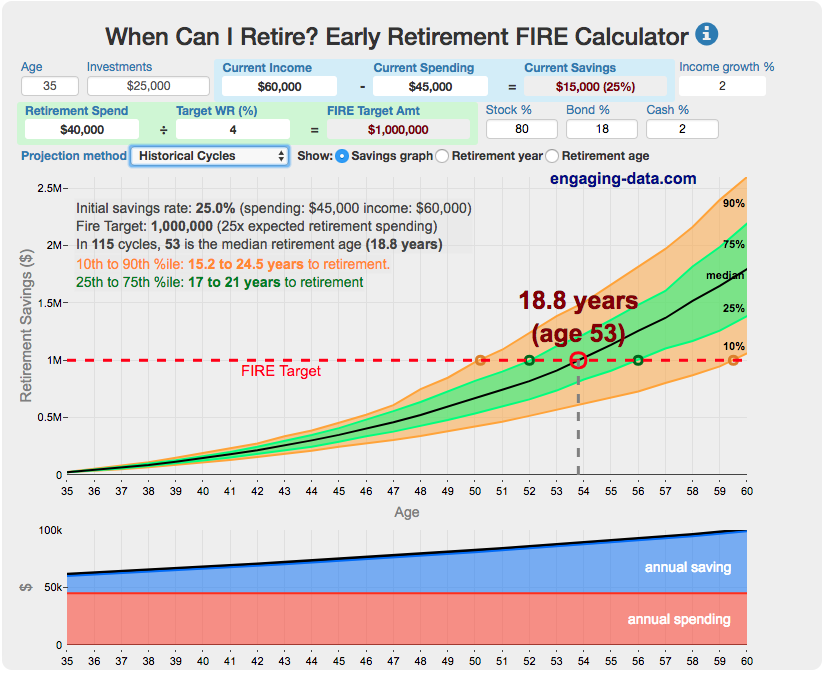

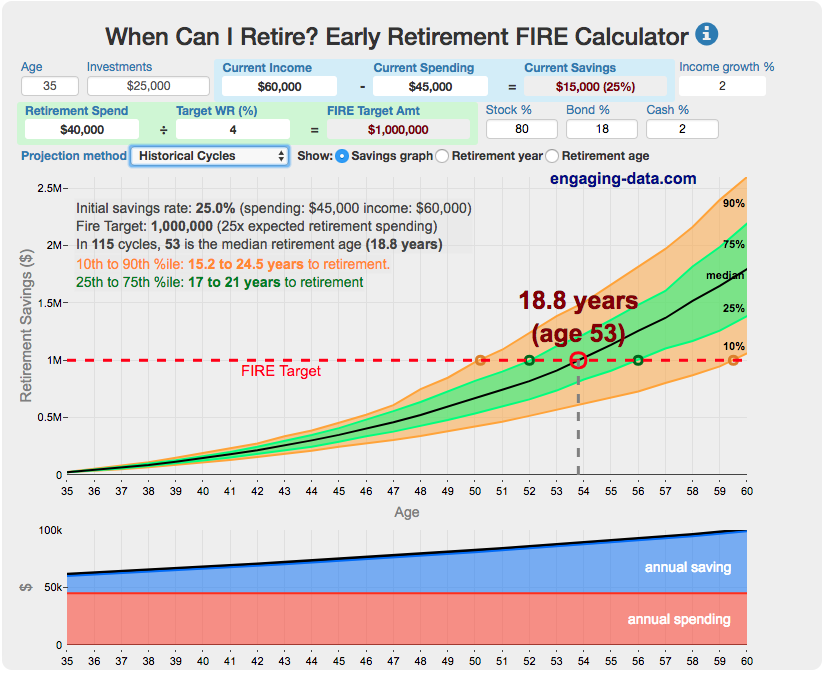

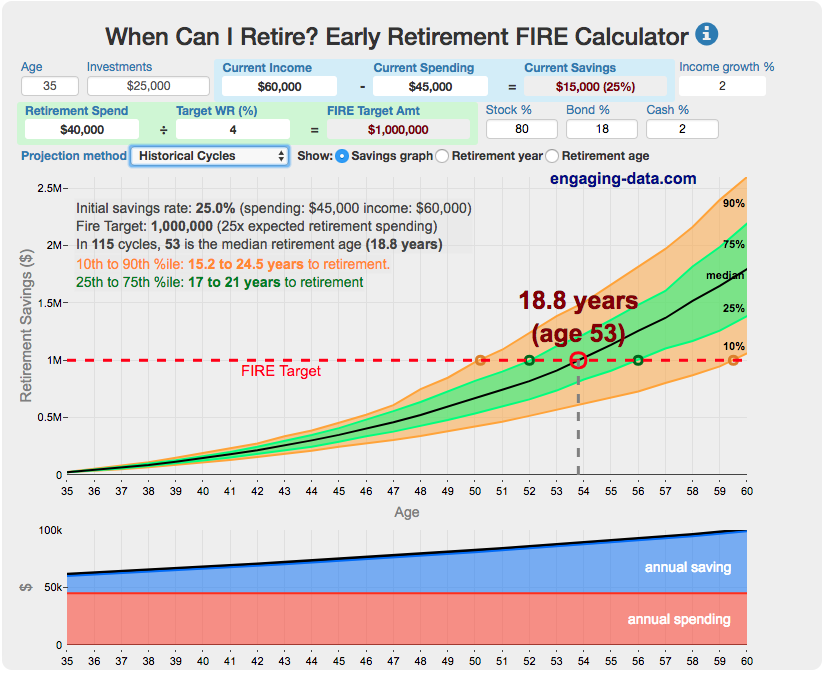

Early Retirement Calculators and Tools

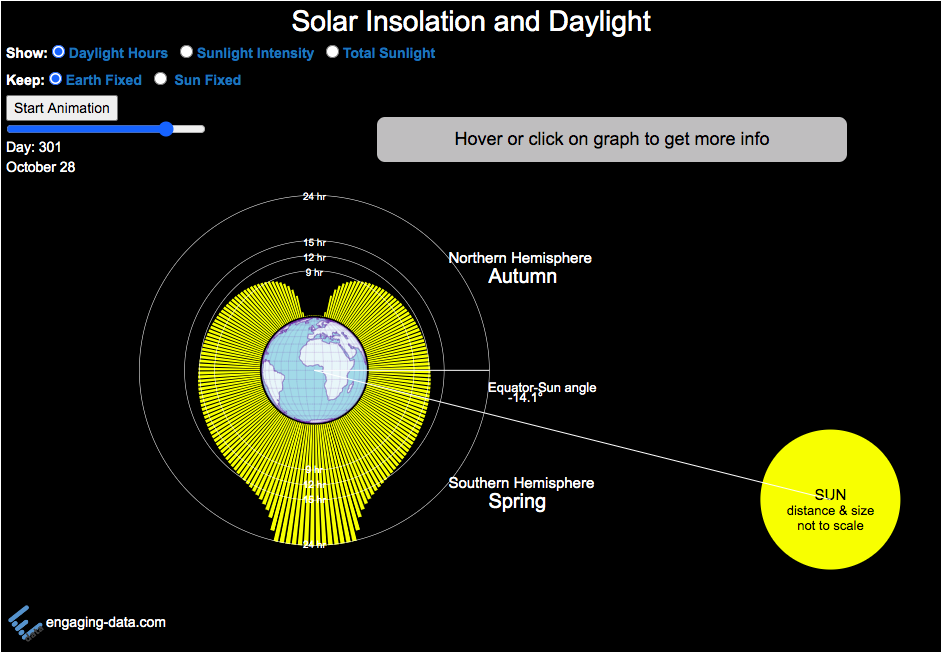

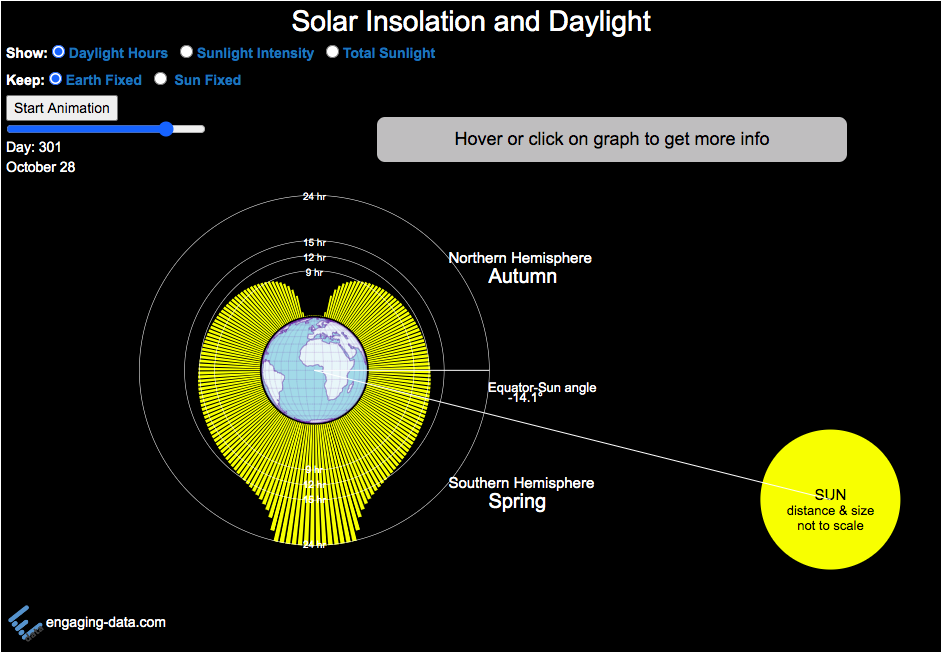

Hours of Daylight by Latitude/Season

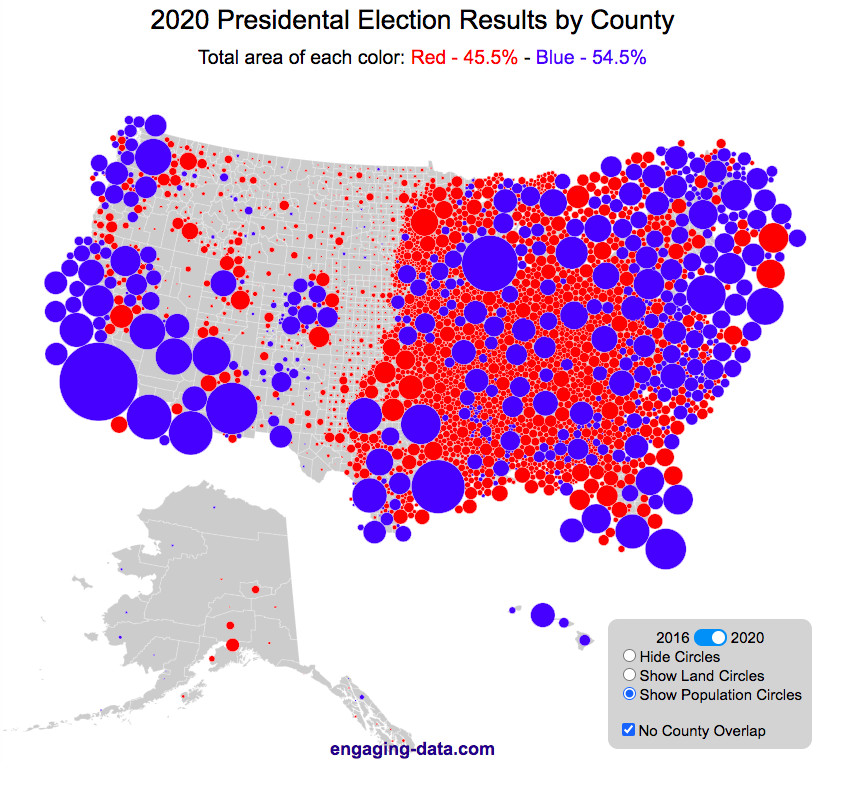

County Electoral Map – Land Area vs Population

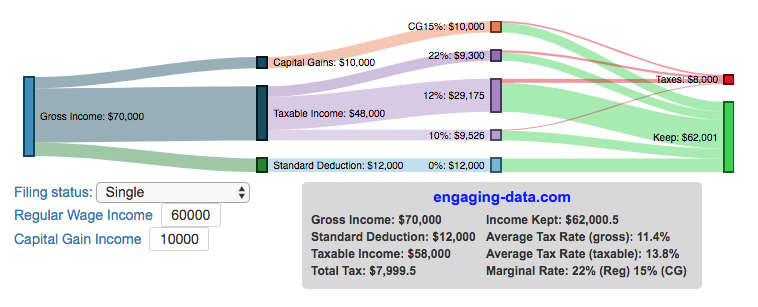

Income Tax Bracket Visualizer Early retirement calculator – When can I retire?

Early retirement calculator – When can I retire?

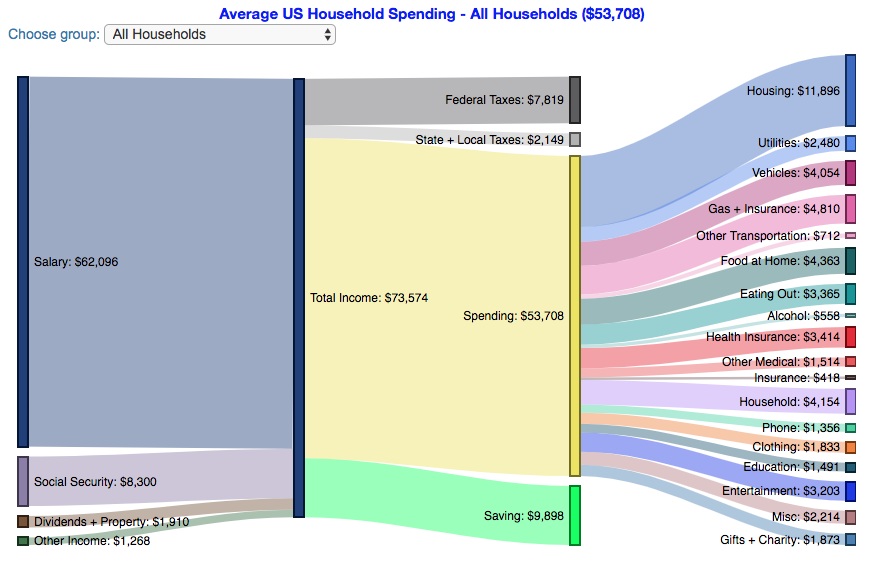

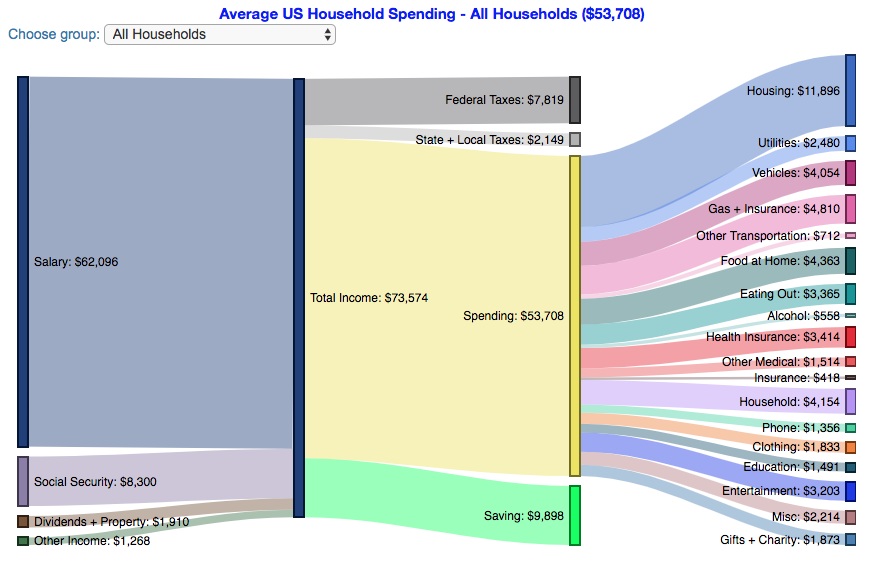

US Household Spending By Income Group

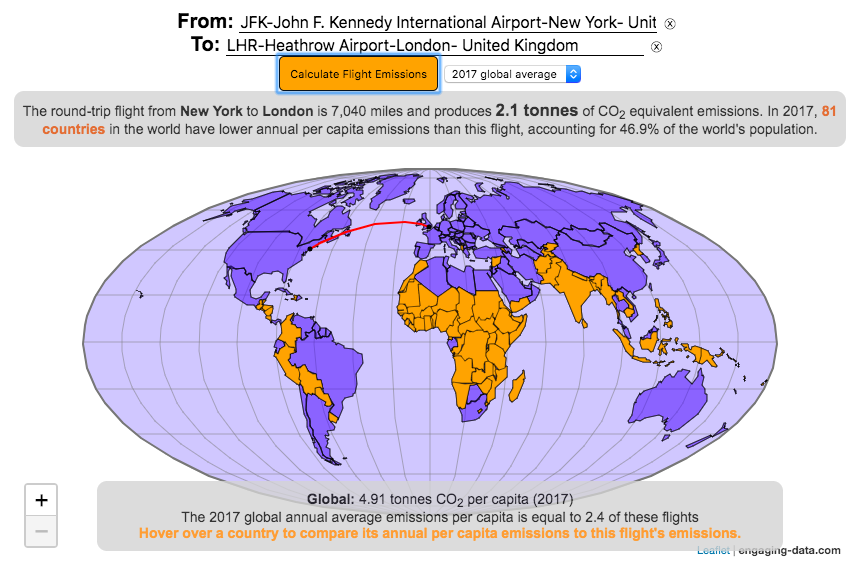

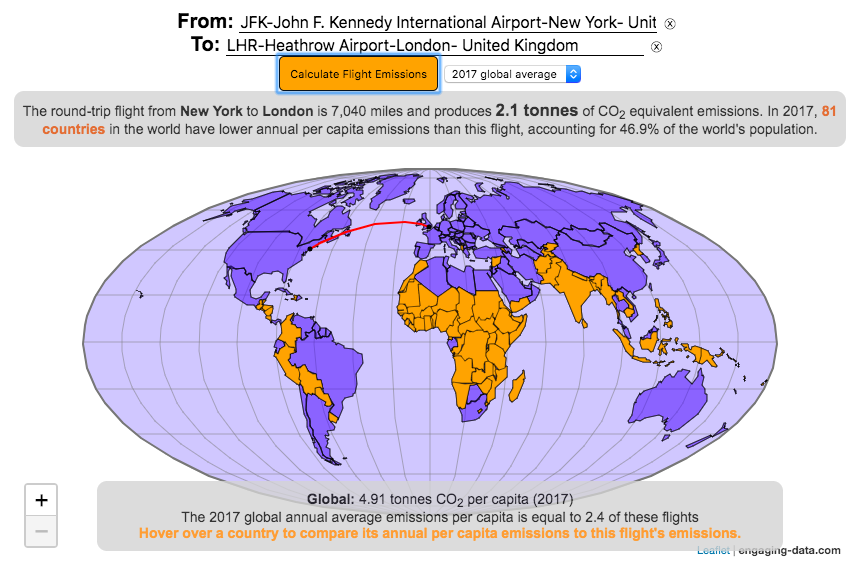

Airplane Flight Emissions

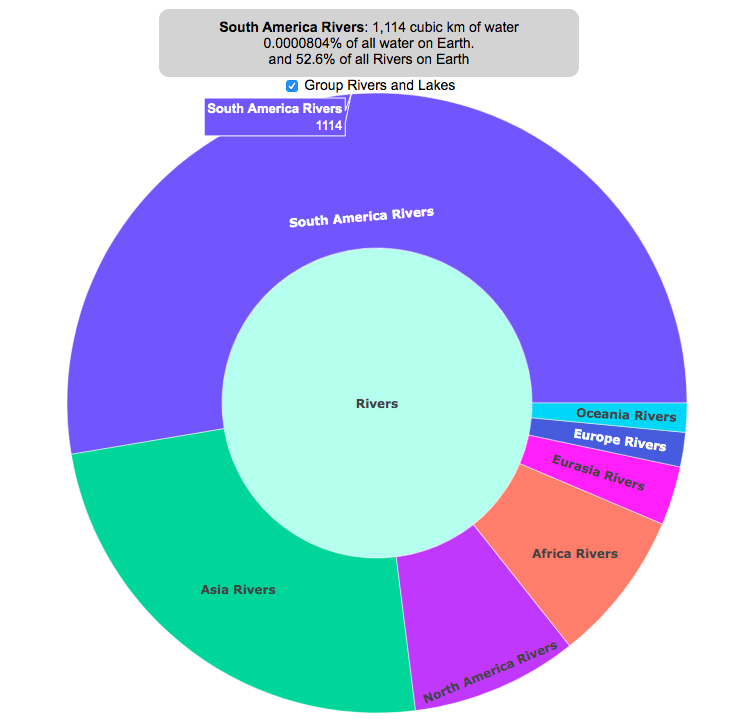

Where is all the water on Earth?

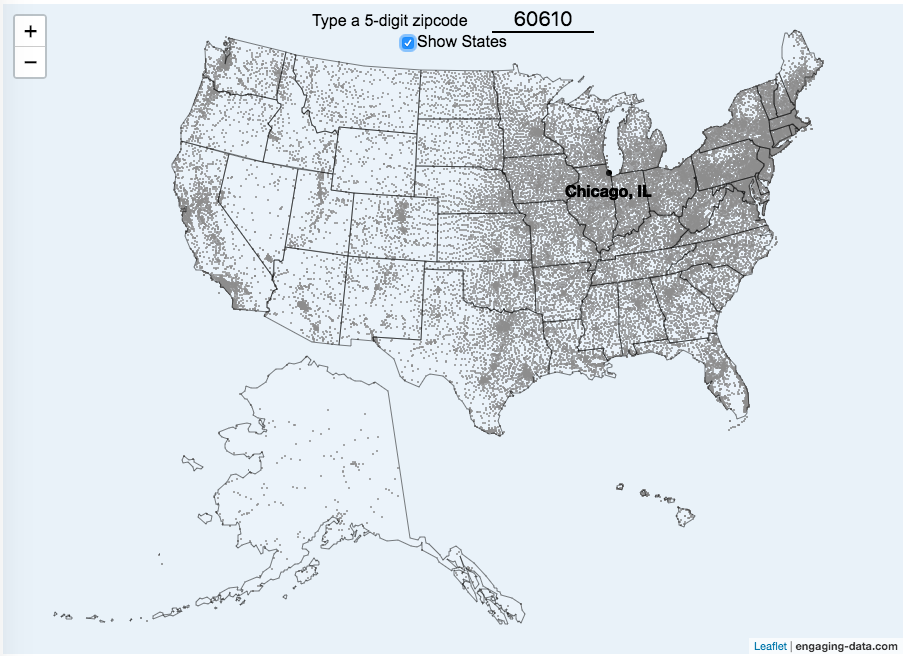

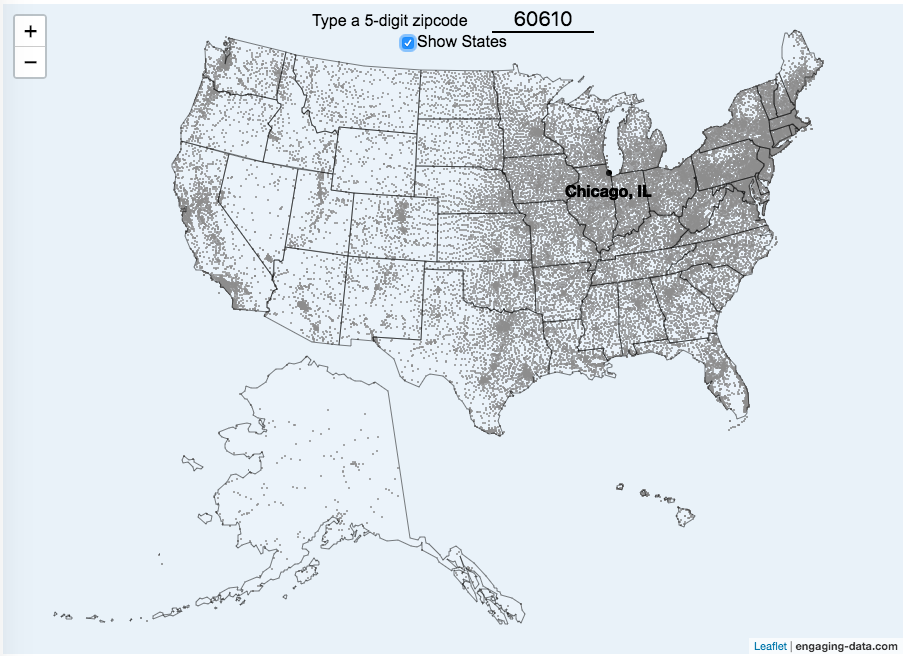

Interactive US Zip Code Map

Assembling the World Country-by-Country

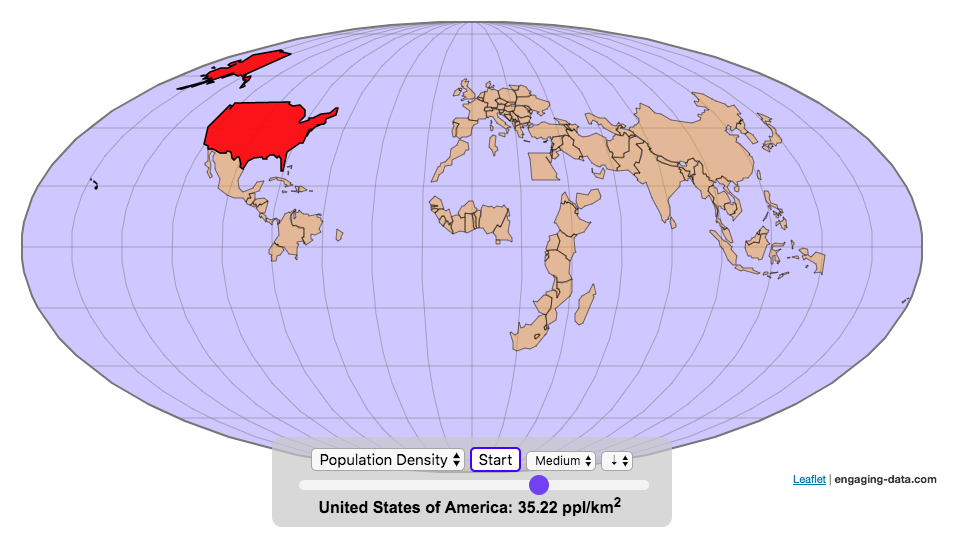

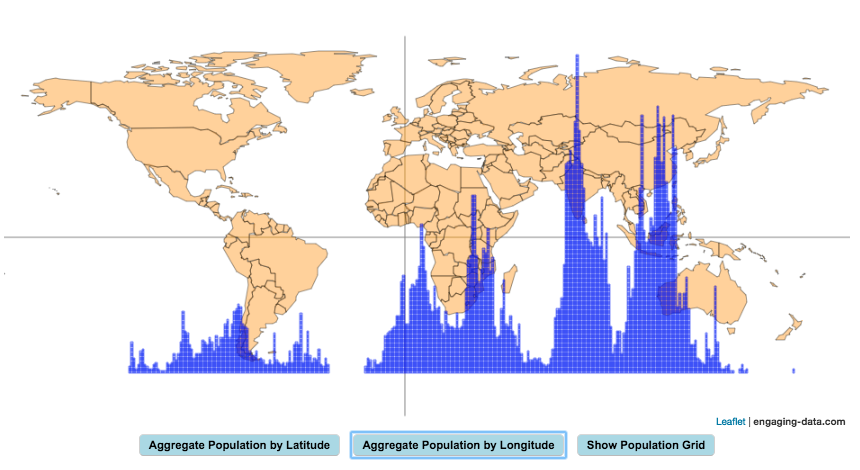

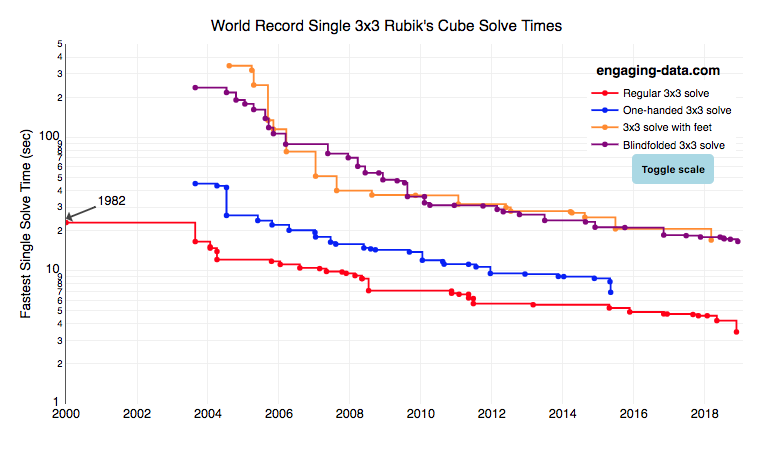

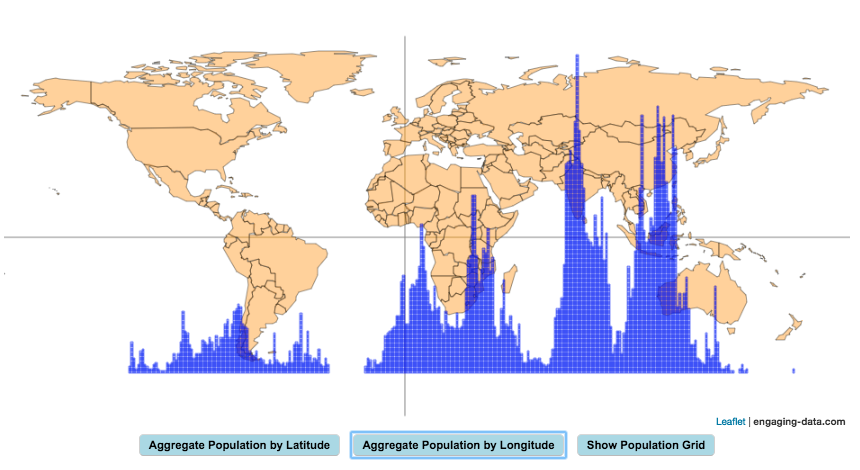

Population by Latitude and Longitude Rubik’s cube world records over time

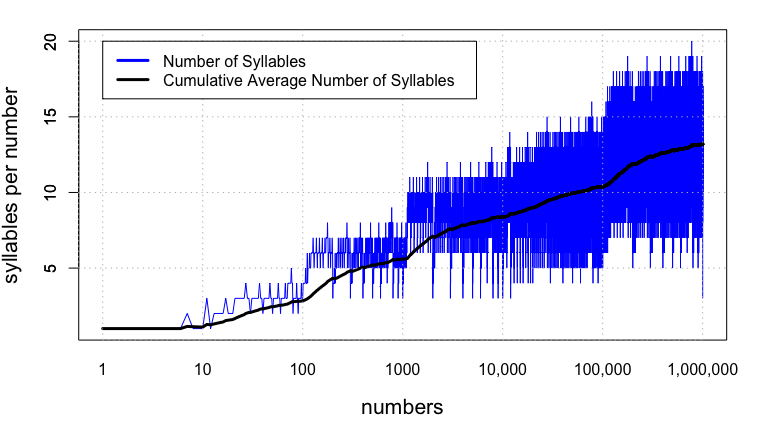

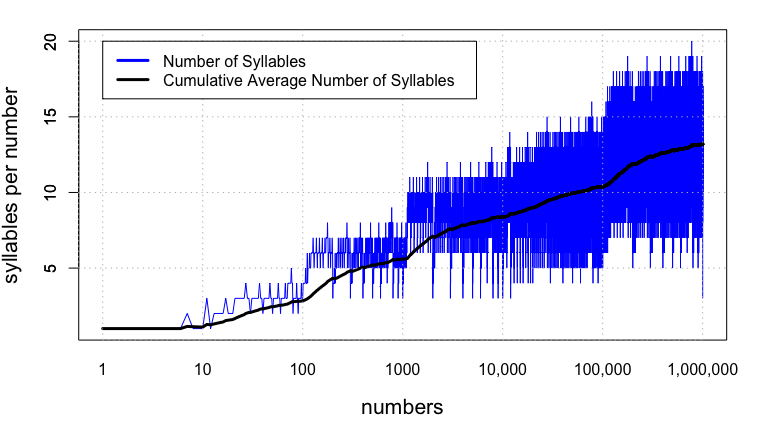

Rubik’s cube world records over time How long does it take to count to one million?

How long does it take to count to one million? Antipodes map

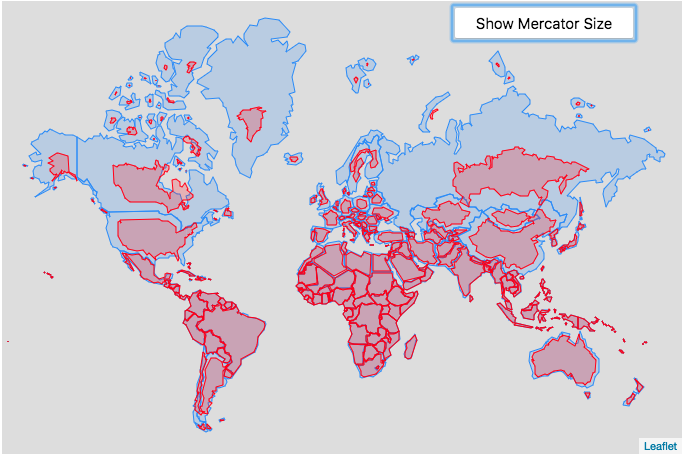

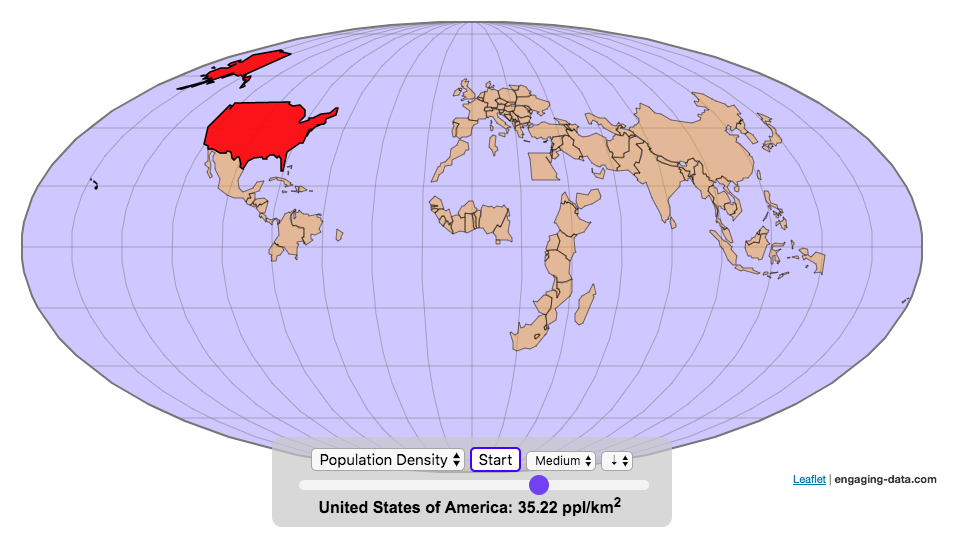

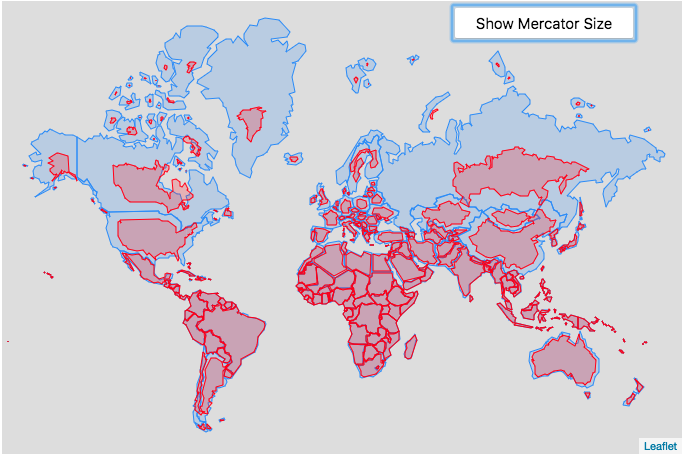

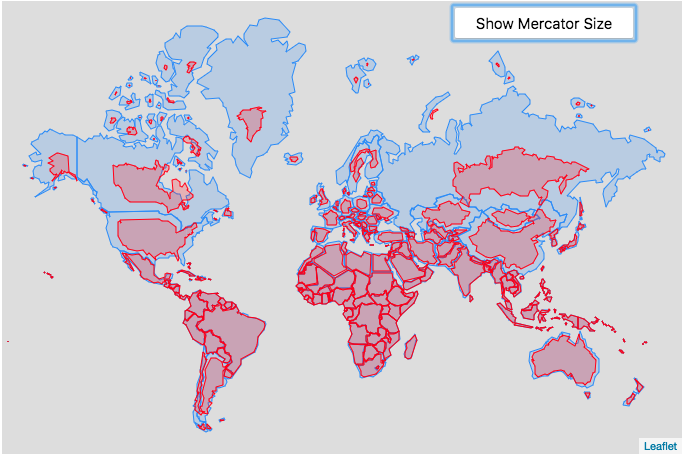

Antipodes map Mercator country size distortion

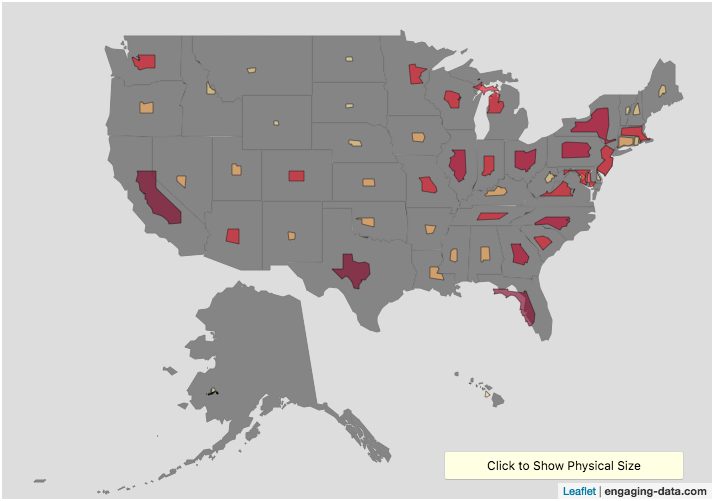

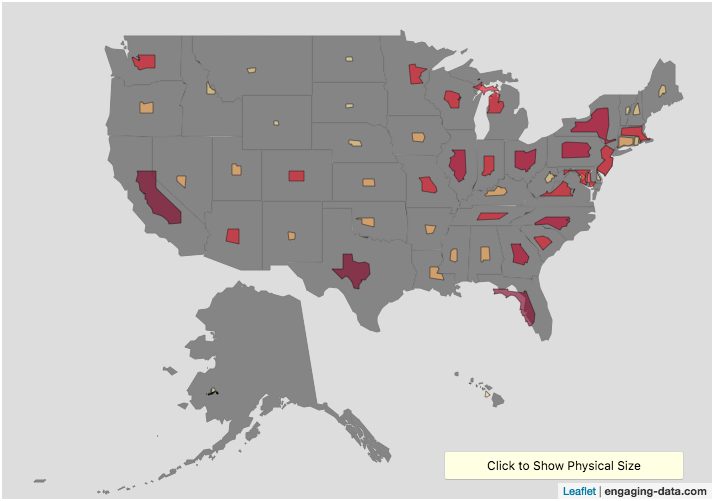

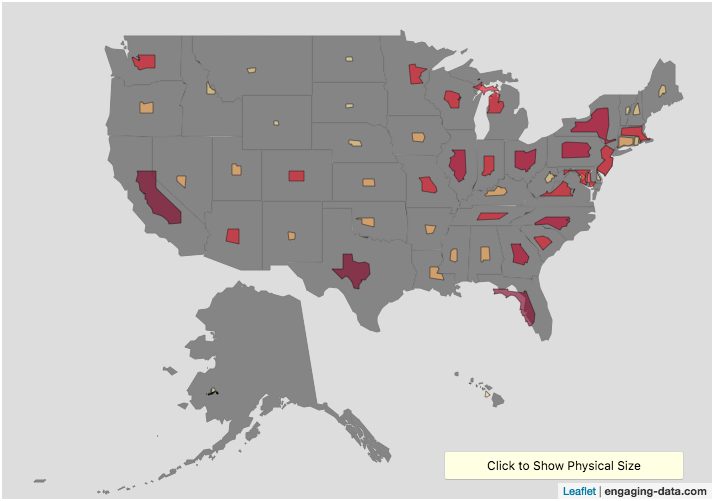

Mercator country size distortion States re-sized to match population

States re-sized to match population How much water is in California reservoirs?

How much water is in California reservoirs?

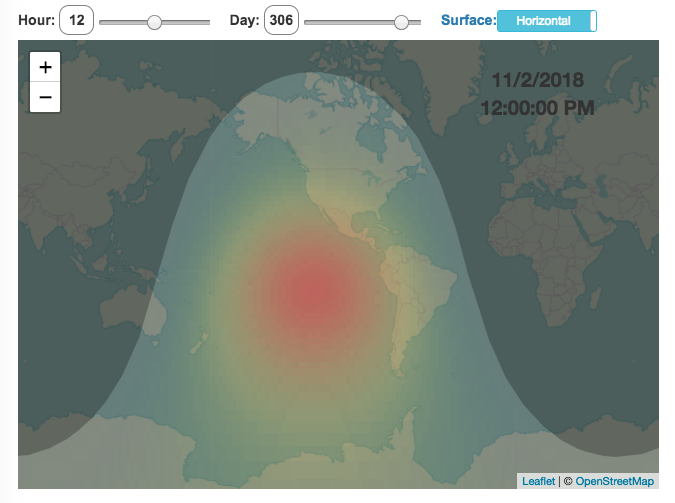

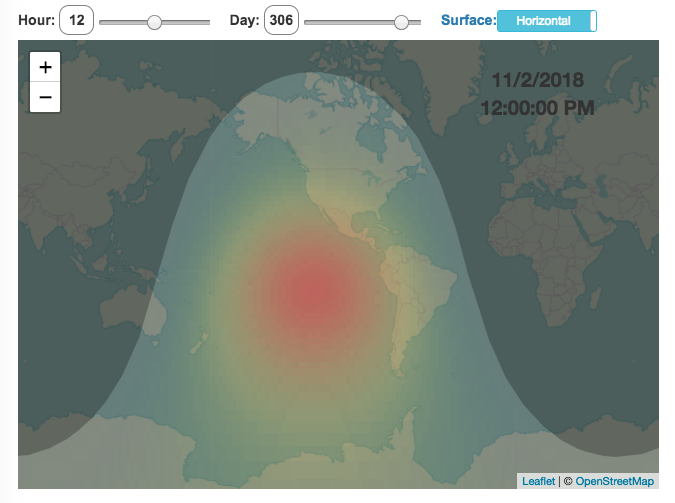

Solar Intensity By Location and Time

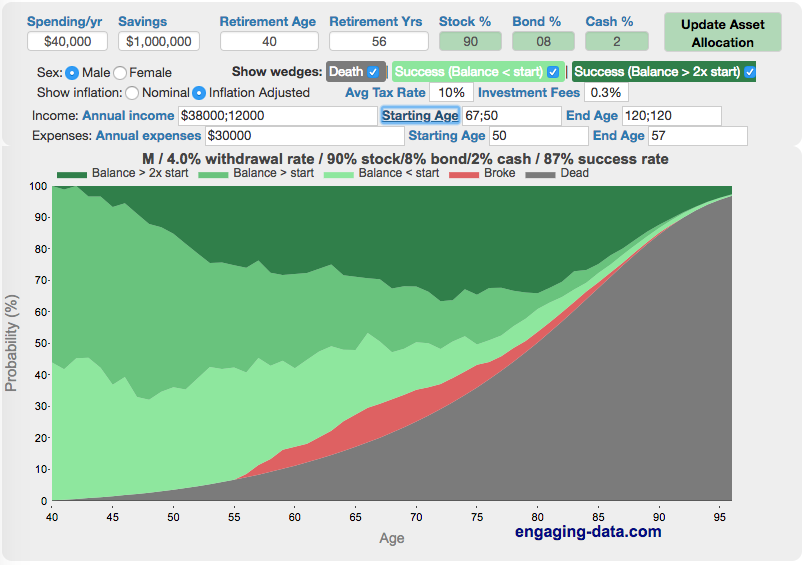

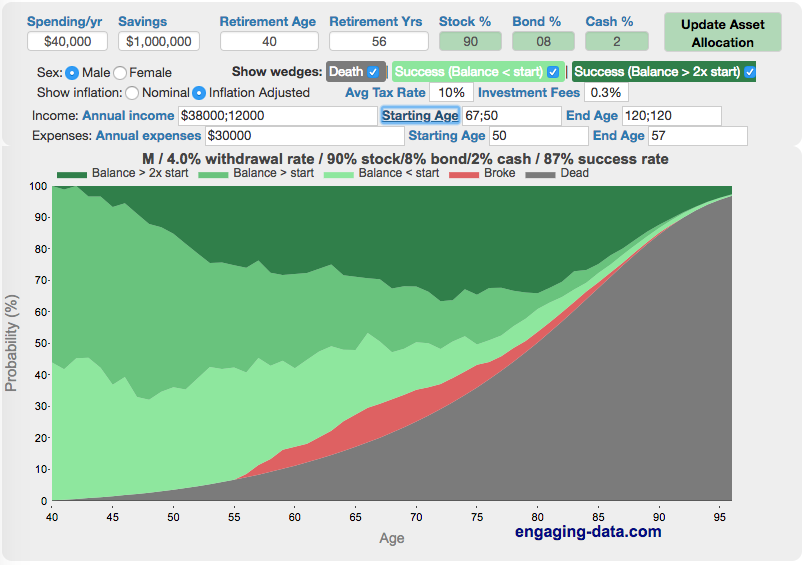

Rich, Broke or Dead – Early retirement and longevity

Visualizations involving maps and geographic data

Global Birth Map

Global Birth Map Splitting the US by Population

Splitting the US by Population

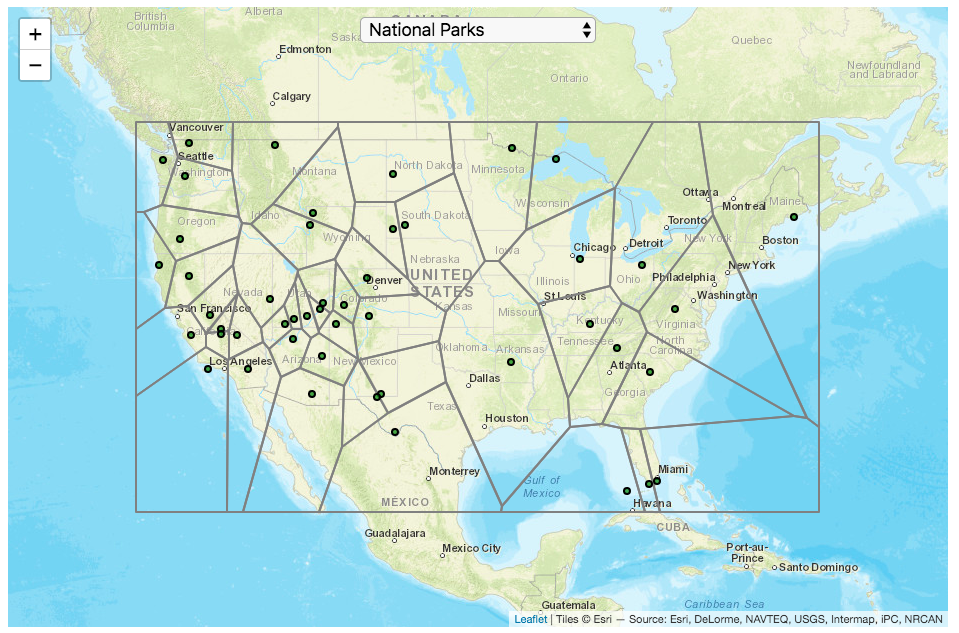

3D Elevation of National Parks

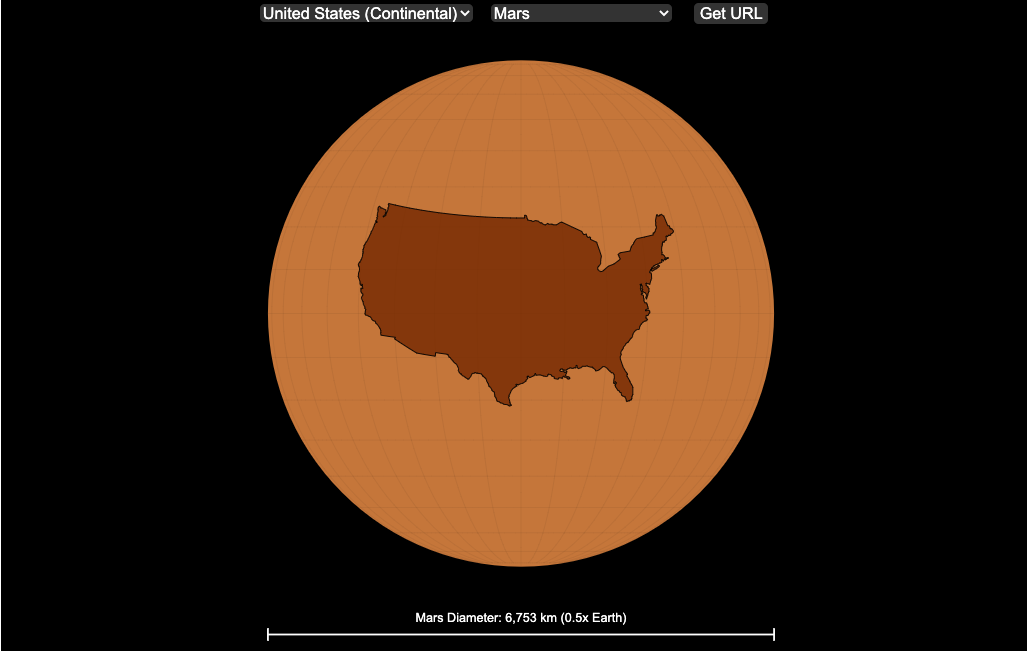

Mapping Countries onto Planets

Country-Centered Maps

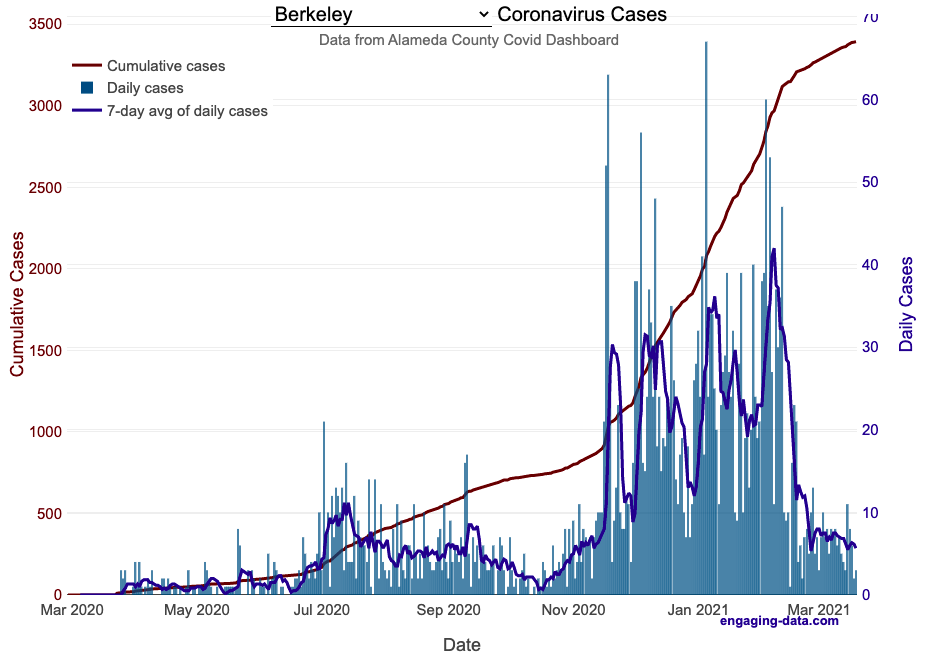

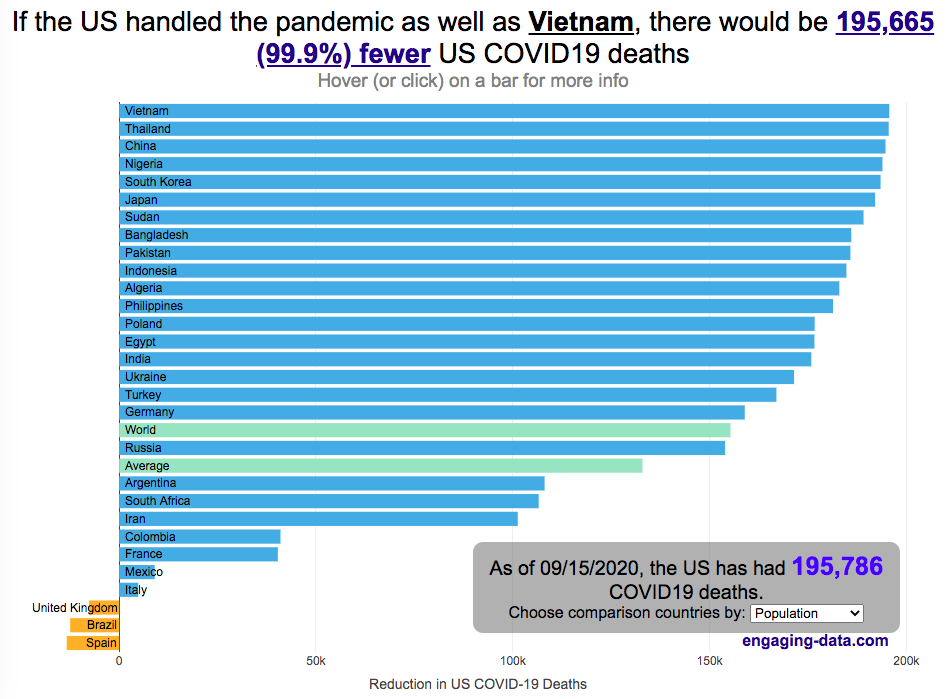

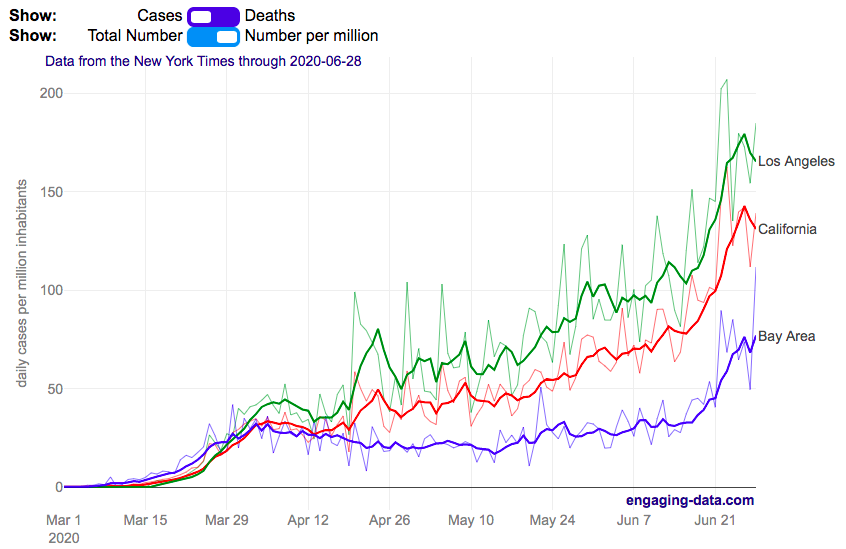

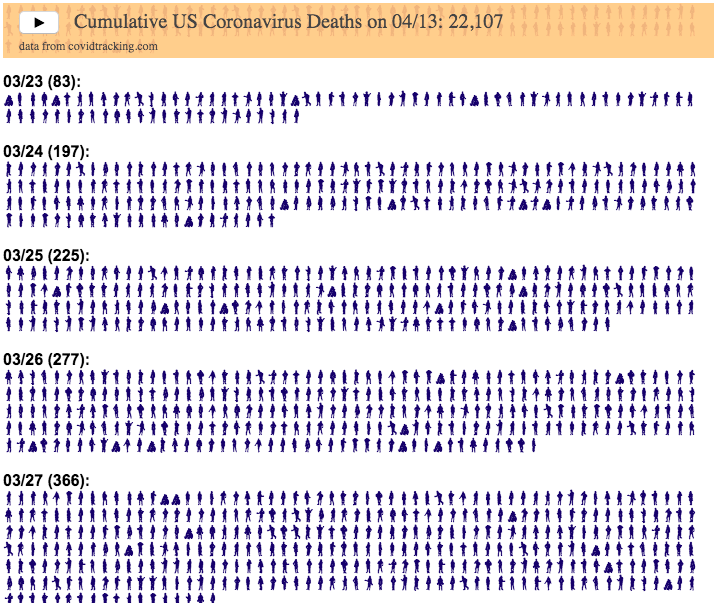

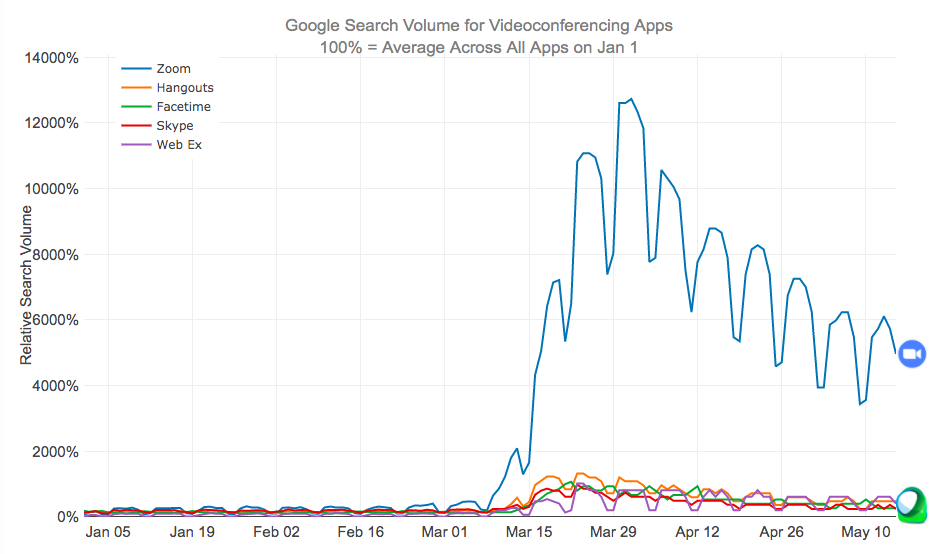

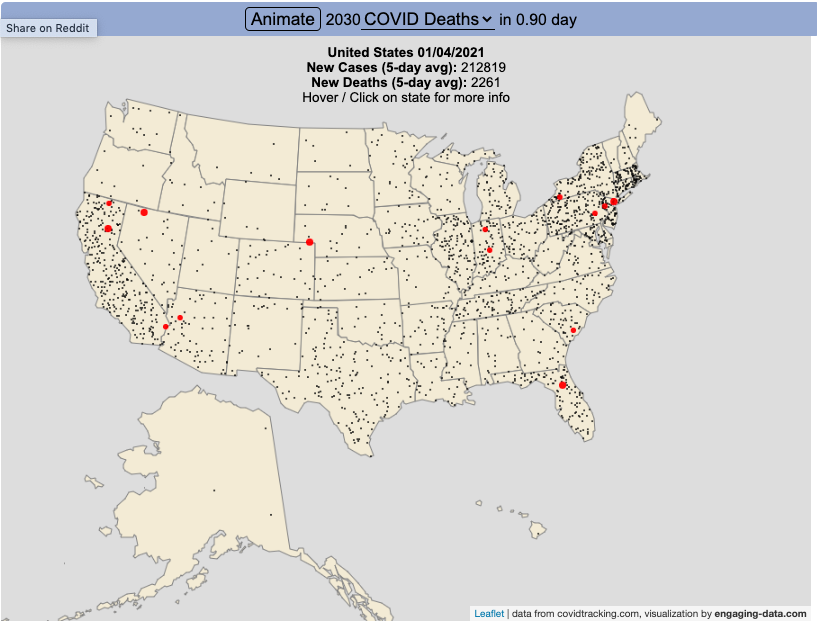

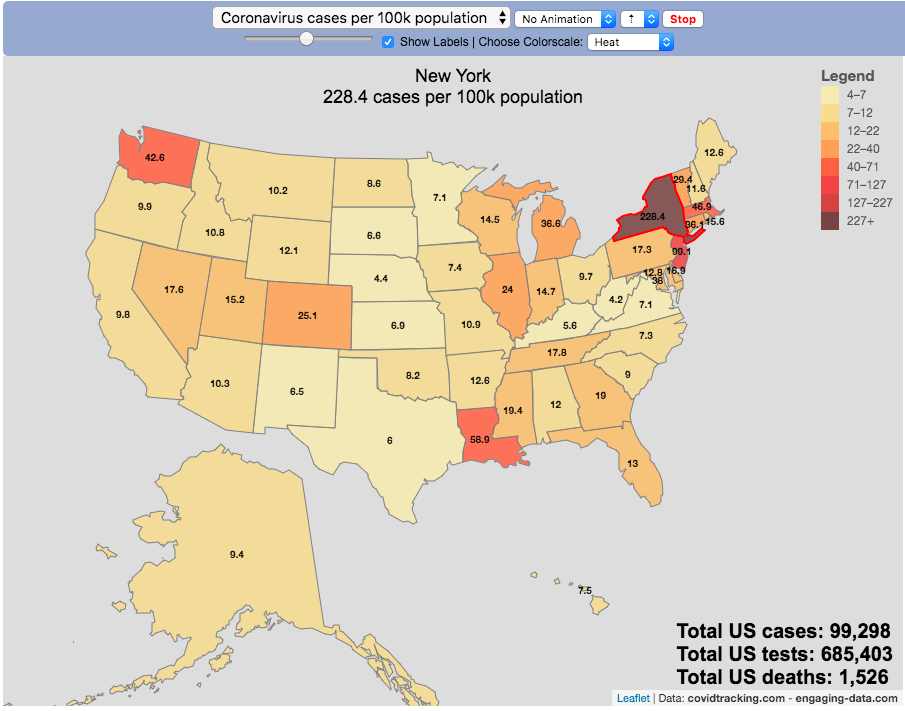

Animating US COVID cases/deaths

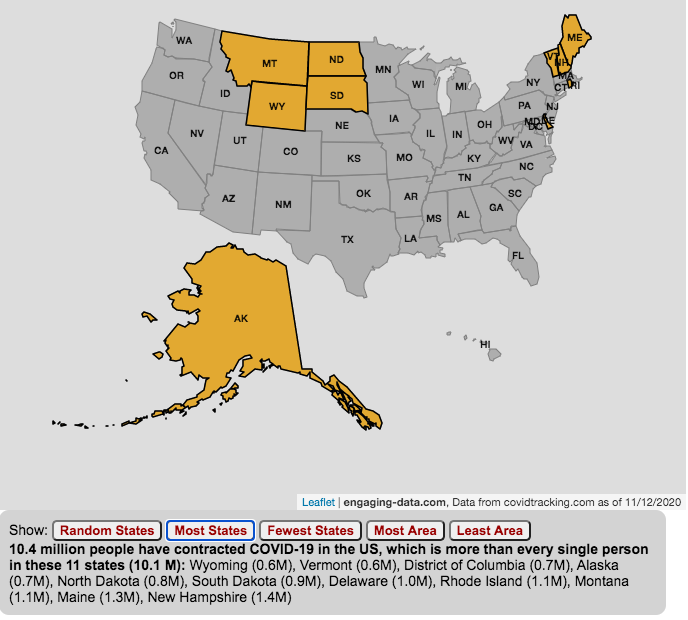

Number of US COVID cases

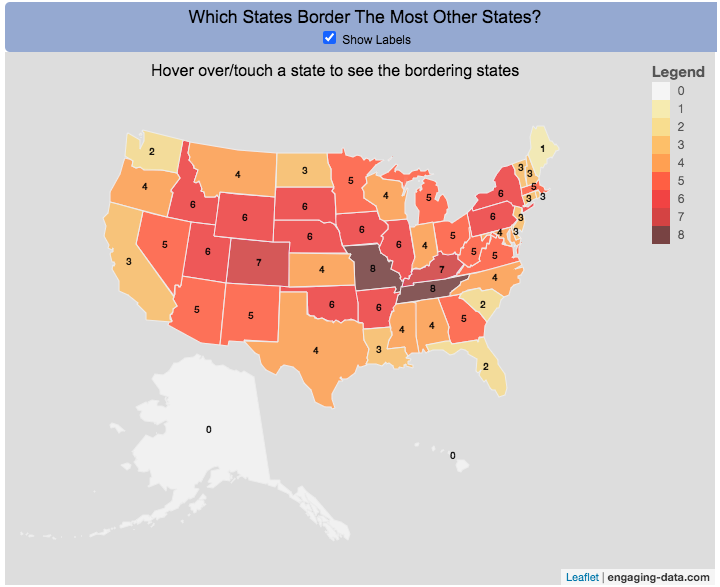

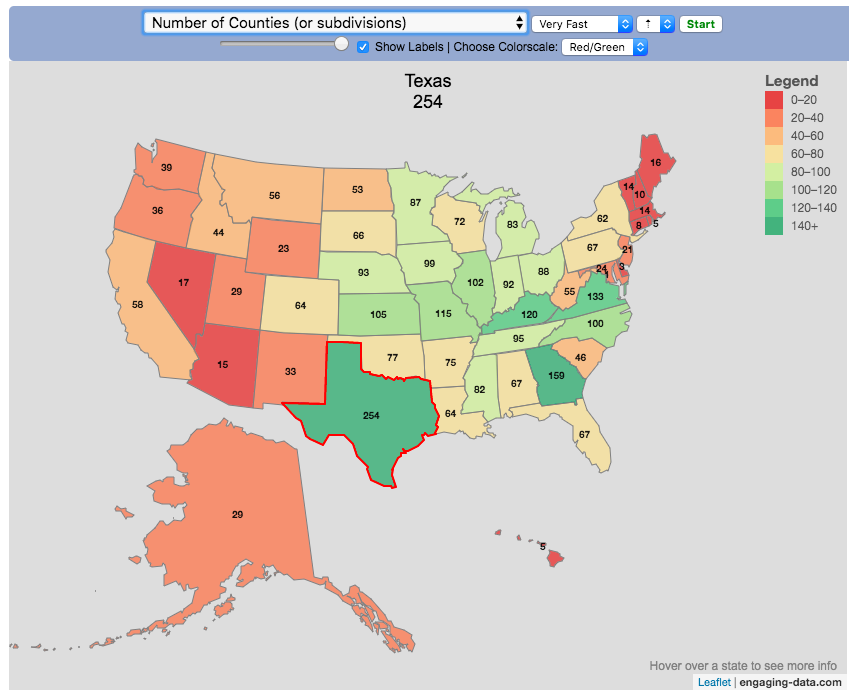

Which State Borders The Most Other States

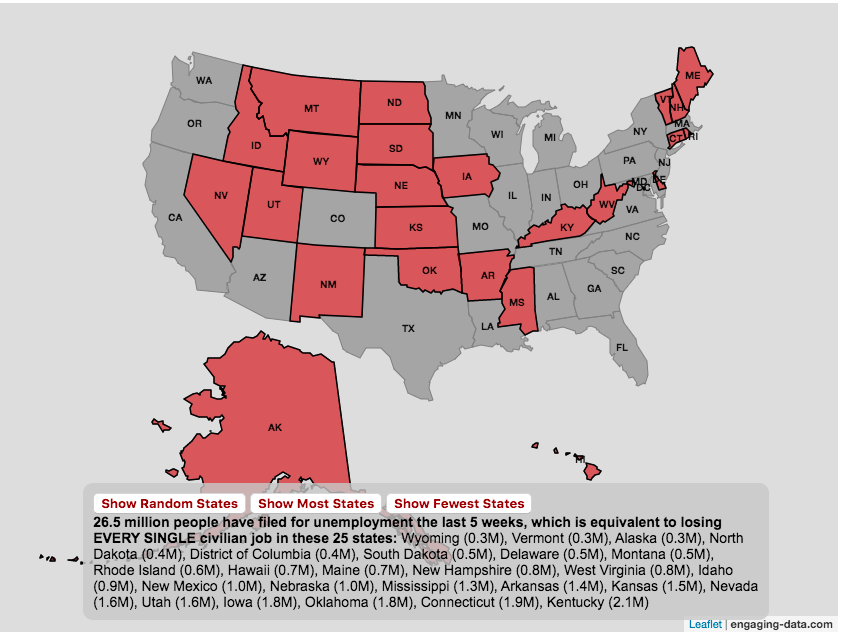

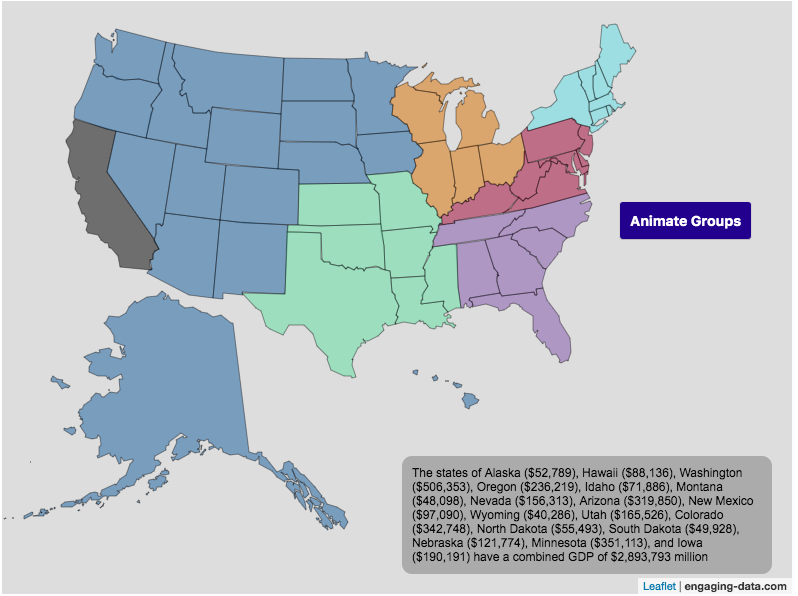

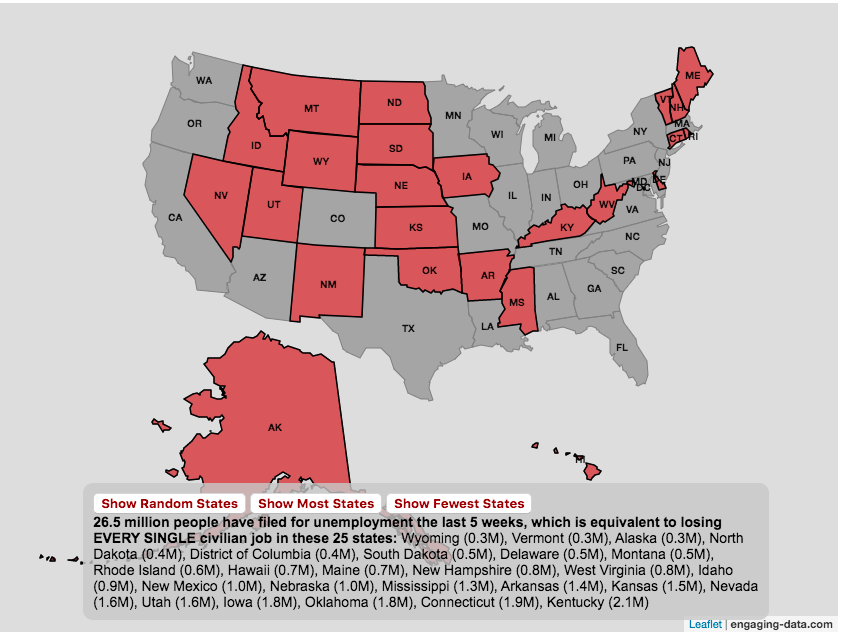

US Unemployment Equal to These States

US Coronavirus statistics by state

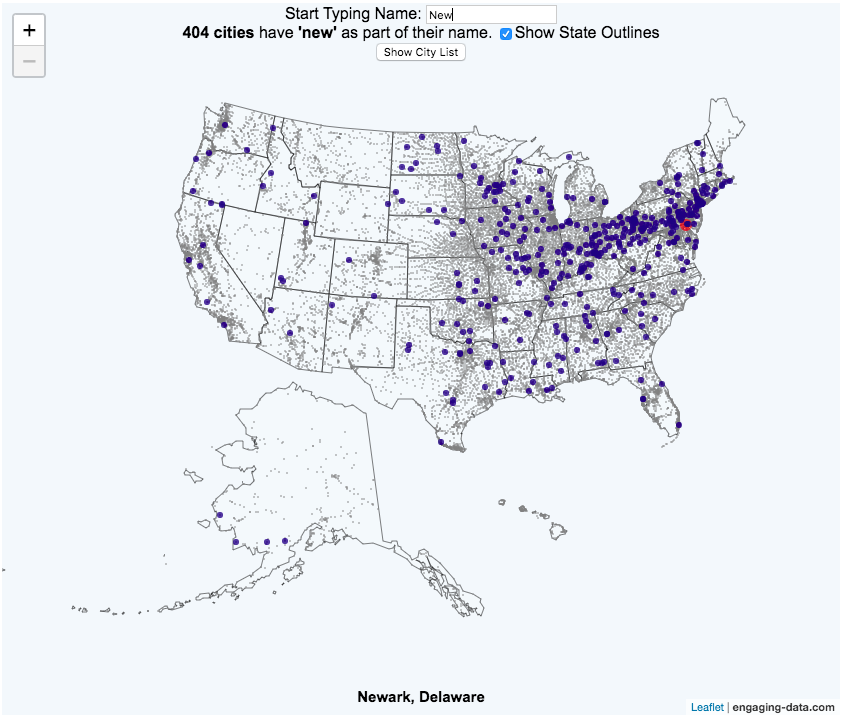

US City Name Map

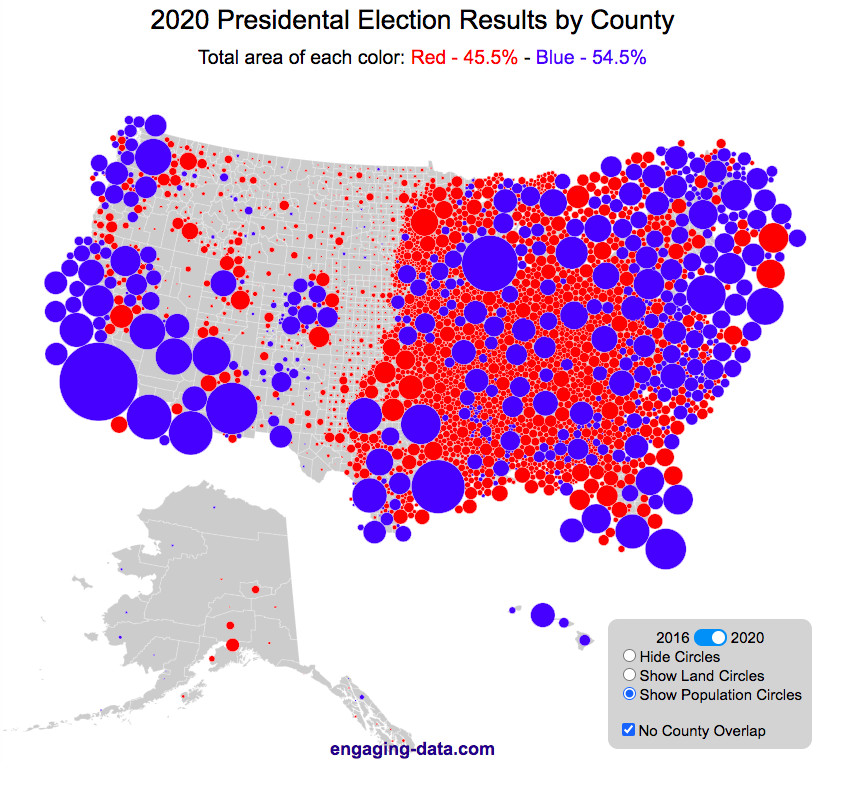

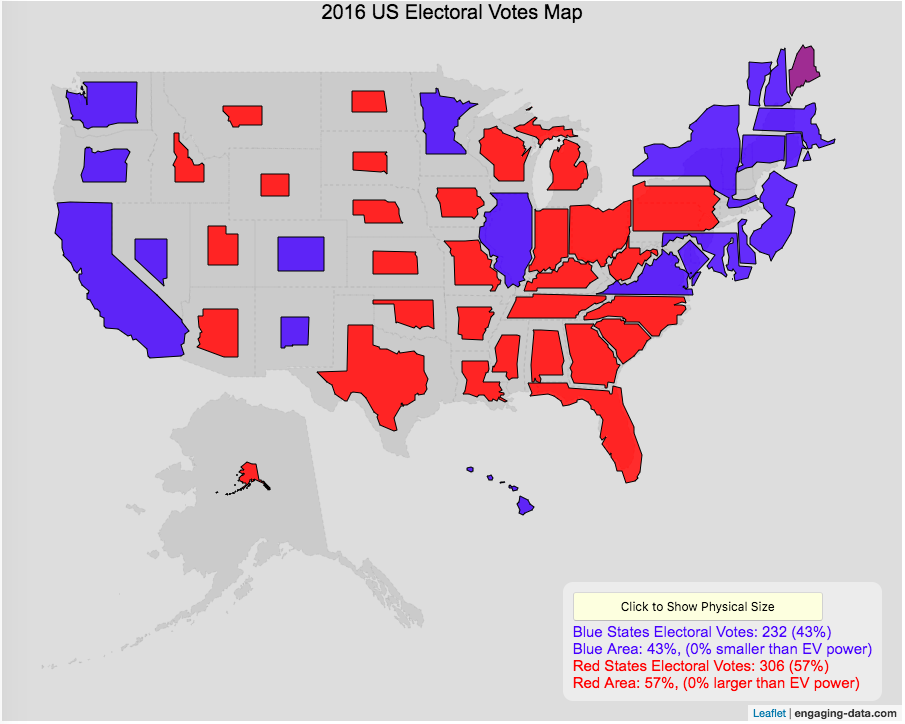

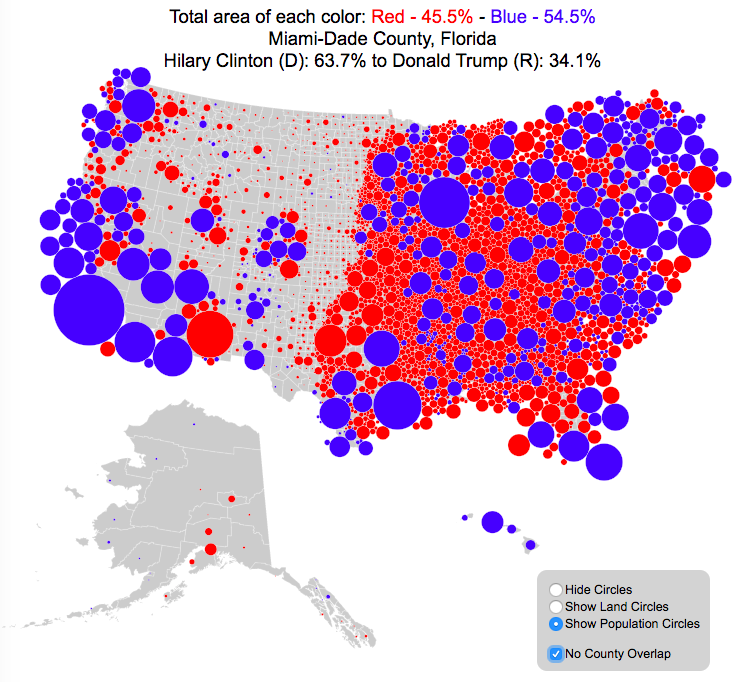

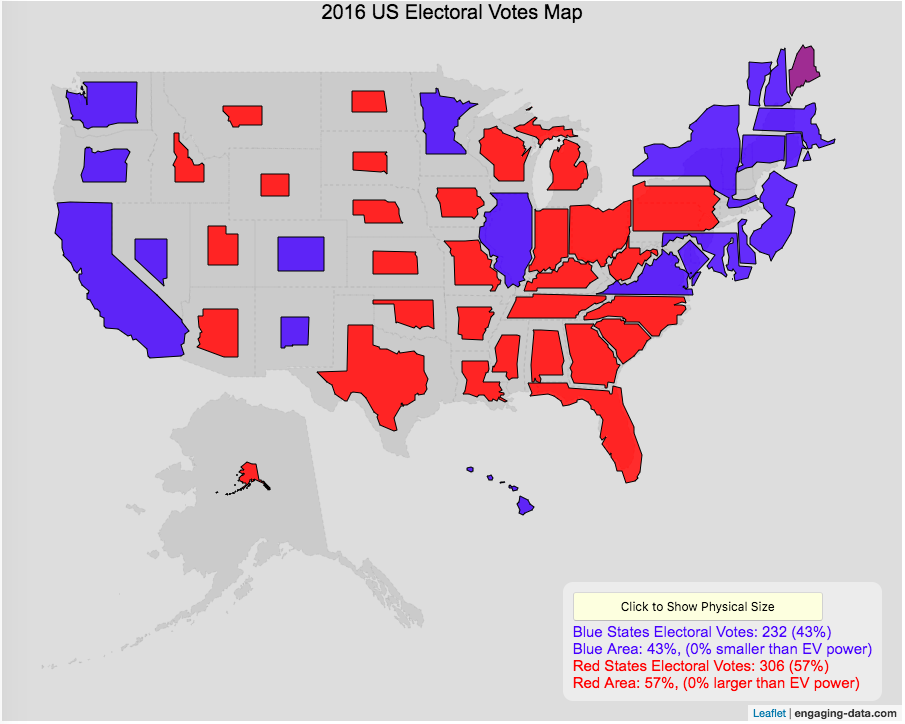

County Electoral Map – Land Area vs Population

Which National Park Is Closest To You?

Interactive US Zip Code Map

Assembling the USA state-by-state

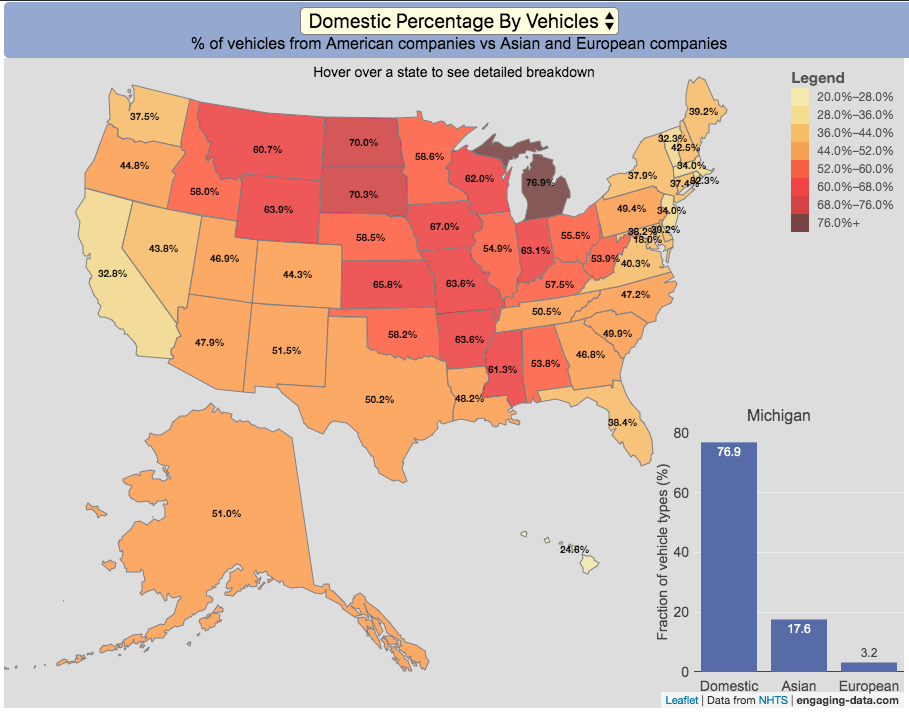

Kinds of cars and trucks by state

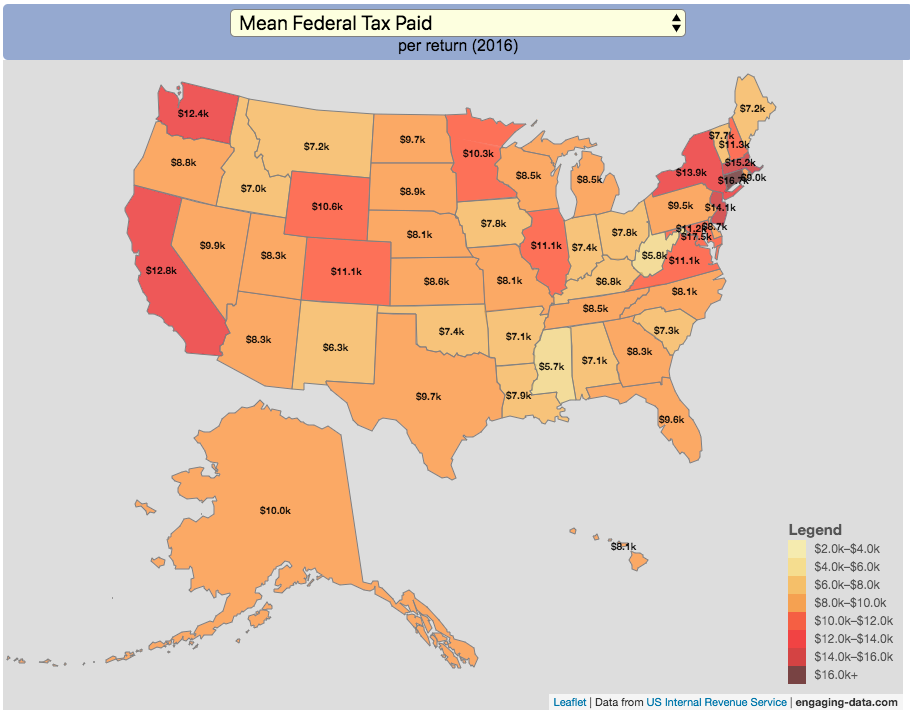

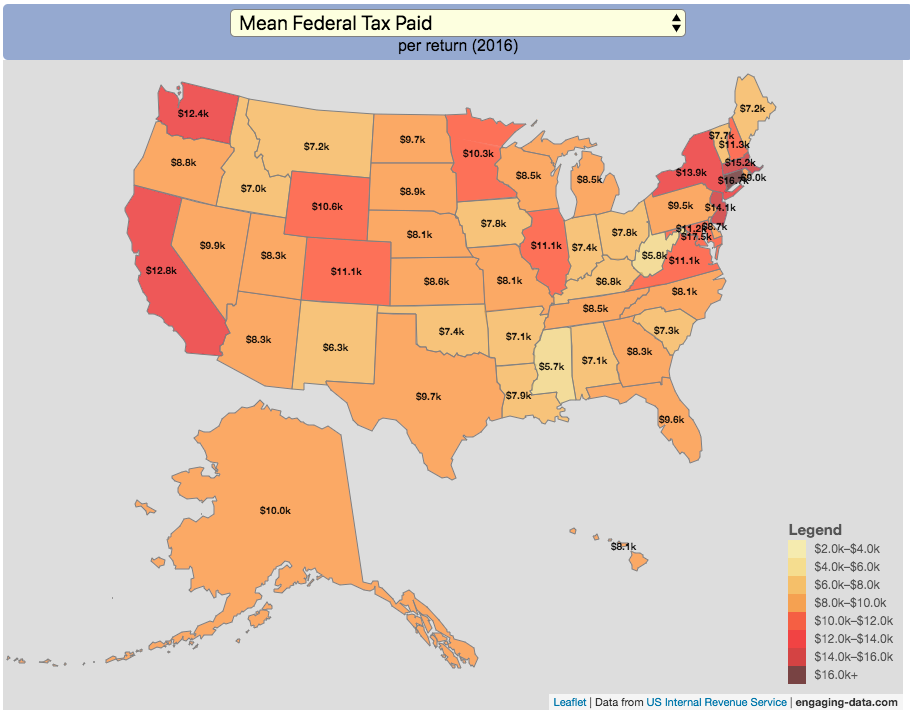

How much does each state pay in taxes

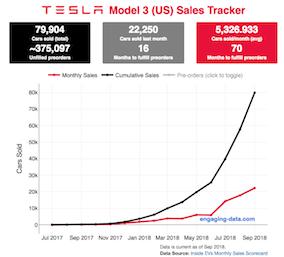

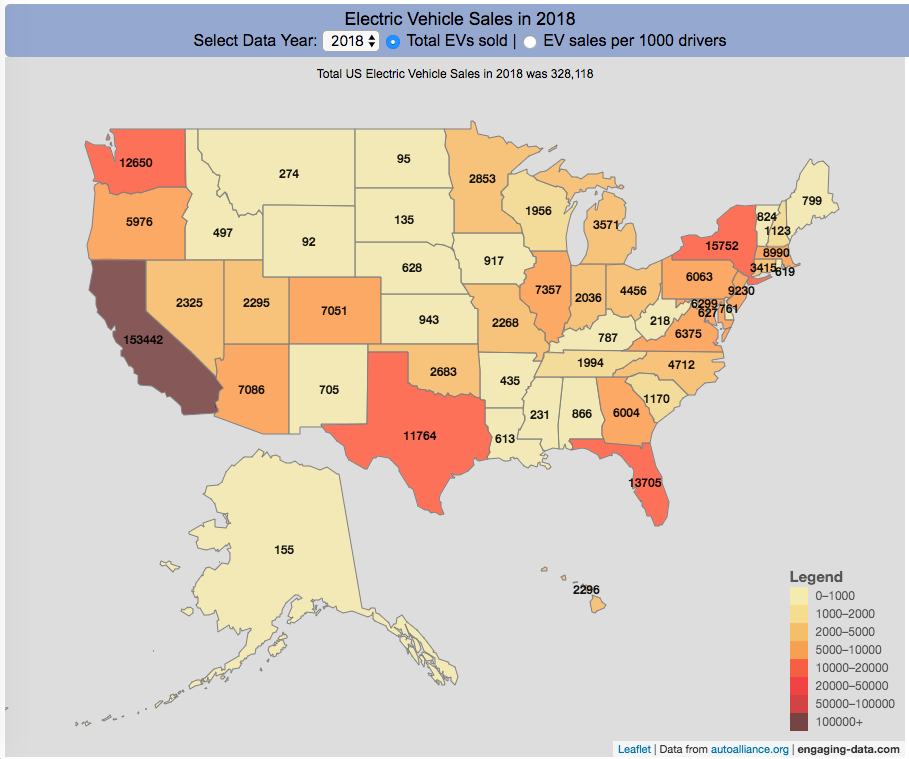

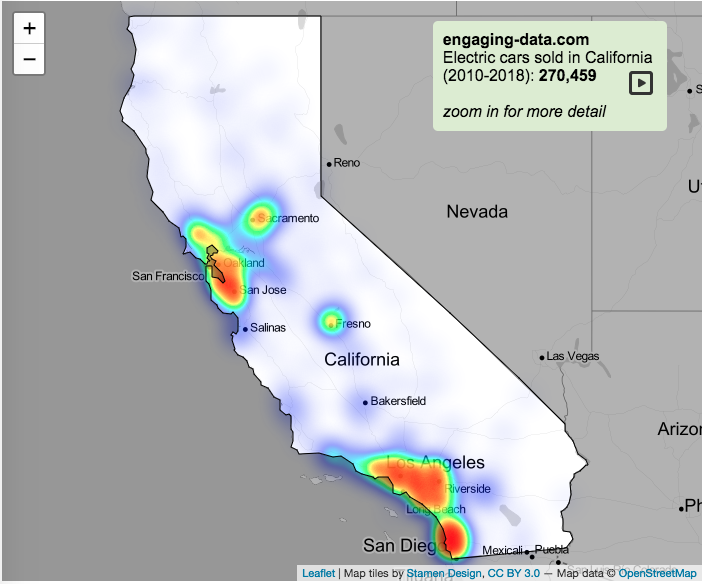

Electric vehicle sales by state States re-sized to electoral votes

States re-sized to electoral votes

Assembling the World Country-by-Country

Population by Latitude and Longitude

Size of California Economy

Heatmap of California Electric Vehicle Sales

Solar Intensity By Location and Time Antipodes map

Antipodes map

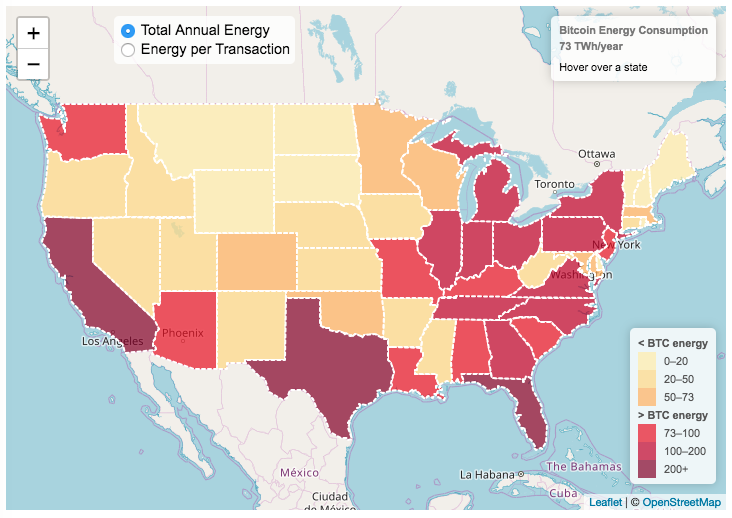

Bitcoin Energy Consumption vs Your State Mercator country size distortion

Mercator country size distortion States re-sized to match population

States re-sized to match population College admissions by state

College admissions by state

Which states are the most stressed?

These visualizations are about Earth’s environment

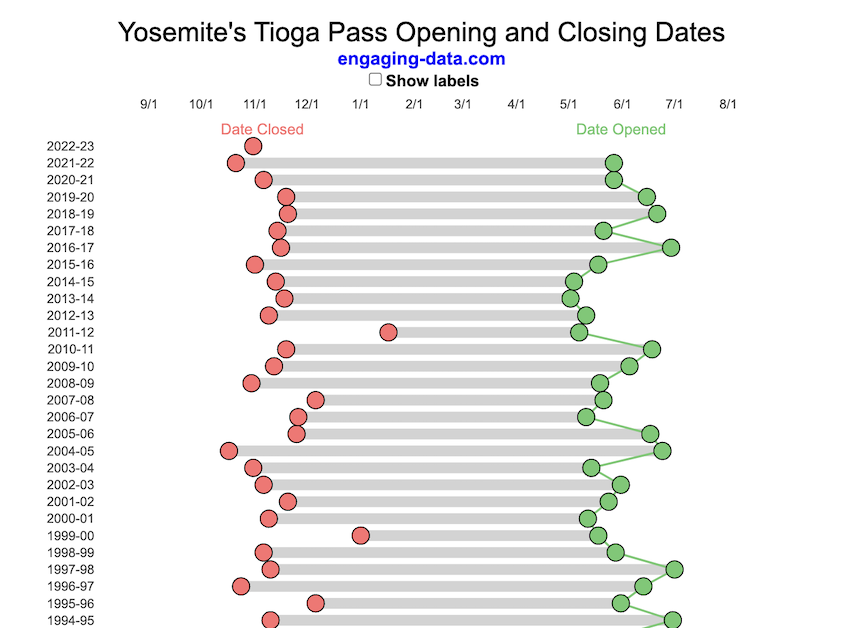

Tioga Pass Opening Dates

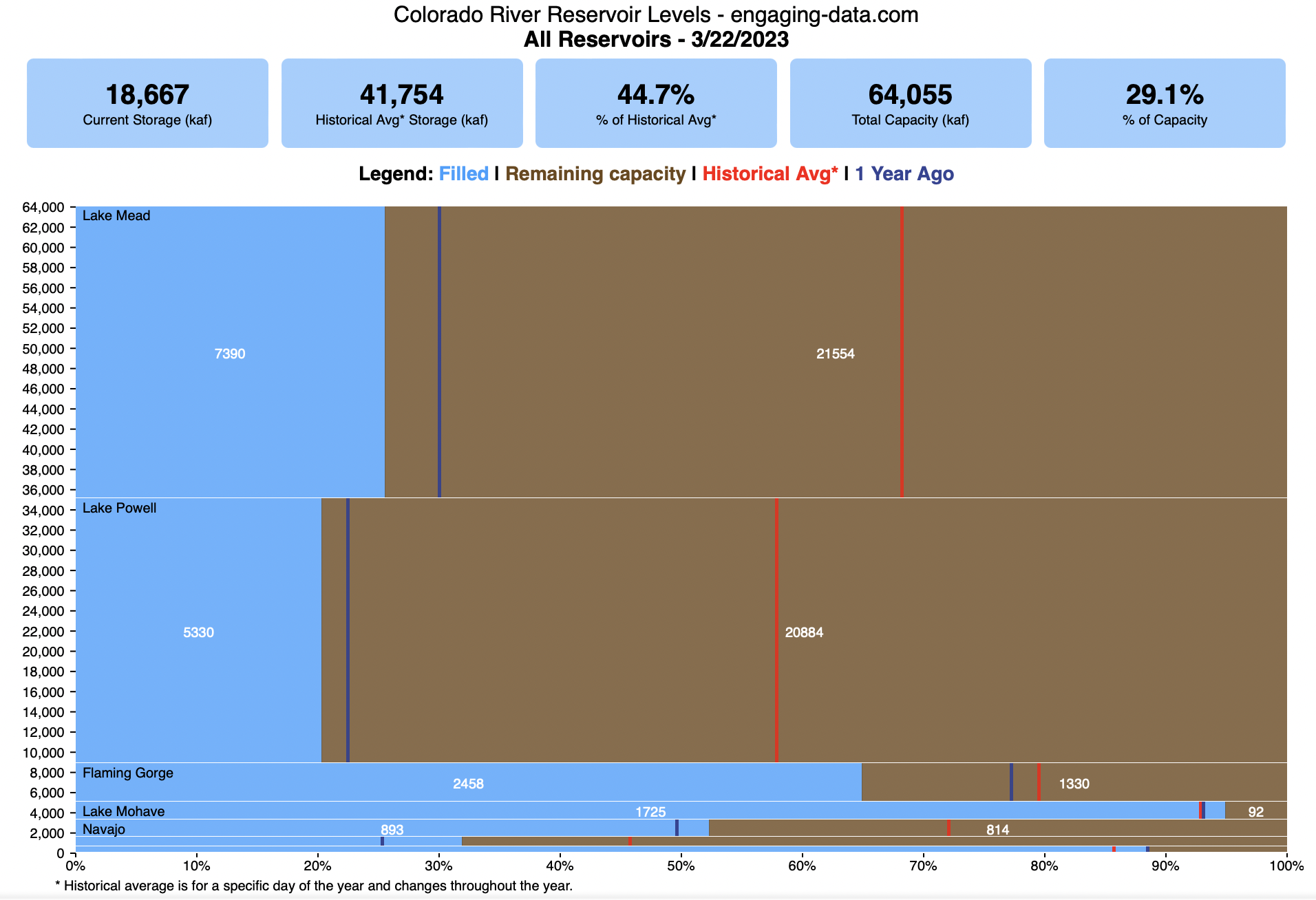

Colorado River Reservoir Levels

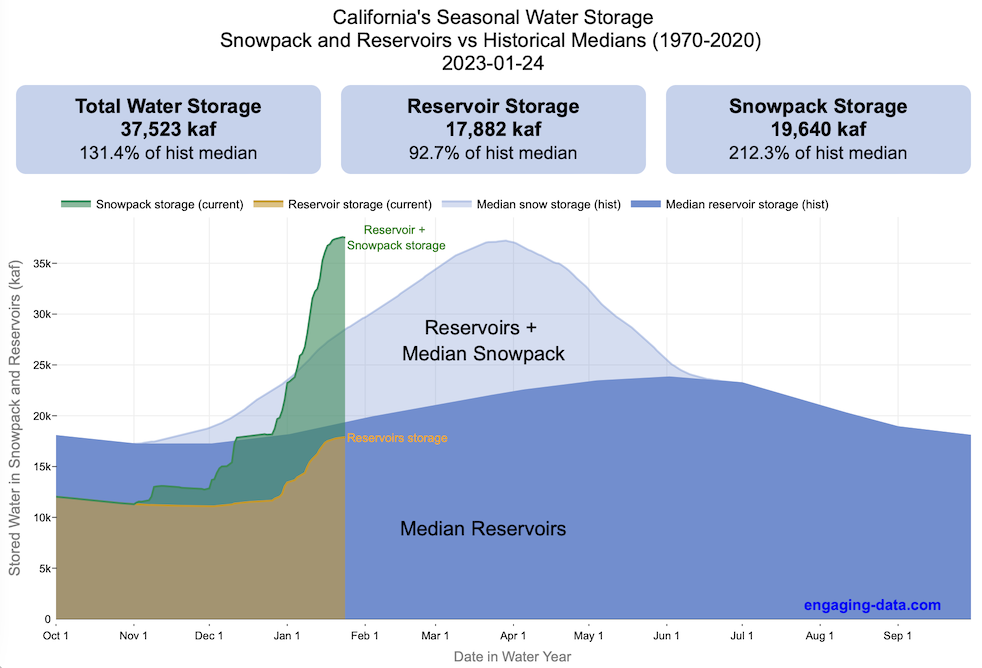

California Reservoirs and Snowpack

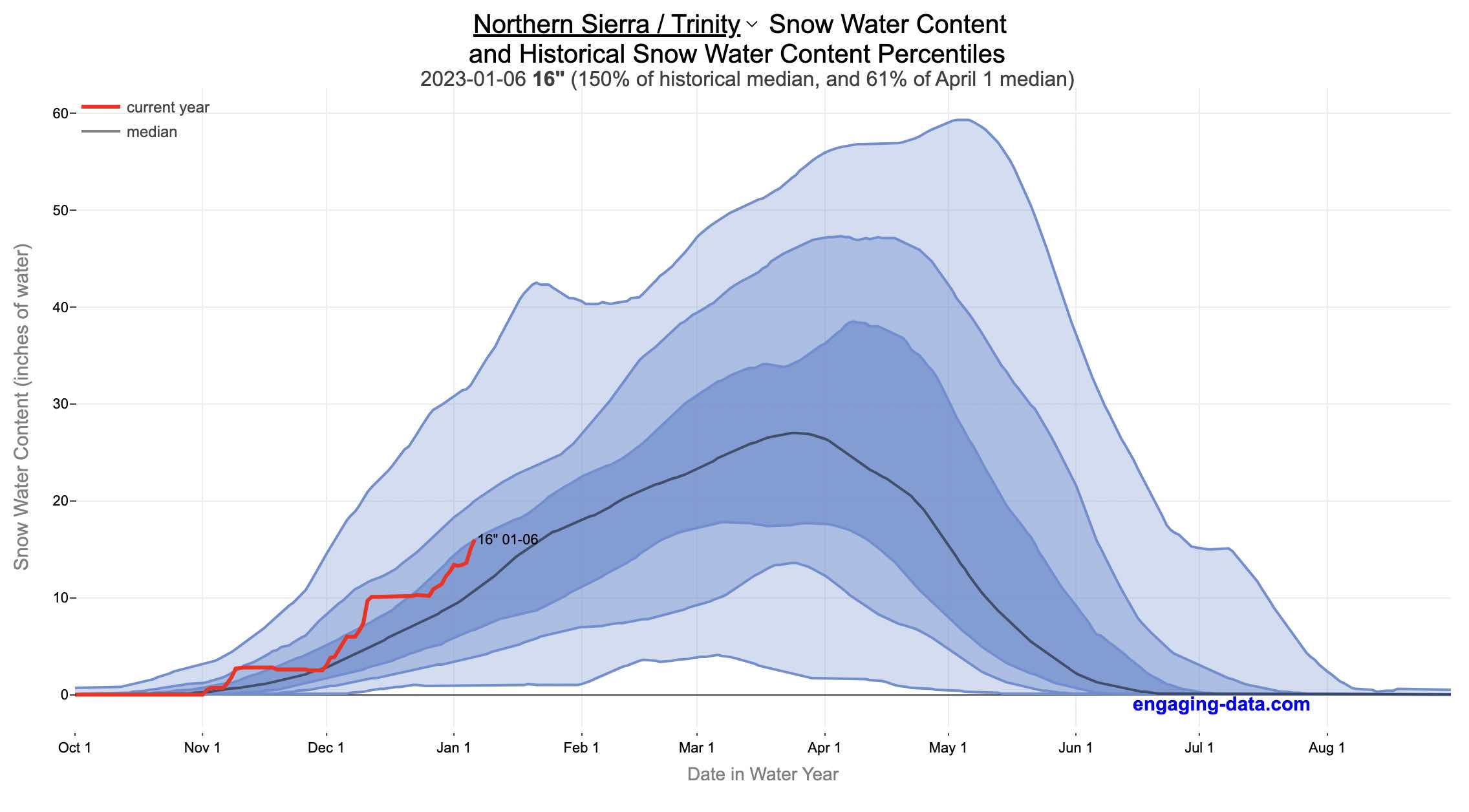

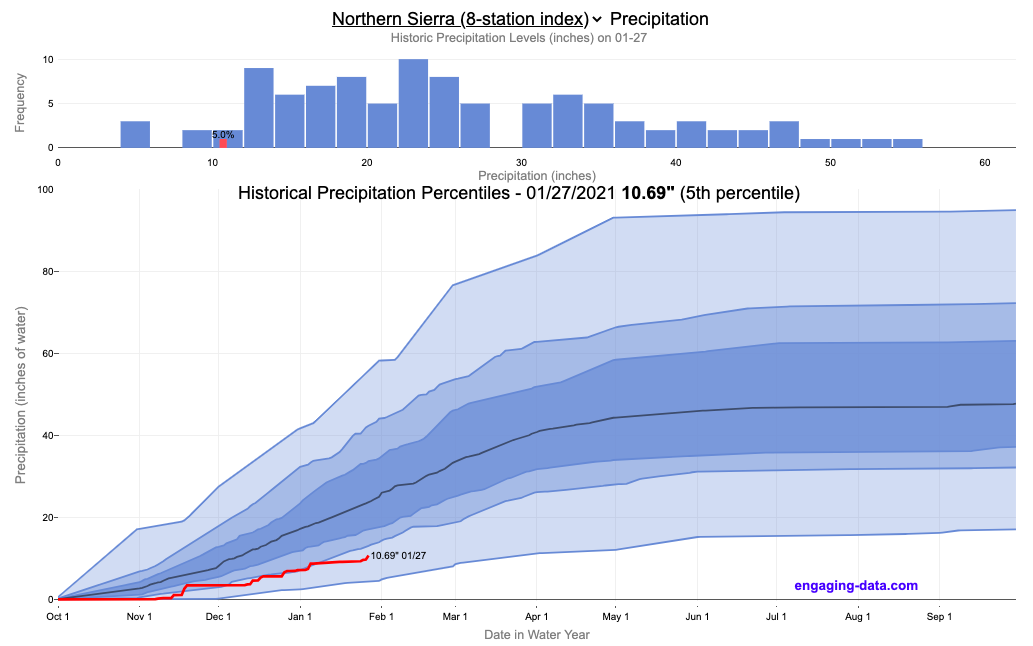

California Snowpack Levels

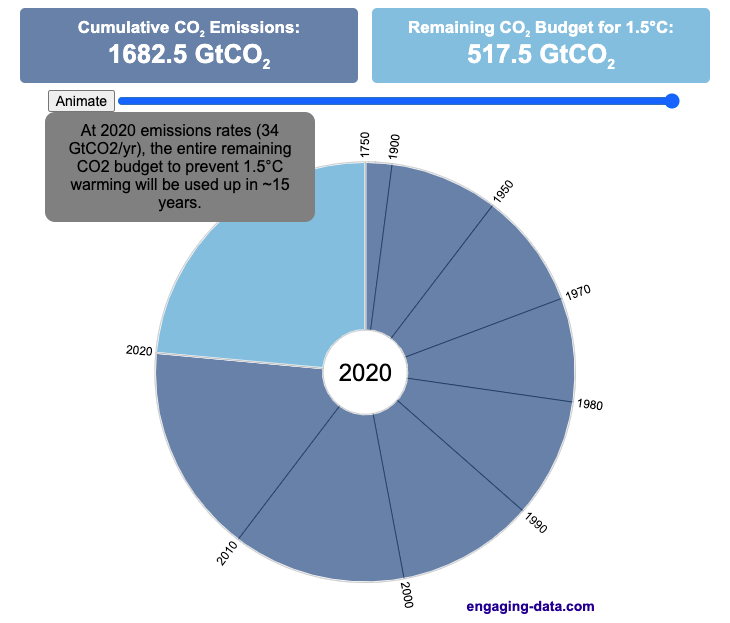

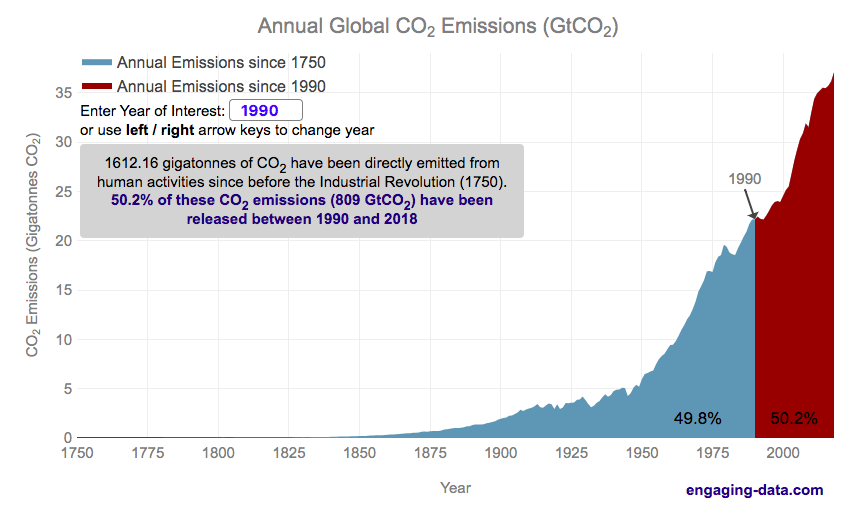

Using up our Carbon Budget

California Rainfall Totals

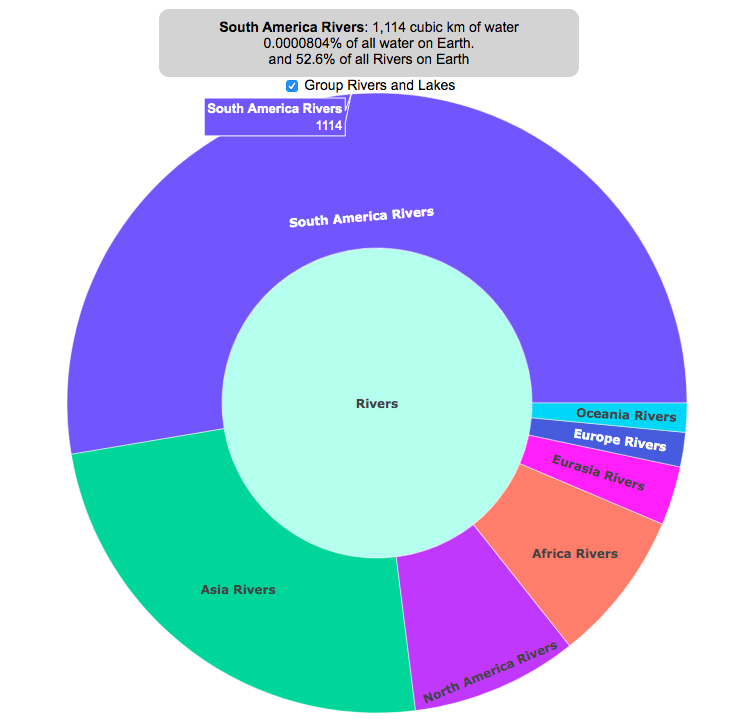

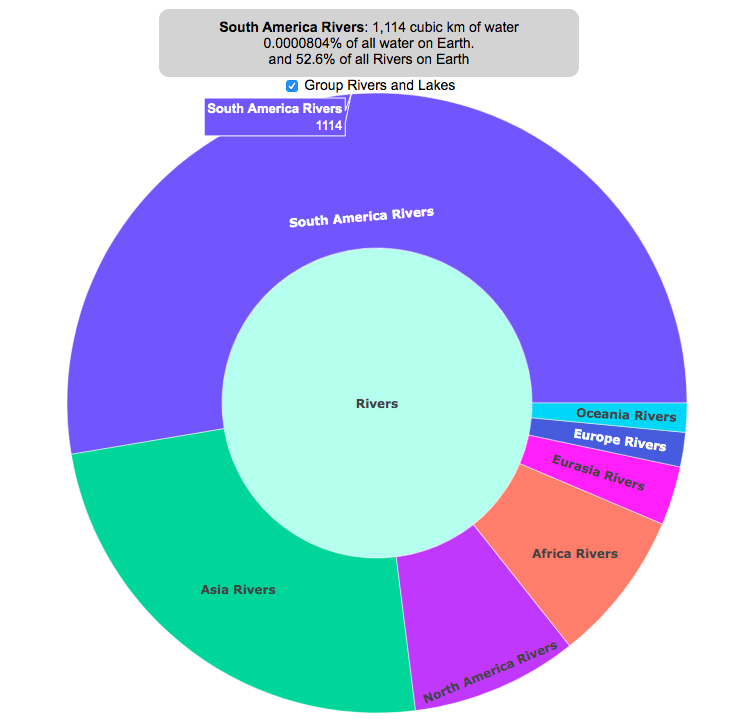

Where is all the water on Earth?

CO2 Emissions Since You Were Born

Airplane Flight Emissions

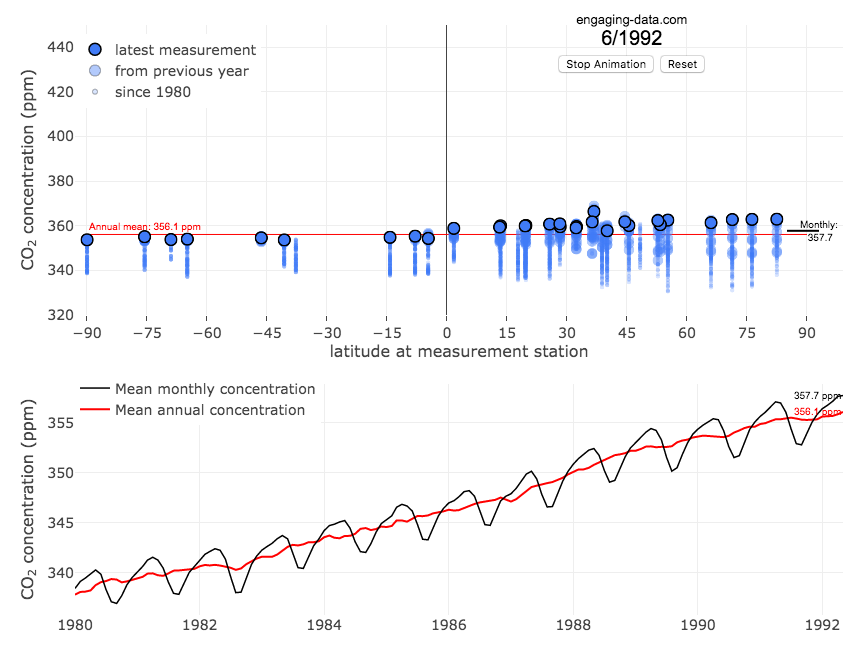

CO2 Concentration Animation

California Reservoir Dashboard How much water is in California reservoirs?

How much water is in California reservoirs?

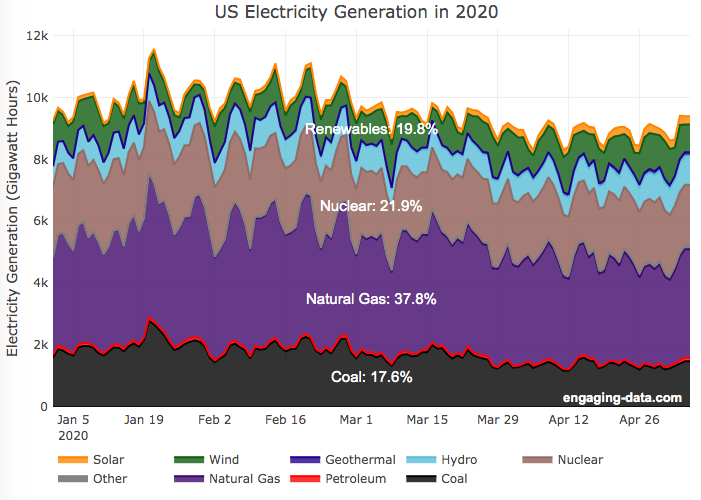

These visualizations focus on energy production and usage

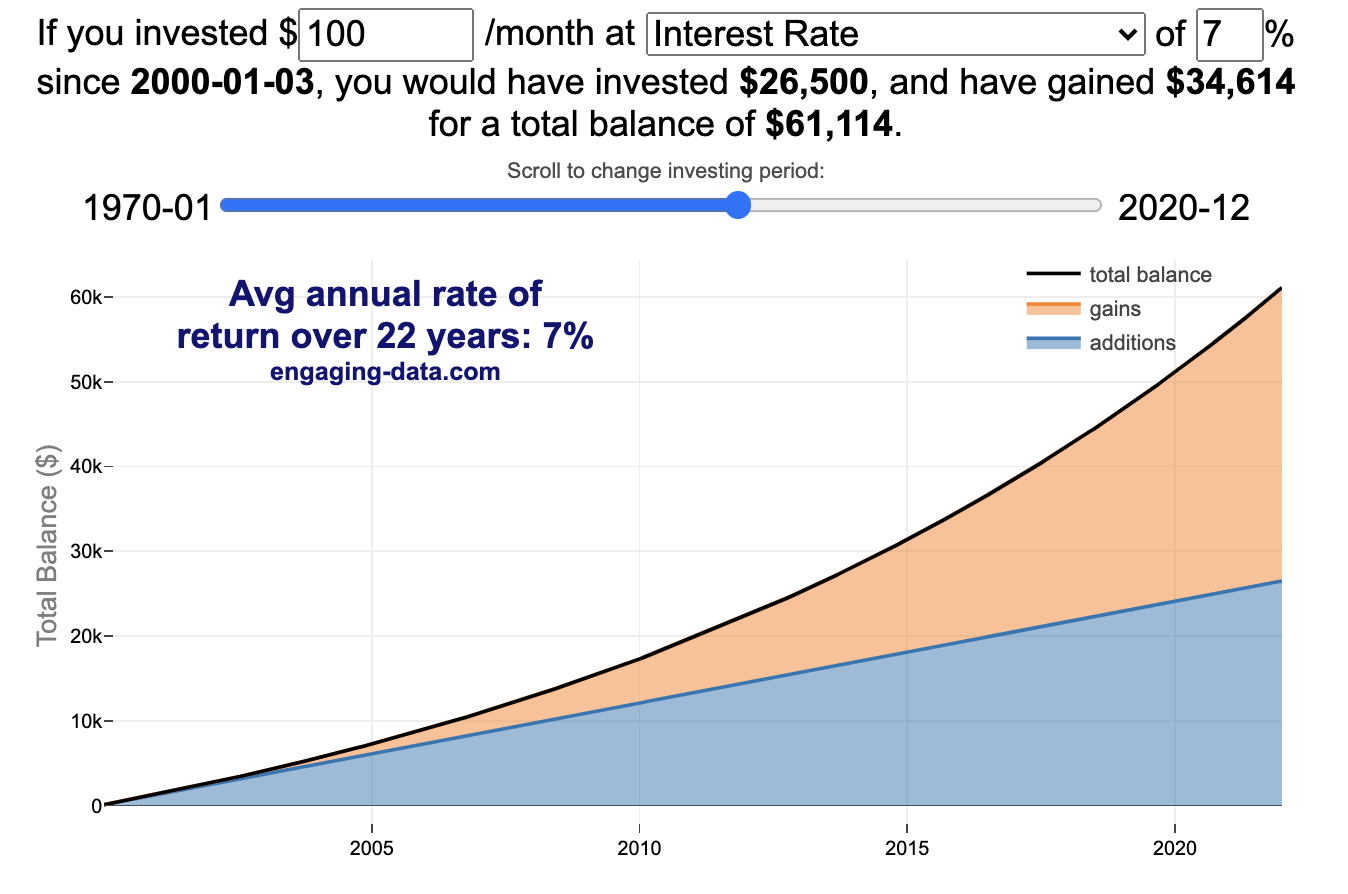

These visualizations and tools focus on financial topics including financial independence, stock market investing, US taxes, and budgeting and spending.

Compound Interest and Stock Returns Calculator

Early Retirement Calculators and Tools

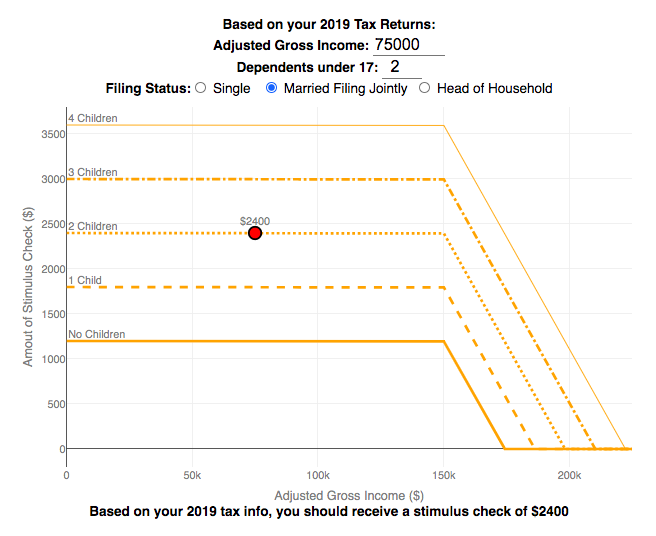

2020 2nd Stimulus Check Calculator

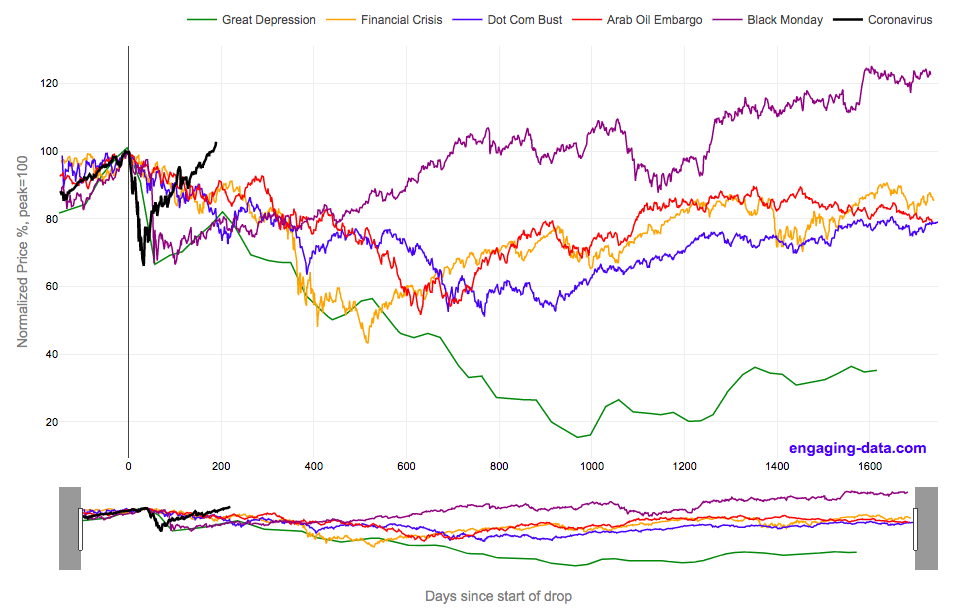

2020 Stock Market Drop vs Other Bear Markets

US Unemployment Equal to These States

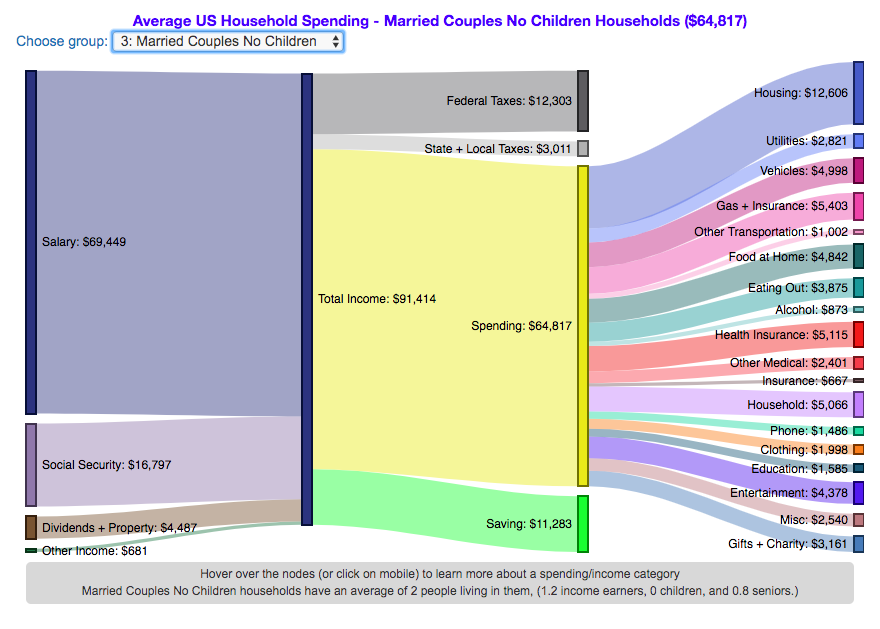

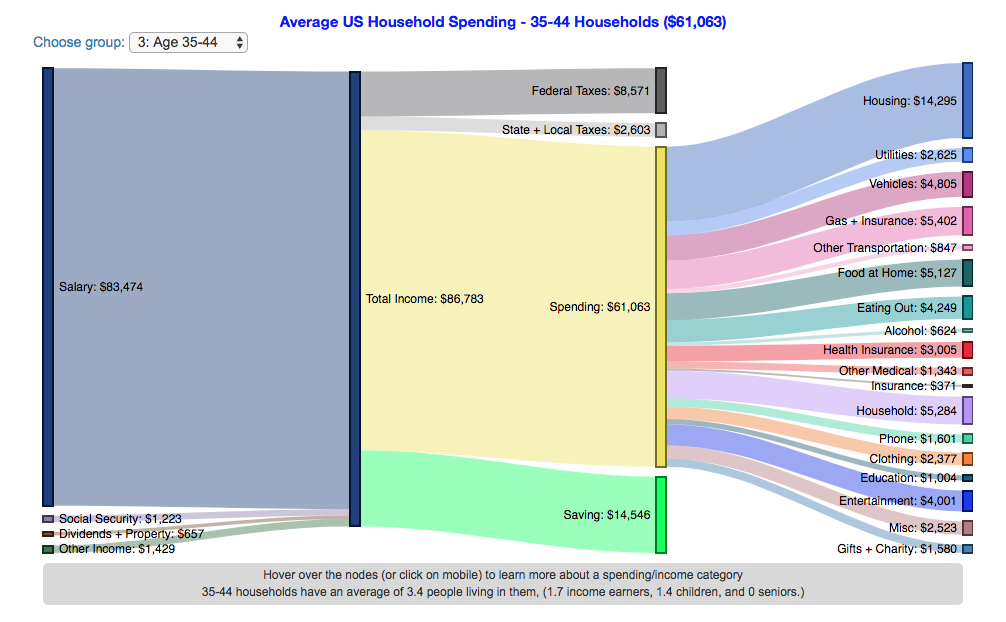

Household Spending By Household Composition

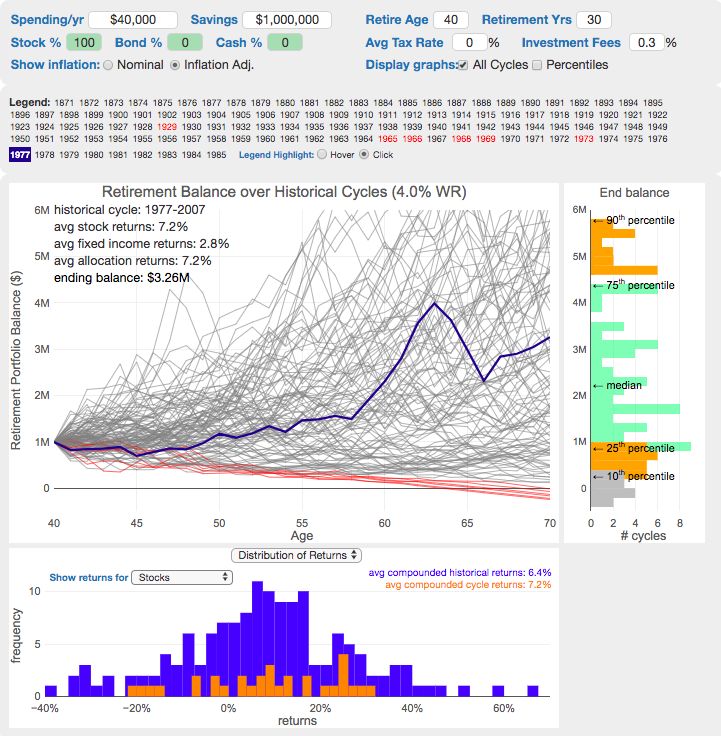

Visualizing the 4% Rule

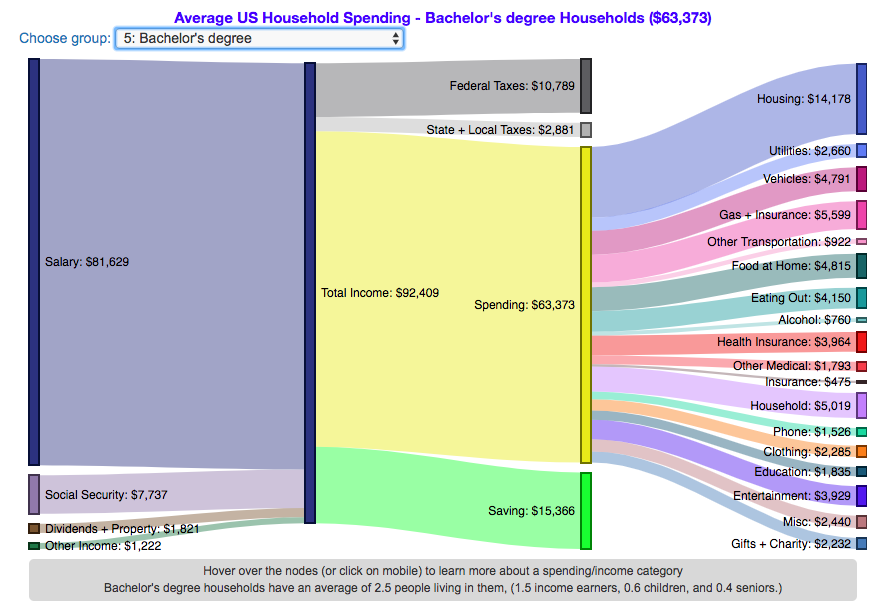

US Household Spending By Education Level

How much does each state pay in taxes

US Household Spending By Age

US Household Spending By Income Group

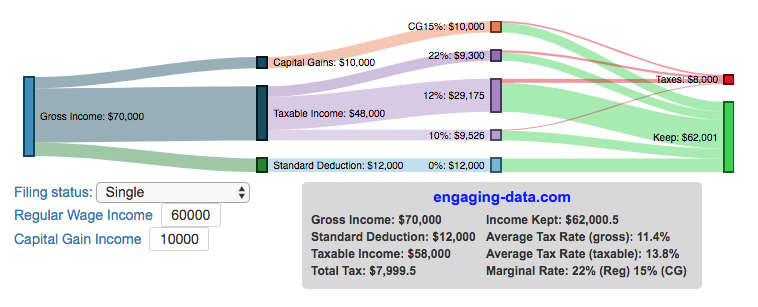

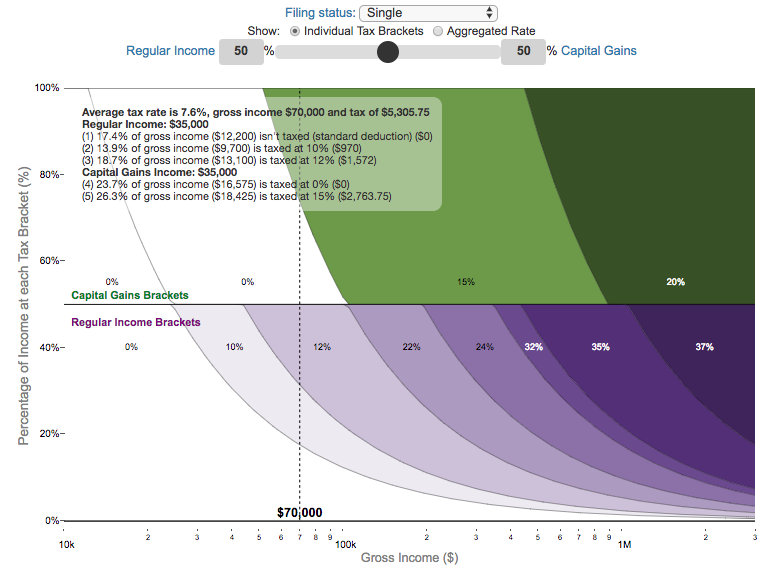

Income Tax Bracket Visualizer

Understanding Marginal Tax Rates

Early retirement calculator – When can I retire?

Rich, Broke or Dead – Early retirement and longevity

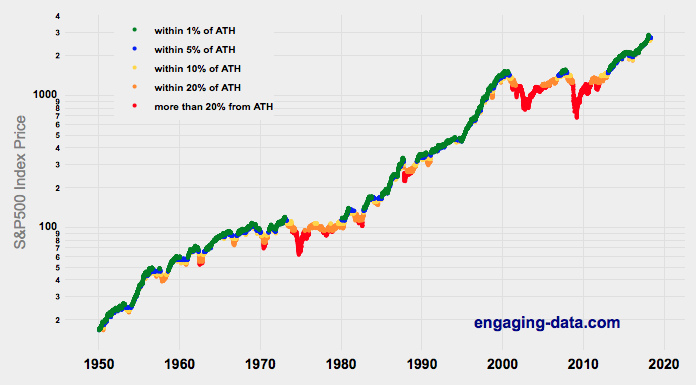

Invest when market is at an all-time-high?

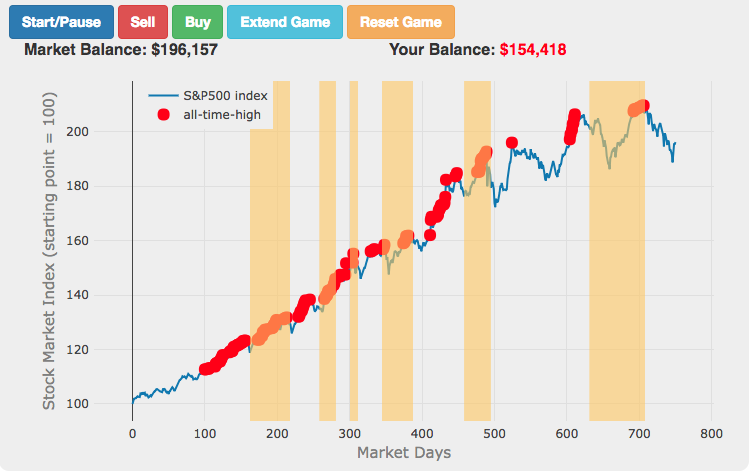

Stock market timing game

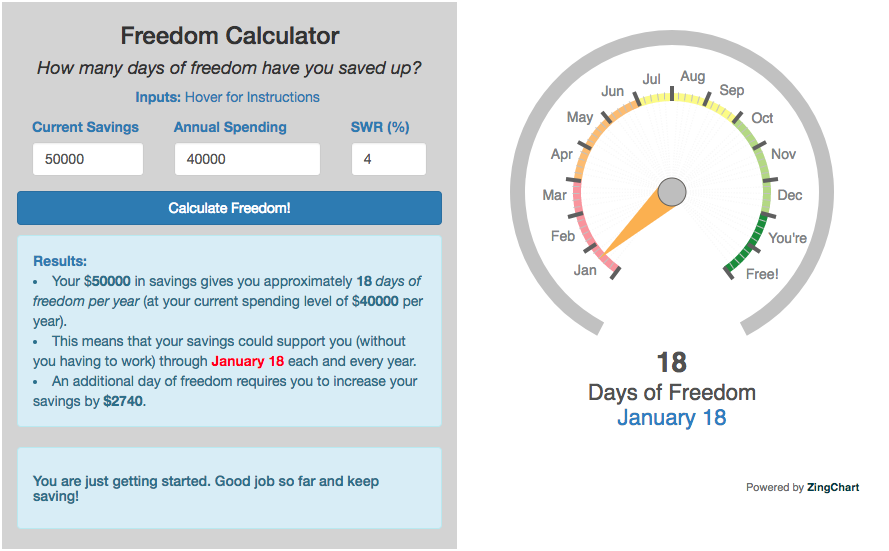

Financial freedom calendar

These visualizations focus on US politics and societal issues.

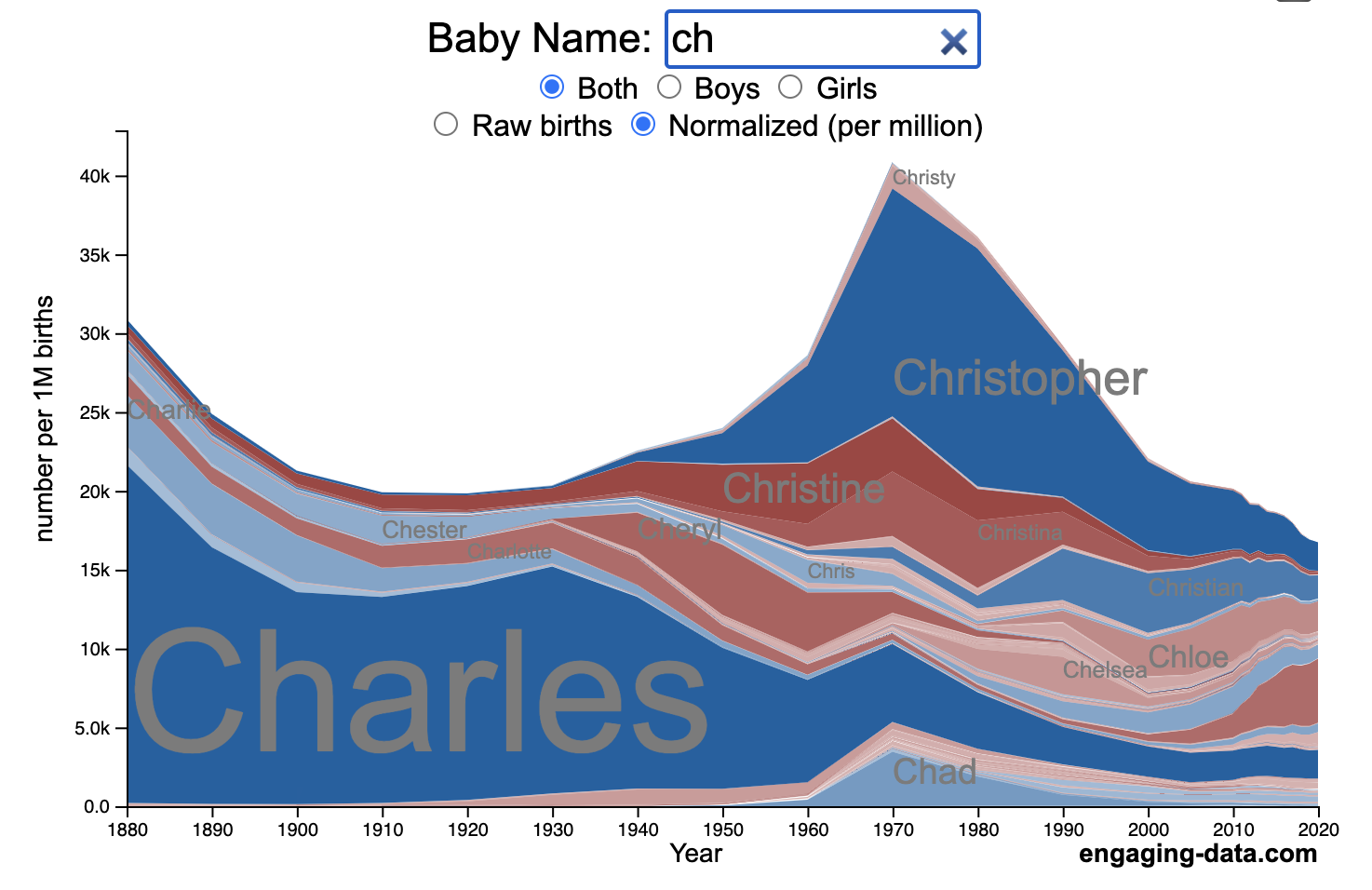

Baby name popularity visualizer

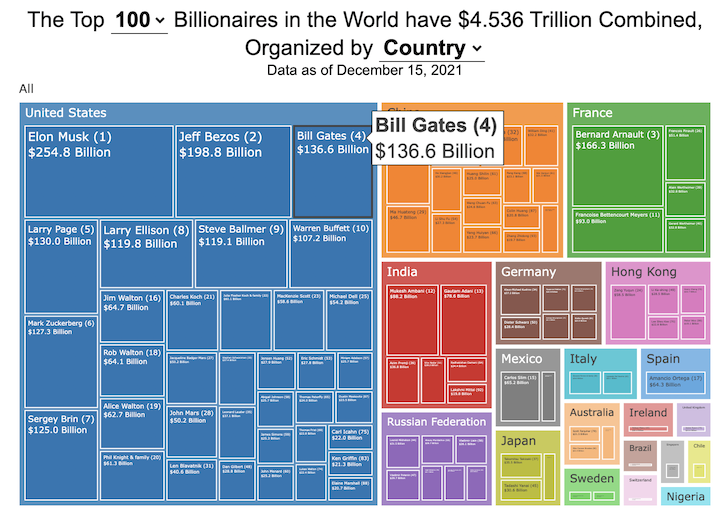

Baby name popularity visualizer How rich are the top billionaires?

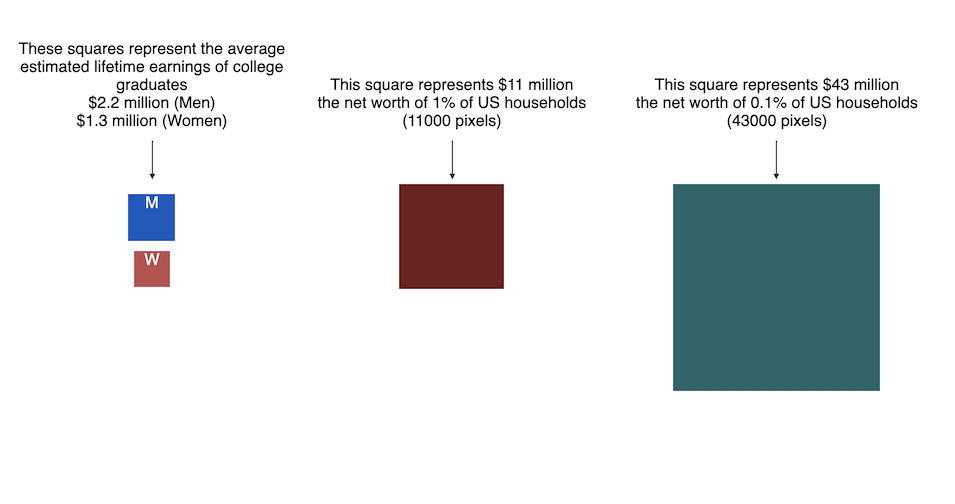

How rich are the top billionaires? How Rich is Elon Musk? shown in pixels

How Rich is Elon Musk? shown in pixels

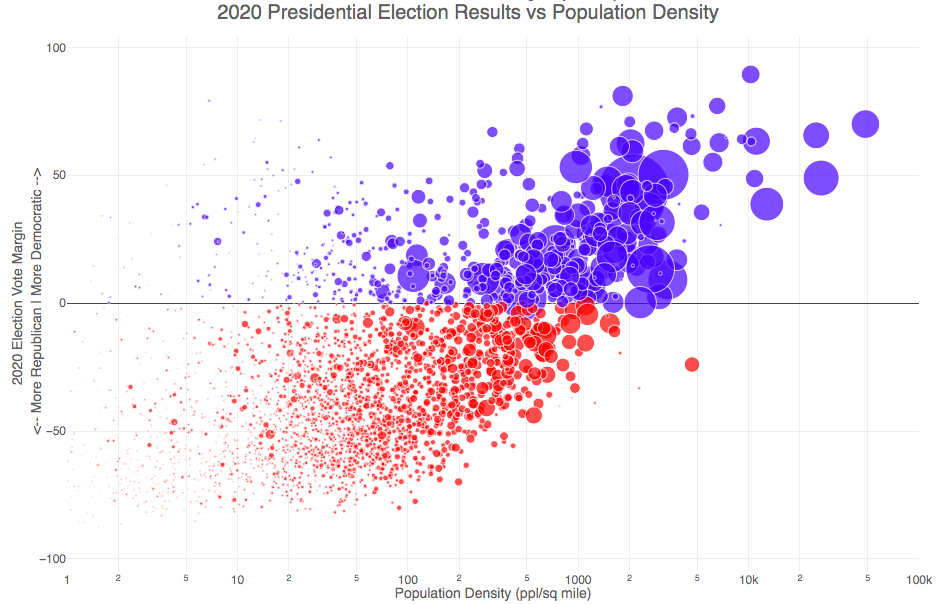

Election by Population Density

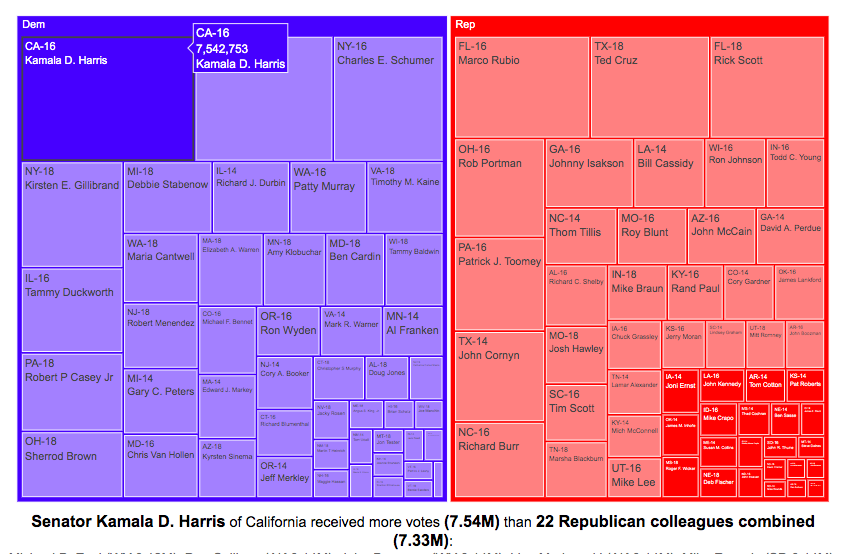

Vote Totals by Senator

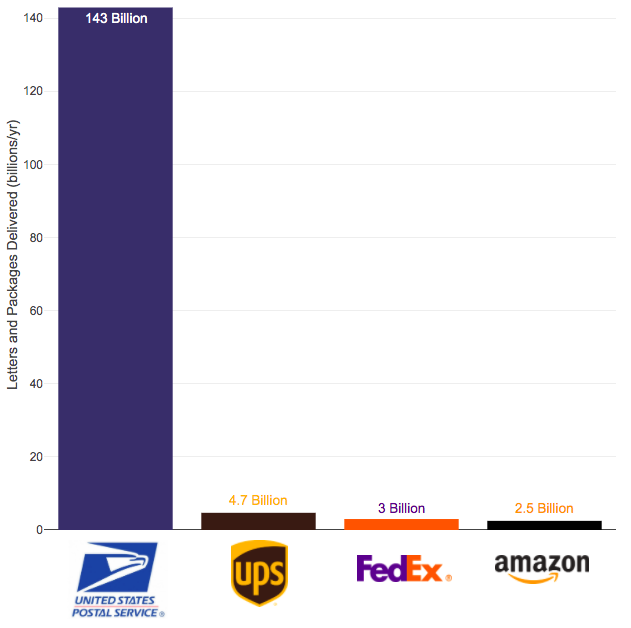

USPS vs private delivery

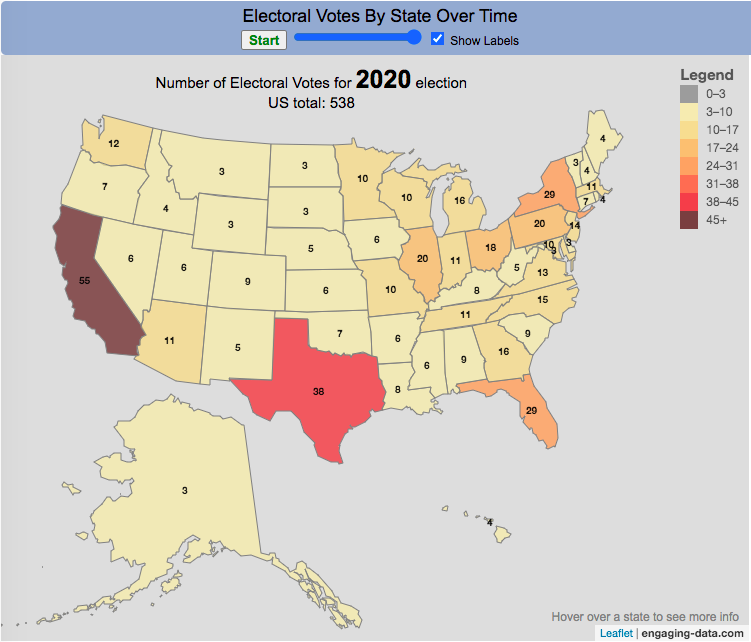

Number of Electoral Votes over Time

County Electoral Map – Land Area vs Population States re-sized to electoral votes

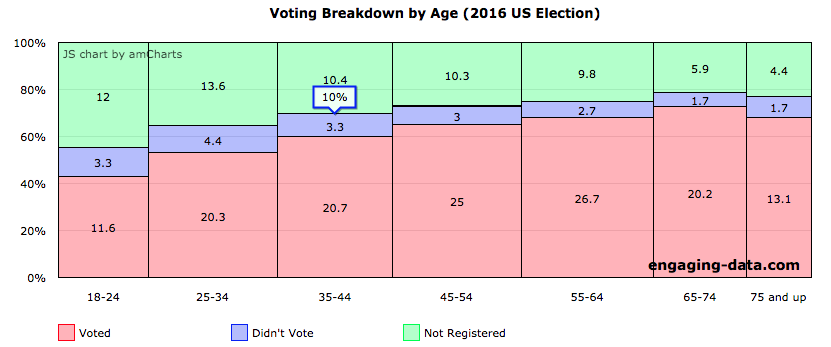

States re-sized to electoral votes Demographic characteristics of US voters in 2016

Demographic characteristics of US voters in 2016

These visualizations focus on health including the coronavirus.

Here are some fun visualizations

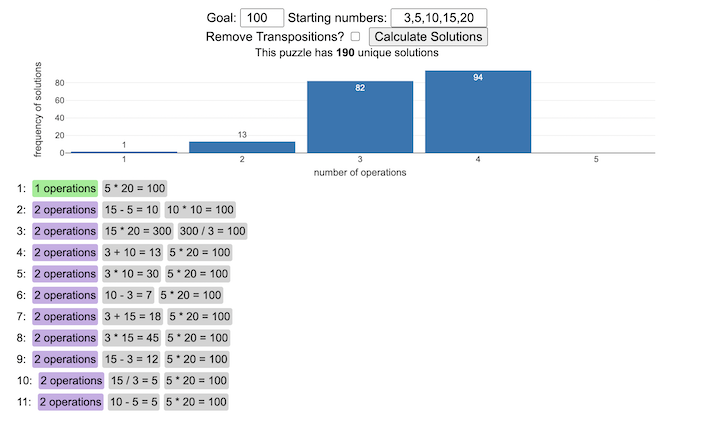

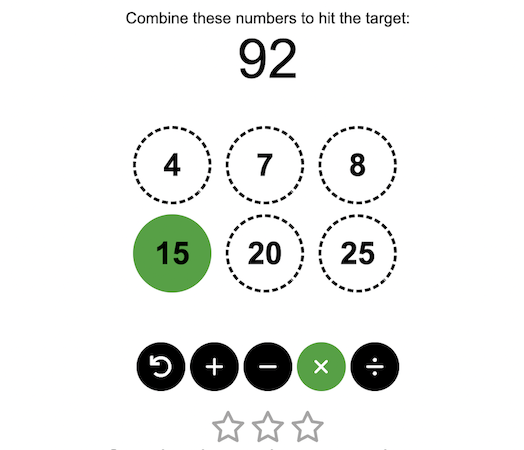

Digits Puzzle Solver

Digits Math Game

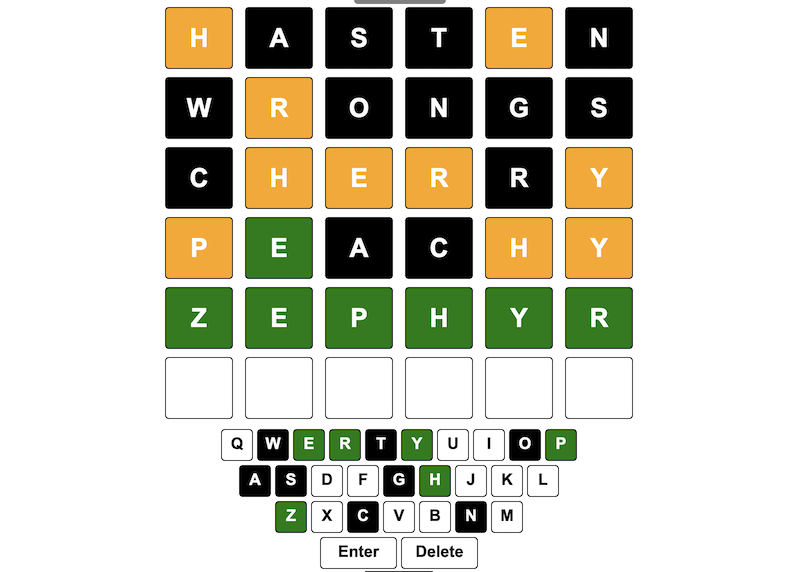

Wordle Guess Distribution

ScrabWordle

Tridle – Triple Wordle WordGuessr Wordle clone

WordGuessr Wordle clone

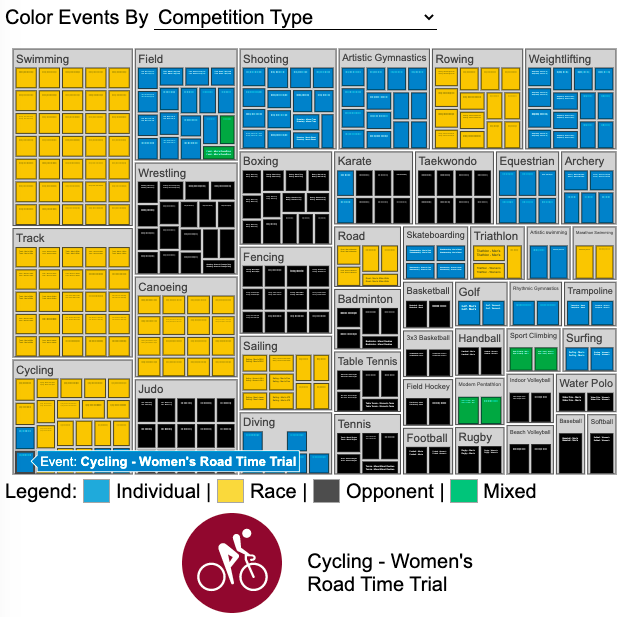

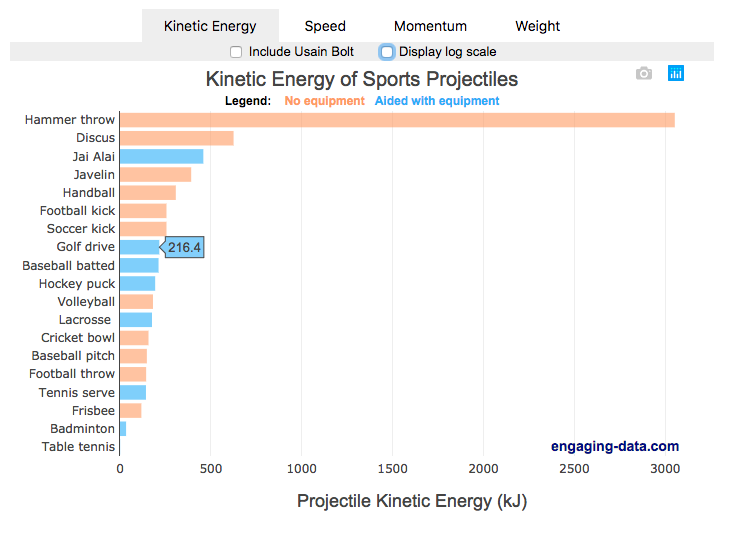

Visualizing Olympic Sports

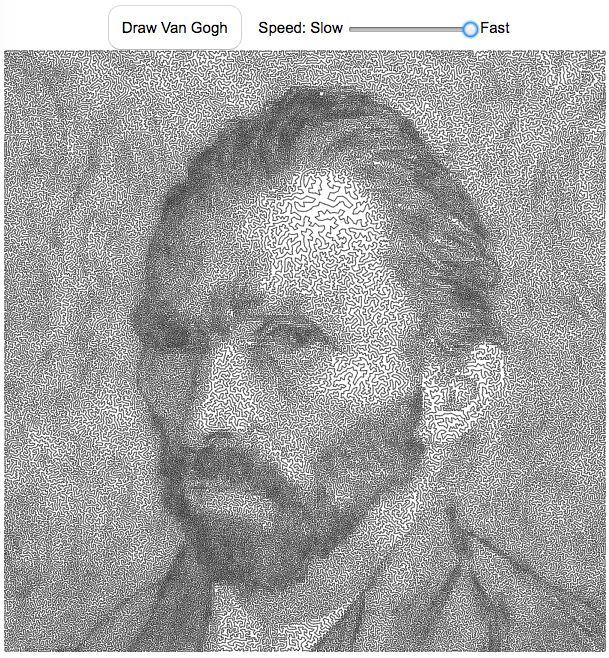

Van Gogh Traveling Salesman Art

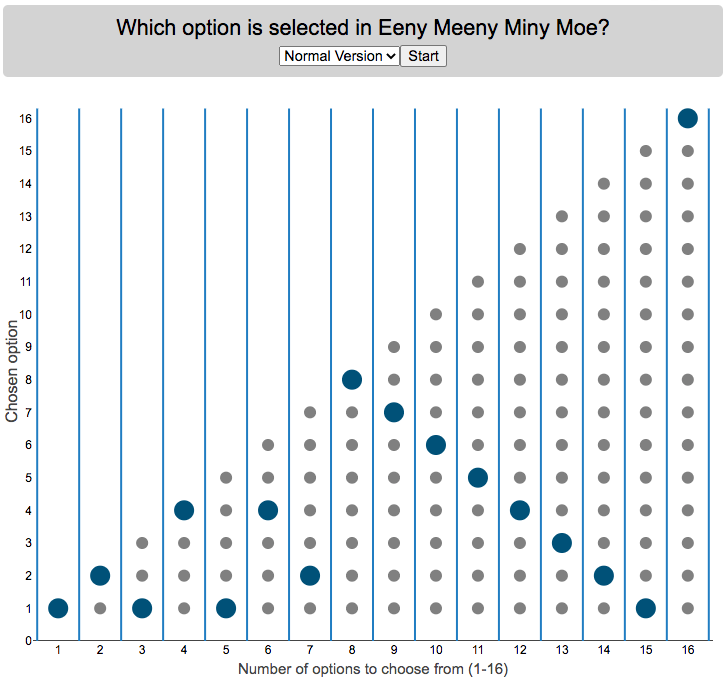

Outcome of Eeny Meeny Miney Moe

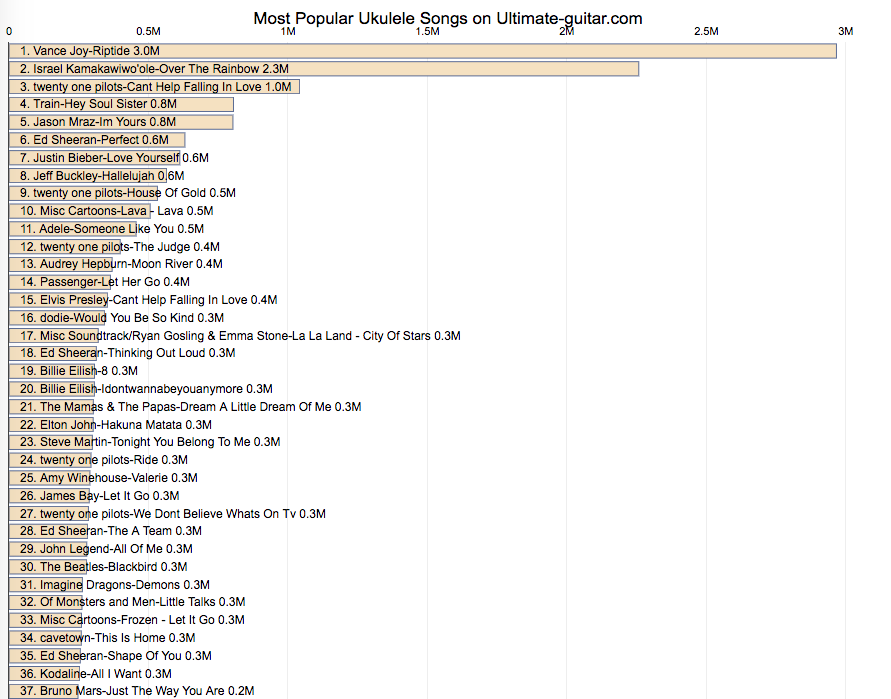

200 Popular Ukulele Songs

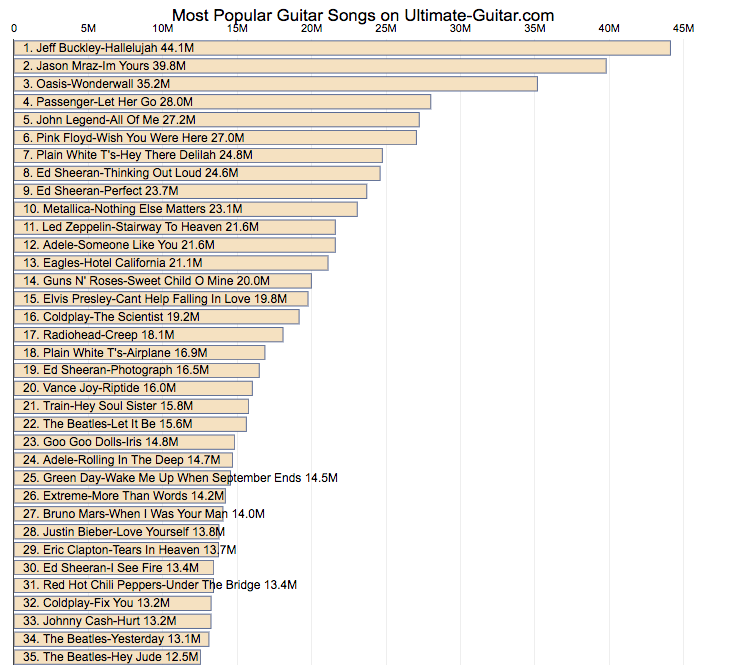

500 Popular Guitar Songs

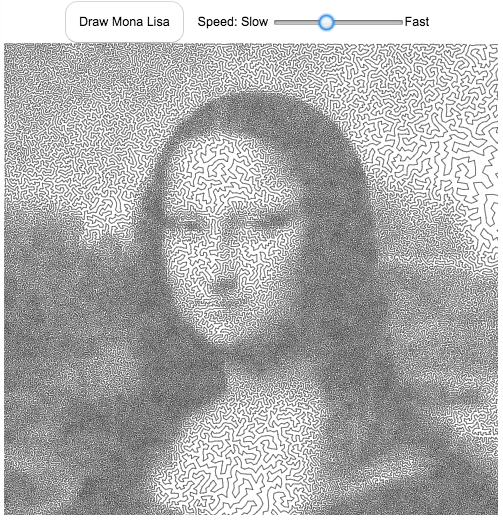

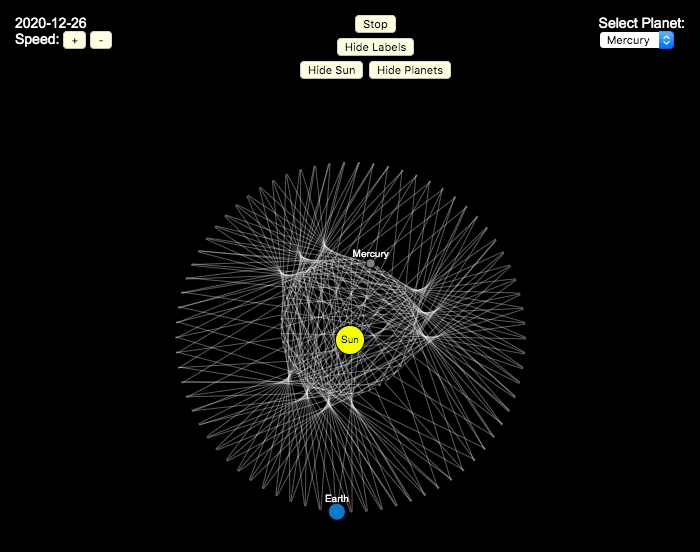

Mona Lisa Traveling Salesman Art Planetary Spirograph

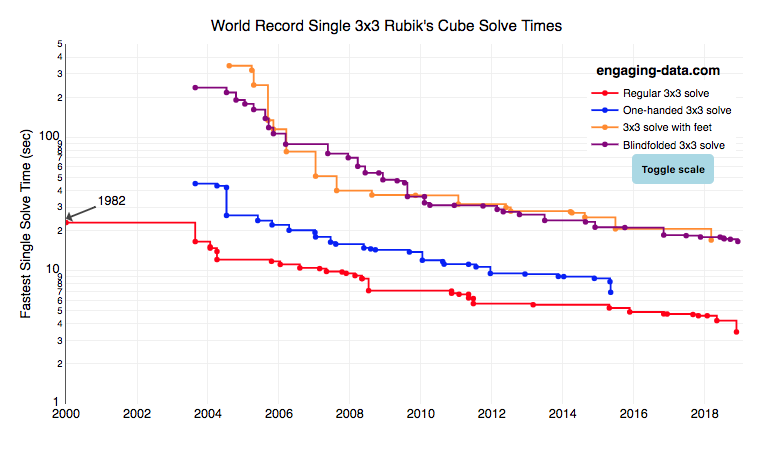

Planetary Spirograph Rubik’s cube world records over time

Rubik’s cube world records over time Mercator country size distortion

Mercator country size distortion States re-sized to match population

States re-sized to match population Antipodes map

Antipodes map Speed and Energy in Sports Projectiles

Speed and Energy in Sports Projectiles

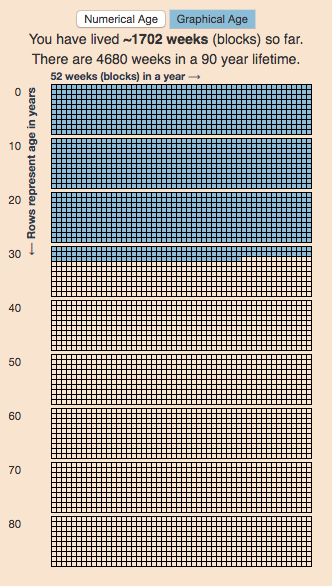

Age calculator and Lifespan Visualization

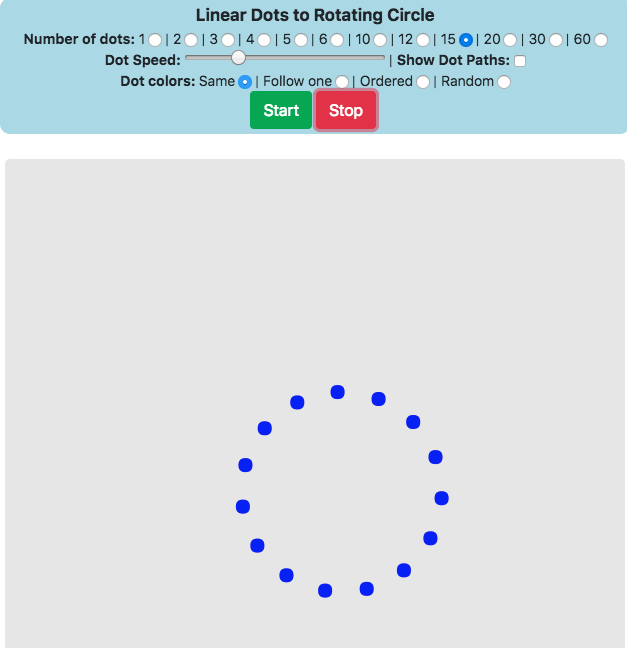

Dot illusion How long does it take to count to one million?

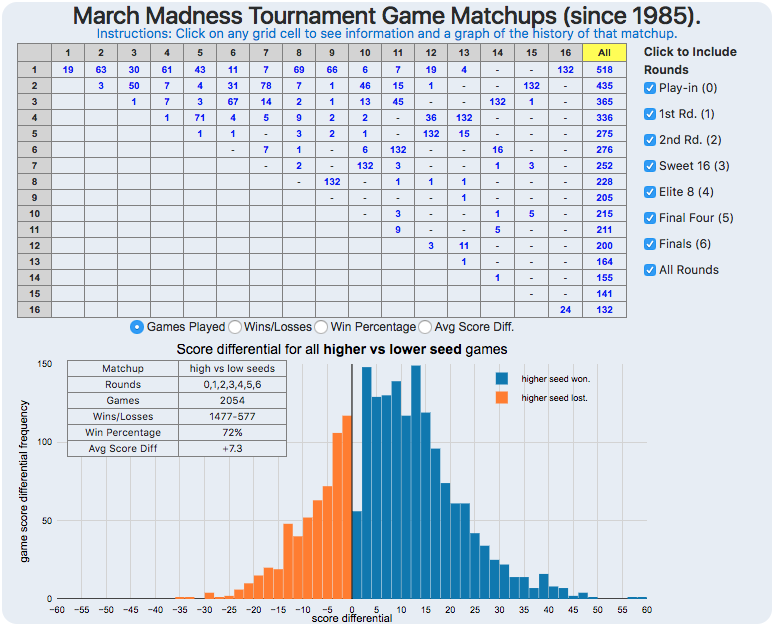

How long does it take to count to one million? March madness matchup visualizer

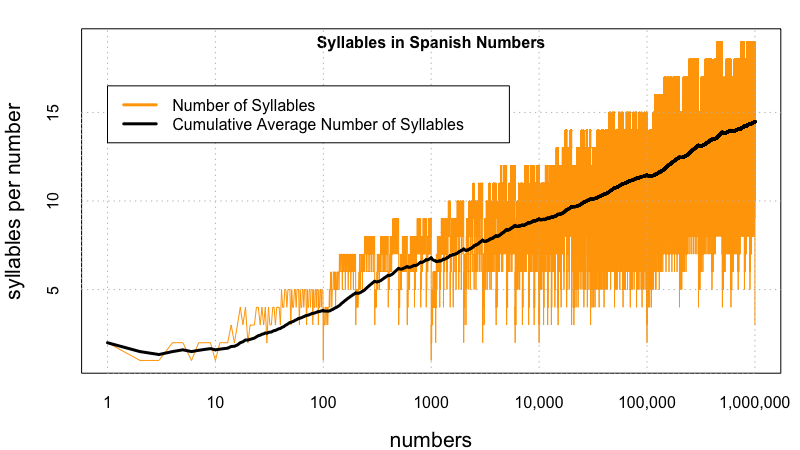

March madness matchup visualizer ¿Cuánto tardarías en contar hasta un millón?

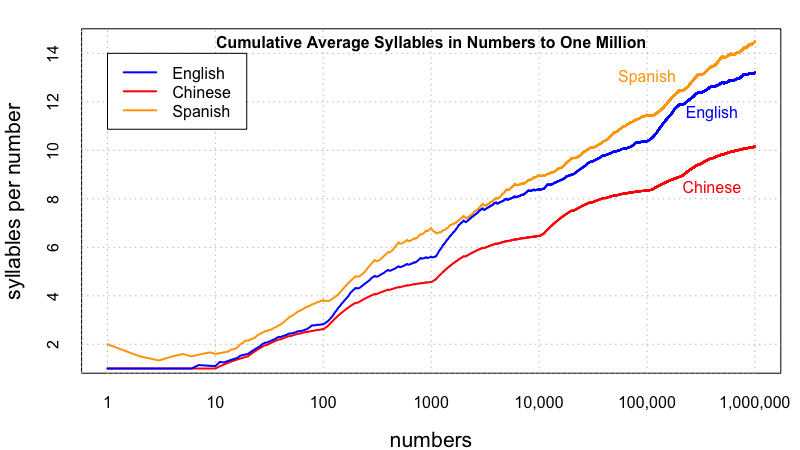

¿Cuánto tardarías en contar hasta un millón? Counting to One Million in Different Languages (Chinese, English and Spanish)

Counting to One Million in Different Languages (Chinese, English and Spanish)

These visualizations focus on demonstrating some mathematical or scientific topics.

Orbital Pattern of the International Space Station

Iceberg Simulator

Mapping Countries onto Planets

Hours of Daylight by Latitude/Season

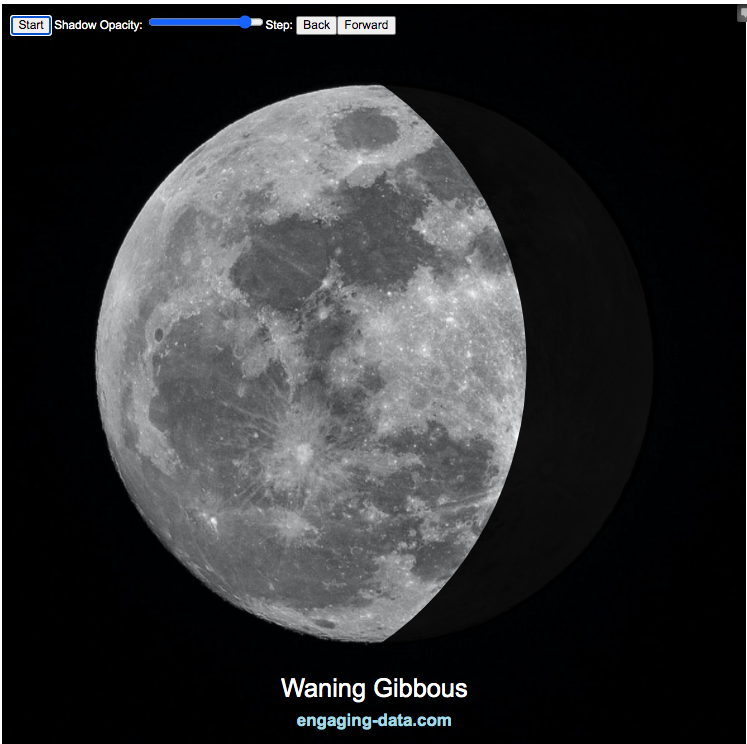

Moon Phases Planetary Spirograph

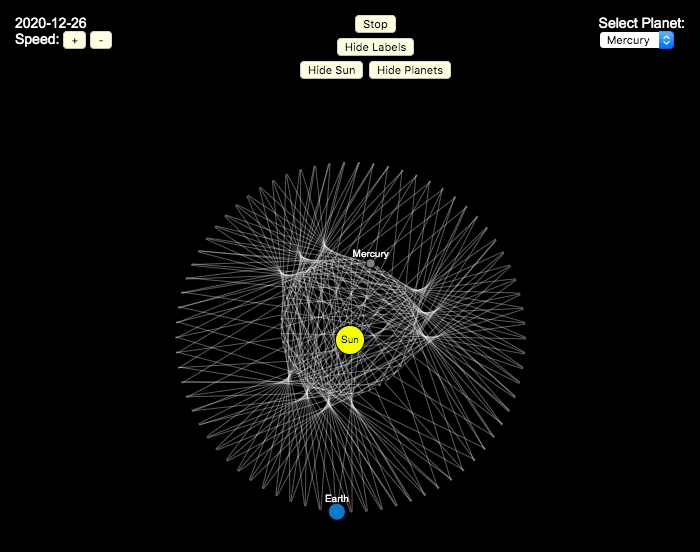

Planetary Spirograph

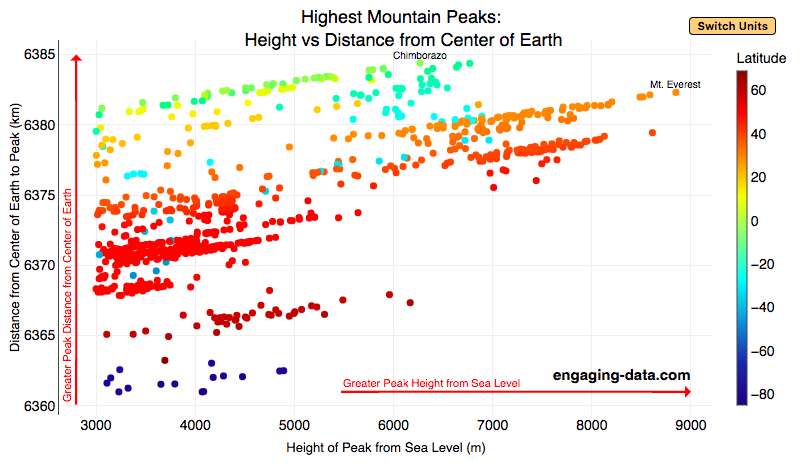

Where is all the water on Earth? What is the Highest Mountain on Earth?

What is the Highest Mountain on Earth?

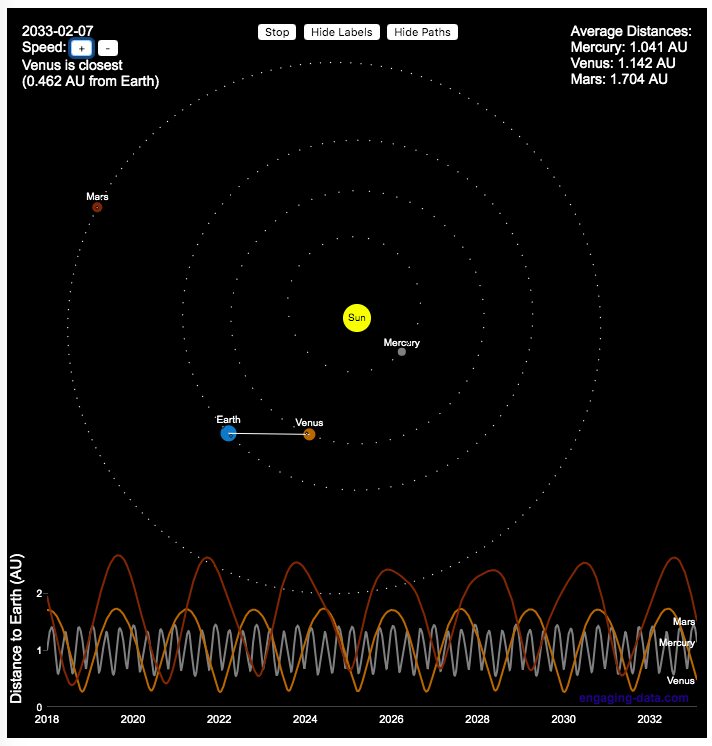

Mercury is closest planet to Earth

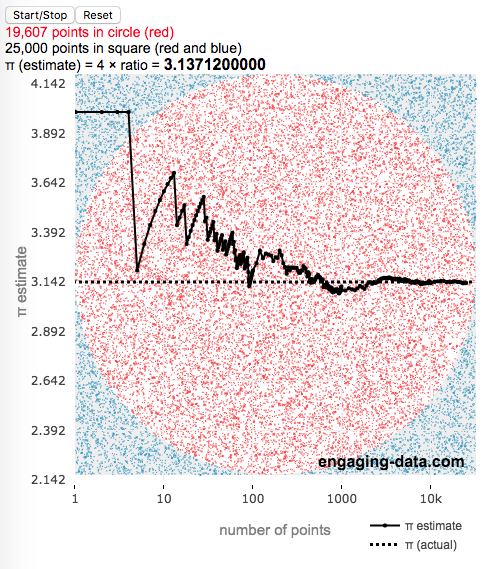

Estimating Pi with Monte Carlo

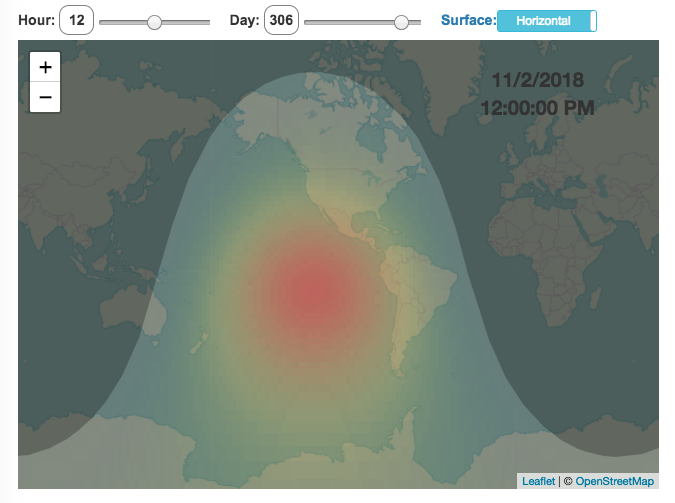

Solar Intensity By Location and Time

These visualizations don’t really have another home.