What is a marginal tax rate?

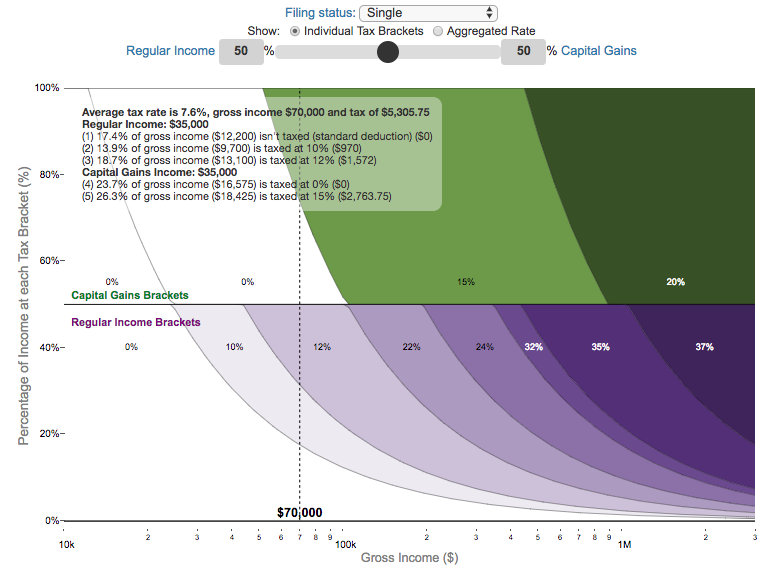

There is a fair amount of confusion about what a marginal tax rate is and how it affects how much tax you would owe the government on a certain amount of income. These graphs are here to help you better understand the difference between a marginal and average tax rate and to easily calculate these rates for specific examples in the US context. This tool only looks at US Federal Income taxes and ignores state, local and Social Security/Medicare taxes.

Marginal tax rates are the rate at which an additional dollar of income will be taxed at. There are different tax brackets (each with its own marginal rate) depending on which dollar of income you are looking at. This is very different from the Average (or effective) tax rate that is the result of applying these marginal tax rates across all of your income.

**Click Here to view other financial-related tools and data visualizations from engaging-data**

Instructions for using the visual tax calculator:

- Select filing status: Single, Married Filing Jointly or Head of Household. For more info on these filing categories see the IRS website

- Select percentage of regular income vs capital gains income. Regular income is wage or employment income and is taxed at a higher rate than capital gains income. Capital gains income is typically investment income from the sale of stocks or dividends and taxed at a lower rate than regular income.

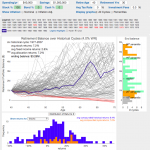

- Move your cursor or click on the graph to select a specific income Make sure you note that the x-axis is a logarithmic-scale, meaning that income grows exponentially as you move to the right.

- Choose your graph preference One graph (Individual Tax Brackets) shows the individual tax brackets and how much of your income is taxed at the different marginal rates. The other graph (Aggregate Rates) shows the net result of applying the different rates to get your effective rate.

Here are two tables that lists the marginal tax brackets in the United States in 2019 that form the basis of the calculations in the calculator. 2018’s numbers are pretty similar.

| Rate | Single Taxable Income Over |

Married Filing Joint Taxable Income Over |

Heads of Households Taxable Income Over |

|---|---|---|---|

| 10% | $0 | $0 | $0 |

| 12% | $9,700 | $19,400 | $13,850 |

| 22% | $39,475 | $78,950 | $52,850 |

| 24% | $84,200 | $168,400 | $84,200 |

| 32% | $160,725 | $321,450 | $160,700 |

| 35% | $204,100 | $408,200 | $204,100 |

| 37% | $510,300 | $612,350 | $510,300 |

You can see that tax rates are much lower for capital gains in the table below than for regular income (table above).

| Single Capital Gains Over |

Married Filing Jointly Capital Gains Over |

Heads of Households Capital Gains Over |

|

|---|---|---|---|

| 0% | $0 | $0 | $0 |

| 15% | $39,375 | $78,750 | $52,750 |

| 20% | $434,550 | $488,850 | $461,700 |

For those not visually inclined, here is a written description of how to apply marginal tax rates. The first thing to note is that the income shown here in the graphs is taxable income, which simply speaking is your gross income with deductions removed. The standard deduction for 2019 range from $12,200 for Single filers to $24,400 for Married filers.

- If you are single, all of your regular taxable income between 0 and $9,700 is taxed at a 10% rate. This means that your all of your gross income below $12,200 is not taxed and your gross income between $12,200 and $21,900 is taxed at 10%.

- If you have more income, you move up a marginal tax bracket. Any taxable income in excess of $9,700 but below $39,475 will be taxed at the 12% rate. It is important to note that not all of your income is taxed at the marginal rate, just the income between these amounts.

- Income between $39,475 and $84,200 is taxed at 24% and so on until you have income over $510,300 and are in the 37% marginal tax rate . . .

- Thus, different parts of your income are taxed at different rates and you can calculate an average or effective rate (which is shown in the aggregate rates graph).

- Capital gains income complicates things slightly as it is taxed after regular income. Thus any amount of capital gains taxes you make are taxed at a rate that corresponds to starting after you regular income. If you made $100,000 in regular income, and only $100 in capital gains income, that $100 dollars would be taxed at the 15% rate and not at the 0% rate, because the $100,000 in regular income pushes you into the 2nd marginal tax bracket for capital gains (between $39,375 and $434,550).

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript and plotted using the plot.ly open source javascript plotting library.

Related Posts

5 Comments »

5 Responses to Visual Guide to Understanding Marginal Tax Rates

Any chance of updating this for 2021 brackets?

awesome way to visualize, really like both views! Something that may not be accounted for is the 3.8% NIIT, but capital gains would still win even with that. Would also be great to have the actual numbers for the regular income vs the capital gains values on the aggregate graph legend.

This is great interactive visualizing tool. It was what I needed to understand numerical threshold tax bracket effects on marginal and average US tax rates vs taxable income? This quickly helped me to understand tax consequence if I elected to take some (IRA funds) and convert its into a a Roth.

Request: Can a CY 2020 tax brackets be added? Thank you for you effort..

Great graph. I’ve been looking for something like this for a while! I especially like the exponential scale for income can you extend that scale out to $10M?

[…] Cool site […]